On October 23, 2025, U.S. President Donald Trump granted a full pardon to Changpeng "CZ" Zhao, the founder of Binance, overturning his 2023 conviction for violating anti-money laundering laws. The decision sparked immediate reactions across political, financial, and cryptographic circles, with critics condemning it as an example of "rules for some, not for all", while supporters hailed it as a pro-innovation move. The pardon eliminated legal barriers for CZ, who had served a four-month sentence and paid a $50 million fine, while Binance itself faced $4.3 billion in penalties, which is one of the largest corporate fines in the U.S. history.

The ramifications extended far beyond CZ’s personal freedom, triggering a cascade of effects across Binance-related assets, global regulatory landscapes, and geopolitical dynamics. Within hours of the announcement, Binance’s native token, BNB, surged by 8%, and a wave of optimism swept through cryptocurrency markets. This article analyzes the four-layer ripple effects of CZ’s pardon, examining its impact on Binance’s ecosystem, meme coins, traditional finance, and Trump-associated projects, while exploring the broader implications for the crypto industry’s future.

Layer 1: Immediate Impact on Binance Ecosystem Assets

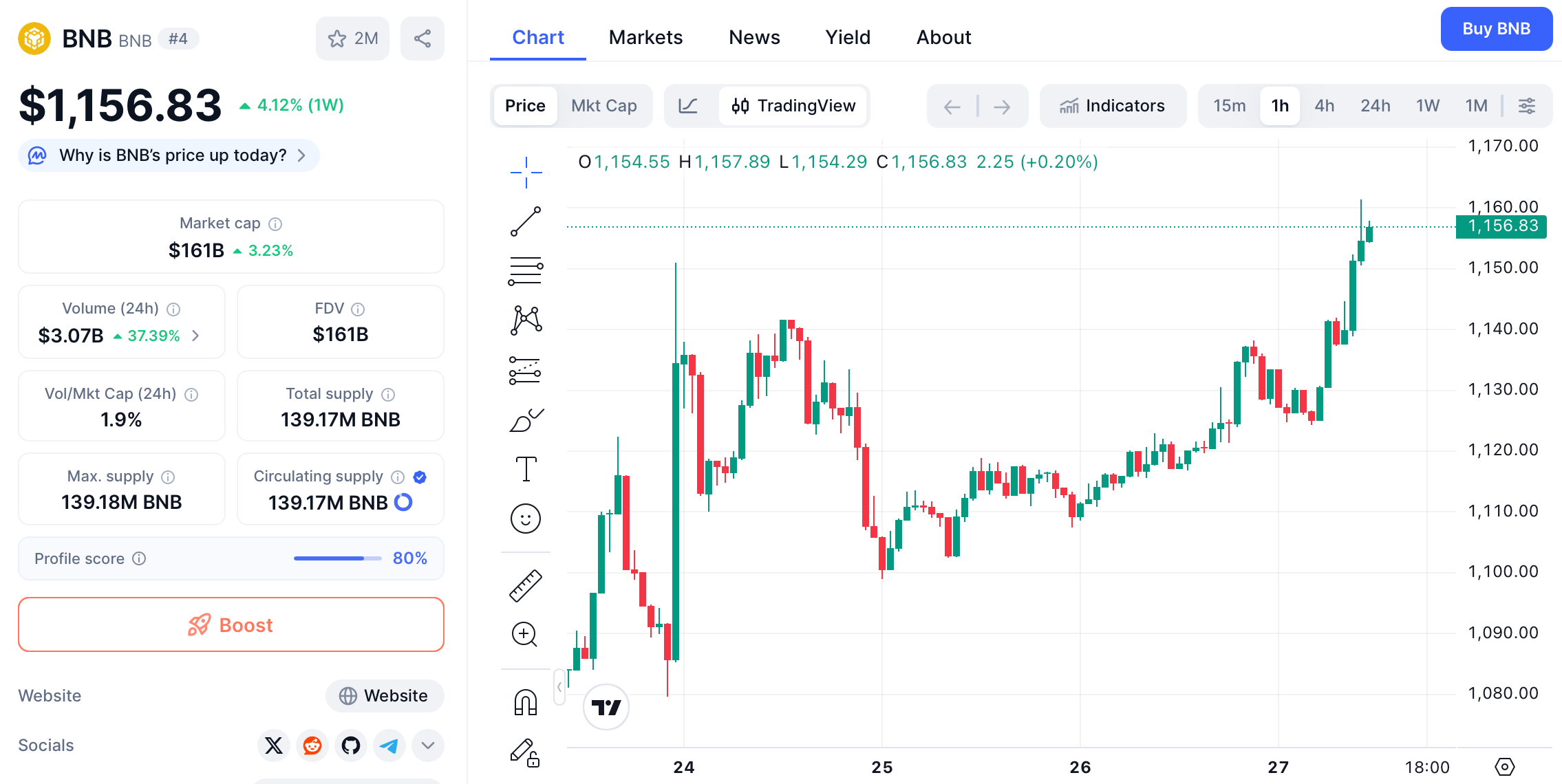

The most direct beneficiaries of CZ’s pardon were assets closely tied to Binance’s operations. BNB, the exchange’s native token, saw a dramatic price increase, jumping from $1,055 to $1,145 within hours—a gain of nearly 8%. The BNB token is now settled at $1,150, it maintained a 24-hour growth of 3-4%, signaling renewed investor confidence in Binance’s leadership and future.

