On November 11th, the crypto market showed signs of stabilization, with Bitcoin maintaining its strength above the $105,000 level and attracting accumulation from large investors. Meanwhile, on the 41st day of a record-long government shutdown, the U.S. Senate voted 60 to 40 to approve a continuing resolution to reopen the government. Uniswap Labs and Uniswap Foundation are joining forces to propose a new sweeping governance proposal called “UNIfication,” aims to align incentives across the Uniswap ecosystem and position the protocol as the default exchange for tokenized assets. Monad will launch its much-anticipated MON token as part of the first public sale using Coinbase's new token listing platform, according to an announcement on Monday.

Crypto Market Overview

BTC (+0.9% | Current Price: $106,925.80)

Bitcoin's price increase to $106,925 contributed to a market capitalization of $2.13 trillion. Bitcoin is demonstrating notable resilience, with its price stability supported by strong on-chain fundamentals. After facing market volatility, BTC has successfully held above the crucial $105,000 support level. Its ability to trade around $107,000 indicates a consolidation phase that could pave the way for a test of the $108,000 resistance, with a potential move toward $110,000 if bullish momentum continues. Data reveals that the recent price dip was likely driven by profit-taking rather than panic selling. Most importantly, large investors (whales) holding between 10,000 and 100,000 BTC have been accumulating, buying over 300,000 BTC (worth nearly $32 billion) after the price briefly touched $101,000. This substantial buying pressure from institutions and large holders has been a key driver in price recovery.

ETH (+0.01% | Current Price: $3626.58)

Ethereum is in a critical technical consolidation phase, with its short-term trajectory hinging on a key resistance level. ETH is currently trading around $3,600, with the $3,600 to $3,700 range acting as a significant resistance zone. A decisive breakout above this barrier is considered essential for triggering bullish momentum and setting the stage for a push toward $4,000. The recovery has been accompanied by a rise in daily trading volume, which has exceeded $27 billion, indicating stronger market participation. Analysts note that the current price structure resembles a previous pattern that preceded a strong rally, offering a cautiously optimistic outlook.

Altcoins

The Fear and Greed Index currently stands at 31, indicating a state of "Fear" within the market. This value is in the 80th percentile for the year, suggesting that although market sentiment is presently cautious, it has been less fearful for the majority of the past year.

Macro Data

The reopening of the U.S. government is restoring clarity to macroeconomic policy, though the Federal Reserve remains divided on the path for interest rates, creating uncertainty. Globally, regulatory developments are advancing, with the U.S. issuing new guidance that allows crypto ETF trusts to stake their assets, a move that could boost institutional participation. A Federal Reserve Governor also noted that stablecoins are increasing demand for U.S. Treasury bills, integrating crypto deeper into traditional finance.

On November 10th, the S&P 500 gained 1.54%, standing at 6,832.43 points; the Dow Jones Industrial Average increased 0.81% to 47,368.63 points, and the Nasdaq Composite gained 2.27% to 23,527.17 points.

Trending Tokens

MELANIA Official Melania Meme (+57.33%, Circulating Market Cap: $164.81 Million)

MELANIA is trading at $0.1797, up approximately 57.33% in the past 24 hours. Melania memes are digital collectibles intended to function as an expression of support for and engagement with the values embodied by the symbol MELANIA. and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type. MELANIA spiked alongside Trump-linked tokens amid rumors of progress in U.S.-China trade talks ahead of a Xi-Trump meeting. Political meme coins like MELANIA are highly sensitive to Trump-related headlines. Traders often front-run diplomatic developments, betting on retail FOMO. MELANIA’s Open Interest (OI) hit 99% in derivatives markets during the rally, signaling leveraged speculation.

UNI Uniswap (+41.89%, Circulating Market Cap: $5.95 Billion)

UNI is trading at $9.44, up approximately 41.89% in the past 24 hours.

Uniswap is a popular decentralized trading protocol, known for its role in facilitating automated trading of decentralized finance (

DeFi) tokens. An example of an automated market maker (AMM), Uniswap launched in November 2018, but has gained considerable popularity this year thanks to the DeFi phenomenon and associated surge in token trading. Uniswap aims to keep token trading automated and completely open to anyone who holds tokens, while improving the efficiency of trading versus that on traditional exchanges. Uniswap Labs and the Uniswap Foundation have proposed activating protocol fees (0.25% of swaps) to support a continuous UNI burn mechanism, including a one-time burn of 100 million UNI from the treasury (Decrypt). Annualized fees are projected to potentially exceed $2 billion, establishing a deflationary trend. The combination of supply reduction and ongoing token burns aims to strengthen UNI's tokenomics and address longstanding concerns regarding limited value accrual. Additionally, increased protocol revenue could attract institutional liquidity and stakers, thereby aligning incentives across the platform.

