Aster (ASTER), with its innovative multi-chain infrastructure, institutional backing, and community-focused tokenomics, has achieved remarkable growth since its debut, positioning itself as a

serious competitor to established DEX platforms. As of October 2025, the token has reached a

market capitalization of $2.43 billion with Total Value Locked (TVL) surging to

$1.005 billion post-token generation event, outpacing rivals in the competitive derivatives trading space. This article explores the technology, economics, and potential of this rising DeFi contender.

What is ASTER?

Aster (ASTER) is a next-generation decentralized perpetual exchange (perp DEX) built from the merger of legacy DeFi perp and liquidity projects. It targets large-scale on-chain derivatives by combining a dual UI (Simple / Pro), multi-chain settlement, on-chain orderbook and AMM primitives, anti-MEV execution features, and aggressive community incentives (airdrop + rewards) to bootstrap liquidity and traders. The ASTER token is positioned as the native utility/governance/reward token with a large allocation reserved for community rewards — a design that encourages rapid distribution but also creates short-term self-pressure risks that must be managed. Official docs, contract lists and community links are published by the team.

The platform stands out for its

multi-chain implementation, allowing seamless asset exchanges across

BNB Chain, Ethereum, Solana, and Arbitrum networks. This cross-chain functionality, combined with support for real-world assets like US stocks, has positioned Aster DEX as a comprehensive solution for both retail and institutional traders seeking exposure to diverse markets through a single interface.

The Technology Behind ASTER

Aster's competitive edge lies in its

high-performance trading infrastructure that combines privacy features with cross-chain liquidity solutions. The platform is built to support

decentralized perpetual futures trading with sub-second transaction finality through its proprietary Layer 1 blockchain.

Aster Chain: A Layer 1 Revolution

Scheduled for launch in Q4 2025, Aster Chain represents a pivotal technological advancement for the ecosystem. This specialized Layer 1 blockchain is optimized specifically for high-frequency derivatives trading, featuring zero-knowledge proof (ZKP) integration to ensure privacy while maintaining necessary transparency. The network's intent-based trading system automates cross-chain strategies for optimal execution, making it particularly attractive to institutional investors seeking to hedge risks across volatile markets.

Cross-Chain Liquidity Aggregation

Aster's architecture addresses one of the most significant challenges in decentralized trading—fragmented liquidity across multiple chains. Through sophisticated liquidity pooling mechanisms, the platform enables large-volume trades without significant slippage, while its ALP (Aster Liquidity Protocol) system allows users to contribute assets and participate in market making.

Why ASTER is Gaining Attention

ASTER has captured significant market attention since its launch, with its price surging over 7,950% since its September 17, 2025 listing, propelling it to become the 36th largest cryptocurrency by market capitalization. This remarkable growth stems from several key factors that differentiate it from competitors.

Institutional Backing and High-Profile Endorsements

The project has received substantial institutional support, including endorsements from Binance founder Changpeng Zhao (CZ) and YZi Labs, a venture capital firm with a proven track record in scaling DeFi projects. CZ's public statement praising the project's "good start" contributed to an 800% weekly price surge shortly after launch.

Impressive Platform Metrics

Aster DEX has demonstrated substantial traction with $217 billion in 24-hour trading volume and a consistent influx of 71,000 new weekly users. The platform has achieved $1.35 billion in cumulative trading volume with $1.93 billion in Total Value Locked (TVL), surpassing Hyperliquid's revenue and recording a 47% increase in key metrics.

Whale Accumulation and Market Sentiment

On-chain data reveals significant accumulation by large investors, with one "mysterious whale" purchasing over $75 million worth of ASTER tokens within just two days. This substantial whale activity indicates strong confidence among sophisticated traders that the token may continue its appreciation, potentially attracting additional retail interest.

ASTER Tokenomics

ASTER implements a

carefully designed token economic model with a total supply of

80 billion tokens, emphasizing community participation and long-term sustainability.