The rally also extended to projects directly championed by CZ, such as Aster, a decentralized perpetual exchange on Binance’s ecosystem. Its token, ASTER, climbed from below $1 to a peak of $1.48 before stabilizing at $1.12, still representing a 10% increase. This initial layer of market reaction underscores the "first-order" impact of pardon, where assets with explicit ties to CZ and Binance experienced the earliest and most significant gains.

Notably, the surge occurred amid a backdrop of regulatory relief. Earlier in 2025, the U.S. Securities and Exchange Commission (SEC) had dismissed its lawsuit against Binance, removing a significant legal overhang. The combination of regulatory clarity and CZ’s restored stature has positioned Binance to reassert its influence in global crypto markets, particularly as the company explores strategies to re-enter the U.S. market, including potentially merging its international and U.S. operations.

Layer 2: Meme Coins and Speculative Assets

The second wave of impact reached meme coins and speculative assets listed on Binance or affiliated with BNB Chain. These tokens, known for their volatility and sensitivity to sentiment shifts, recorded explosive short-term gains. For instance, "币安人生" (Binance Life) briefly rallied from $0.23 to $0.28, while the token "4" skyrocketed by over 34%, climbing from $0.07 to $0.15.

This phenomenon highlights the speculative fervor that often accompanies high-profile crypto news. Meme coins, with their lower market capitalization and thinner liquidity, are particularly susceptible to rapid price swings driven by retail investor sentiment. The surge in these assets reflects a "second-layer" effect, where traders shifted attention from blue-chip crypto assets to riskier, high-yield opportunities in the wake of CZ’s pardon.

However, the gains proved fleeting. Both tokens subsequently retraced their peaks, underscoring the inherent volatility of meme-based investments. Analysts observed that while the initial momentum was strong, sustaining it would require broader adoption or utility, which is a challenge for many speculative assets.

Layer 3: Traditional Finance and Public Equities

The third layer of impact involved traditional financial instruments, particularly equities of companies linked to Binance’s treasury investments. BNB Network Company (BNC), a publicly traded entity, saw its shares rise from $7.20 to $8.50, a gain of 6.5%, while Nano Labs (NA) posted a more modest 1.16% increase. Similarly, ALT5 Sigma, a fintech firm associated with Trump-family crypto ventures, saw its stock price jump by 13.44%.

This cross-market reaction demonstrates how crypto-related news increasingly influences traditional equity markets. As Binance’s ecosystem expands, its interconnectivity with publicly listed companies creates channels for regulatory and political developments to transmit beyond digital assets into conventional finance. The stock price movements also reflect growing investor recognition of the synergies between crypto innovation and mainstream business infrastructure.

Layer 4: Trump-Linked Projects and Political Crypto Alliances

The outermost ripple effect encompassed projects and assets tied to Trump’s political brand. World Liberty Financial (WLFI), a crypto initiative openly associated with the Trump family, saw its token rebound from a low of $0.07 to $0.146, which is a 15% surge in just 15 minutes. The token’s recovery, following a prolonged downtrend, underscores how Trump’s pro-crypto stance has become a catalyst for related assets.

The pardon reinforces Trump’s alignment with the crypto industry, a strategic move likely aimed at consolidatingsupport among blockchain advocates and libertarian-leaning voters. Since taking office, Trump has positioned himself as a champion of crypto innovation, in stark contrast to the Biden administration’s adversarial approach. His administration’s dismissal of SEC lawsuits against Binance and other crypto firms further signals a regulatory thaw.

CZ’s response to the pardon—expressing gratitude and pledging to help "make America the cryptocurrency capital of the world"—suggests a deepening alliance between Binance and Trump’s political agenda. This relationship dates back to 2021, when Binance provided technical support for Trump-affiliated NFT and token projects, laying the groundwork for today’s collaboration.

Broader Implications for Crypto Regulation and Market Stability

Beyond market movements, CZ’s pardon carries profound implications for crypto regulation and institutional participation. The Biden administration had pursued an aggressive enforcement strategy, treating Binance and other industry players as regulatory targets. Under Trump, however, the U.S. appears poised to embrace a more innovation-friendly framework, potentially accelerating the integration of digital assets into the mainstream financial system.

This shift is already evident in the SEC’s recent actions. Under new leadership, the agency has shifted from "regulation by enforcement" to a more collaborative approach, emphasizing clarity and compliance. The dismissal of the Binance lawsuit in May 2025, coupled with the establishment of specialized crypto working groups, signals a pragmatic pivot aimed at fostering growth while maintaining investor protections.

Nevertheless, risks remain. Critics, including Senator Elizabeth Warren, argue that the pardon undermines accountability and could encourage further corporate malfeasance. Others point to ongoing international challenges, such as the detention of Binance executives in Nigeria, as reminders that global regulatory harmony remains elusive.

Conclusion

Trump’s pardon of CZ represents more than the resolution of a legal case—it marks a turning point for the cryptocurrency industry. The four-layer ripple effect, from Binance-native assets to Trump-linked projects, illustrates the interconnectedness of crypto markets, politics, and traditional finance. As regulatory headwinds diminish, Binance is well-positioned to re-engage with the U.S. market, leveraging CZ’s leadership and the company’s reinforced compliance measures.

For investors, the episode underscores the importance of monitoring regulatory developments and political trends alongside technical indicators. The "ripple model" of analyzing crypto markets—where news impacts radiate outward from core assets to peripheral ones—offers a valuable framework for identifying opportunities ahead of broader market reactions.

As Binance and U.S. regulators embark on this new chapter, the industry will watch closely to see whether Trump’s pro-crypto policies can translate into sustainable growth and innovation. One thing is certain: the pardon of CZ has irrevocably altered the landscape of crypto politics and finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.