Cardano stands out in the crowded blockchain space as a third-generation platform built on

scientific research and peer-reviewed methodology

. Developed as a more scalable and sustainable alternative to earlier blockchains like Bitcoin and Ethereum, Cardano aims to balance security, decentralization, and scalability. Its native cryptocurrency, ADA, has emerged as a major digital asset supporting a wide range of decentralized applications. With recent developments, including technological upgrades and potential ETF approval, Cardano continues to evolve as a significant player in the blockchain ecosystem. This article explores Cardano's technology, use cases, recent developments, and future potential.

What Is Cardano Blockchain? What Is ADA?

Cardano is a

decentralized proof-of-stake (PoS) blockchain platform designed to support smart contracts and decentralized applications (dApps). Founded by Ethereum co-founder Charles Hoskinson, Cardano was developed to address limitations in earlier blockchain systems, particularly regarding scalability, interoperability, and sustainability.

ADA is the

native cryptocurrency of the Cardano network, named after Ada Lovelace, a 19th-century mathematician recognized as one of the first computer programmers. ADA serves multiple functions within the ecosystem: it facilitates transactions, powers smart contracts, supports network governance through staking, and serves as a medium for value transfer.

Unlike many blockchain projects that prioritize rapid development, Cardano distinguishes itself through its

methodical, research-driven approach. All protocol upgrades undergo rigorous academic peer review before implementation, ensuring enhanced security and reliability.

History of Cardano (ADA)

Cardano's development began in 2015 under the leadership of Charles Hoskinson, who had become frustrated with Ethereum's limitations. The mainnet launched in 2017, beginning the platform's structured, multi-phase development roadmap.

The project has been methodically implemented through five distinct eras, each named after a prominent historical figure:

-

Byron (2017): Marked Cardano's initial launch with basic functionality for ADA transactions.

-

Shelley (2020): Focused on decentralization by introducing stake pools and enabling users to participate in network operations through staking.

-

Goguen (2021): Implemented smart contract capability through the Alonzo hard fork, allowing developers to build dApps on Cardano.

-

Bashō (Current): Aimed at improving scalability and interoperability through solutions like the Hydra layer-2 protocol.

-

Voltaire (Future): Will introduce decentralized governance, allowing ADA holders to vote on network decisions and manage treasury funds.

This structured approach to development reflects Cardano's commitment to creating a robust, scientifically-grounded blockchain platform.

Features of Cardano (ADA)

Ouroboros Consensus Mechanism

Cardano utilizes

Ouroboros, a pioneering proof-of-stake protocol that validates transactions and creates new blocks. Unlike Bitcoin's energy-intensive proof-of-work system, Ouroboros is highly energy-efficient, consuming only 0.5478 kWh per transaction compared to Bitcoin's 707 kWh. The protocol selects validators based on their staked ADA, eliminating the need for competitive mining and significantly reducing the network's environmental impact.

Two-Layer Architecture

Cardano employs a

unique two-layer architecture that separates the settlement layer (CSL) from the computation layer (CCL). This division allows the CSL to handle ADA transactions efficiently while the CCL manages smart contracts and dApps without disrupting network operations. This separation enhances flexibility and enables targeted upgrades to specific network components.

Scalability Solutions

Cardano continues to enhance its transaction capacity through multiple approaches. Its base layer can process approximately

250 transactions per second (TPS), significantly higher than Ethereum's 15-30 TPS. With the implementation of Hydra layer-2 solutions, this capacity could potentially reach

1,000 TPS. The upcoming Leios upgrade, currently in the engineering phase, aims to further boost throughput to

10,000 TPS through parallel processing lanes.

Peer-Reviewed Development

A distinguishing feature of Cardano is its commitment to

academic rigor and peer review. Before implementation, all upgrades undergo formal academic assessment, ensuring reliability and security. This methodical approach potentially reduces vulnerabilities and enhances network stability compared to projects that prioritize speed over security.

Cardano News and Update

Leios Upgrade and x402 Protocol Integration

Cardano's upcoming Leios upgrade represents a significant advancement in blockchain scalability. The redesign

decouples block creation from validation, reducing bottlenecks and optimizing finality times. This upgrade officially entered the engineering phase after a formal handover from Input Output Research to Input Output Engineering in September 2025.

Additionally, Cardano's integration of the x402 protocol enables

AI agents to autonomously execute verifiable payments via APIs without traditional authentication systems. Charles Hoskinson emphasized this development's significance, noting its potential to establish Cardano as a financial backbone for the emerging AI Agent Economy.