-

Ticker: $ASTER

-

Maximum supply: 8,000,000,000

-

Token format: BEP-20 on Binance Smart Chain

-

Token address: 0x000Ae314E2A2172a039B26378814C252734f556A

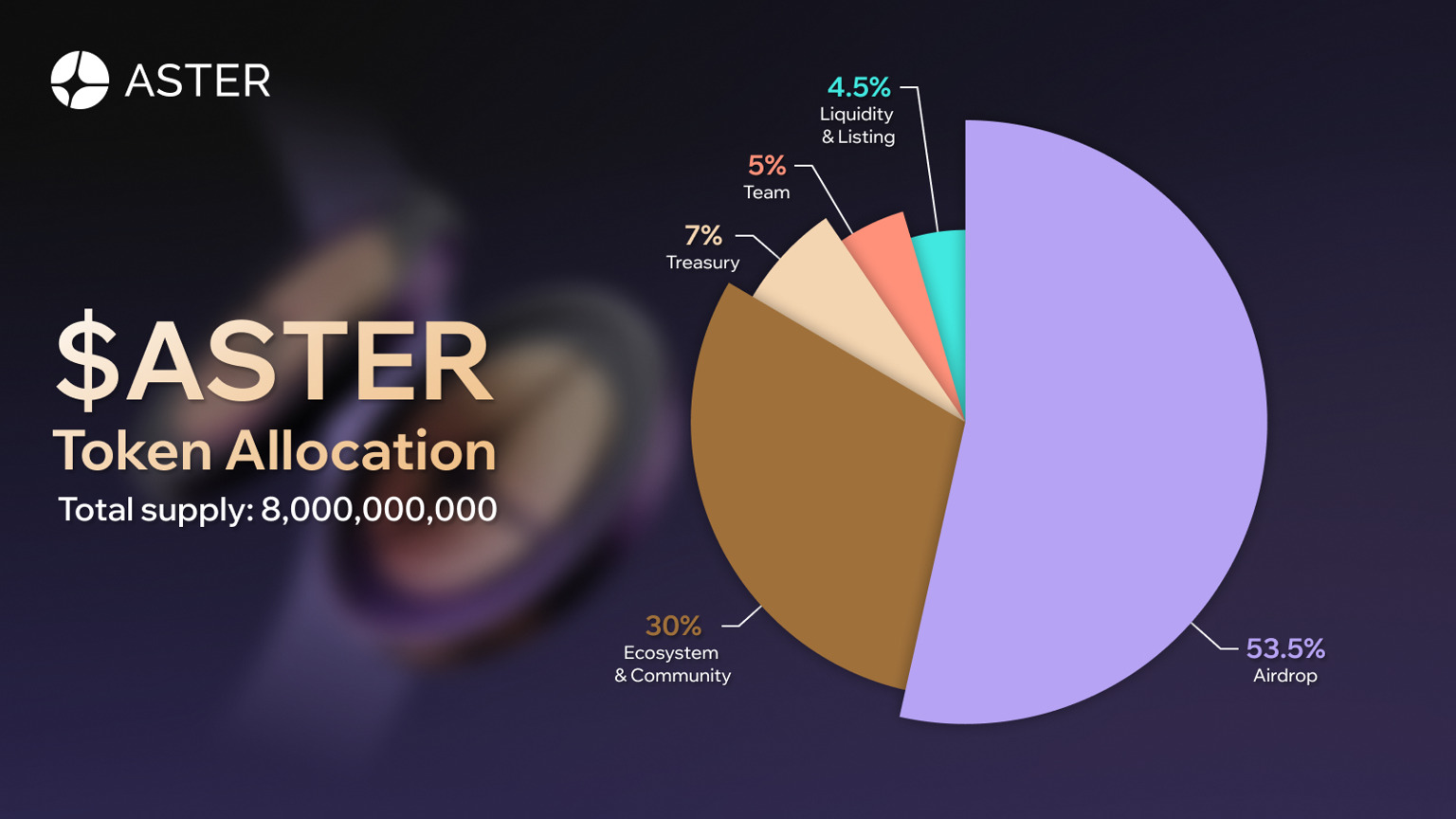

Strategic Token Allocation

The allocation structure demonstrates an unprecedented commitment to decentralized governance and user incentives, with a substantial 53.5% of the total supply dedicated to community rewards. This community-centric approach includes immediate distribution of 8.8% at the Token Generation Event (TGE), providing instant value for early adopters, while the remaining 41.7% follows a strategic release schedule over 80 months to ensure sustained community engagement without flooding the market.

The remaining tokens are allocated to essential ecosystem functions: 30% to ecosystem and community growth, 7% to treasury reserves, 5% to the team with a 20-month vesting period, and 4.5% to liquidity provision for market stability.

Deflationary Mechanisms and Value Accrual

ASTER incorporates a sophisticated dual-mechanism deflationary system utilizing both fee buybacks and token burns to systematically reduce total supply. The protocol directs 7% of all protocol revenue to buy back ASTER tokens from the open market, creating immediate price support. Additionally, token burns permanently remove ASTER from circulation by sending them to inaccessible addresses, creating long-term value appreciation through controlled scarcity.

Use Cases and Features

Aster DEX offers a comprehensive suite of trading tools and features that differentiate it from conventional decentralized exchanges:

Advanced Trading Capabilities

The platform provides both Simple Mode for one-click execution and Professional Mode with advanced tools including hidden orders and grid trading strategies. This dual-approach interface accommodates both novice traders and experienced professionals seeking sophisticated trading functionality.

Real-World Asset Integration

A significant innovation is Aster's support for US stock trading with cryptocurrency settlement, providing 24/7 exposure to traditional markets without custodial risk. This bridges the gap between conventional finance and DeFi, allowing global access to equity markets through a decentralized infrastructure.

