The oracle sector has evolved from a niche infrastructure component into a critical pillar of the blockchain ecosystem. By securely transmitting external data to smart contracts, oracles enable a vast array of decentralized applications, from complex DeFi protocols to tokenized real-world assets. As of October 2025, the global oracle sector's Total Value Secured (TVS) has surpassed

$1.02 trillion

, with a collective market capitalization exceeding

$14.1 billion

. This growth is increasingly driven by a "multiplier effect," where adoption in one sector, such as Real-World Assets (RWA), fuels growth in others, like cross-chain communication and AI. This article provides a comprehensive analysis of the oracle landscape, exploring its market structure, technological evolution, competitive dynamics, and emerging value capture models that are positioning it as the indispensable trust engine for the future of Web3.

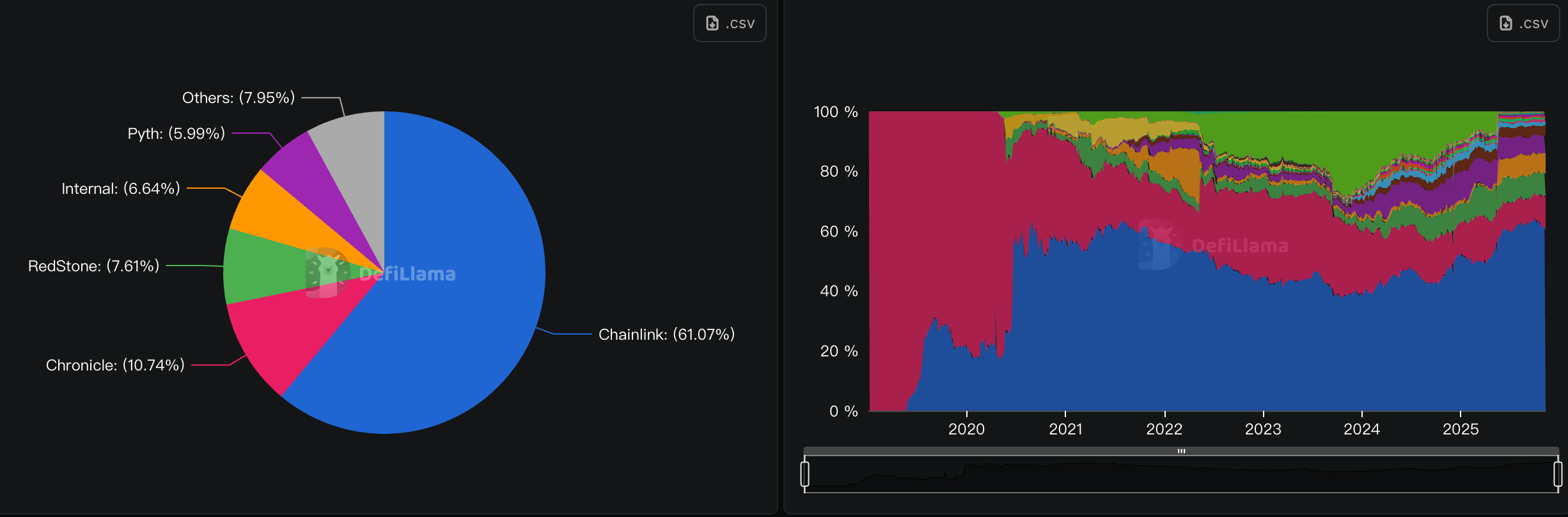

The Oracle Landscape: Market Structure and Dominant Forces

Oracles ranked by TVS. Source: DefiLlama

The oracle market is characterized by a clear hierarchy of established leaders and agile innovators.

Chainlinkmaintains a dominant position, controlling over

87% of the sector's market capitalization and securing

61.58% of the total TVS. This hegemony is built on first-mover advantage, a vast ecosystem of integrations, and a robust network of node operators. For years, its primary service has been price feeds for DeFi protocols, which remain the core battleground with a Total Value Locked (TVL) of approximately

$1.68 trillion.

However, the competitive focus is shifting. The market is no longer solely about price feed accuracy but is increasingly defined by

service quality, economic sustainability, and the ability to integrate cross-chain communication. This has created openings for emerging protocols to carve out niches.

