Pendle (PENDLE)'s

innovative protocol has transformed how investors interact with yield, turning traditionally passive income streams into active, tradable assets. With its

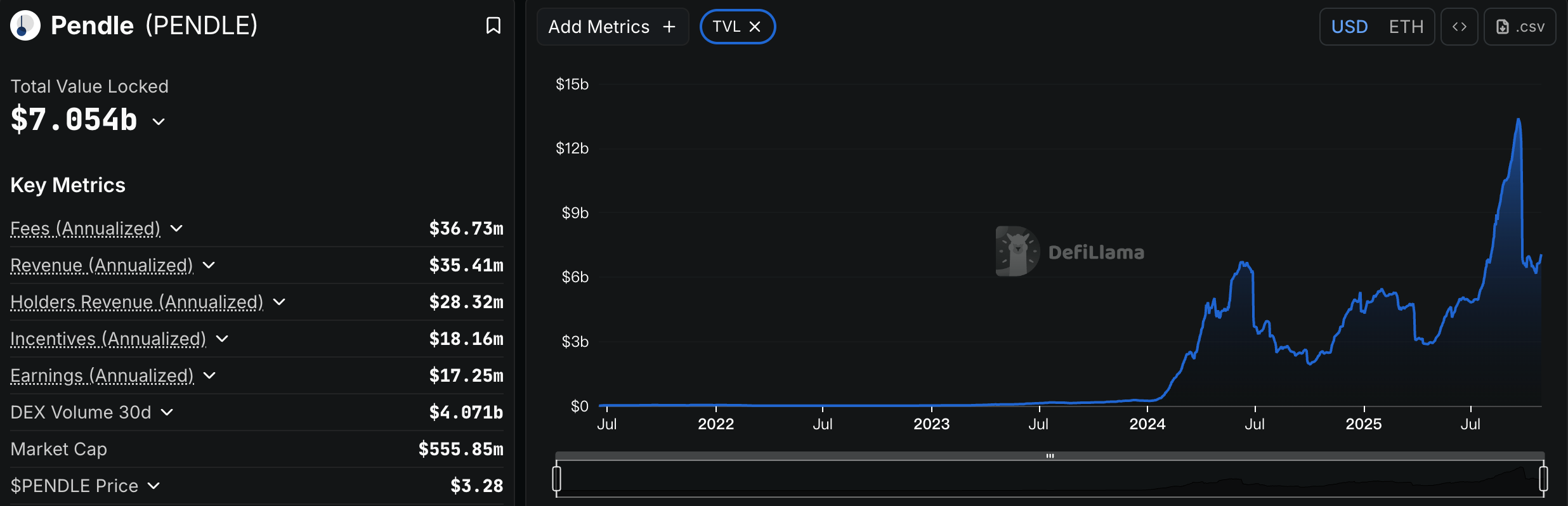

Total Value Locked (TVL) surpassing $13 billion (September 17th)

and achieving over 50% growth in just 30 days, Pendle has solidified its position as a dominant force in the DeFi landscape. Its unique approach to yield tokenization comes at a crucial time when investors increasingly seek sophisticated tools for risk management and return optimization. As DeFi continues to mature, Pendle's infrastructure aims to become the foundational layer for fixed-income products across the entire crypto ecosystem.

Pendle TVL. Source: DefiLlama

What is Pendle?

Pendle is a

decentralized finance protocol that enables the trading of future yield through a process called yield tokenization. At its core, Pendle allows users to separate yield-bearing assets into two distinct components: principal and yield. This separation creates new opportunities for investors to hedge risks, speculate on future yields, or lock in fixed returns.

The platform has grown from a niche DeFi experiment into a comprehensive fixed-income layer, currently ranking among the

top 10 DeFi protocols by TVL. What began as a tool primarily for crypto-native users has expanded to attract institutional interest through compliant offerings, positioning Pendle at the intersection of traditional finance and DeFi innovation.

How Pendle Works?

Pendle's core innovation lies in its ability to

split yield-bearing assets into two separate tokenized components: Principal Tokens (PT) and Yield Tokens (YT).

When a user deposits a yield-bearing asset like staked ETH or a yield-generating stablecoin into Pendle, the protocol creates:

-

Principal Tokens (PT): These represent the underlying principal value and function similarly to zero-coupon bonds. PT holders can redeem them for the underlying asset at maturity, effectively locking in a fixed yield based on the purchase discount.

-

Yield Tokens (YT): These represent the right to all yield generated by the underlying asset until expiration. YT holders receive the variable yield but lose their value after maturity.

This mechanism is made possible through Pendle's

Standardized Yield Token (SY) standard, which creates a uniform wrapper for different yield-bearing assets. The relationship between these components follows a simple formula:

1 SY = 1 PT + 1 YT.

Pendle V2 introduced significant upgrades to this infrastructure, including a specialized Automated Market Maker (AMM) designed specifically for PT-YT trading. This AMM incorporates dynamic parameters that adjust liquidity over time, resulting in tighter spreads, better yield discovery, and reduced slippage compared to its V1 predecessor.

Why Pendle is Gaining Attention?