WLFI World Liberty Financial (+20.84%, Circulating Market Cap: $3.85 Billion)

WLFI is trading at $0.1589, up approximately 20.84% in the past 24 hours. World Liberty Financial (WLFI) is a decentralized finance (DeFi) protocol merging traditional banking infrastructure with blockchain technology, anchored by its USD1 stablecoin and $WLFI governance token. President Trump pardoned Binance founder Changpeng Zhao (CZ) on November 9, following Binance’s $2B investment in WLFI-linked projects. This fueled speculation about regulatory leniency and WLFI’s institutional adoption. While the move boosted short-term sentiment, it raises governance risks. Trump’s family reportedly holds ~25% of WLFI’s supply, creating centralization concerns. Price action remains vulnerable to political volatility, as seen in past Trump-linked token rallies.

Market News

Senate Approves Shutdown Ending Legislation, Sending Bill to the House for a Vote

On the 41st day of a record-long government shutdown, the U.S. Senate voted 60 to 40 to approve a continuing resolution to reopen the government. The measure would fund much of the government through Jan. 30 and provide funding for some agencies through the end of next September.

But the shutdown will not end right away. The U.S. House of Representatives must also pass the legislation, which is not guaranteed, before President Donald Trump can sign it into law.

Seven Democrats and one independent senator voted with nearly every Senate Republican to approve the stopgap funding bill after a more than monthlong impasse that resulted in missed paychecks for millions of federal workers, delayed food assistance benefits and air travel disruptions.

Uniswap Proposes Sweeping ‘UNIfication’ With UNI Burn and Protocol Fee Overhaul

Uniswap Labs and Uniswap Foundation, two of the main firms that help steer the Uniswap protocol, are joining forces to propose a new sweeping governance proposal that would completely change the way the ecosystem works today.

The proposal, called “UNIfication,” aims to align incentives across the Uniswap ecosystem and position the protocol as the default exchange for tokenized assets. It would do this by activating protocol fees, burning millions of UNI tokens and consolidating the project’s key teams under a single growth strategy, according to a blog post dated November 11 but briefly published on November 10. Under the proposal, which DAO members will vote on, the protocol would redirect a portion of trading fees to a UNI burn mechanism and fees from Uniswap’s layer-2 network, Unichain, would also flow into the burn.

Other features like Protocol Fee Discount Auctions (PFDA) would allow traders to bid for fee discounts, internalizing MEV (maximal extractable value) and further fueling the burn process, the team claims. In addition, Uniswap v4 would evolve into an onchain aggregator, collecting fees from external liquidity sources through new “hooks.”

Uniswap Labs also proposed a retroactive burn of 100 million UNI from the treasury, which the team claims would equal the amount that might have been burned if protocol fees had been active since launch. Uniswap Labs, which is the main developer firm that supports the Uniswap protocol, will absorb the Uniswap Foundation’s ecosystem teams. Co-founders Hayden Adams, Devin Walsh and Ken Ng, along with Callil Capuozzo and Hart Lambur, will sit on a five-member board overseeing the new structure, the proposal said.

Monad Unveils Tokenomics, Says Over 50% of MON Tokens Will Be Locked at Launch

Monad will launch its much-anticipated MON token as part of the first public sale using Coinbase's new token listing platform, according to an announcement on Monday. The hyper-performant Layer 1 will open its token sale on Nov. 17 at 9 a.m. ET. The offering on Coinbase will be accessible in over 80 countries, including the U.S., and run until Nov. 22 at 9 p.m. ET.

