Token standards are a set of agreed-upon rules that guide the design, development, behavior, and operation of cryptocurrency tokens on a given blockchain protocol. For token standards to be useful, they must be widely adopted. Without adoption, their rules cannot be elevated to the status of a “standard”—because standards are the rules that are generally followed by a wide range of people. As we progress through 2025, these technical specifications are evolving beyond simple technical protocols to become

crucial bridges

connecting traditional finance with the emerging decentralized economy, while simultaneously addressing increasingly complex

regulatory requirements

.

What Are Token Standards?

Token standards are blueprints or specifications defining how tokens function on a blockchain network. These standards ensure that digital assets created following the same rules will be

interoperable with various wallets, exchanges, and decentralized applications (dApps) within that ecosystem. Think of them as the HTML of blockchain, a common language that allows different systems to recognize and properly interact with digital assets.

The concept of token standards emerged primarily from the Ethereum ecosystem, which pioneered the creation of

multiple standardized formats for different use cases. While Ethereum remains the most prominent platform for token standards, similar concepts have been adopted by other blockchain networks with varying implementations.

The core value proposition of token standards lies in their ability to create

consistency and compatibility. Without such standards, every new token would require custom integration for every wallet, exchange, or application, which is a process that would be impossibly inefficient and would severely limit innovation in the blockchain space. By establishing common interfaces and expected behaviors, standards allow developers to create applications that can seamlessly interact with any token implementing the same specification.

Why Do We Need Token Standards?

Let’s start by understanding what we mean by “token”. A token in the crypto world is generally a cryptocurrency that is created, managed, and distributed using blockchain-based technology—most typically, smart contracts. A token may have market value, and may also have some utility that makes it desirable to hold the token beyond financial gain.

A standard is a set of rules that “standardizes” something. In the context of tokens, standardization means having a set of rules that define what data a token should contain, the behaviors and actions the token is capable of, and what operations a holder or community of holders can take with respect to that token. Token standards offer guidelines for the creation, issuance, deployment, transfer, destruction, and other attributes of tokens on their underlying blockchain. As might be expected, these token standards are likely to arise on blockchains that support smart contract development because such a blockchain would be able to support the creation of an arbitrary number of tokens on top of it.

We now understand what token standards are, but to really understand their role in the ecosystem, we need to understand their benefits. In other words, why do we want token standards, and what problem do they solve?

At a very general level, a standard allows for multiple implementations. For example, Ethereum has standards for the client software that Ethereum nodes run to provide connectivity to the Ethereum network. These standards make it possible for anybody to write their own version of an Ethereum client in any programming language they choose, provided the standards and specifications for Ethereum nodes and clients are met. Thus, the Ethereum network can have any number of nodes and clients, some of which run Ethereum software written in Golang, Rust, Java, C#, C++, or Python. This adds to “client diversity,” which makes the network stronger by reducing dependency on a single codebase’s implementation. But all these implementations, regardless of software language, design, or implementation details, have one thing in common—they all follow a single specification for clients.

So standards help add to the diversity of implementations. This means there can be different approaches to security, speed, scalability, etc., and that diversity enriches the overall experience. It also means that developers and designers can design with reference to a stable point regarding the minimum set of behaviors required from the system. This stimulates innovation on top of the standard, which unlocks more use cases, drives more adoption, and so on.

This is exactly why token standards are important. Standardizing the functionality of different tokens helps developers build applications on top of those standards, knowing that the underlying interfaces will be the same as long as the standard is being applied.

Another huge benefit of token standards is that the smart contracts that implement them become “composable.” This means that we can design contracts to interact with each other because standardization enables us to know what functions, methods, data types, and behaviors a complying smart contract will expose. We can then write code to interact with these contracts, which means that the ecosystem of smart contracts can interoperate, interconnect, and mix and match in different ways so that the whole is much greater than the sum of the parts. A simple example is that when a new crypto token is issued on an Ethereum-based blockchain network, and it complies with the ERC-20 standard for fungible tokens, then its smart contract will be compatible with decentralized exchanges that are designed to work with ERC-20 tokens.

