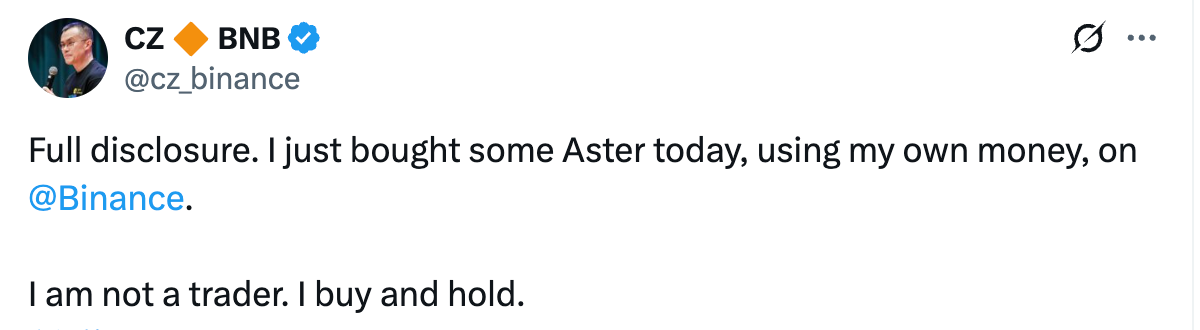

In the crypto world, few events can trigger an immediate and massive market reaction. However, a single social media post from Changpeng "CZ" Zhao, the founder of Binance, remains one of them. On November 2, 2025, CZ disclosed on X that he had personally purchased ASTER, the native token of the decentralized exchange (DEX) Aster. This rare public endorsement from one of the industry's most influential figures sent the token's price on a meteoric rise, surging over 24% in 24 hours and pushing its market capitalization to

$24.23 billion

.

This was not a typical influencer pump. CZ clarified his approach, stating, "I'm not a trader. I buy and hold", and compared this purchase to his early acquisition of BNB, which he has held for eight years. This move signals a profound, long-term conviction in the Aster project, which is positioned as a next-generation perpetual合约 DEX. The announcement instantly reshaped market dynamics, creating a classic tug-of-war between bullish retail investors inspired by CZ and skeptical whales mounting massive short positions. This event highlights the powerful intersection of influencer credibility, project fundamentals, and the high-stakes game of crypto derivatives.

CZ's Contrarian Bet: More Than Just a "Call"