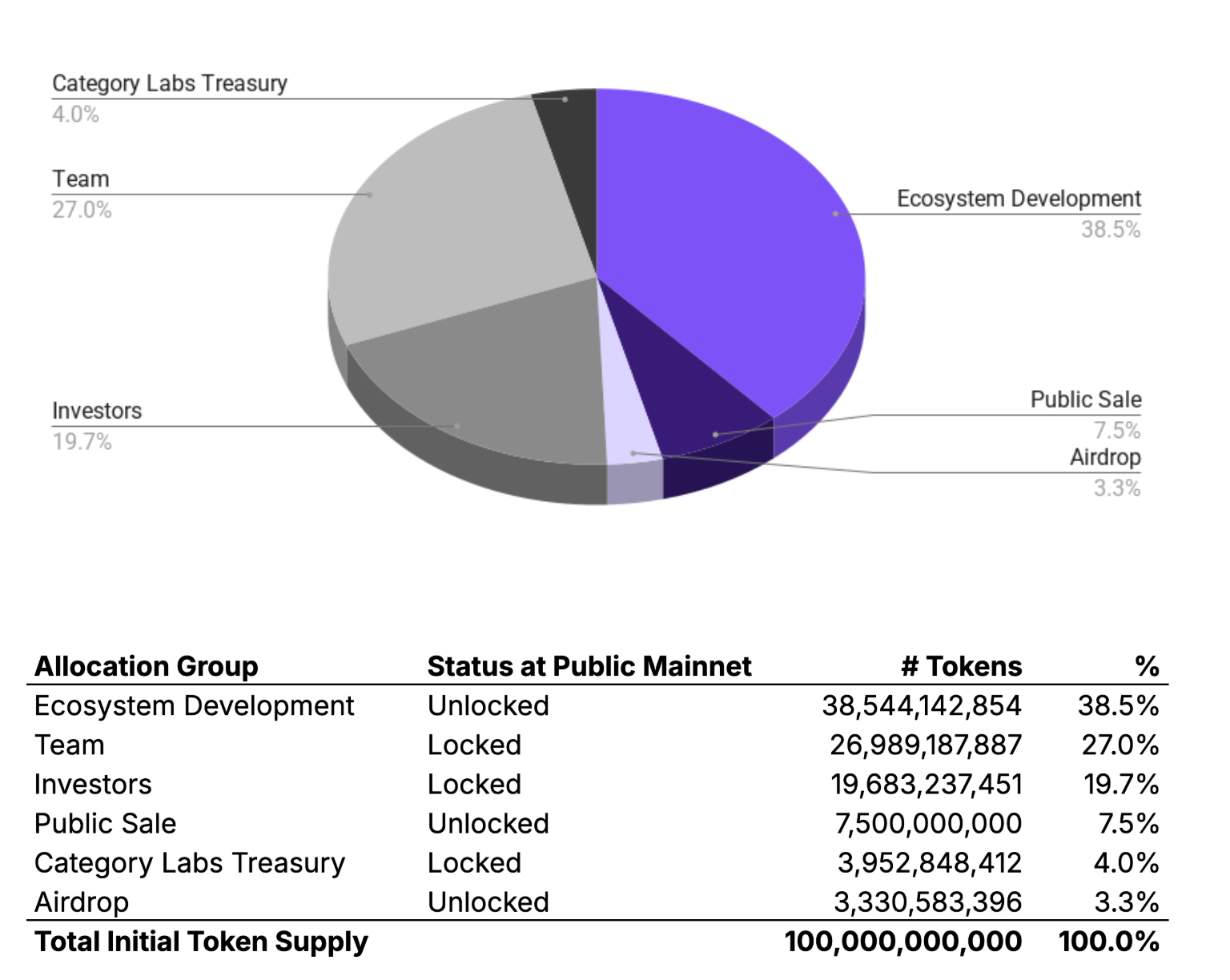

Some 7.5% of the total supply will be offered via Coinbase at $0.025 per MON, with a minimum $100 bid size. Participants can offer a max bid of up to $100,000. Of the max 100 billion MON token supply, 38.5% will be reserved for ecosystem development, 27% for the team, and 19.7 for investors. A smaller 4% allocation is reserved for the Category Labs Treasury.

On Monday, Coinbase unveiled a new "end-to-end token sales platform" designed to offer retail traders access to initial coin offerings. The move comes shortly after the largest U.S. exchange acquired the Echo and Sonar crowdfunding platforms built by prominent crypto trader and commentator Jordan "Cobie" Fish for around $400 million. "Coinbase token sales has provided a platform for the Monad Foundation to distribute MON through a public sale via its subsidiary, MF Services (BVI), Ltd., enabling the purchase of MON tokens right before the launch of Monad Public Mainnet on November 24th," the Monad Foundation wrote, disclosing its mainnet launch date and tokenomics scheme for the first time.

According to the Monad tokenomics plan published on Monday, the 3.3% amount and 7.5% of the token supply set aside for the MON airdrop and public sale via Coinbase, respectively, will be unlocked, along with the sizable amount set aside for ecosystem development. Starting at Monad’s token launch, 50.6 billion tokens, representing 50.6%, will be locked. These tokens cannot be staked. Monad Labs was renamed to Category Labs.

Monad was founded in 2022 and raised $225 million to build an EVM-compatible network that rivals Solana’s speed and Ethereum’s decentralization.

Reference:

CoinMarketCap. (n.d.).

Crypto Fear & Greed Index. Retrieved November 10, 2025, from

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.