ETF Recognition

In a significant regulatory development, the

U.S. Securities and Exchange Commission (SEC) acknowledged Grayscale's ADA ETF proposal in February 2025. This recognition marks an important step toward potential institutional adoption and reflects the growing regulatory acceptance of Cardano. Following this announcement, ADA's price increased by 8.5%, and trading volume surged by 150%.

ADA Value

Current Market Position and Technical Analysis

As of October 2025, ADA trades at approximately $0.65, with a market capitalization of around $23 billion, ranking it among the top cryptocurrencies globally. Technical analysis suggests ADA may experience significant growth through 2025-2028:

-

2025: Price range projected between $0.66-$1.10, with an average price of $0.93.

-

2026: Potential to reach approximately $1.22, with bullish momentum expected in May.

-

2027: Projected peak of $1.69 in October, aligning with historical fourth-quarter crypto market rallies.

-

2028: Continued upward trajectory with prices potentially reaching $1.71.

Long-term predictions suggest ADA could reach $3.33 by 2030, with more ambitious targets of $10 possible by 2030 if significant technical barriers are overcome.

Investment Perspective

From an investment viewpoint, Cardano has demonstrated substantial growth potential since its launch. A $10,000 investment at ADA's earliest trading price of $0.02 would have grown to approximately $1.55 million at its September 2021 peak of $3.10. Though currently trading below this peak, the token has still generated impressive returns of over 3,150% in eight years.

The Impact of ETF Inclusion on Cardano's Adoption and Price

The potential approval of a Cardano ETF could significantly impact ADA's adoption and price dynamics across multiple timeframes:

Short-Term Impact

ETF approval would likely trigger

immediate liquidity injection and price appreciation. Analysts project ADA could rapidly challenge the

$1 psychological barrier following approval. Historical patterns from Bitcoin and Ethereum ETF approvals suggest that, typically, heightened trading volume and increased short-term volatility would accompany such a development.

Medium-Term Implications

Beyond initial price movements, ETF approval would provide

legitimacy and regulatory validation, making ADA accessible to a broader investor base. Institutional investors, wealth managers, and retirement funds could incorporate Cardano into diversified portfolios without direct blockchain interaction, significantly expanding its potential investor base.

Long-Term Strategic Value

In the long term, ETF approval would likely prompt a

comprehensive revaluation of Cardano's fundamental strengths, including its Ouroboros consensus mechanism, Voltaire governance framework, and real-world deployment in areas like government systems, educational credentials, and supply chain management. This institutional scrutiny could drive more utility-focused development within the Cardano ecosystem.

Community Sentiment and Long-Term Holder Confidence

Cardano maintains a

strong, engaged community of developers and ADA holders. The network's staking mechanism has been particularly successful in fostering long-term holder confidence. ADA holders can delegate their tokens to stake pools to earn rewards while contributing to network security. This economic incentive encourages participation and reduces selling pressure from token holders.

The upcoming Voltaire era will further empower the community by implementing a

decentralized governance modelthat allows ADA holders to vote on protocol decisions and funding proposals. This transition to community-led governance represents a significant step toward full decentralization and aligns stakeholder interests with network development.

Despite short-term price fluctuations, fundamental metrics suggest sustained community support. The network has hosted over

1,000 smart contracts, and projects like the SundaeSwap decentralized exchange achieved

$70 million in total value locked in its first month, demonstrating robust ecosystem development.