Yield-Bearing Collateral

The platform introduces capital-efficient trading through yield-generating collateral such as asBNB or yield-bearing USDF, reducing the opportunity cost typically associated with locked collateral in DeFi protocols. This innovative approach allows traders to earn yield on their collateral while maintaining trading positions.

Governance Rights

ASTER token holders can stake their tokens to obtain veASTER, granting them governance rights to vote on platform upgrades, new asset listings, and fee structure changes. This decentralized governance model ensures the community maintains control over protocol evolution.

USDF Stablecoin

USDF is a fully collateralized, yield-bearing stablecoin issued by Aster. It is convertible 1:1 with USDT and designed to generate passive returns.

The underlying USDT is used to create delta-neutral strategies, approaches that aim to earn yield while minimizing exposure to price swings. These strategies help support staked USDF (asUSDF) rewards.

Delta-neutral strategy and capital flows

USDF offers a decentralized and yield-bearing alternative to traditional stablecoins. Innovative mechanisms ensure stability, risk management, and revenue generation for holders. A critical component of USDF's operation is its integration of a low-risk delta-neutral strategy. Below, we’ll explain how USDF works, the flow of funds, and the delta-neutral positions used to generate revenue.

Delta-neutral strategy for fee generation

One of the core strategies employed by USDF to generate returns is the delta-neutral strategy. This strategy helps maintain stability and minimize exposure to market volatility, while still allowing holders to earn rewards.

The table below summarizes its key characteristics based on the available information.

| Characteristic |

Description |

| Ecosystem Role |

Native, yield-bearing stablecoin for the ASTER DEX . |

| Primary Function |

Serves as trading collateral while simultaneously allowing users to earn a yield . |

| Backing & Security |

Supported by assets held in custody by Ceffu Global(Binance's custody partner), and has undergone audits . |

| Price Stability |

Designed to be pegged to the US Dollar; price was reported at approximately $0.998 in August 2025 . |

Is ASTER a Good Investment?

Evaluating ASTER's investment potential requires considering both its promising fundamentals and inherent risks in the volatile DeFi sector.

Growth Potential

Analysts project significant upside, with price targets suggesting potential growth of up to 480% from current levels. Some forecasts indicate ASTER could reach $1.35 by the end of 2025 and potentially $3.50 by 2030 if the platform captures significant market share in the derivatives trading space. The projection is based on comparative valuation with competitors like Hyperliquid, which achieved a $18 billion market cap at its peak—nearly 4.8 times ASTER's current valuation.

Competitive Advantages

Aster's first-mover advantage in stock perpetuals, combined with its multi-chain architecture and institutional-grade infrastructure, positions it favorably against competitors. The platform's focus on user experience through both simple and professional interfaces creates accessibility while maintaining advanced functionality for sophisticated traders.

Risks to Consider

The project faces typical DeFi risks, including regulatory scrutiny around stock-settled perpetuals, potential token unlock sell pressure from team and investor allocations, and intensifying competition from established players like Hyperliquid and emerging protocols. Additionally, the token's substantial price appreciation since launch increases potential for short-term volatility and profit-taking.

ASTER Airdrop Strategy

The project has implemented a

carefully structured airdrop program designed to maximize decentralization and reward genuine users.

Community-Centric Distribution

Aster has allocated

53.5% of its total token supply to airdrops and community rewards, representing one of the most generous community allocations in the DeFi space. This approach emphasizes fair distribution while establishing a truly decentralized ecosystem through mechanisms that prevent centralization and airdrop manipulation.

Phased Distribution Schedule

The airdrop program implements a long-term distribution strategy spanning 80 months (approximately 7 years), ensuring stable protocol adoption without market disruption. Only 8.8% of tokens were unlocked immediately at TGE, with the remaining community allocation subject to gradual release to maintain engagement and prevent token dumping.

Ongoing Airdrop Campaigns

As of September 2025, the platform is running an

airdrop campaign continuing until October 5, complemented by a

4% token unlock scheduled for October 17 that is expected to drive continued mining activity, trading volume, and potential upward price momentum.

Conclusion

ASTER represents a

significant evolution in decentralized perpetual trading, combining sophisticated technology with community-focused tokenomics to create a compelling alternative to both traditional and decentralized exchanges. Its

cross-chain architecture, institutional backing, and innovative features like stock trading with crypto settlement position it at the forefront of DeFi innovation.

While the project shows substantial promise, investors should remain cognizant of the

inherent risks in the volatile DeFi sector, including regulatory uncertainty and competitive pressures. The token's dramatic initial performance demonstrates strong market confidence, but sustainable long-term value will depend on continued platform adoption, technological execution, and navigating the evolving regulatory landscape.

For traders and investors interested in the convergence of traditional and decentralized finance, ASTER offers exposure to one of the most innovative projects in the space, with a

unique value proposition in the rapidly growing perpetual derivatives market. As with any cryptocurrency investment, thorough research and appropriate risk management remain essential when considering ASTER allocation within a diversified portfolio.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.