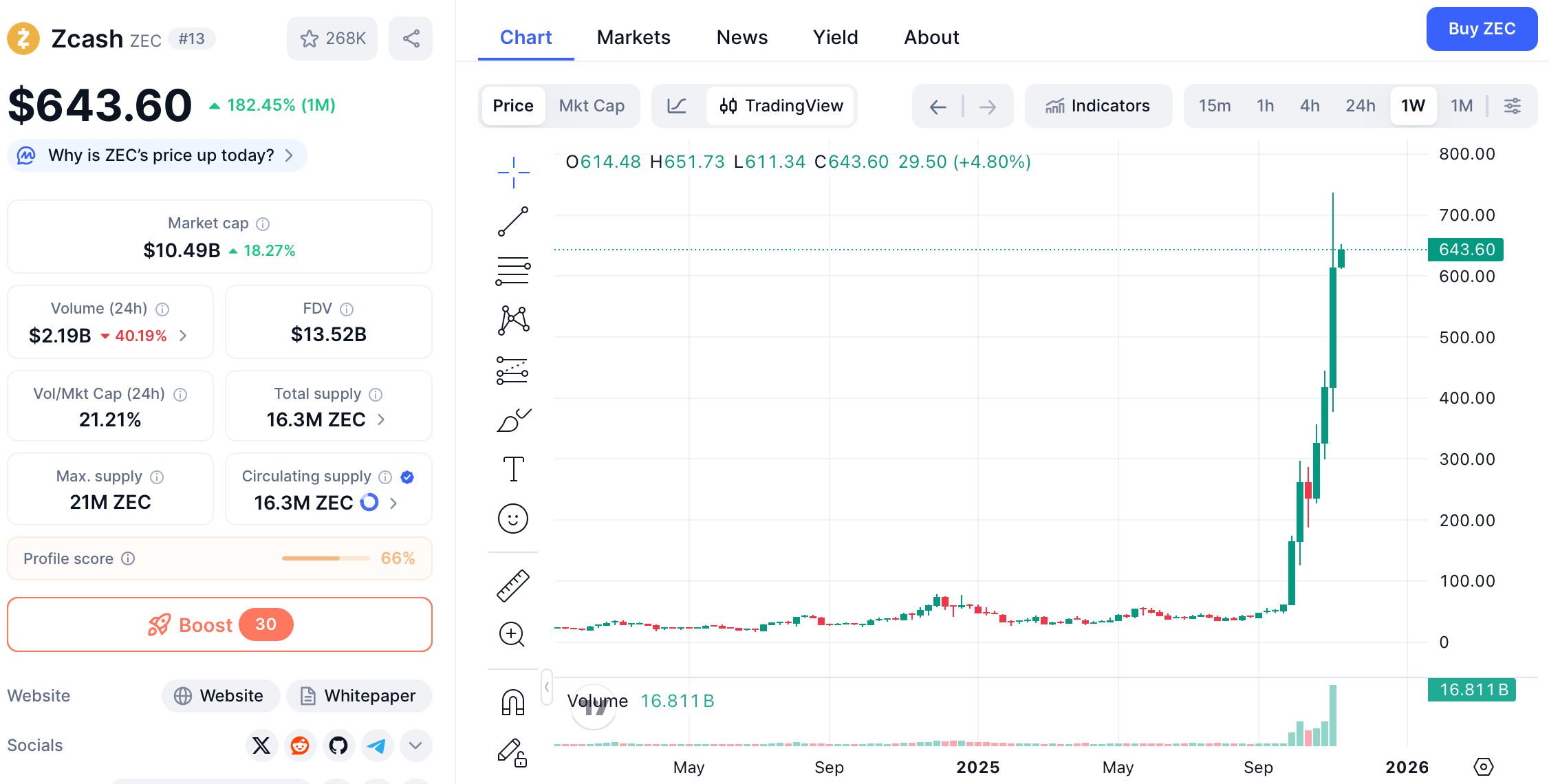

The cryptocurrency market witnessed an unexpected seismic shift in Q4 2025 as Zcash (ZEC), a privacy-focused digital asset, surged to unprecedented heights. On November 7, 2025, ZEC shattered its 2018 record, breaching the $500 barrier to reach an all-time high of $538, which is a staggering 700% gain since September. This rally defied broader market stagnation, propelling Zcash’s market capitalization to $8.56 billion and igniting discussions about a "privacy renaissance" in crypto. While skeptics questioned whether the movement was orchestrated, evidence points to organic drivers: escalating demand for financial anonymity, influential endorsements, and critical technical upgrades. This article analyzes the convergence of factors behind ZEC’s meteoric rise, exploring its implications for the future of privacy-centric cryptocurrencies.

The Privacy Narrative Reawakens

The need for privacy is more urgent than ever. Source: a16z

Zcash (ZEC) has seen a 700% surge in just two months, reigniting market enthusiasm for the crypto privacy coin. This article provides an in-depth analysis of Zcash's technological innovations, its privacy integration with NEAR Intents, product optimizations of the Zashi wallet, and its market performance surpassing Monero, exploring why privacy has once again become a core focus of the crypto industry.

The term "cryptocurrency" originally meant "secret" or "hidden" money, but for most of its development, the industry has lacked emphasis on privacy. Only recently has this situation begun to change.

In the past few weeks, privacy has made a strong comeback. Zcash (ZEC), as one of the earliest and most well-known privacy coins, has seen a surge of 700% since September, and the crypto community seems to be discussing privacy overnight. Some Bitcoin opinion leaders believe this surge is "artificial hype" and warn that buyers may become "sellers" (i.e., those left holding the bag).

