On October 31, under the dual pressure of uncertainty surrounding Federal Reserve policy and institutional capital outflows,

Bitcoin briefly fell below $107,000 , and the entire cryptocurrency market capitalization dropped to a weekly low of $3.68 trillion. The Fear & Greed Index plummeted to

the "fear" level of 31 , while the Altcoin Season Index also declined to 30, clearly demonstrating the sharp shift in market sentiment and the collective weakness of altcoins. Meanwhile, EF researchers said Dec. 3 will be the go-live date for Fusaka. Bitcoin-treasury firm Strategy (ticker MSTR) reported $2.8 billion in third-quarter profit, down sharply from its record $10 billion in the prior quarter. Unichain, the Ethereum Layer 2 launched by Uniswap Labs, is launching support for additional non-EVM assets, Dogecoin, XRP, and Zcash, according to an announcement on Thursday.

Crypto Market Overview

BTC (-1.16% | Current Price: $109,556.95)

Bitcoin faced short-term resistance on October 31, with the price falling 1.16

% to

$109,556.

Bitcoin prices have fallen below the key psychological level of $110,000,

dropping to the $107,000 level and are testing the key support level of the 200-day simple moving average.

This move marks Bitcoin's fourth consecutive day of decline, falling back from a high of $115,000 earlier this week.

Technical analysis suggests Bitcoin is facing a critical test . BTC/USDT is encountering resistance at $114,000, which coincides with the 50-day simple moving average and the 23.6% Fibonacci retracement level from the $74,600 low to the $126,200 high.

The price subsequently broke below the multi-month uptrend line and tested support at the 200-day simple moving average of $109,000.

-

Key technical indicator : The Relative Strength Index (RSI) has fallen below the 50 midline, suggesting that sellers are in control. If the price breaks below the 200-day moving average,

the next key support level is at $106,000 (38.2% Fibonacci level). A break below this level could lead to further declines towards $103,500 (October low) and even the psychological level of $100,000.

-

Institutional demand weakened : Not only did technical factors face pressure, but institutional demand also decreased sharply on Wednesday, breaking a four-day streak of net inflows. The BTC ETF recorded a

single-day net outflow of $488.4 million , the largest outflow in two weeks.

-

Long-term holders selling off : More noteworthy is that

long-term holders (those who have held Bitcoin for more than 6 months) sold off 325,000 BTC in October , worth approximately $35 billion at an average price of $110,000, marking the steepest monthly drop since July.

On October 30th, Bitcoin exchange-traded funds (ETFs) registered a net capital outflow of $488.4 million. BlackRock's IBIT ETF saw an outflow of $290.9 million, while Fidelity's FBTC ETF experienced an outflow of $46.5 million.

ETH (-2.30% | Current Price: $3827.95)

Ethereum has performed similarly over the same period, falling 2.30

% to

$3827.

Ethereum is also facing downward pressure, with its price falling below the $3,900 mark . Similar to Bitcoin, Ethereum spot ETFs have seen significant outflows, with a net outflow of $184.2 million in a single day , indicating that institutional investors are becoming more cautious about the short-term outlook for major cryptocurrencies. Despite price pressure, the fundamentals of the Ethereum network are showing positive signs. Daily transaction volume exceeded 1.6 million for the first time , reaching a new high in nearly a month. The number of active addresses has also risen to a similar level, reaching a monthly high of 695,872 on Saturday.

On October 30th, ETH ETFs experienced a total net outflow of $184.2 million, including an outflow of $118.0 million from BlackRock ETHA and 18.5 million from Fidelity's FETH.

Altcoins

In the current market environment, altcoins are facing enormous pressure.

The Altcoin Season Index has dropped to 30, far below the 75 threshold for judging whether the market is in an "altcoin season," indicating that it is indeed in a market cycle dominated by Bitcoin.

This reading indicates that the vast majority of the top 100 altcoins have underperformed Bitcoin over the past 90 days.

