The cryptocurrency market is witnessing the explosive rise of the

x402 ecosystem, a suite of tokens built on Coinbase’s experimental protocol for internet-native micropayments. In late October 2025, the total market capitalization of x402-related tokens surged by

265% in 24 hours, surpassing

$180 million and capturing the attention of traders, developers, and institutional observers. This rally was fueled by a convergence of factors: the protocol’s innovative use of

HTTP 402 status codes to enable seamless stablecoin transactions, the viral success of memecoins like

PING, and growing anticipation of autonomous AI agents driving future digital commerce. As Brian Armstrong, Coinbase’s CEO, noted, the protocol is “growing like crazy”, with transaction volume increasing

10,000% month-over-year in October. This article explores the technical foundations of x402, its role in bridging AI and decentralized finance (DeFi), and the risks and opportunities within its rapidly expanding ecosystem.

What is the x402 Protocol?

The x402 protocol is an

open standard developed by Coinbase that re-purposes the previously unused

HTTP 402 (“Payment Required”) status code to facilitate blockchain-based micropayments. By integrating stablecoins like USDC, the protocol allows websites, APIs, and AI agents to request instant payments without intermediaries such ascredit card networks. For example, an AI assistant could autonomously pay for computational resources or data access using x402, with settlements occurring on-chain in real-time.

A key innovation of x402 is its

chain-agnostic design, which initially prioritizes Base (Coinbase’s Ethereum Layer-2 network) but also supports Solana and Sui. This flexibility enables low-friction transactions while leveraging the security of underlying blockchains. In practice, the protocol operates as a dual-layer system:

-

HTTP Layer: Services return a 402 error to clients requiring payment, accompanied by a signed invoice.

-

Blockchain Layer: Clients submit payments via stablecoins, with on-chain verification granting access.

-

This architecture has proven particularly suited for

AI-agent economies, where automated systems execute high-frequency microtransactions. As one showcase project, Stableburn x402, demonstrates, the protocol can even power deflationary tokenomics by using revenue from API fees to buy and burn tokens.

Market Performance and Key Tokens

The x402 ecosystem’s meteoric growth is underscored by token performance data. Between October 24–26, 2025, the cumulative market cap of x402-related assets skyrocketed from under $20 million to

$180 million, though individual tokens exhibited volatility. Notable projects include:

PING: A memecoin on Base that briefly eclipsed $60 million in market cap after rising 365% in 24 hours. Its “inscription-style” minting mechanism—where users pay $1 via x402 to receive 5,000 tokens—drove over 31,000 buyers and $50 million in trading volume.

BNKR: Outperformed PING during the rally, gaining 4% while PING corrected by 22.5%, reflecting investor rotation toward perceived stability.

SANTA: Soared 600% over two days, buoyed by its association with QuestFlow, a Google-partnered project in the x402 ecosystem.

Despite pullbacks, the sheer volume of activity highlights robust retail interest. The protocol itself processed

