On October 27, the global cryptocurrency market saw a broad-based rally on October 27, 2025, with major cryptocurrencies demonstrating significant bullish momentum, breaking the recent consolidation pattern. According to real-time market data,

Bitcoin (BTC) successfully broke through the key resistance level of $115,000, posting a 24-hour gain of 3.44%, reigniting market optimism. Meanwhile,

Ethereum (ETH) performed even more impressively, surging by over 6% and briefly breaking through the $4,200 mark, demonstrating its dominance among leading altcoins. Meanwhile, Japan’s JPYC announced today the world’s first yen-pegged stablecoin, a fully redeemable digital yen backed by domestic deposits and Japanese government bonds (JGB). Kalshi has reported a staggering $4 billion in trading volume over the past 30 days as of October 2025. Inveniam and MANTRA say the new layer 2 blockchain is purpose-built to advance the management and utilization of private real estate assets.

Crypto Market Overview

BTC (+3.44% | Current Price: $115,562.34)

Bitcoin's performance this trading day was remarkable, successfully breaking through

the downtrend line formed from its all-time high . This technical breakthrough has important symbolic significance, suggesting that the previous period of adjustment may have come to an end. In terms of price action, Bitcoin has repeatedly tested the $108,000 support level over the past week, and each time it dipped below this area, it was strongly pulled back by buyers. In particular, the bullish engulfing pattern formed on October 24th clearly conveyed the technical signal of a bullish counterattack. Regarding the future market trend,

$113,500 has transformed from a previous resistance level into a key support level, becoming a key line of defense for bulls. On the upside,

$116,000 is the immediate resistance level that needs to be broken through in the near term. This level has twice suppressed price increases earlier this month. Once Bitcoin can successfully break through $116,000, the next target will be $118,000.

On October 24th, Bitcoin ETFs experienced a net inflow of $90.6 million. BlackRock IBIT experienced an inflow of $32.7 million, while Fidelity FBTC observed an inflow of $57.9 million.

ETH (+2.60% | Current Price: $3,981.56)

Ethereum's performance on October 27th was remarkable, with its price exceeding $4,200, a single-day increase of over 6%. More importantly, its on-chain data showed positive changes. According to Pintu News, over

820,000 ETHhave been withdrawn from the Binance exchange since August, causing the ETH reserves on Binance to drop to their lowest level since May. This phenomenon has significant market significance, as declining exchange reserves typically indicate that investors are more inclined to transfer assets to private wallets for long-term holding, reducing the immediate supply in the market and creating favorable conditions for price increases. From a technical analysis perspective, Ethereum is currently trading around $3,986 (some data sources suggest it has already broken through $4,200).

The daily RSI indicator is at 46.9, neither entering the overbought nor oversold zones, suggesting further upside potential. The

On-Balance Volume (OBV) indicator is stable at around 11.92 million, indicating sustained buying pressure but no unusual volatility. This steadily rising price-volume balance is typically characteristic of a healthy uptrend.

On October 24th, ETH ETFs experienced a total net outflow of $93.6 million, including an outflow of $101.0 million from BlackRock ETHA.

Altcoins

The current

Altcoin Seasonality Index is stuck at 29, well below the threshold of 75 required to identify an Altcoin Season. This value clearly shows that the market is still in a "Bitcoin Season," meaning that most Altcoins are still underperforming Bitcoin.

Today's

Crypto Fear and Greed Index stands at 42, in neutral territory and a significant increase of 6 points from yesterday. This reading indicates that market sentiment is rapidly recovering from its previous panic. Historically, the index has averaged 30 over the past seven days and 34 over the past 30 days, indicating a steady improvement in market sentiment.

While the overall altcoin market hasn't yet entered its peak season, some sectors are showing signs of activity. In addition to the DeFi and Layer 2 sectors mentioned above, Zcash (ZEC) in the Layer 1 sector surged 29.19%, while Dash (DASH) in the PayFi sector also saw a 27.68% increase. This phenomenon of spreading hot spots generally indicates a gradual increase in market risk appetite.

Macro Data

Traditional financial markets are closely watching the upcoming

U.S. Federal Reserve meeting on October 28-29 , with widespread market expectations that the Fed may consider cutting interest rates. If this expectation comes true, it will provide a more relaxed liquidity environment for the cryptocurrency market, further driving capital flows to risky assets.

On October 24th, the S&P 500 gained 0.79%, standing at 6,791.69 points; the Dow Jones Industrial Average increased 1.01% to 47,207.12 points, and the Nasdaq Composite gained 1.15% to 23,204.87 points.

