On November 7th, the cryptocurrency market is in a corrective phase, characterized by cautious sentiment and declining prices across major assets. Meanwhile, Circle submitted a comment letter to the U.S. Department of the Treasury, responding to the Advance Notice of Proposed Rulemaking on the GENIUS Act. The new cross-chain trading app Fomo said on Thursday it raised $17 million in a Series A round led by Benchmark.

Zcash (ZEC) is trading at $582. This is an amazing 18.44% rise in the last 24 hours and the coin’s rise to heights not seen since 2018.

Crypto Market Overview

BTC (-1.48% | Current Price: $101,836.88)

Bitcoin is undergoing a significant correction, having shed about 22% from its recent all-time high of $126,000. The price recently wobbled, briefly dipping below the $102,000 level before recovering slightly.

A key on-chain metric, the True MVRV ratio, is currently over 1.8. Low values and down-trends: The market value of the coin supply is decreasing relative to the realized value (cost basis). Lower values indicate a smaller degree of unrealized profit is in the system which may signal both undervaluation, or poor demand dynamics. Historically, readings below 1.5 have often coincided with local market bottoms, similar to patterns observed in mid-2024 and early 2025. This suggests that BTC may be trading in a discounted territory relative to its "fair value" based on the aggregate cost basis of its holders.

MVRV ratio. Source: CryptoQuant

Despite the price drop, a key bullish divergence exists: stablecoin reserves on major exchanges like Binance have swelled to a nine-month high of nearly $10 billion. This indicates that a substantial amount of asset is waiting on the sidelines, ready to be deployed into the market once sentiment improves.

On November 6th, institutional products are seeing a retreat. Bitcoin exchange-traded funds (ETFs) registered an inflow of $127.5 million. Fidelity's FBTC ETF saw an inflow of $61.6 million.

ETH (-2.13% | Current Price: $3350.75)

Ethereum has resumed its downtrend, trading below the key short-term support level of $3,300. This bearish move is part of a broader negative sentiment affecting the crypto market .

A profoundly bullish long-term signal is the continued decline of ETH balances on exchanges. According to Glassnode, the balance has plummeted to 13.3 million ETH, its lowest level in nine years. This steady outflow suggests consistent accumulation, as holders move their assets into self-custody or staking. The effect is a reduction in the available supply for sale, which eases downward pressure and could foster scarcity-driven price increases in the future .

From a technical perspective, sellers are in control. The Relative Strength Index (RSI) is at 32, approaching oversold territory, and the Moving Average Convergence Divergence (MACD) indicator maintains a sell signal. Key downside levels to watch are $3,057 and $2,880.

On November 6th, ETH ETFs experienced a total net inflow of $4.5 million, including an inflow of $4.9 million from Fidelity's FETH.

Altcoins

The market on November 7, 2025, is navigating a complex set of signals. The prevailing mood is one of "Fear," with prices in a clear corrective phase as evidenced by Bitcoin's 22% drop from its peak and Ethereum breaking below $3,300. The immediate narrative is dominated by several headwinds: persistent ETF outflows, a sharp decline in futures open interest indicating a flight from leverage, and sustained selling from long-term Bitcoin holders. The technical outlook for both BTC and ETH favors sellers in the short term.

The Altseason Index has shown a significant rise to 22. Top Performers and Market Leaders: Data from Delphi Digital highlights that only 11 altcoins closed higher in the recent period, underscoring the challenging environment. However, the top performers saw astronomical gains, led by ORE (+2710%), ZEC (+239%), and Clanker (+166%).

Macro Data

Traditional markets are also facing uncertainty. A US bank president has cited caution regarding further interest rate cuts, citing a lack of reliable economic data due to the recent federal government shutdown. This data blackout makes it difficult to assess the inflation trajectory, leading to a more cautious stance from the Fed.

On November 6th, the S&P 500 fell 1.12%, standing at 6,720.32 points; the Dow Jones Industrial Average fell 0.84% to 46,912.30 points, and the Nasdaq Composite dropped 1.90% to 23,053.99 points.

Trending Tokens

HIPPO sudeng (+232.38%, Circulating Market Cap: $76.29 Million)

HIPPO is trading at $0.007646, up approximately 232.38% in the past 24 hours. $HIPPO is a fan-created memecoin on SUI that celebrates the adorable Su Deng, the cutest hippo in the world. Under new community-driven management, the project donates a portion of its profits to global wildlife causes, starting with Khao Kheow Open Zoo, home to Moo Deng. Over the past week, whale addresses have been making

continuous large-scale purchases, with the largest single transaction reaching approximately $2.94 million. The top ten addresses collectively hold approximately 62% of the tokens. In the past 24 hours, open interest in the derivatives market surged by over 400%, forcing short positions to be liquidated and further driving up market buying. During the same period, the RSI indicator rose above 90, indicating that the market is extremely overbought and faces significant downward pressure in the short term.

