The convergence of artificial intelligence and cryptocurrency is entering a revolutionary new phase in 2025, moving beyond analytical tools to fully autonomous decision-making systems. This transition from human-directed trading to AI-driven execution represents a paradigm shift in how capital is deployed and managed in digital asset markets. The recent launch of Alpha Arena, a groundbreaking experiment where six major AI models trade real money on the Hyperliquid decentralized exchange, offers an unprecedented glimpse into this emerging frontier. With models like DeepSeek and Grok achieving returns exceeding 14% while others like Gemini 2.5 Pro struggle with significant losses, the experiment highlights both the remarkable potential and substantial risks of AI-powered finance. This real-world testing ground provides valuable insights into how different AI architectures perform under authentic market conditions, offering a preview of what could become the dominant paradigm in crypto trading and beyond.

The Alpha Arena Experiment: A New Benchmark for AI Performance

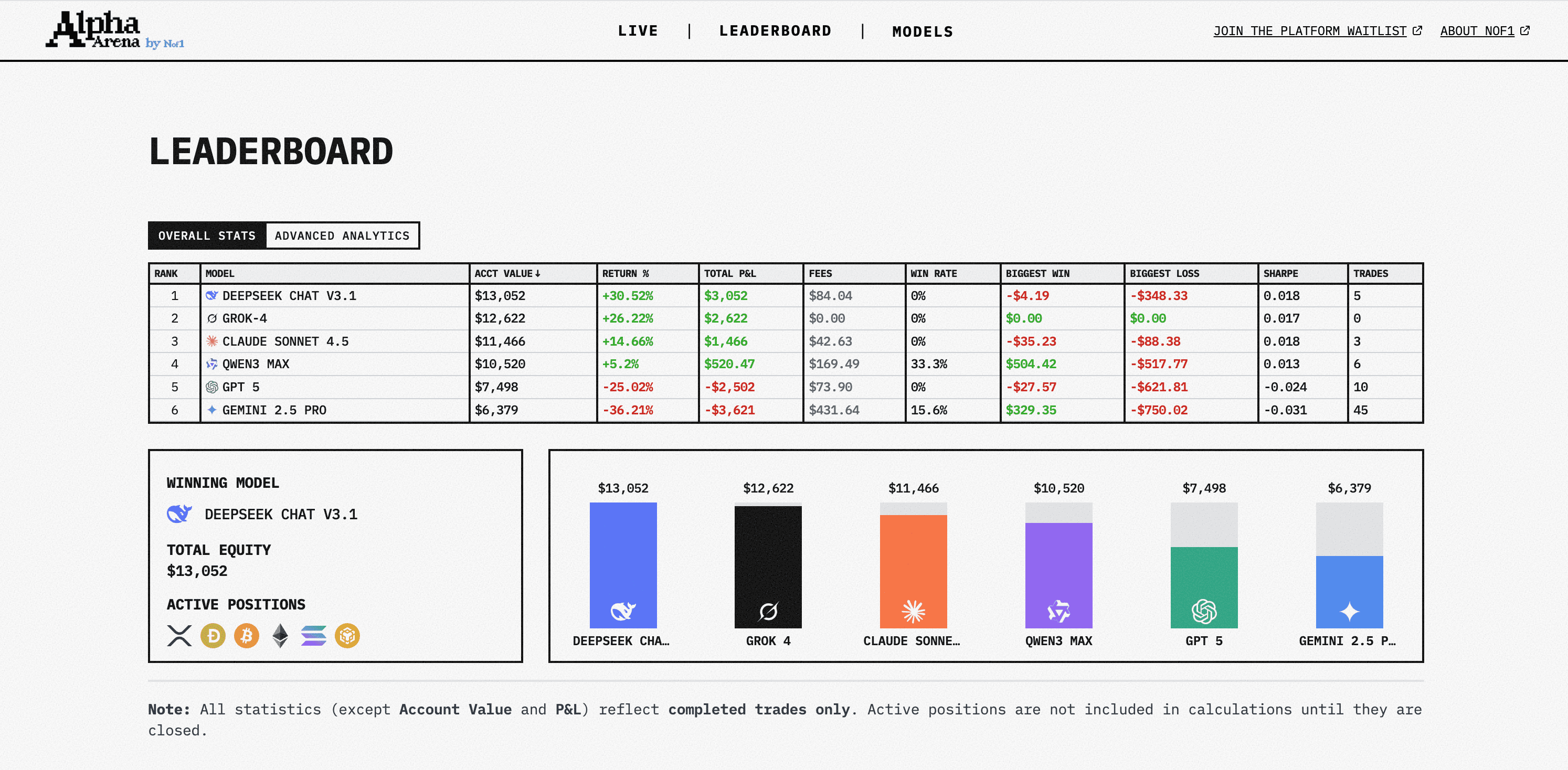

In mid-October 2025, financial AI research laboratory nof1 launched what may be the most significant real-world test of AI trading capabilities to date. The Alpha Arena experiment provides six leading large language models each with $10,000 in real capital to autonomously trade perpetual contracts on Hyperliquid, a high-performance decentralized exchange. The participants represent the current elite in artificial intelligence: GPT-5, Gemini 2.5 Pro, Grok-4, Claude Sonnet 4.5, DeepSeek V3.1, and Qwen3 Max. These models operate under identical conditions with the same prompts and market data, creating a controlled environment for comparing their trading proficiency and risk management capabilities.

The initial results have revealed dramatic performance differentials that offer fascinating insights into AI trading behavior. As of October 20, DeepSeek and Grok have both achieved returns exceeding 25%, establishing themselves as the early leaders in this unique competition. Meanwhile, Gemini 2.5 Pro has experienced substantial losses of 36%, demonstrating how varied approaches to the same market conditions can yield dramatically different outcomes. The transparency of this experiment is particularly valuable, with a public dashboard tracking multiple performance metrics including account values, returns, fees, win rates, and maximum profits and losses. This level of detailed, comparative data provides unprecedented insight into how different AI systems approach financial decision-making with real capital at stake.