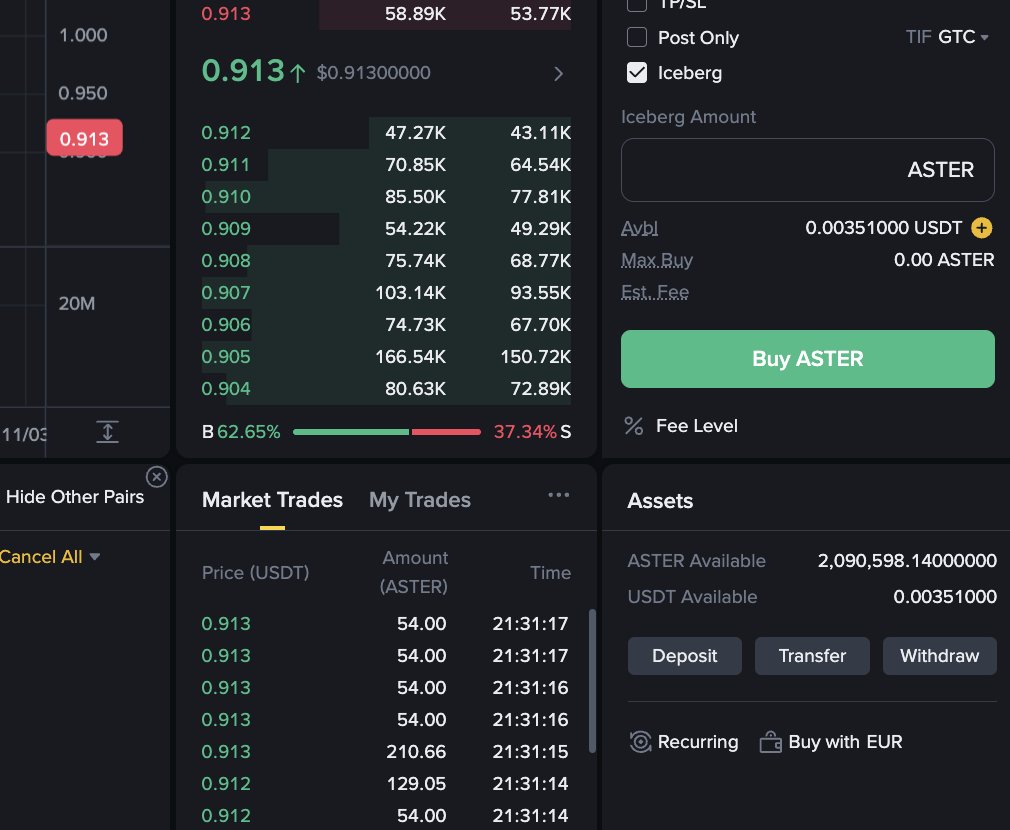

CZ's disclosure was notable for its rarity and transparency. He shared a screenshot showing a balance of

2.09 million ASTER tokens, acquired at a market price of approximately

$0.91 per token, representing a personal investment of around

$1.9 to $2 million. By emphasizing that he used his own money on the public market, CZ aimed to present this as a personal, long-term investment rather than a promotional stunt.

Screenshot of CZ's account. Source: CZ X accoount

His follow-up comment, referencing his eight-year hold of BNB, was a powerful signal to the market. It positioned ASTER not as a short-term trade but as a foundational bet on the future of decentralized trading infrastructure. This"buy-and-hold" philosophy, coming from a figure of CZ's stature, resonates deeply with a segment of the crypto community that values long-term project viability over speculative gains.

The timing and nature of this endorsement suggest a deep strategic alignment. CZ's family office,

YZi Labs, was an early investor in Astherus, Aster's predecessor project. Furthermore, Aster is a core project within the

BNB Chain ecosystem, which CZ has been actively promoting since stepping down as Binance CEO. His investment is thus seen as a move to strengthen the entire BNB Chain ecosystem by backing a promising Perp DEX that could compete with rivals like Hyperliquid.

Immediate Market Impact and the Short Squeeze Dynamics

The market's response to CZ's post was swift and explosive. Within minutes, the price of ASTER surged

20-35%, jumping from around

$0.91 to a multi-week high of $1.17. The rally continued, with the token later breaking through

$1.15 and even touching

$1.26 at its peak. This price action triggered a significant surge in trading activity. According to DeFiLlama data, ASTER's 24-hour trading volume skyrocketed from $224 million to over

$2 billion, a staggering increase that underscores the immense influence CZ commands.

This volatile environment set the stage for a potential short squeeze. Before CZ's announcement, a large whale had established a substantial leveraged short position on ASTER. This entity had initially shorted

42.966 million ASTER tokens with 3x leverage, with an entry price of $1.208 and a liquidation threshold between

$1.81 and $2.09. Intriguingly,

after CZ's announcement, this same whale

added to their short position, increasing it by

24.41 million tokens.

This created a high-stakes standoff. As the price rose due to bullish sentiment from CZ's backing, this whale's short position, now totaling over

$50 million in value, faced increasing pressure. A continued price rise towards the $2.08 liquidation price could force the whale to buy back ASTER to cover their position, potentially creating a feedback loop that fuels further explosive price gains—a classic short squeeze.

Aster's Fundamental Drivers: Beyond the Hype

While CZ's endorsement provided the spark, Aster's recent fundamental developments provided the fuel for sustained investor interest. The project has introduced several key upgrades to its tokenomics and platform activity that support a bullish long-term thesis.