Recent Price Drop and Challenges

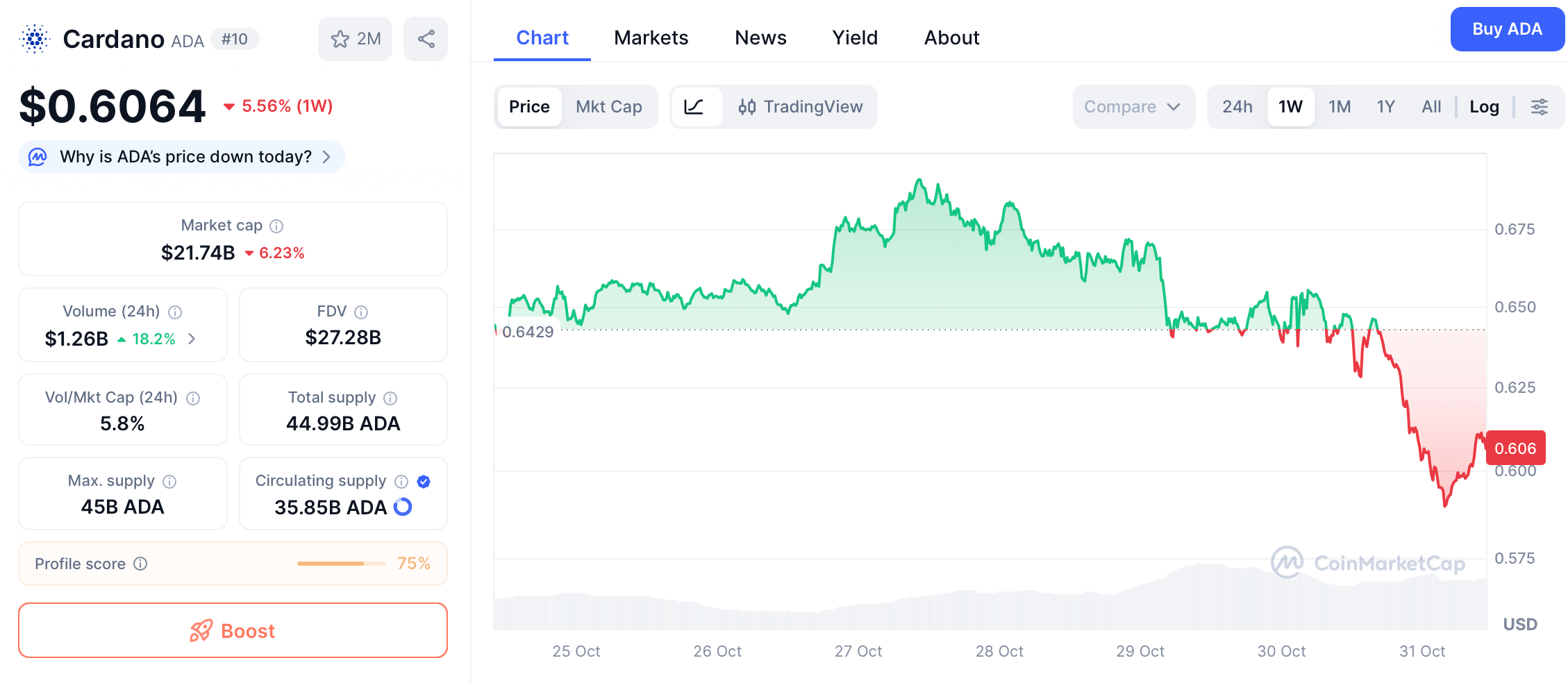

ADA price chart. Source: CoinMarketCap

The recent price decline in Cardano (ADA) is mainly due to a combination of factors, including large-scale selling, bearish technical signals, and the impact of macroeconomic policies.

Large-scale sell-off: Major holders (whales) sold approximately 100 million ADA tokens (valued at about $65 million) within a 72-hour period, leading to a decline in the price from $0.88 to $0.64.

Weakening technical indicators: A "death cross" pattern has emerged, with the 50-day moving average crossing below the 200-day moving average, which is generally interpreted as a bearish signal. Concurrently, the price broke below the key support level of $0.685.

Macroeconomic policy influences: Although the Federal Reserve announced an interest rate cut, Chairman Powell indicated that a further rate reduction in December is not guaranteed, which tempered market optimism regarding easing policies and exerted pressure on high-risk assets.

Ecosystem maturity: The total value locked (TVL) in the Cardano network declined from $360 million in early October to approximately $280 million, suggesting diminished activity within its DeFi ecosystem.

ETF market sentiment: Expectations for the approval of a Cardano spot ETF decreased significantly from 96% in September to 68%, impacting overall market sentiment.

Conclusion

Cardano represents a unique approach to blockchain development, prioritizing

scientific rigor, sustainability, and methodical progress over rapid expansion. Its distinctive features—including the Ouroboros proof-of-stake protocol, two-layer architecture, and research-backed upgrades—position it as a potential leader in the next generation of blockchain platforms.

While Cardano faces challenges in expanding its DeFi ecosystem and competing with established smart contract platforms, upcoming developments like the Leios upgrade, x402 protocol integration, and potential ETF approval provide significant growth catalysts. These advancements could enhance Cardano's utility across DeFi, AI, and enterprise applications.

For investors and users, Cardano offers a fundamentally sound blockchain platform with substantial long-term potential. Its commitment to peer-reviewed research, energy efficiency, and decentralized governance creates a strong foundation for continued development and adoption. As the blockchain space evolves, Cardano's scientific philosophy and technological innovations may well establish it as a cornerstone of the decentralized future.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.