Several factors explain Pendle's remarkable growth and rising prominence in the DeFi ecosystem:

Dominant Market Position: Pendle now commands

over 50% market share in the yield market, making it five times larger than its nearest competitor. This dominant position creates strong network effects that reinforce its leadership.

Proven Product-Market Fit: The protocol has successfully capitalized on major DeFi narratives, including liquid staking tokens (LST), restaking, and yield-bearing stablecoins. Its ability to serve as a launchpad for asset issuers has made it indispensable to new projects seeking liquidity and yield discovery.

Sustainable Revenue Model: With annualized fees reaching

$72 million and a price-to-fees ratio of approximately 10x, Pendle has demonstrated a viable business model that benefits token holders. This "casino-like" fee generation provides sustainable revenue unlike many speculative DeFi projects.

Resilience Under Pressure: The protocol has successfully handled multiple large expiry events, including a

$1.5 billion maturity that tested its infrastructure. Its ability to absorb these outflows without significant disruption has built market confidence in its scalability and reliability.

What is the PENDLE Token?

PENDLE serves as the native token for the Pendle Finance protocol, serving a vital role in both governance and liquidity provision. Token holders can utilize PENDLE to vote on proposals which would impact the protocol's development and maintenance, empowering them with a voice in decision-making processes. PENDLE tokens can also be used to provide liquidity to the Pendle Finance market, ensuring sufficient liquidity for users to buy and sell $YT tokens. PENDLE tokens can be staked, offering the opportunity to earn rewards, and allowing users to generate passive income while supporting the Pendle Finance ecosystem.

In summary, PENDLE holds intrinsic utility, being an instrumental governance and liquidity provision tool for the Pendle Finance protocol. Its flexibility allows users to vote on proposals, ensuring liquidity in the market, and earning rewards through staking. With a transparent tokenomics structure and compatibility with the Ethereum blockchain, PENDLE presents a compelling option for users seeking opportunities in crypto yield trading.