The Major Players: ERC-20 and ERC-721

ERC-20: The Fungible Standard

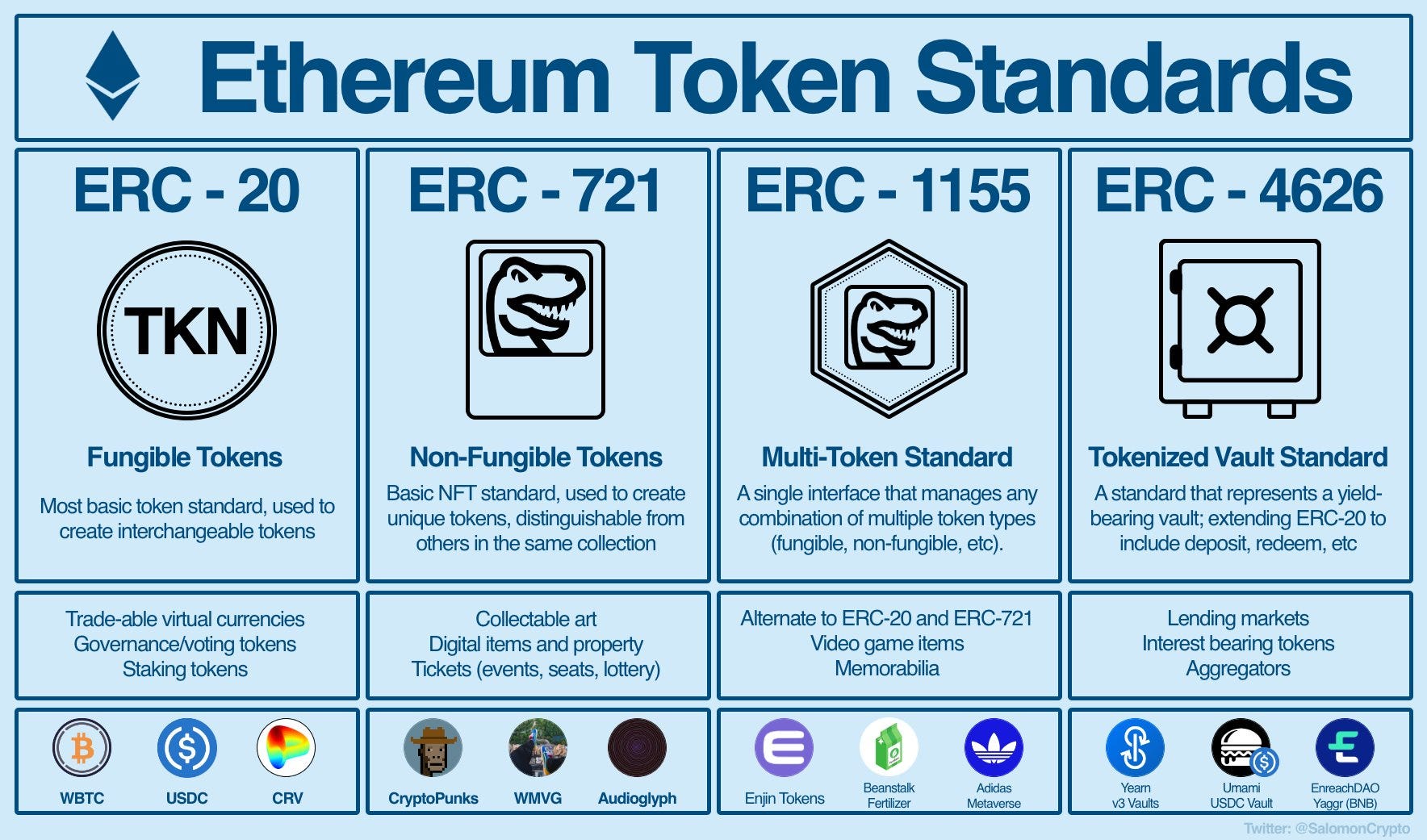

The ERC-20 standard is arguably the most influential and widely adopted token standard in blockchain space. As a fungible token standard, it treats all tokens as identical and interchangeable—much like traditional currency, where one dollar bill has the same value as any other dollar bill.