Pyth Network, for instance, has gained traction by leveraging first-party data from major exchanges and trading firms, offering superior speed and low latency that is critical for high-frequency derivatives trading and on-chain gaming. Similarly,

RedStone has adopted an innovative approach with its verifiable data packages, which are cryptographically signed off-chain and then unpacked and verified on-chain by the executing contract. This model provides greater flexibility and security for developers.

Another significant trend is the rise of specialized oracles focusing on specific data types or trust models.

UMA's Optimistic Oracle operates on a dispute-resolution mechanism, where data is assumed to be correct unless explicitly challenged, making it highly cost-efficient for complex financial contracts and insurance protocols. The recent

$12 million funding round for Chronicle Labs, a project that originated within the MakerDAO ecosystem, underscores the growing investor confidence in oracles that specialize in high-transparency data for both DeFi and traditional finance (TradFi) institutions. This evolving landscape demonstrates that while Chainlink remains the giant, the market is maturing to support a diverse set of players with differentiated value propositions.

Technological Evolution

The technological journey of oracles can be segmented into three distinct phases, each expanding their capabilities and role within the blockchain stack. The

first generation consisted of centralized oracles, which were simple but introduced single points of failure. The

second generation, pioneered by Chainlink, introduced decentralized networks that aggregated data from multiple sources and used cryptographic proofs and economic incentives to ensure data reliability. This model became the industry standard for DeFi.

We are now entering the

third generation: the era of modular and verifiable oracles. This phase is defined by specialized protocols that offer customizability, enhanced security through advanced cryptography, and a focus on verifiable data paths. A groundbreaking innovation in this space is the advent of

AI-powered oracles. Supra, forexample, has launched a "Threshold AI Oracle" that embeds on-chain, cryptographically verified AI reasoning. This protocol can process contextual queries, such as "Did this regulatory change actually occur?" or "Should this liquidation be executed given current market sentiment?" This moves oracles beyond simple data piping to providing intelligent, reasoned insights directly on-chain.

Furthermore, the architecture of data delivery is being rethought. Traditional oracles typically use a "push" model, where data is constantly updated on-chain, incurring significant gas costs. RedStone's

Atom upgrade introduces a "pull" model for critical moments, specifically for liquidations. When a price triggers a liquidation condition, Atom enables

zero-delay data updates, ensuring instantaneous execution. This not only makes lending protocols safer but also allows them to capture the Oracle Extractable Value (OEV) that was previously lost to MEV bots, creating a new revenue stream for the protocols themselves. These technological leaps are transforming oracles from passive data conduits into active, intelligent participants in the DeFi ecosystem.

Emerging Growth Drivers: RWA, Cross-Chain, and AI

| Sector |

Correlation Strength (1-5) |

Core Demand |

Revenue Contribution Potential |

Driving Logic |

| 1. DeFi |

5 |

Real-time Price Feeding, Liquidation Triggering |

Core Stable Income |

Oracle is the only basis for liquidation logic. Without oracle, there would be no unsecured loans and derivatives. |

| 2. RWA |

5 |

Asset Reserve Verification, Yield Synchronization |

Highest Medium-to-Long-Term Increment |

RWA is the only trusted input layer for off-chain assets to be on-chain, and the demand is compliant and long-term. |

| 3. Cross-Chain Communication |

4.5 |

State Verification, Message Signature, Asset Cross-Chain |

Explosive Growth |

Oracle undertakes the composite function of "state verification + price conversion" and is the basis for multi-chain interoperability. |

| 4. Prediction Market |

4 |

Real-World Event Result Input |

Emerging Data Revenue |

Oracle acts as the "truth machine" for event settlement, ensuring the fairness and objectivity of market settlement. |

| 5. AI + Oracle |

3.5 |

Model Verification, Data Feeding and Return |

Long-Term High Growth Potential |

Oracle serves as a trusted data input layer, driving the autonomous execution and prediction tasks of on-chain AI Agents. |

While DeFi remains the foundational market, the most significant growth for the oracle sector is now coming from new frontiers. The tokenization of

Real-World Assets (RWA), with an on-chain asset scale exceeding

$350 billion, is emerging as a powerful engine for institutional adoption. Oracles are the critical link that secures this bridge between TradFi and DeFi. They are tasked with reliably bringing off-chain asset data—such as treasury bond yields, forex rates, and real estate valuations—onto the blockchain. This function is paramount for the integrity of RWA protocols, making oracles the de facto "trust layer" for the entire tokenized asset economy.