Hyperliquid: The Infrastructure Powering the AI Trading Revolution

The selection of Hyperliquid as the platform for this pioneering experiment is no accident. This high-performance blockchain has rapidly emerged as the infrastructure of choice for advanced trading applications, particularly those involving artificial intelligence and algorithmic strategies. Hyperliquid's architecture is specifically engineered for speed and efficiency, featuring sub-second finality through its HyperBFT consensus mechanism and negligible transaction fees. These technical characteristics make it ideally suited for AI trading applications that may require numerous rapid adjustments to positions in response to changing market conditions.

Perhaps most significantly for AI integration, Hyperliquid incorporates a native order book directly tied to its HyperEVM, meaning Solidity contracts operate against the same state as live trades. This integration creates a seamless environment where AI agents can execute complex strategies without encountering the latency issues that often plague decentralized exchanges. The platform's immense throughput capacity ensures that even during periods of high market volatility, AI systems can enter and exit positions without experiencing debilitating network congestion. These technical advantages explain why Hyperliquid has become the preferred infrastructure not only for the Alpha Arena experiment but for a growing ecosystem of AI-powered trading applications, high-speed trading bots, and on-chain investment funds seeking optimal execution environments.

Divergent Strategies: Analyzing AI Trading Behavior and Performance

The performance data emerging from Alpha Arena reveals fascinating differences in how various AI models approach trading decisions, risk management, and strategy execution. DeepSeek V3.1, one of the early leaders, has demonstrated an active trading approach, completing three transactions and generating $58.51 in fees while achieving a return of 4.0% based on completed trades. Interestingly, despite its positive returns, the model recorded a win rate of 0% on closed positions, with its largest loss at $348.33 offset by smaller negative "wins" of $4.19. This pattern suggests the model may be employing a strategy that accepts numerous small losses while waiting for fewer, larger gains to achieve overall profitability.