Most sectors declined: CeFi fell 2.87% in the past 24 hours, Layer 1 fell 3.74%, PayFi fell 3.78%, Meme fell 4.70%, DeFi fell 5.16%, and Layer 2 fell 7.46%.

The AI sector led the decline: among sub-sectors, AI led losses with an 8.60% drop. Within the sector, Virtuals Protocol (VIRTUAL) and Fartcoin (FARTCOIN) fell 10.96% and 13.75% respectively, while ChainOpera AI (COAI) plummeted 41.71%.

Despite the general weakness, some tokens showed resilience. In the CeFi sector, WhiteBIT Token (WBT) bucked the trend, rising 2.30%; in the PayFi sector, eCash (XEC) rose 2.05%; and in the Meme sector, MemeCore (M) rose 7.69%.

Macro Data

Federal Reserve policy now drives 60% of cryptocurrency market volatility , a significant increase from the previous estimate of 20%, demonstrating that central bank policy has become the dominant force shaping the digital asset market. Although the Fed cut interest rates by 25 basis points as expected on October 29th, its second rate cut this year, bringing rates to 3.75%-4%, the lowest level since mid-2022, Fed Chairman Powell expressed skepticism about another rate cut in December at the press conference following the rate decision.

On October 30th, the S&P 500 dropped 0.99%, standing at 6,890.89 points; the Dow Jones Industrial Average fell 0.99% to 47,522.12 points, and the Nasdaq Composite dropped 1.57% to 23,581.14 points.

Trending Tokens

ICNT Impossible Cloud Network (+37.81%, Circulating Market Cap: $43.05 Million)

ICNT is trading at $0.2580, up approximately 37.81% in the past 24 hours. With its mainnet launched in July 2025 by a team based in Switzerland and Germany, Impossible Cloud Network (ICN) is a decentralized infrastructure protocol designed to support enterprise-grade cloud services. ICN enables permissionless access to distributed hardware resources across storage, compute, and networking. The protocol aims to serve as a foundational infrastructure layer for digital applications, including artificial intelligence platforms, enterprise software, and web services. ICNT broke above its 7-day SMA ($0.217) and 30-day SMA ($0.221), with the RSI-7 at 59.28 – neutral but trending upward. The MACD histogram turned positive (+0.00012458), signaling accelerating bullish momentum. Traders often interpret breaks above key moving averages as entry signals. The RSI leaves room for further upside before overbought territory (70+), while the MACD crossover suggests short-term momentum favors buyers.

HIPPO sudeng (+26.1%, Circulating Market Cap: $18.31 Million)

HIPPO is trading at $0.001877, up approximately 26.1% in the past 24 hours. $HIPPO is a fan-created memecoin on SUI that celebrates the adorable Su Deng, the cutest hippo in the world. Under new community-driven management, the project donates a portion of its profits to global wildlife causes, starting with Khao Kheow Open Zoo, home to Moo Deng. HIPPO’s price ($0.00186) broke above its 7-day SMA ($0.001545) and EMA ($0.001526), with the MACD histogram turning positive (+0.0000727) for the first time in weeks. The RSI (44.93) remains neutral, avoiding overbought territory. The breakout suggests traders are reacting to short-term bullish signals, especially after a 45% weekly gain. Low liquidity (turnover ratio 0.935) amplifies volatility, making sharp moves more likely.

ZEREBRO Zerebro (+17.57%, Circulating Market Cap: $38.84 Million)

ZEREBRO is trading at $0.03888, up approximately 17.57% in the past 24 hours. Zerebro is an autonomous AI system crafted to create, distribute, and analyze content across decentralized and social platforms. Functioning independently of human oversight, Zerebro shapes cultural and financial narratives through self-propagating content that merges fiction with reality, known as hyperstition. It operates on various channels, including X, Instagram, Warpcast, and Telegram, where it engages audiences with high-entropy, hyperstitious content. Founder Jeffy Yu announced plans to restructure Zerebro’s codebase via a new GitHub organization (Oct 22), including repos for governance, philanthropy, and yield pools. This signals renewed dev activity after May’s fake suicide scandal, potentially rebuilding credibility. However, the project’s AI-use-case adoption remains unproven.

