The Web3 landscape in 2025 is defined by two dominant trends: the rise of decentralized community coordination and the explosive growth of AI-integrated protocols. Among these emerging projects,

COMMON ($COMMON)

has quickly captured market attention, positioning itself as a next-generation collaboration layer combining community governance, contributor incentives, and AI-driven automation.

Launched amid a flurry of exchange listings and a substantial airdrop campaign,

COMMON

aims to solve critical challenges in decentralized ecosystems, such as fragmented governance and inefficient resource allocation. However, its early market performance reveals the volatility inherent in nascent crypto projects, with the token experiencing dramatic price swings shortly after its debut. This article explores COMMON’s vision, technology, and market dynamics, offering insights into its potential and risks.

What Is COMMON?

COMMON is a

Web3 collaboration platform designed to serve as a unified coordination layer for decentralized communities, contributors, and AI agents. Integrating governance tools, incentive mechanisms, and AI-powered automation enables smoother interaction and decision-making across decentralized autonomous organizations (DAOs) and other Web3 projects.

The protocol allows communities to deploy governance contracts, manage fundraising, and facilitate discussions in a single dashboard, reducing the friction often experienced when coordinating across multiple blockchains. Its ecosystem already supports over 700 communities, including prominent names like dYdX and Axie Infinity, and ecosystem foundations for NEAR, Solana, and Polygon.

How COMMON Works: The Mechanics of Coordination

At its core, COMMON leverages a tripartite model to streamline decentralized operations:

-

Community Governance: The platform provides modular tools for creating and managing DAOs, enabling token-based voting, proposal discussions, and treasury management. This ensures transparency while reducing reliance on fragmented, chain-specific solutions.

-

Contributor Incentives: Through its native token, COMMON rewards users for meaningful contributions, such as content creation, development, or community moderation. This aligns participant interests with long-term ecosystem growth.

-

AI Agent Integration: A key innovation lies in its use of AI agents to automate tasks like workload distribution, governance participation, and community monitoring. These agents enhance scalability and responsiveness, addressing inefficiencies in human-led governance.

The platform’s technical foundation includes support for multiple blockchains and an emphasis on user-friendly interfaces, allowing both technical and non-technical users to engage seamlessly.

Why COMMON Stands Out

COMMON’s unique value proposition has attracted significant interest for several reasons:

-

Substantial Funding Backing: The project raised

$20 million from top-tier investors, including Polychain Capital, Dragonfly, and Wintermute. This financial support underscores investor confidence in its vision and execution capability.

-

Multi-Chain Compatibility: Unlike many protocols tied to a single blockchain, COMMON offers cross-chain functionality, serving communities on Ethereum, Solana, NEAR, and Polygon. This interoperability is critical in a multi-chain ecosystem.

-

AI-Driven Governance: By incorporating AI agents, COMMON addresses a key pain point in DAO management: the slow pace of manual coordination. This positions it at the intersection of two high-growth niches: AI and decentralized governance.

-

Exchange Endorsements: Rapid listings on platforms like Binance Alpha, Gate US, and Bitget have provided liquidity and visibility, though they have also introduced volatility.