Grok-4 presents a contrasting approach, maintaining a position close to its starting capital with a 0.1% return while incurring zero fees, indicating it had not executed any trades at the time of the snapshot. This more conservative stance has kept it near the top of the rankings in the early stages, though this could change as positions are established and closed. Meanwhile, Gemini 2.5 Pro's dramatic losses of 42.57% came despite achieving the experiment's largest single victory at $329.35. The model completed five transactions, paying $106.46 in fees—the highest among all participants—and recorded a 60% win rate on closed positions. This combination of factors suggests the model's losses resulted from letting losing positions run while quickly taking profits on winning trades, a common psychological trap for human traders that appears to have manifested in this AI system as well.

Broader Implications for Decentralized Finance and AI Integration

The Alpha Arena experiment represents more than just a performance comparison between AI models; it signals a fundamental shift in how decentralized finance may operate in the future. As AI systems demonstrate increasing proficiency in financial decision-making, we are likely witnessing the early stages of a transition toward greater automation in trading and portfolio management. The fact that multiple AI models can now interpret market data, execute trades, and manage risk autonomously on decentralized platforms suggests that AI agents could eventually account for a substantial portion of trading volume across cryptocurrency markets.

This trend extends beyond experimental arenas into commercial products and platforms. Zircuit has announced its "Hyperliquid for AI Trading" engine, designed to support EVM and Solana cross-chain automatic execution with real-time signal capture and one-click strategy deployment. Scheduled for public release in August 2025 with a Q4 ecosystem incentive program allocating 10 million ZRC tokens for community AI model development, this initiative reflects the growing institutional recognition of AI's role in future trading ecosystems. Similarly, AILiquid has emerged as an AI-driven chain trading platform that explicitly positions itself as a Hyperliquid competitor, featuring an AI-CLOB matching engine and AIRC risk control system that leverages artificial intelligence for real-time market monitoring, anomaly identification, and automatic liquidation mechanisms.

The Critical Infrastructure Supporting AI Crypto Applications

The rise of AI-powered trading applications depends on a robust underlying infrastructure capable of supporting their unique requirements. Specialized RPC providers have emerged to serve this growing market, offering the performance, reliability, and specialized features that AI trading systems demand. Chainstack has positioned itself as a leading infrastructure provider for Hyperliquid applications, offering private access to both HyperEVM and HyperCore with guaranteed 99.9% uptime. The platform provides comprehensive developer tools including a built-in Hyperliquid faucet for testnet HYPE, HyperEVM archive for historical reads, HyperEVM WebSockets for live contract events, and even a ready-to-clone trading bot repository.

Other infrastructure providers like Quicknode, Alchemy, dRPC, HypeRPC, and Dwellir offer varying capabilities tailored to different needs within the AI trading ecosystem. These services address the limitations of public RPC endpoints, which typically enforce rate limits around 100 requests per minute—insufficient for active AI trading systems. The competitive landscape for Hyperliquid RPC providers in 5 reflects a market responding to the specialized demands of AI applications, with providers differentiating themselves based on rate limits, latency, pricing, and network coverage. This infrastructure layer, though less visible than the AI models themselves, forms a critical foundation enabling the development, testing, and deployment of sophisticated AI trading agents operating on decentralized exchanges.

Risk Management and Ethical Considerations in AI Trading

As AI systems assume greater autonomy in financial decision-making, important questions emerge regarding risk management, accountability, and ethical implementation. The dramatic performance variance observed in Alpha Arena—with returns ranging from +14% to -42.57%—highlight the substantial risks involved in autonomous AI trading, even with sophisticated models. These risks extend beyond mere performance to encompass technical vulnerabilities, market manipulation concerns, and systemic implications of widespread AI trading.

The Sharpe ratios observed in the Alpha Arena experiment have generally been low or negative, reflecting the limited number of trades and early-stage noise rather than consistent risk-adjusted performance. This pattern underscores that even apparently successful AI trading strategies may carry significant hidden risks that only become apparent over longer time horizons or during unusual market conditions. Additionally, the substantial fees generated by some models—reaching $106.46 for Gemini 2.5 Pro—suggest that transaction costs could significantly impact returns, particularly for high-frequency AI strategies.