SAPIEN Sapien (+180.48%, Circulating Market Cap: $84.96 Million)

SAPIEN is trading at $0.3388, up approximately 180.48% in the past 24 hours. Sapien is an open protocol for sourcing verified human knowledge at scale. Its network of millions of contributors spans more than 100 countries, ranging from doctors and engineers to artists and students. Together they produce high-quality AI training data, validated through Sapien’s onchain Proof of Quality system. This ensures enterprises and AI developers can access trusted, human-in-the-loop data while transforming fragmented online work into a sustainable, reputation-based profession. SAPIEN was officially listed on Binance Spot on November 6 at 10:00 UTC, with trading pairs including USDT, USDC,

BNB, and TRY. Concurrently, Binance initiated a HODLer airdrop, which rewarded users who staked BNB through Simple Earn or On-Chain Yield between October 20 and 22. This listing provides a significant liquidity boost by granting SAPIEN access to Binance’s extensive user base, thereby driving immediate buy-side demand. Additionally, the airdrop incentives prompted eligible participants to claim free tokens, resulting in a temporary increase in token scarcity.

PROMPT Wayfinder (+53.48%, Circulating Market Cap: $38.48 Million)

PROMPT is trading at $0.1050, up approximately 53.48% in the past 24 hours. Wayfinder is an artificial intelligence (AI) focused omni-chain protocol enabling user-owned, autonomous AI agents to securely and efficiently navigate across blockchain ecosystems and Dapps while independently transacting assets you control via dedicated Web3 wallets. The 24h rally pushed PROMPT’s 7-day RSI to 64 (neutral) but daily RSI hit 92.5 on August 26, indicating extreme overbought conditions (AMBCrypto). The MACD histogram turned positive (+0.00145), supporting near-term bullish momentum. However, price faces resistance at the 38.2% Fibonacci level ($0.1065). A break below $0.10 (50% retracement) could trigger profit-taking.

Market News

Circle Urges “Same Activity, Same Rules” For GENIUS Act Stablecoins

Circle posted comments on Genius Act implementation. Source: Circle X account

Circle submitted a comment letter to the U.S. Department of the Treasury, responding to the Advance Notice of Proposed Rulemaking on the GENIUS Act.

The filing outlines a national framework for payment stablecoins and describes how uniform requirements could support users, issuers, and intermediaries across U.S. markets.

The letter presents its recommendations within a single regime that accommodates both permitted U.S. issuers and qualifying foreign issuers, while ensuring consumer funds are protected through clear reserve, redemption, and disclosure standards established in rules rather than marketing claims. Circle proposes that payment stablecoins be fully backed with cash and high-quality liquid assets, kept separate from company funds, and redeemable at par on demand, with independent monthly checks and plain language reports that allow users and supervisors to verify backing.

The company links these requirements to a level playing field for bank and nonbank issuers under a common prudential baseline, and to a standalone issuer structure with the staffing and controls needed to meet obligations in the Act.

The letter calls for a reciprocal path for foreign regimes that match GENIUS standards and that maintain ongoing supervision. It adds that determinations should be published so market participants can understand which cross-border issuers qualify.

Cross-chain Trading App Fomo Raises $17 Million in Round Led by Benchmark

The new cross-chain trading app Fomo said on Thursday it raised $17 million in a Series A round led by Benchmark.

"While crypto infrastructure has consistently improved, user experience has remained an afterthought. This has led to fragmentation—incompatible chains, wallets, liquidity, and users scattered across ecosystems," Fomo said in a blog post. Calling itself the "largest cross-chain trading application in crypto," Fomo said it has, during six months of beta, "processed nearly $700 million in volume" and onboarded more than 120,000 users and over 35,000 traders.

Also, on Thursday, major blockchain projects including Solana, Fireblocks, Monad and Polygon formed an alliance to develop a common framework for cross-chain payments.

Fomo said its app lets users maintain a single balance across multiple chains without dealing with bridges or gas fees. It charges a 0.5% fee per trade, with a $0.95 minimum on Solana transactions and no minimum on lower-cost networks like Base and BNB Chain, according to TechCrunch.

"Benchmark has a proven track record of backing bold, world-changing consumer products like Uber, Snapchat, Instagram, and Twitter," Fomo said in its statement. Angel investors joining Fomo's Series A include Pudgy Penguins CEO Lucas Netz and MoonPay CEO Ivan Soto-Wright. The startup has raised a total of $19 million.