Trending Tokens

PI Pi (+28.97%, Circulating Market Cap: $2.24 Billion)

PI is trading at $0.2672, up approximately 28.97% in the past 24 hours. Pi Network is a social cryptocurrency, developer platform, and ecosystem designed for widespread accessibility and real-world utility. It enables users to mine and transact Pi using a mobile-friendly interface while supporting applications built within its blockchain ecosystem. Pi Network approved 3.36M new KYC users in October 2025 via AI-driven verification, enabling Mainnet migrations. Concurrently, 10M PI tokens left exchanges this month, cutting CEX supply to 410M. Faster KYC reduces locked token overhang fears, while exchange withdrawals suggest holders are opting for long-term storage over immediate selling. However, 121M PI tokens are still to be unlocked in November 2025, risking renewed pressure.

ENSO Enso (+26.75%, Circulating Market Cap: $195.96 Million)

ENSO is trading at $2.25, up approximately 26.75% in the past 24 hours. Enso serves as a vital piece of infrastructure for the ecosystem, enabling developers to build and scale onchain applications seamlessly. Enso is already powering over 145+ enterprise-grade products and has been used to settle more than $17 billion onchain. Notably, it played a key role in the high-profile launch of Berachain, where Enso was used to facilitate over $3.1 billion in executed transactions. The Uniswap position migration tool was released in collaboration with Uniswap, LayerZero, and Stargate. Plume, ZkSync, and Sonic used Enso for their incentivized launch campaigns. There are many more high-profile enterprises that use Enso to build their products. Over 1.75M ENSO (1.75% of supply) was distributed via Binance Alpha airdrops and Enso Points rewards. Users needed 245+ Alpha Points to claim tokens, creating urgency to hold/trade ENSO. Airdrops often trigger short-term buying pressure as users position to qualify. However, recipients may sell after claiming, risking a pullback. ENSO’s 20.59% circulating supply (20.5M tokens) limits immediate dilution risk, but unlocks for investors (31.3% of supply) begin in 2026.

VANA Vana (+21.45%, Circulating Market Cap: $98.63 Million)

VANA is trading at $3.27, up approximately 21.45% in the past 24 hours. Vana is an EVM-compatible Layer 1 blockchain network that enables users to transform personal data into financial assets by aggregating private datasets for AI model training. This approach allows individuals to tokenize and monetize their data through Data Decentralized Autonomous Organizations (Data DAOs), granting them ownership and control over their digital footprints. VANA broke above its 30-day SMA ($3.16) and Fibonacci 38.2% retracement level ($3.16), reaching $3.28. The MACD histogram turned positive (+0.029), signaling short-term bullish momentum. Trader Breaking $3.16 – a key resistance since early October – likely triggered stop-loss orders and algorithmic buying. The RSI-14 (40.39) remains neutral, but a push above 50 could invite profit-taking near the 50% Fibonacci level ($2.79).

Market News

Japan's New Yen Stablecoin is Asia’s Only Truly Global Fiat-Pegged Token

Japan has done what its Asian peers can’t: launch a stablecoin that can circulate globally.

Japan’s JPYC announced today the world’s first yen-pegged stablecoin, a fully redeemable digital yen backed by domestic deposits and Japanese government bonds (JGB). The stablecoin issuer said that it won't charge a transaction fee and instead generate revenue from interest on holdings of JGBs.

Here's what makes it stand out from regional peers: Unlike the Korean Won or Taiwan dollar, which are both onshore currencies by local law, Japan's Yen is freely convertible and can be used offshore.

Following reforms in the 1980s that dismantled Japan’s postwar capital controls, the yen became fully usable outside the country through the euro-yen market, where global banks and investors borrow, lend, and trade the currency without restrictions — unlike South Korea’s won, which remains confined to onshore use under strict foreign exchange controls designed to limit offshore speculation and preserve monetary stability.Seoul's policy for the won preserves monetary control but leaves little room for a global stablecoin to breathe. A won-backed token would be limited to whitelisted Korean users and mostly domestic settlements, making it a niche product in a market where instant, free interbank transfers already exist.