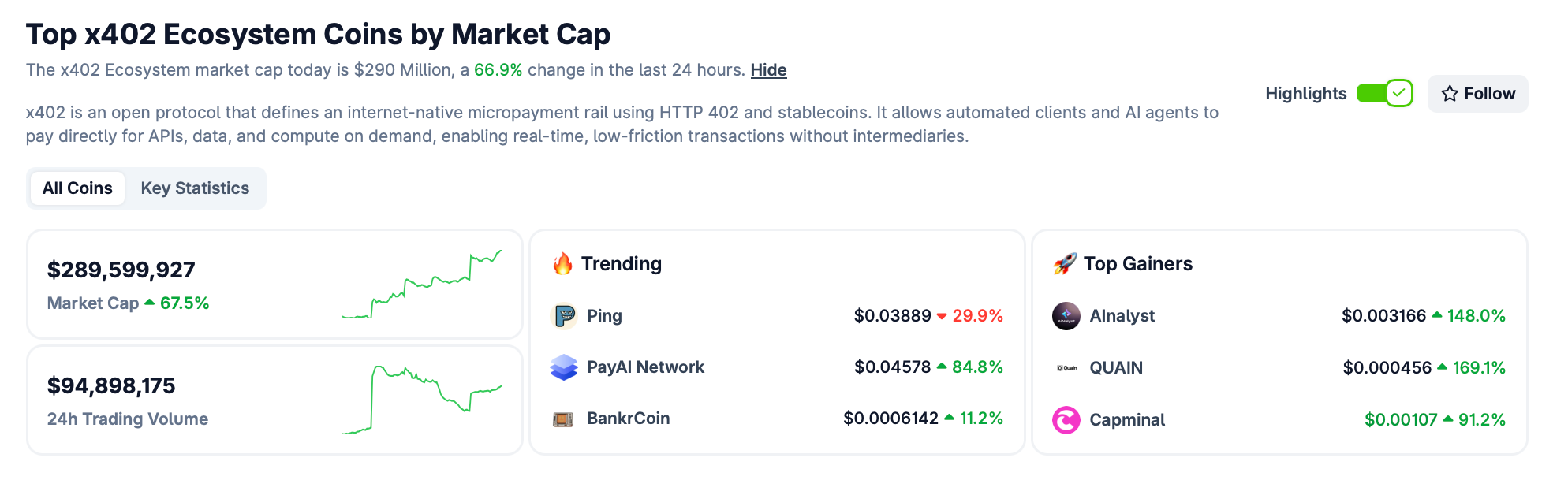

nearly 500,000 payments in one week, with daily transactions peaking at 239,505. This adoption has cemented x402 as a

distinct asset category, now tracked separately by CoinGecko.

x402 ecosystem page on CoinGecko.

Drivers of the x402 Boom

Three primary factors explain the ecosystem’s rapid expansion:

AI-Agent Integration: x402’s architecture aligns with the emerging “agentic economy,” where autonomous AI systems perform tasks like NFT trading or data analysis. Projects like Starchild already leverage x402 to let traders on Orderly-powered DEXs execute portfolio analysis and technical indicators through AI interfaces. Andreessen Horowitz predicts such agents could facilitate

$30 trillion in autonomous transactions by 2030, positioning x402 as critical infrastructure.

Memecoin Hype and Inscriptions: PING’s success stems from a novel minting model that combines the virality of memecoins with the fairness of inscription-based launches. Unlike traditional airdrops, users directly pay small amounts via x402 to receive tokens, creating a self-sustaining economy. This mechanism generated

8,000% more protocol activity in its first week.

Strategic Backing: Coinbase’s integration of x402 into its Multi-Chain Platform (MCP) and collaboration with Cloudflare ensure scalability and accessibility. Solana co-founder Toly’s endorsement of x402 as “amazing” further amplified credibility.

The AI and DeFi Nexus

x402’s most profound impact lies in bridging AI and DeFi. Through platforms like Orderly Network, AI agents use x402 to pay for on-chain services, converting user intent into executed trades. For instance, Starchild’s AI provides real-time portfolio analytics, with fees settled via x402’s micropayment channels. Similarly, the Stableburn project routes x402 revenue into a treasury that automatically burns tokens, creating deflationary pressure.

This synergy extends to major AI-focused tokens.

Fetch.ai (FET) and Render (RNDR) have seen bullish sentiment amid x402’s rise, with traders anticipating increased on-chain activity from AI-driven demand. As Lincoln Murr, an Ethereum developer, notes, the protocol’s “distrustless settlement layer” simplifies invoice resolution and refunds, reducing friction for agent-mediated commerce.

Risks and Challenges

Despite its potential, the x402 ecosystem faces significant headwinds:

-

Speculative Volatility: Many x402 tokens are memecoins with minimal utility. PING’s 22.5% drop shortly after its peak exemplifies the risk of profit-taking and hype cycles. As BlockBeats cautions, these assets are “highly volatile” and often lack practical use cases.

-

Centralization Concerns: Over 93% of PING holders are on Base, creating dependency on Coinbase’s ecosystem. Moreover, critics allege transaction volumes may be artificially inflated, akin to blockchain spam attacks.

-

Regulatory Uncertainty: The use of stablecoins for micropayments could attract scrutiny from financial authorities, particularly if x402 gains mainstream traction.

Future Outlook

The x402 protocol is poised to influence two broader trends:

Mainstream Adoption of Crypto Payments: By embedding payments into HTTP, x402 could enable websites to replace ads with micropayments—a shift Solana’s co-founder celebrated as “solving the internet’s original sin”.

AI-Agent Economies: As projects like Kite AI and AurraCloud integrate x402, the protocol may become the default standard for machine-to-machine transactions. Coinbase’s focus on expanding its MCP will further strengthen this niche.

However, long-term success hinges on sustaining developer engagement and demonstrating real-world utility beyond speculative trading.

Conclusion

The x402 ecosystem’s ascent to a

$180 million market cap reflects a larger narrative: AI, DeFi, and internet infrastructure convergence. While memecoins like PING ignited initial interest, the protocol’s potential to power autonomous agent economies represents its enduring value. For investors, space offers high-reward opportunities but demands caution amid volatility. As the industry watches Coinbase’s next moves, x402 could become the backbone of a trillion-dollar agentic economy—provided it evolves beyond speculation into scalable utility.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.