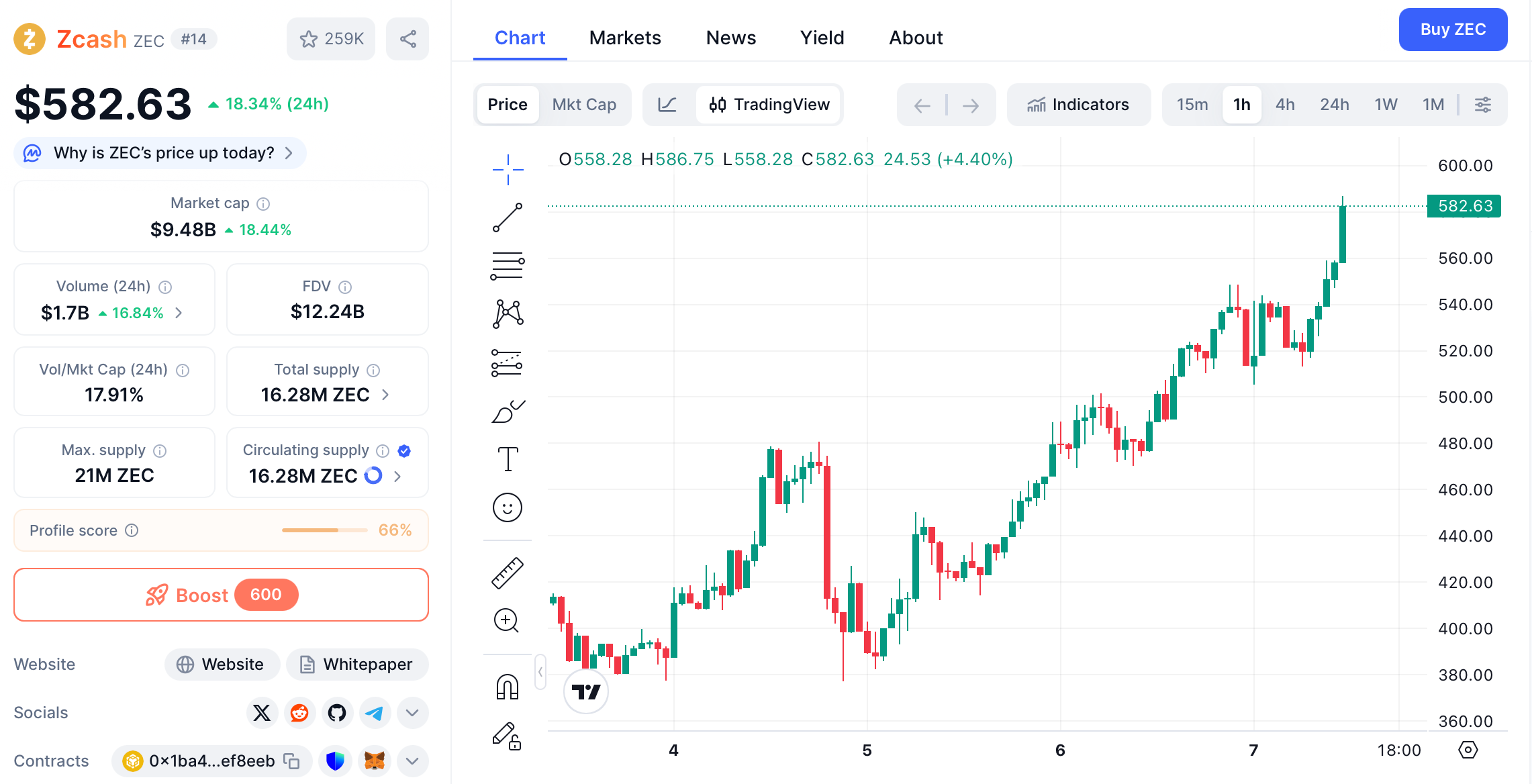

Zcash Surges Past $582 as Privacy Narrative Drives Seven-Year High

ZEC price chart. Source: CoinMarketCap

ZCash (ZEC) is surging through the cryptocurrency cosmos, capturing the attention of everyone, from everyday enthusiasts to finance titans.

At the time of writing,

Zcash (ZEC) is trading at $582. This is an amazing 18.44% rise in the last 24 hours and the coin’s rise to heights not seen since 2018. The cryptocurrency that focuses on privacy has been one of the best performers of 2025, rising more than 330% in the previous month, while the rest of the crypto markets have been having a hard time.

So what’s fueling ZCash’s meteoric ascent? A major factor is the activity of long-term investors, many of whom are parting ways with their long-held ZEC assets. The resurgence of these dormant holdings—coins that have remained static for years—has introduced a wild sense of volatility to the landscape. Metrics like CDD Multiple highlight the significant shift as these aged coins enter the market once again. Investors need to keep a sharp eye out; the movements of long-term holders can result in swift price surges but just as easily lead to unexpected downturns.

At present, ZCash finds itself at a critical juncture, caught between historic peaks and the potential risk of being overextended. The asset recently breached the $430 mark, propelled by a renewed fervor for privacy-oriented cryptocurrencies in an increasingly security-conscious world. Analysts are vigilant as ZEC approaches vital Fibonacci extension levels, where the chances for significant price fluctuations rise notably. While this rising trend piques the interest of traders, it serves as a crucial reminder of the risks that accompany such bullish momentum, as correction phases tend to lurk around the corner.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.