Kalshi Surpasses $4 Billion in 30-Day Trading Volume

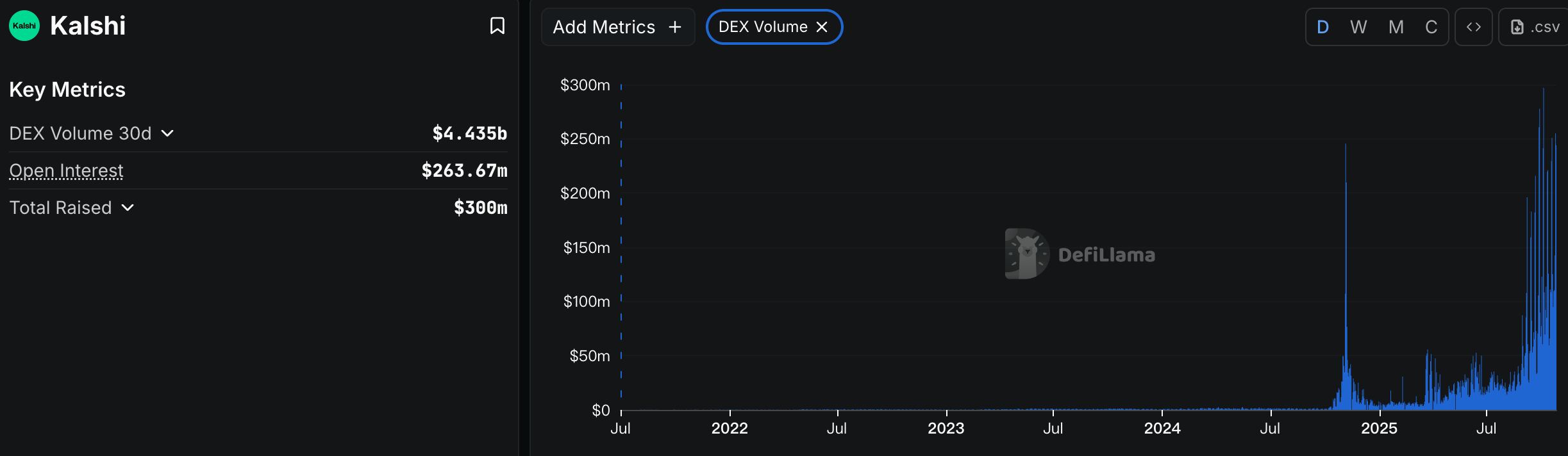

Kalshi 30d trading volume. Source: DefiLlama

Kalshi has reported a staggering $4 billion in trading volume over the past 30 days as of October 2025. This figure is not just a number-it signals the emergence of event-based trading as a transformative force in financial innovation and risk management. By enabling users to trade on real-world events, from political elections to economic indicators, Kalshi is redefining how markets aggregate information and hedge uncertainty.

Kalshi's meteoric rise is fueled by a combination of strategic partnerships, regulatory clarity, and global expansion. The platform's collaboration with Robinhood accounts for 25–35% of its daily trading volume, democratizing access to prediction markets for retail investors, according to a Coinfomania report. Simultaneously, Kalshi's expansion into 140 countries has broadened its user base, while its valuation has doubled to $5 billion in just three months, reflecting institutional confidence in its model.

This growth is not accidental. Kalshi operates as a Designated Contract Market (DCM) under CFTC regulation, distinguishing it from unregulated offshore platforms like Polymarket. By aligning with U.S. regulatory standards, Kalshi has attracted both retail and institutional participants, with Q3 2025 notional volumes exceeding $3 billion, a Coinotag article notes. The platform's focus on sports betting and political event trading has further amplified its appeal, blending entertainment with financial utility.

Beyond speculation, prediction markets like Kalshi serve as powerful forecasting tools. By allowing traders to buy "Yes" or "No" contracts on events such as Federal Reserve interest rate decisions, Kalshi's market prices often outperform traditional polling data, as argued in an SCCG Management article. For instance, contracts tied to inflation reports or job market outcomes act as real-time barometers of collective expectations, offering insights that traditional financial instruments cannot.

MANTRA and Inveniam Unveil New L2 Blockchain to Power Private Real Estate Data

Inveniam and MANTRA say the new layer 2 blockchain is purpose-built to advance the management and utilization of private real estate assets.

The L2 targets artificial intelligence and decentralized finance ecosystems and will power the management and utilization of commercial real estate data. Currently, the commercial real estate industry ranks as one of the lowest-frequency but most data-rich asset classes in the world.

The L2 is the first on the MANTRA Chain and will help bring the $27 trillion private CRE market to MANTRA. Tapping into Inveniam’s decentralized data management solution will allow Inveniam Chain to structure, hash, and credential trillions of private real estate data points. These proprietary data points feed into AI agents, private market indices, DeFi ecosystems, and data-sharing marketplaces. According to details, Inveniam Chain’s connection to AI agents and DeFi allows it to act as “the metachain for every digital instrument.” The L2 supports assets on MANTRA as well as those traded digitally on leading blockchain networks, including Ripple, Avalanche, Hedera, ZK Sync and Ethereum.

MANTRA’s announcement comes just over a month since the layer 1 platform activated key network upgrades.In September, the RWA-focused platform released its latest mainnet upgrades that saw MANTRA become the first blockchain protocol to natively support both the Ethereum Virtual Machine and CosmWasm smart contracts.

Another key milestone is the platform’s registration as a Virtual Asset Service Provider in the United Arab Emirates. Specifically, the platform has a VASP license from Dubai’s Virtual Assets Regulatory Authority.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.