A critical development was the refinement of Aster's

buyback and airdrop model (S3). The project announced that

50% of all buybacks from both its S2 and S3 phases would be permanently burned. Token burning effectively reduces the total supply of ASTER, creating deflationary pressure that can support the token's value over the long term. The remaining 50% is sent to a locked airdrop address, reducing the circulating supply in the short term and reserving tokens for future distribution to loyal users.

Furthermore, Aster's innovative product,

Rocket Launch, has demonstrated remarkable traction. In its first six days, the platform generated a total trading volume of over

$1 billion ($122 million in spot and $933 million in contracts), showcasing strong user adoption and platform liquidity. A new round of Rocket Launch activities focused on the Nubila oracle network, featuring a reward pool of $600,000, is poised to further stimulate trading activity on the platform.

On-chain data also revealed supportive signals. A separate whale, distinct from the one shorting, withdrew

6.8 million ASTER tokens from Binance to the Aster ecosystem over six days, indicating a strategic, long-term accumulation of the token rather than a short-term trading play.

The Road Ahead

Despite the bullish momentum, ASTER faces significant challenges that could test its recent gains. A major near-term hurdle is the scheduled

token unlock in November. The project is set to release approximately

2 billion tokens (2.5% of total supply) on November 10, valued at around

$2.4 billion, followed by another

727.3 million tokens (0.91% of supply) on November 17. Such unlocks increase the circulating supply and can create substantial selling pressure if large holders decide to take profits.

The derivatives market also presents a mixed picture. While the open interest for ASTER futures remains high at

$437 million, the trading volume for derivatives has fallen

40.55% quarter-on-quarter. This contrasts sharply with the 537% surge in spot volume, highlighting a divergence in trader sentiment between short-term speculators and long-term holders.

The ongoing standoff with the shorting whale remains a critical variable. While the whale is currently reporting a floating profit of

$129 million on the ASTER short position, their continued presence adds a layer of instability. If the price approaches the

$2.08 liquidation level, it could trigger a cascade of buying, but if the whale successfully unwinds their position or market sentiment sours, it could lead to a sharp downturn.

Macro risks also persist. The broader cryptocurrency market remains sensitive to macroeconomic factors like Federal Reserve policy and AI infrastructure spending, which can influence capital flows into and out of digital assets.

Conclusion

CZ's public purchase of ASTER has done more than just trigger a short-term price pump; it has cast a spotlight on a project aiming to become a leader in the competitive Perp DEX arena. This event underscores the immense power of credible influencer endorsement in the crypto space, but it also highlights a market maturing enough to weigh such endorsements against project fundamentals.

The coming weeks will be a critical test for ASTER. The project's strengthened tokenomics, demonstrated by its aggressive buyback-and-burn program, and its robust platform activity, evidenced by Rocket Launch's success, provide a solid foundation. However, it must navigate the imminent token unlock and the persistent overhang of large short positions.

For the market, the ASTER saga is a case study in modern crypto dynamics. It demonstrates how strategic investments from industry leaders can validate projects, attract capital, and create complex market scenarios where fundamentals, influencer power, and derivatives trading collide. Whether ASTER can sustain its momentum will depend on its ability to continue delivering real value and utility, proving that CZ's bet was not just on a token, but on the future of decentralized finance.

References:

CZ Binance [@cz_binance]. (n.d.). Tweets [X (formerly Twitter) profile]. Retrieved November 3, 2025, from https://x.com/cz_binance

AInvest. (2025, November 2). The ASTER Short Squeeze and CZ's Contrarian Buy Signal: A Strategic Contrarian Opportunity? Retrieved from https://www.ainvest.com/news/aster-short-squeeze-cz-contrarian-buy-signal-strategic-contrarian-opportunity-2511/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.