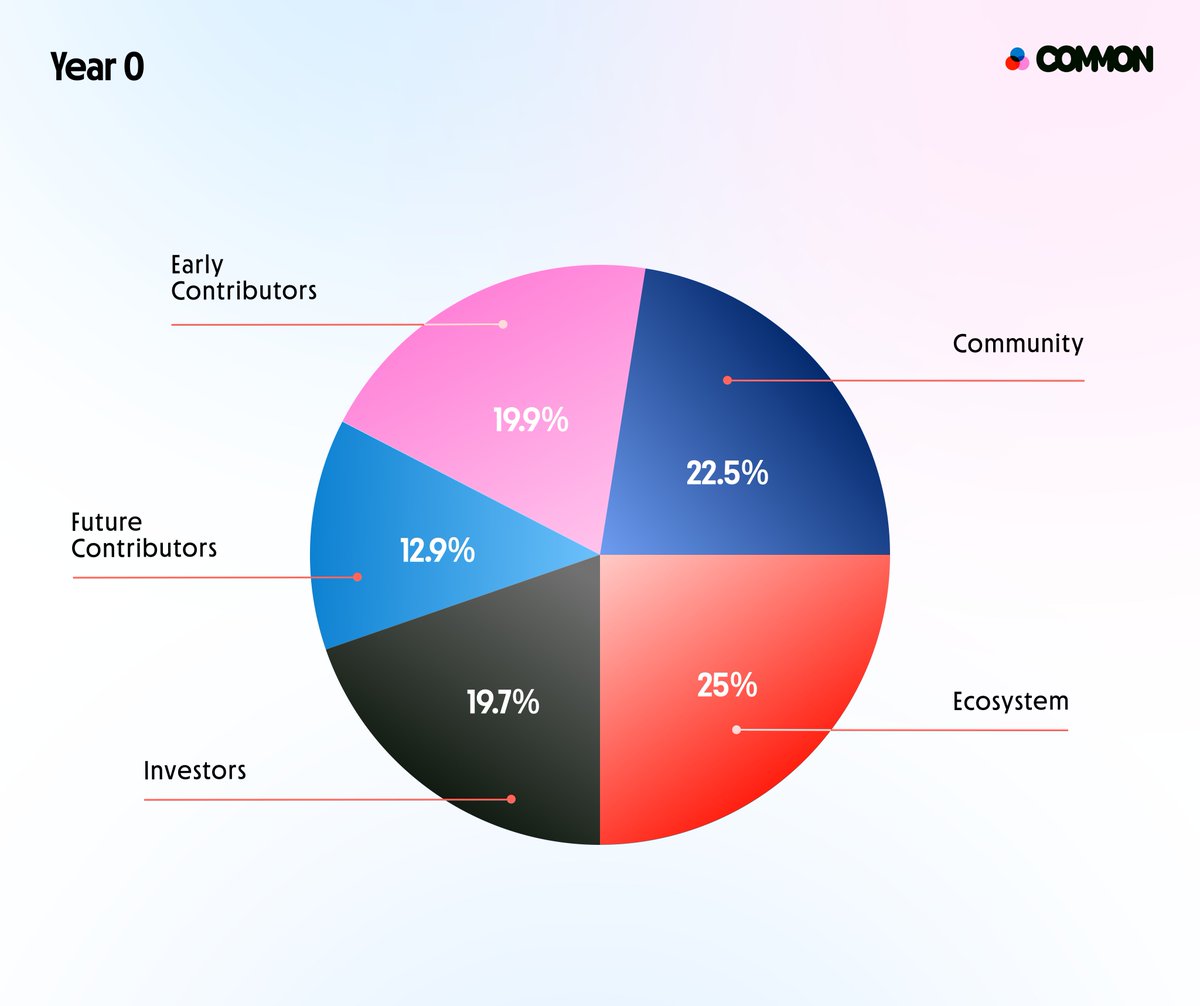

COMMON Tokenomics

COMMON’s tokenomics are designed to support ecosystem growth and incentivize participation. Key metrics include:

-

Total Supply: The maximum supply is capped at

12.41 billion tokens.

-

Circulating Supply: Approximately

1.48 billion tokens are currently in circulation.

-

Market Capitalization: At its all-time high, the token reached a market cap of over $44 million, though this has since declined.

The token serves multiple purposes, including governance voting, staking rewards, and access to platform features. A portion of the supply was distributed via a

27.77 million token airdrop on Bitget, aimed at driving initial adoption.

COMMON Token Allocaions

Use Cases and Features

COMMON’s utility spans several areas:

-

DAO Management: Communities use COMMON to deploy and manage governance frameworks, conduct voting, and allocate funds.

-

Cross-Chain Coordination: The platform unifies discussions and decision-making for projects operating across different blockchains.

-

Airdrop and Reward Distribution: Its infrastructure supports transparent airdrop campaigns and contributor reward systems.

-

AI-Powered Automation: AI agents help automate repetitive tasks, such as spam detection in governance proposals or resource allocation.

Recent Developments and News

COMMON has been at the center of several notable recent events:

-

Major Exchange Listings: The token launched on Binance Alpha and Gate US, with subsequent listings on Bitget and MEXC expanding its accessibility.

-

Price Volatility: Shortly after its debut, COMMON’s price fell sharply, declining

47.93% in 24 hours to trade at approximately $0.02. This highlights the risks associated with newly launched tokens.

-

Staking Initiatives: Gate Launchpool introduced a staking program allowing users to earn COMMON rewards by locking BTC, ETH, or COMMON tokens.

Is COMMON a Good Investment?

Potential Upsides:

-

COMMON addresses a clear need in the Web3 space: scalable, cross-chain coordination.

-

Backing by reputable VCs and integration with major DAOs provides credibility.

-

AI and automation trends could further boost adoption.

Risks to Consider:

-

High volatility, as seen in its recent price drop, may deter risk-averse investors.

-

The project is still in its early stages, with unproven long-term utility.

-

Regulatory uncertainty around token-based governance and airdrops persists.

For investors, a cautious approach that focuses on fundamental growth rather than short-term speculation is advisable.

Conclusion

COMMON represents an ambitious attempt to redefine how decentralized communities coordinate and operate. By merging governance, incentives, and AI, it addresses critical inefficiencies in the Web3 ecosystem. However, its journey is just beginning, and the path ahead involves navigating market volatility, technological execution, and regulatory landscapes.

For crypto enthusiasts and investors, COMMON offers a window into the future of decentralized collaboration, but it also serves as a reminder of the risks inherent in emerging projects. As the platform evolves, its ability to deliver on its vision will determine whether it becomes a foundational layer for Web3 or merely a footnote in its history.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.