Cross-chain interoperability is another major growth vector. Chainlink's Cross-Chain Interoperability Protocol (CCIP) is at the forefront, enabling not just the transfer of assets between chains but also the secure transmission of messages and commands. This capability is essential for the vision of a unified "Internet of Contracts," where smart contracts on different blockchains can interact seamlessly. As ecosystems become more interconnected, the demand for reliable cross-chain data and messaging will only intensify, further cementing the role of oracles as key infrastructure.

Finally, the convergence of

Artificial Intelligence and oracles (AI+Oracle) is creating a new frontier for innovation. As seen with Supra's Threshold AI Oracle, the integration allows smart contracts to leverage complex, AI-driven inferences in a trust-minimized way. This opens up possibilities for more sophisticated prediction markets, dynamic NFT attributes based on real-world events, and AI-governed DAOs that can make complex decisions based on verified off-chain information. This synergy positions oracles to become the crucial data-abstraction layer for the nascent DeAI (Decentralized AI) sector.

Economic Models and Value Capture

The economic models underpinning oracle tokens are undergoing a fundamental shift, which is crucial for their long-term valuation. The industry is moving away from a simple

"pay-per-call" model, where revenue is directly tied to the number of data requests. While this model served the sector in its early days, it lacks sustainability and does not inherently align the security of the network with its usage.

The new paradigm is shifting towards a

"service staking" model. In this system, node operators are required to stake the native token (e.g., LINK) as collateral to provide data services. This staking mechanism serves two critical functions: it provides a strong cryptographic and economic guarantee for the data's accuracy (malicious behavior results in slashing), and it fosters a circular economy for the token itself. A portion of the protocol's revenue is then used to fund staking rewards, creating a virtuous cycle where increased network usage drives higher rewards, which in turn incentivize more staking, further securing the network.

This evolution is changing how Oracle tokens are valued. The valuation logic is transitioning from being purely "narrative-driven" to being grounded in fundamental metrics such as

Market Capitalization to TVS (Mcap/TVS) ratios and protocol revenues. For instance, Gate Research estimates that LINK's long-term reasonable valuation could lie between

$26 and $35, with the potential to reach

$40 to $45 if innovative mechanisms like Smart Value Recycling (SVR) are implemented to enhance value accrual. This more mature economic framework suggests that oracle tokens are developing into assets with tangible, metrics-based value, supported by the essential services their networks provide.

Future Outlook

The future trajectory of the oracle sector points towards its entrenchment as the foundational data layer not just for crypto, but for a broader digitized global economy. The sector's expansion is increasingly linked to the concept of the

"multiplier effect," where growth in one domain, such as RWA, naturally stimulates demand in adjacent areas, including cross-chain communication and AI-driven automation. This creates a synergistic growth loop that is far more powerful than linear expansion.

A profound long-term implication is the emergence of what some reports term the

"information interest rate". As oracles begin to reliably stream a wide array of traditional financial data onto the blockchain—including interest rate curves, bond yields, and inflation indices—they will enable the creation of entirely new DeFi primitives and yield-generating strategies. This would effectively create a decentralized financial system with its own native interest rates, derived from and verified against real-world economic conditions through oracles.

However, this path is not without challenges. The sector must navigate an increasingly complex

regulatory landscape, especially as it deals with more TradFi assets and data. Furthermore, the technical challenge of maintaining

decentralization and robust security while scaling to meet the demands of global finance remains paramount. Projects that can build not only technologically superior systems but also ones that are regulatory-friendly and maximally secure are the ones most likely to thrive. In conclusion, oracles are evolving from a single-purpose tool into the indispensable "trust engine" and "data settlement layer" for Web3, poised to play a central role in the convergence of decentralized and traditional finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.