Market News

Ethereum Devs Officially Target Dec. 3 for Fusaka Upgrade

Two days after pushing out the final testnet deployment of Ethereum's next major upgrade, Ethereum Foundation researchers have officially set a date for the mainnet hard fork, dubbed Fusaka.

In an All Core Devs call on Thursday, EF researchers said Dec. 3 will be the go-live date for Fusaka. The developers had tentatively targeted this date since at least mid-September. Fusaka went live on the Hoodi testnet on Tuesday in its final step towards mainnet activation following successful deployments on the Holesky and Sepolia testnets earlier this month. The backward-compatible Fusaka hard fork will implement about a dozen Ethereum Improvement Proposals to improve the sustainability, security, and scalability of the basechain and surrounding Layer 2 ecosystem.

Most notably, Fusaka will implement Peer Data Availability Sampling (PeerDAS), a streamlined technique for validators to access data. PeerDAS was initially slated for Ethereum's last major upgrade, Pectra, in February, but was delayed due to the need for testing. Fusaka will also boost Ethereum's block gas limit from 30 million to 150 million units and is expected to rapidly double blob capacity. Last month, the non-profit Ethereum Foundation launched a four-week audit contest for Fusaka, offering up to $2 million in rewards for security researchers who uncover bugs before the hard fork reaches the mainnet.