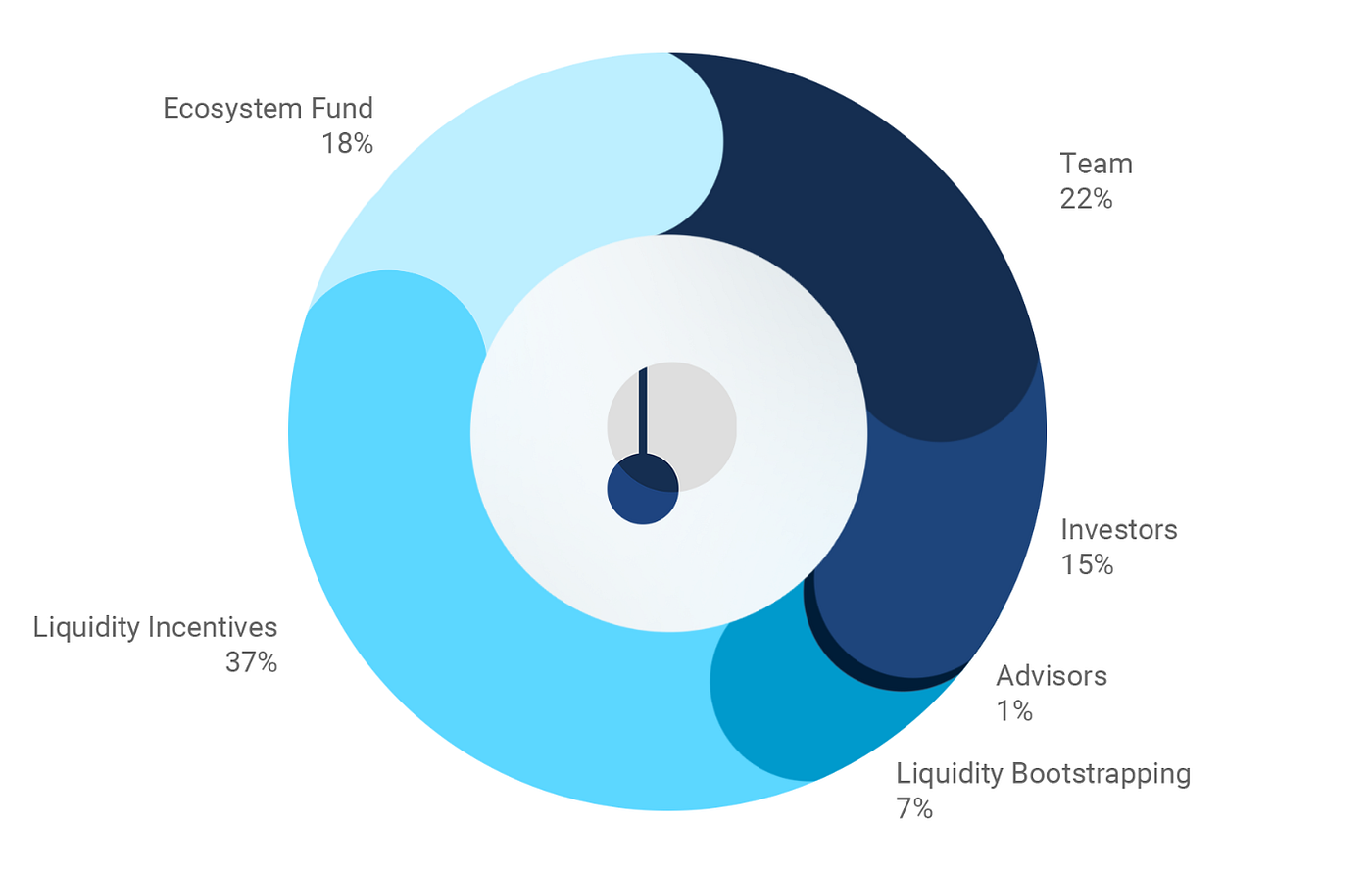

Pendle Tokenomics

Use Cases and Features

Pendle's architecture supports a diverse range of strategies catering to different risk appetites and market views:

Fixed Income Strategies: Conservative investors can purchase PT at a discount to lock in fixed yields, similar to buying traditional bonds. This approach has proven particularly attractive during market euphoria phases when yields spike, allowing investors to secure high single-digit or low double-digit fixed returns.

Yield Speculation: Traders can purchase YT to gain leveraged exposure to future yield rates without needing to hold the underlying asset. This strategy performed exceptionally well during recent airdrop cycles, where users could leverage their position to accumulate valuable points and tokens.

Liquidity Provision: Liquidity providers can deposit PT-YT pairs into specialized AMM pools to earn trading fees while maintaining limited exposure to impermanent loss, especially when held to maturity.

Cross-Chain Functionality: Pendle's recent expansion enables

PT as universal cross-chain collateral, breaking down liquidity barriers between ecosystems. This innovation allows users to access opportunities across different chains without the typical capital inefficiency of bridged assets.

Boros Module: The recently introduced Boros extension brings

fixed funding rate trading to perpetual contracts, addressing a massive market with over $150 billion in open interest. This positions Pendle to capture value from CeFi and TradFi participants seeking hedging solutions for their derivative positions.

Should You Buy PENDLE? Investment Considerations

Evaluating PENDLE as a potential investment requires balancing several factors:

Bullish Considerations:

-

Growth Trajectory: Pendle's TVL has grown over 20x in 2024 alone, yet its token ranks approximately 30th by market capitalization while being 6th by TVL among DeFi protocols, suggesting potential undervaluation.

-

Expansion Potential: The protocol's planned expansion to Solana, TON, and Hyperliquid could tap into new user bases and liquidity sources.

-

Institutional Adoption: The Citadels initiative aims to bring compliant yield products to traditional finance, potentially opening up a

$4.5 trillion Islamic finance market and other institutional capital pools.

-

Market Leadership: Pendle's dominance in stablecoin yield markets (approximately 75% share) provides a strong competitive moat.

Risk Factors:

-

Complexity Barrier: Pendle's sophisticated mechanics may limit mainstream adoption and keep it primarily within the domain of advanced DeFi users.

-

Market Dependency: The protocol's growth is tied to the broader DeFi ecosystem and yield opportunities. A prolonged bear market could reduce attractive yield opportunities.

-

Execution Risk: Ambitious expansion plans across multiple chains and into traditional finance carry significant execution challenges.

Recent Developments and News

Pendle continues to evolve rapidly with several notable recent developments:

Cross-Chain PT Launches: The protocol recently deployed its first major cross-chain product with

PT-USDe on Avalanche, demonstrating the practical implementation of its cross-chain ambitions.

Boros Goes Live: The Boros module for fixed funding rate trading is now operational, expanding Pendle's reach beyond spot yield markets into the massive perpetual contracts space.

Institutional Partnerships: Pendle has formed strategic partnerships with traditional finance entities, including a collaboration with Edge Capital that has seen their mEDGE strategy library packaged as PT on Pendle, attracting over

$10 million in TVL.

Stablecoin Dominance: The protocol has become the primary marketplace for yield-bearing stablecoins, with approximately

48% of all Ethena's USDe locked in Pendle pools. New stablecoin projects increasingly view Pendle integration as essential for launch.

Conclusion

Pendle has fundamentally transformed how yield is traded and managed in decentralized finance. By separating principal from yield and creating liquid markets for both, it has opened new strategies for risk management, speculation, and fixed income generation. Its remarkable growth trajectory, dominant market position, and ambitious expansion plans suggest it may become a foundational layer for the entire DeFi fixed income ecosystem.

The protocol's future success will depend on its ability to execute its multi-chain strategy, navigate regulatory landscapes for institutional adoption, and maintain its innovation edge against emerging competitors. However, its proven resilience, sustainable fee model, and growing integration across the DeFi stack position it favorably for continued leadership.

As DeFi matures and blends with traditional finance, Pendle's infrastructure appears well-suited to bridge these worlds, potentially bringing trillions of dollars in traditional fixed income products on-chain. For investors and users alike, Pendle represents both a practical tool for yield optimization today and a strategic bet on the future of decentralized finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.