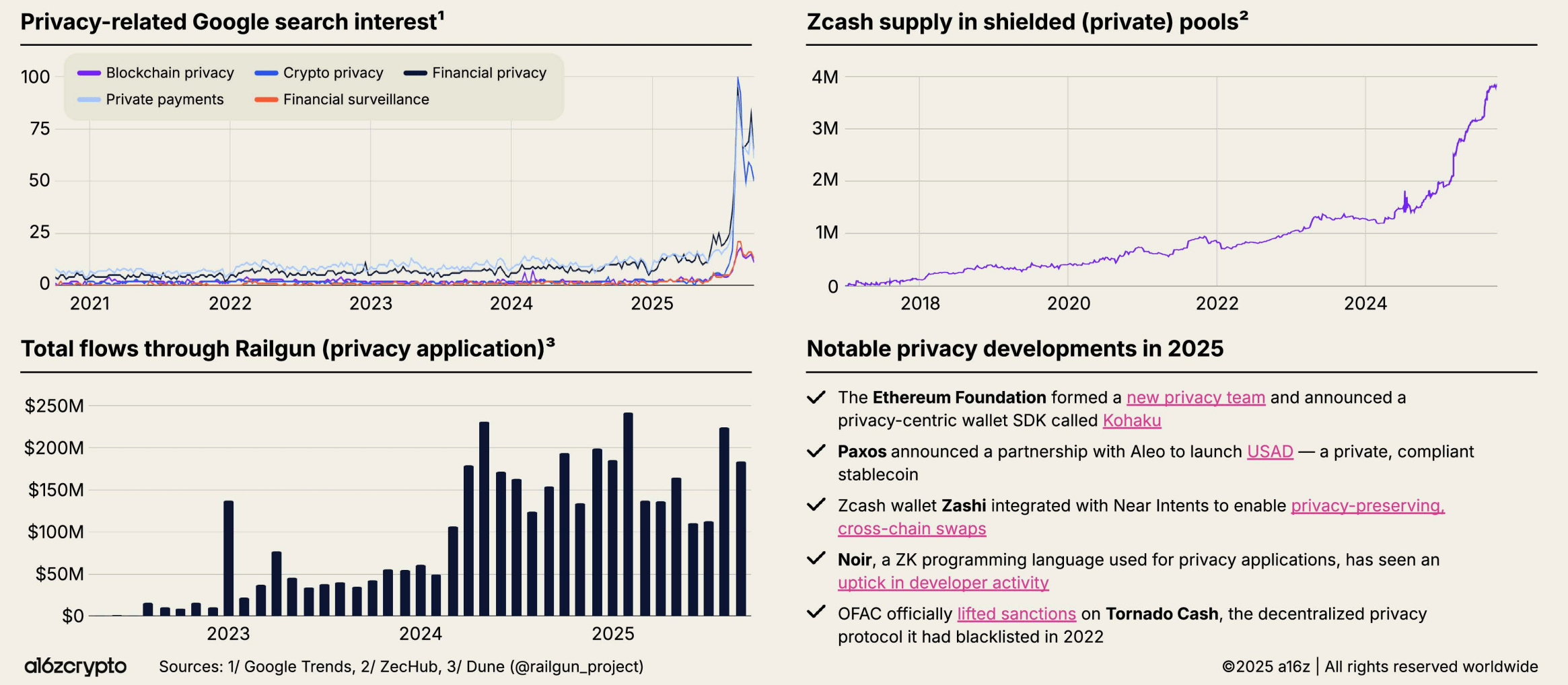

Zcash’s revival is rooted in a fundamental shift in market sentiment. As regulatory scrutiny intensifies globally, privacy has transitioned from a niche concern to a central investment thesis. The surge in ZEC’s value coincides with a broader 80% spike in the privacy coin sector’s market cap, which briefly eclipsed $240 billion in early November. This trend reflects growing disillusionment with transparent ledgers like Bitcoin, whose traceability conflicts with crypto’s original ethos of financial sovereignty.

Galaxy Digital researchers attribute

ZEC’s performance to an "anti-surveillance" movement, accelerated by crackdowns on privacy tools such as Samourai Wallet and Tornado Cash. Notably, Bitcoin’s transparency—once hailed as a virtue—is now seen as a vulnerability. As Zcash Foundation executive director Alex Bornstein observed, "People are waking up to what Zcash can accomplish" in an era of government overreach. This philosophical realignment has transformed Zcash from a peripheral asset into a symbol of resistance, attracting capital from users seeking autonomy over their financial data.

Development History and Network Upgrades

Zcash originated from academic research in 2013, starting with the Zerocoin protocol developed by cryptography experts at Johns Hopkins University. Through continuous evolution, it evolved into Zerocash and eventually became Zcash, in order to solve the limitations of the original scheme in terms of computation and efficiency.

Zcash officially launched in 2016, a privacy fork of Bitcoin created by cypherpunk artist Zooko Wilcox and the Electric Coin Company (ECC). Its goal was to address the shortcomings in transaction privacy in Satoshi Nakamoto's original design while preserving Bitcoin's original monetary attributes.

Unlike Bitcoin, where all transaction information is publicly available on the blockchain (as shown in mempool.space), Zcash employs a specific type of zero-knowledge proof technology—zk-SNARKs. This technology allows users to prove the validity of a transaction without disclosing the sender, receiver, or amount. Regarding privacy, while Monero predates Zcash in using technologies like ring signatures, hidden addresses, and Bulletproofs to protect privacy, Zcash is the first mainstream blockchain project to integrate zk-SNARKs at the protocol level.

Zcash employs an on-chain fund management model, with a portion of block rewards used to fund community projects rather than being entirely distributed to development organizations. According to ZIP 1016, 8% of block rewards go to the Zcash Community Grants, and 12% belongs to the Holders Fund (governed by holder votes). ECC and the Zcash Foundation do not automatically receive rewards; these funds must be obtained through an application process.

During its development, Zcash underwent several network upgrades:

-

Sapling (2018): Significantly improves the efficiency and user experience of privacy transactions.