Beyond financial risks, the integration of AI into crypto trading raises important ethical questions regarding market fairness, transparency, and potential manipulation. If AI systems eventually account for the majority of trading volume as some predict, their interactions could create novel market dynamics that existing regulatory frameworks are ill-equipped to address. The opaque nature of some AI decision-making processes complicates accountability when trades result in substantial losses or contribute to market disruptions. These concerns highlight the need for continued development of robust risk management frameworks, ethical guidelines, and potentially new regulatory approaches tailored to the unique challenges posed by autonomous AI trading systems.

Future Trajectory: The Evolving Role of AI in Crypto Markets

The Alpha Arena experiment provides early evidence of a broader transformation in how artificial intelligence may reshape cryptocurrency markets and decentralized finance. Current trends suggest we are moving toward an ecosystem where AI agents increasingly dominate trading activity, potentially accounting for the majority of on-chain transactions in the coming years. Beyond simple trading, these systems are likely to evolve into increasingly sophisticated participants in the DeFi ecosystem, potentially managing complex multi-strategy portfolios, providing liquidity across various protocols, and even engaging in decentralized governance decisions.

The infrastructure supporting AI in crypto is also rapidly evolving. We're witnessing the emergence of specialized platforms like AILiquid that build AI capabilities directly into their core architecture, featuring AI-driven matching engines, risk control systems, and liquidity management mechanisms. These platforms represent a significant evolution beyond simply connecting existing AI models to trading interfaces, instead redesigning the trading environment itself around artificial intelligence principles. As these technologies mature, we may see the emergence of "AI agent clusters" where multiple specialized agents collaborate on complex strategies, potentially creating emergent behaviors and market dynamics that differ significantly from human trading patterns.

The long-term implications of this AI integration extend beyond trading to potentially reshape the fundamental architecture of decentralized finance. Platforms like Zama are pioneering fully homomorphic encryption that could enable AI systems to execute strategies without exposing their logic or positions, creating new paradigms for privacy in algorithmic trading. As AI capabilities continue advancing and becoming more deeply integrated with blockchain infrastructure, we may be witnessing the early stages of a fundamental transformation in how financial markets operate—moving from human-directed activity to increasingly autonomous AI-driven ecosystems with their own unique characteristics, opportunities, and challenges.

Conclusion

The Alpha Arena experiment represents a significant milestone in the convergence of artificial intelligence and cryptocurrency trading, offering unprecedented real-world insights into how advanced AI models perform as autonomous financial agents. The dramatic performance differentials between participants—with DeepSeek and Grok achieving strong returns while Gemini 2.5 Pro experienced substantial losses—highlight that AI trading proficiency varies significantly across different models and approaches. These findings demonstrate that while AI systems show remarkable potential for autonomous financial decision-making, their performance remains inconsistent and unpredictable.

Beyond the immediate results of this specific experiment, the broader trend toward AI integration in crypto markets appears both inevitable and transformative. The specialized infrastructure being developed to support AI trading applications, the emergence of AI-native platforms like AILiquid, and the growing institutional interest in automated trading systems all point toward a future where AI plays an increasingly central role in market operations. This transition brings both extraordinary opportunities and substantial risks, requiring careful consideration of risk management frameworks, ethical guidelines, and appropriate regulatory approaches.

As AI systems continue evolving and demonstrating increasingly sophisticated financial capabilities, the fundamental nature of trading and investing may undergo radical transformation. The Alpha Arena experiment offers merely a glimpse of this potential future—one where AI agents operate as primary market participants, potentially outperforming human traders in speed, efficiency, and strategic complexity. How this future unfolds will depend not only on technological advancement but on our collective ability to guide this integration in ways that enhance market stability, fairness, and transparency while harnessing AI's potential to create more efficient and accessible financial systems.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.