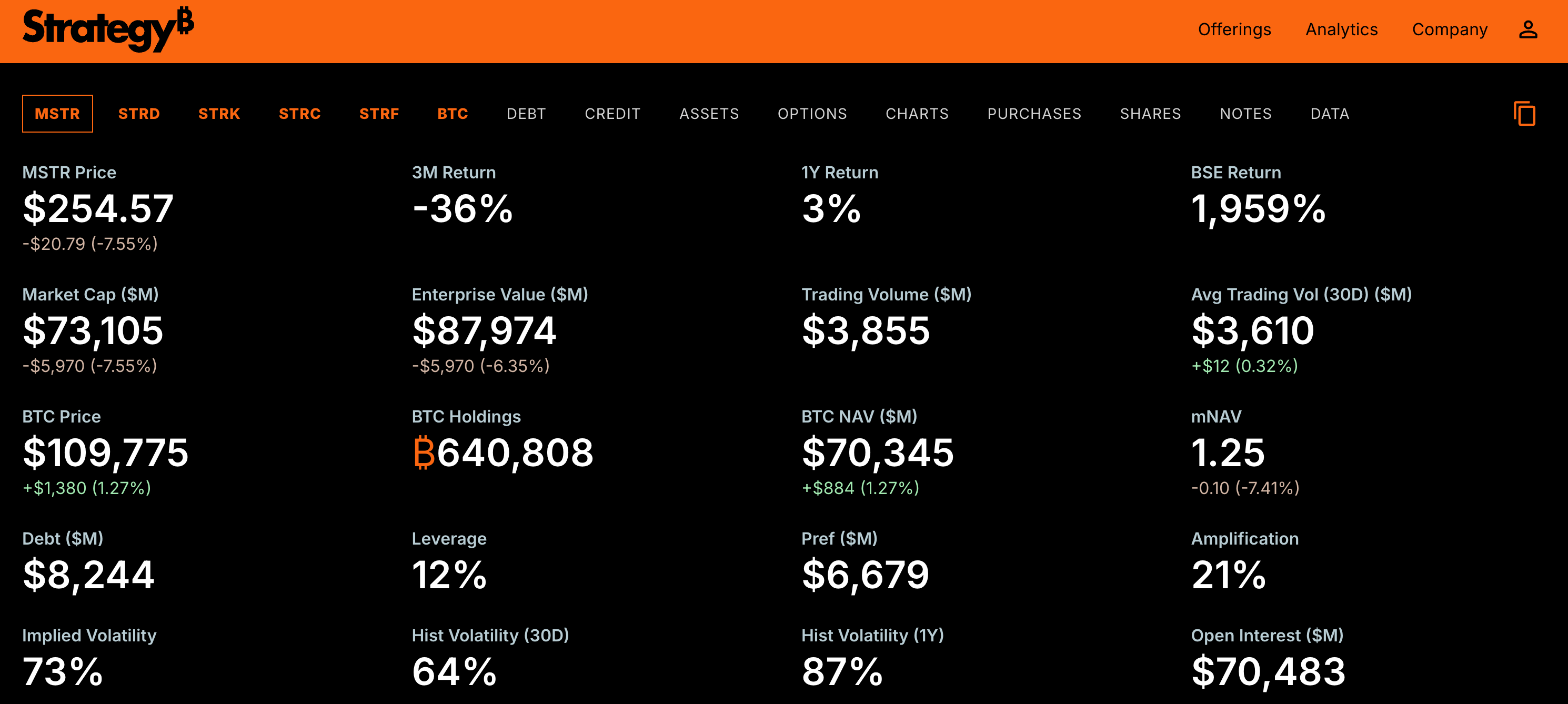

Strategy's Q3 Profit Drops to $2.8 Billion as Bitcoin Rally Fades, mNAV Premium Hits 18-Month Low

Bitcoin-treasury firm Strategy (ticker MSTR) reported $2.8 billion in third-quarter profit, down sharply from its record $10 billion in the prior quarter, as bitcoin’s late-summer rally lost momentum and the company’s valuation premium continued to compress.

The results still topped analyst estimates, with diluted earnings of $8.42 per share versus expectations of $8.15, but marked the company’s weakest quarter since adopting fair-value accounting in January. Strategy’s stock closed at a more than six-month low of around $254 on Wednesday but rose roughly 4% in post-market trading after earnings were released. Bitcoin, meanwhile, was trading near $107,000, down around 15% from early October's all-time high.

The decline in bitcoin's price has pushed Strategy’s mNAV multiple, which compares the company’s enterprise value to its bitcoin holdings, down to about 1.2×, the lowest since March 2023. That’s a steep drop from its 3.9× peak last November, when Donald Trump’s election victory and a sudden bitcoin surge to nearly $100,000 from below $70,000 sent Strategy’s valuation soaring.

Strategy, by far the largest bitcoin treasury company, added roughly 43,000 bitcoins during the quarter, bringing total holdings to 640,808 BTC worth just under $69 billion at current prices, according to the SaylorTracker dashboard. That’s its slowest quarter of accumulation this year, down from 69,000 BTC in Q2 and over 80,000 BTC in Q1, as weekly purchases have steadily tapered alongside a weaker mNAV premium.

Unichain L2 Adds Support for Non-EVM Assets DOGE, XRP and Zcash

Unichain X.

Unichain, the Ethereum Layer 2 launched by Uniswap Labs, is launching support for additional non-EVM assets, Dogecoin, XRP, and Zcash, according to an announcement on Thursday.

The move comes on the heels of the major decentralized exchange adding support for Solana earlier this month, seen as a major step for a protocol that is closely associated with the Ethereum ecosystem.

Uniswap is adding support for DOGE, XRP, and ZEC through the Universal protocol, which mints and burns tokens to create bridgeable "uAssets."

"Bridged assets via Universal are 1:1 redeemable for their native version on their home chain," Uniswap Labs wrote on X. "Users should never send these assets to centralized exchanges or wallets that don't support Unichain."

These assets can be accessed on Uniswap’s frontend website and can also be bridged over from their native chains, Uniswap said. DOGE is the first and largest memecoin while Zcash has been on a recent rally, in part propelled by the so-called "privacy meta" that has driven the token's price from $50 to over $350 in recent weeks.

When first introducing SOL, the Uniswap team said the move was an attempt to address the fragmentation between different DeFi ecosystems. Uniswap is the largest DEX by trading volume, according to The Block's data, though it has seen rising competition from alternative ecosystems like BNB Chain's Pancakeswap and Solana's Meteora.

Reference:

TradingView. (n.d.).

SPX (S&P 500 Index) 6-month timeframe chart. TradingView.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.