-

Heartwood (2020): Introduced privacy miner rewards (coinbase), allowing miners to receive block rewards privately.

-

Canopy (2020): For the first time, rewards were halved and the funding distribution system was reformed, eliminating founder rewards and replacing them with a development fund jointly governed by ECC, the Zcash Foundation and the community.

-

NU5 / Orchard (2022): This is the most important upgrade to date, introducing Halo 2 recursive proofs to replace complex trusted setups, launching unified addresses (UA), combining transparent and privacy payment methods, and introducing the Orchard privacy pool.

-

NU6 (2024): Implements fund locking functionality within the protocol, enhancing the decentralization and transparency of fund management.

Please refer to the relevant documentation for a complete upgrade path. In the future, the protocol will continue to innovate upon the NU7 version.

Furthermore, it's worth noting that ZEC's market performance has been consistently weak, failing to surpass Bitcoin's (BTC) performance and even being outperformed by Monero (XMR) to some extent. Monero provides basic privacy features to all users by default, employing a small, disguised anonymity set. It uses ring signatures to mix the real input with 15 disguised inputs to form a medium-sized anonymity set, but its technology also faces anonymity limitations revealed by research.

Regulatory bodies are paying closer attention to Monero (XMR), primarily because its privacy features are enabled by default. In 2020, the IRS Criminal Investigations Division commissioned Chainalysis and Integra FEC to investigate Monero's tracking technology. In contrast, Zcash offers optional privacy mechanisms, utilizing zk-SNARKs to encrypt transaction information, allowing privacy addresses to form a larger set of anonymities.

Zcash's dual-mode design offers users greater flexibility but also carries the risk of misuse—for example, mistakenly hiding a transparent address transaction as a private transaction. However, with proper maintenance, Zcash's privacy protection is mathematically more robust and resistant to quantum attacks, a level of security not yet achieved by Monero's current ring signature technology. To address this deficiency, Monero's developers plan to enhance it through upgrades using technologies such as FCMP++.

Currently, the market price of ZEC reflects the differences resulting from its various technologies and development paths.

The ZEC price chart. Source: CoinMarketCap

Influencers and Institutional Endorsements

The rally gained momentum through vocal support from key industry figures. BitMEX co-founder Arthur Hayes publicly declared ZEC his second-largest liquid holding, advocating for a $1,000 price target and allocating substantial capital to long positions. His stance was echoed by investors like Naval Ravikant, who argued that "transparent cryptocurrencies cannot survive government crackdowns". These endorsements resonated across social media, with influencers like Mert Mumtaz and ThreadGuy amplifying Zcash’s optional privacy features.

Critically, this advocacy was organic rather than coordinated. Bornstein clarified that the Zcash Foundation, which is a U.S.-registered nonprofit, had "absolutely nothing to do" with the promotional wave. Instead, the grassroots movement mirrored Bitcoin’s early adoption phase, where communities self-organized around shared ideals. YouTube personality Ran Neuner captured this sentiment, describing Zcash as "the most exciting thing in crypto" and comparing its social dynamics to Bitcoin’s 2009–2017 ascent.

Technological Milestones and Adoption Metrics

Beyond rhetoric, Zcash’s infrastructure upgrades enabled its breakthrough. The Network Upgrade 5 (NU5) and subsequent Halo 2 proof system eliminated the need for trusted setups, streamlining private transactions via unified addresses. These improvements fueled tangible adoption: over 30% of ZEC’s circulating supply—approximately 4.9 million tokens—now resides in shielded pools, a historic high that strengthens anonymity for all users.

User experience enhancements further accelerated adoption. The Zashi wallet, launched by Zcash’s creator Electric Coin Co. (ECC), simplified cross-chain privacy through integration with NEAR Intents. This allows users to seamlessly move assets between transparent and shielded pools without exposing transactional links. Additionally, ECC’s Q4 2025 roadmap prioritizes reducing technical debt and expanding hardware wallet support, signaling a commitment to mainstream accessibility.