The key innovation of ERC-20 was establishing a

common interface that all compatible tokens must follow, including basic functions like:

-

Transferring tokens between addresses

-

Checking account balances

-

Allowing third parties to spend tokens on a user's behalf

This standardization has made ERC-20 the foundation of the DeFi ecosystem, with applications ranging from stablecoins and utility tokens to governance tokens. The widespread adoption is evident in the numbers—over 180,000 different ERC-20 tokens have been created on the Ethereum blockchain.

From a technical perspective, ERC-20's simplicity has been both its greatest strength and its limitation. While it excels at representing interchangeable assets, it lacks the sophistication to handle more complex digital assets with unique properties or regulatory requirements.

ERC-721: The Non-Fungible Revolution

The ERC-721 standard introduced a paradigm shift in digital ownership by creating a framework for non-fungible tokens (NFTs). Unlike ERC-20 tokens, each ERC-721 token is unique and non-interchangeable, with distinct properties and values.

Proposed in 2018 by William Entriken, Dieter Shirley, Jacob Evans, and Nastassia Sachs, ERC-721 implements a system where each token has a unique identifier that distinguishes it from all other tokens in the same contract. This simple but powerful concept unlocked entirely new use cases for blockchain technology, including:

-

Digital art and collectibles with verifiable scarcity and provenance

-

Game assets with true ownership that can transfer across platforms

-

Virtual real estate in metaverse environments

-

Tokenized representations of physical assets

The core technical difference lies in ERC-721's treatment of tokens as discrete entities with individual properties, rather than interchangeable units. This uniqueness makes ERC-721 tokens inherently non-divisible, so that you can't send someone 0.1 of a CryptoPunk in the same way you can send 0.1 ETH.

The impact of ERC-721 extends far beyond digital art, enabling new models of digital ownership and property rights that were previously impossible to enforce in purely digital environments.

The Evolving Process of Token Standards

ERC-1155

As the token ecosystem matured, the limitations of both ERC-20 and ERC-721 became apparent—particularly in applications like gaming that required both fungible currencies and non-fungible assets. ERC-1155 emerged as a hybrid solution that supports both fungible and non-fungible tokens within a single contract.

This multi-token standard offers significant gas efficiency improvements and enables batch operations, making it particularly suitable for applications that manage diverse digital asset portfolios. For game developers, this means being able to manage in-game currencies (fungible) and unique items (non-fungible) through the same smart contract infrastructure.

ERC-3643 and ERC-7518

Perhaps the most significant development in token standards during 2025 has been the emergence of compliance-focused frameworks designed specifically for real-world asset (RWA) tokenization.

ERC-3643 has gained notable attention, including being explicitly referenced in SEC Chairman Paul Atkins' "Project Crypto" initiative announcement. This standard functions as a "compliant version of ERC-20" by incorporating identity verification, permission controls, and transaction restrictions directly into the token contract.

The key innovation of ERC-3643 is its integration with a decentralized identity framework (ONCHAINID) that ensures only verified users can hold or transfer tokens. This "permissioned token" approach creates a hybrid model where the underlying blockchain remains decentralized, but access to specific assets remains controlled—effectively bridging the gap between traditional finance's regulatory requirements and blockchain's efficiency benefits.

Similarly, ERC-7518 (also known as Dynamic Compliant Interoperable Security Token or DyCIST) builds upon ERC-1155 to create a secure, compliant, and interoperable standard for RWA tokenization. It introduces the concept of partitions, where each token ID represents a unique asset class or investor group with its own rules and metadata.

What makes ERC-7518 particularly innovative is its dynamic compliance capability, which is the ability to adapt to evolving regulations without requiring contract redeployment. This addresses one of the critical challenges in tokenizing regulated assets: the need to maintain compliance as laws change across different jurisdictions.