Table: Zcash Key Adoption Metrics (November 2025)

| Metric |

2025 Status |

Significance |

| Shielded Supply |

30% of circulating ZEC (4.9M tokens) |

Enhances privacy set strength, making transactions harder to trace . |

| Market Capitalization |

$8.56B–$106B (varies by source) |

Reflects investor confidence and liquidity influx . |

| Price Surge (Since Sept.) |

700% |

Demonstrates narrative momentum and speculative interest . |

What are NEAR Intents?

NEAR Intents is a new cross-chain coordination layer on the NEAR protocol that allows users to express their operational intentions (such as "pay X amount of ETH to address y") without having to manually bridge, exchange, or operate wallets.

The underlying instruction is automatically completed by the intent executor (on-chain autonomous agent), and is realized through liquidity routing, exchange and cross-chain settlement.

For Zcash, the integration intent means that users can transfer assets from a transparent chain to a Zcash privacy pool and back without exposing every step on the chain. In practice, traders or institutions can transfer funds from a public chain (such as Ethereum) to Zcash to execute privacy transactions, and then return to the original chain if needed, with no direct link between the two addresses.

After NEAR Intents was integrated into the Zashi wallet (the official ECC wallet and the most mainstream Zcash wallet), the technical barriers to user bridging and privacy were completely eliminated. Zcash also supports

viewing keys and selectively disclosing private transaction details to meet audit or compliance requirements. These features make Zcash privacy convenient for individuals while also meeting the compliance needs of institutions.

Market Dynamics and Trader Behavior

Zcash’s price action triggered a self-reinforcing cycle driven by derivatives and short squeezes. Open interest for ZEC futures skyrocketed to $897.4 million, an all-time high that indicates sustained bullish positioning. As prices climbed, bearish traders faced escalating liquidation pressure, exacerbating upward volatility. This dynamic was particularly evident on November 7, when ZEC’s 23% single-day spike forced cascading short coverings.

Technical indicators, however, flash warning signs. The Relative Strength Index (RSI) hit 84, signaling extreme overbought conditions. Analysts speculate that a correction toward $360—a 35% drop from recent peaks—could foster healthier long-term growth. Despite this, institutional accumulation persists. Galaxy Digital reported a 225.9% 30-day gain for ZEC, with entities like Grayscale’s Zcash Trust (ZCSH) providing indirect exposure for regulated investors.

Regulatory Challenges and Future Trajectory

Privacy coins operate in a contentious regulatory landscape. The European Union’s upcoming Anti-Money Laundering (AML) regulations, slated for 2027, aim to ban "enhanced anonymity" tokens like Zcash from regulated exchanges.Similarly, Japan and South Korea have historically restricted privacy assets, though Zcash’s optional shielding has allowed it to maintain listings where competitors like Monero faced delistings.

Despite these hurdles, Zcash’s hybrid model which is enabling transparent transactions for compliance and shielded ones for privacy, positions it as a pragmatic choice. ECC’s focus on "selective disclosure" tools, such as view keys for auditors, helps bridge the gap between regulatory requirements and user autonomy. Looking ahead, the protocol’s planned Network Upgrade 7 (NU7) and Project Tachyon—a scalability solution—could further bolster its utility.

Conclusion

Zcash’s 2025 resurgence is no anomaly; it is the culmination of technological refinement, cultural shift, and market forces aligning under a privacy-first banner. While speculative fervor and overbought signals warrant caution, the underlying demand for financial privacy suggests ZEC’s rally is more than fleeting hype. As regulatory battles loom, Zcash’s ability to balance anonymity with adaptability will determine whether it becomes a lasting pillar of the cryptoeconomy or a footnote in its evolution. For investors and advocates alike, its journey offers a pivotal test of privacy’s place in the digital age.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.