ERC-7621

The recent mainnet launch of the Alvara Protocol has brought ERC-7621 into production, which is a standard designed specifically for tokenized investment baskets. Unlike proprietary basket solutions, ERC-7621 creates fully fungible ERC-20 tokens that can be used as collateral, traded on any DEX, or integrated into lending protocols without custom integrations.

This standard enables a universal liquidity layer where all tokenized baskets can interact with the same DeFi primitives, dramatically reducing the fragmentation that has plagued previous attempts at creating managed portfolio products in DeFi.

Solana Token Standards

While token standards are simply a type of standardization rule (we have them from chemicals to construction!), they do go by different names in different contexts. In the

Solana ecosystem, token standards are contained in the Solana Program Library (SPL), which is a library of on-chain software programs that run on the Solana chain’s runtime. SPL-compliant tokens are compatible with the Solana chain and Solana wallets and add to composability in the Solana ecosystem. Solana tokens are covered by the Solana

Token Program, which is part of the overall SPL. This program creates a standardized interface for the creation, issue, transfer, and destruction of Solana-compatible tokens and is comparable to ERC-20 and ERC-721 in the Ethereum ecosystem.

Solana’s native token is the SOL token, comparable to Ethereum’s ETH. This is also an SPL token. SPL tokens can vary greatly in their functionality—some can be NFTs, others can be fungible but with a small circulating supply, and others can combine the functionality of various other types.

Once again, complying with the SPL standard means that tokens on Solana can be interacted with using SPL-compliant wallets and smart contracts, which enables composability and innovation within the ecosystem. They also enable analytics and meta information for research, as can be seen on

Solscan. This site’s functionality is enabled by the SPL standards, which prescribe what functionality SPL-compliant tokens must have so that frontends like this can be built to interact with all SPL-compliant tokens.

The Future of Token Standards: Interoperability and Specialization

As we look beyond 2025, several trends are likely to shape the continued evolution of token standards:

Cross-Chain Interoperability

Future token standards will increasingly need to address

cross-chain functionality, allowing assets to move seamlessly between different blockchain networks while preserving their properties and compliance features. Standards like ERC-7518 are already pioneering this approach with architectures designed to "preserve compliance across EVM and non-EVM chains".

Increased Specialization

The one-size-fits-all approach of early token standards is giving way to

highly specialized frameworks optimized for specific asset classes or use cases. We're seeing standards designed specifically for real estate, carbon credits, intellectual property, and various financial instruments.

Regulatory Native Design

Rather than treating compliance as an afterthought, emerging token standards are building regulatory requirements directly into their core architecture. This "compliance by design" approach reduces the friction of integrating regulated assets into blockchain ecosystems while maintaining necessary investor protections.

Institutional-Grade Infrastructure

As tokenization moves from experimental to production-ready, standards are evolving to support the robustness, security, and scalability requirements of institutional users. Features like automated fee distribution, transparent on-chain management, and enterprise-grade security are becoming standard expectations rather than premium features.

Conclusion

Token standards, while largely technical and operating in the background, have become the

critical infrastructure enabling the digital asset economy to evolve from simple cryptocurrencies to sophisticated representations of value. What began as basic specifications for creating tokens on Ethereum has grown into a rich ecosystem of specialized standards powering everything from digital art markets to tokenized real-world assets.

The evolution of these standards from the fungible ERC-20 to the non-fungible ERC-721, and now to compliant frameworks like ERC-3643 and ERC-7518—mirrors the broader maturation of the blockchain space from experimental technology to a

legitimate financial infrastructure.

As Dominic Ryder, Co-founder of Alvara Protocol, aptly noted about the ERC-7621 standard: "We're not just launching another basket product, we're activating a new standard that the entire ecosystem can build upon". This sentiment captures the transformative potential of token standards: they're not just technical specifications, but

foundational layers upon which new economic models can be constructed.

For developers, entrepreneurs, and investors in the blockchain space, understanding token standards is no longer optional. It's essential knowledge for navigating the increasingly complex and specialized world of digital assets. As space continues to evolve, these standards will likely play an even more central role in bridging traditional finance with the emerging decentralized economy, ultimately creating a more efficient, transparent, and accessible global financial system.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financi

al advice.