The blockchain ecosystem is maturing, moving beyond speculative assets to solve tangible, real-world problems. Two critical areas demanding robust solutions are verifiable digital credentials and the efficient, transparent distribution of tokens. While many projects focus on one vertical, SIGN is ambitiously building the global infrastructure to address both. By combining an omni-chain attestation protocol with a sophisticated token distribution platform, SIGN positions itself as a fundamental pillar for the next generation of the web, from government-level digital public infrastructure to the intricate needs of decentralized applications (dApps) and their communities. This article provides a comprehensive analysis of the SIGN project, exploring its dual-product ecosystem, the utility of its native token, and the factors that could influence its market valuation in the coming months and years. Understanding SIGN requires looking at both the technical promise of its protocol and the immediate, product-market fit of its TokenTable platform.

What is SIGN?

SIGN is a blockchain project constructing core infrastructure for the digital economy. Its mission is bifurcated into two synergistic products that cater to a broad spectrum of users, from sovereign nations to Web3 startups. The first product,

Sign Protocol, is an omni-chain attestation protocol. In simpler terms, it provides a universal framework for creating, managing, and verifying any type of credential or attestation on a blockchain. These can range from educational certificates and professional licenses to proofs of humanity and KYC verifications. Its "omni-chain" nature means it is not confined to a single blockchain, allowing attestations to be created and used across multiple networks, enhancing accessibility and utility.

The second product,

TokenTable, addresses a critical pain point in the crypto industry: token distribution. It is a smart contract-based platform that enables projects to manage their entire token distribution lifecycle, including airdrops, vesting schedules for team members and investors, and the transparent unlocking of tokens. By providing a secure and customizable toolkit, TokenTable aims to become the standard for building trust between projects and their communities, mitigating the risks associated with centralized control and opaque token release schedules. Together, these products establish SIGN as a foundational layer for trust and efficiency in the digital world.

SIGN Token Utility and Governance Features

The SIGN token is the economic and functional heart of the ecosystem, designed to capture value from the usage of both Sign Protocol and TokenTable. Its utility is multifaceted, driving demand through practical necessity.

Protocol Incentives and Fees: Within Sign Protocol, the token is used to pay for attestation services. Attesters—the entities creating and issuing credentials—may need to stake or pay fees in SIGN tokens to operate, ensuring their commitment to the network's integrity. This creates a direct demand loop where increased usage of the protocol for verifiable credentials translates into higher token utilization.

TokenTable Operations: The SIGN token is deeply integrated into TokenTable's functionality. Projects using TokenTable to manage their token distributions may be required to pay fees in SIGN tokens for services like creating vesting schedules, executing airdrops, or utilizing advanced features. This provides a steady, recurring demand source based on the platform's adoption by other crypto projects, which is already evident given TokenTable's early traction with prominent names.

Governance: As the ecosystem matures, the SIGN token is expected to transition into a governance token, granting holders the right to vote on crucial decisions. This could include protocol upgrades, changes to fee structures, treasury management, and the future roadmap of both Sign Protocol and TokenTable. This democratic approach ensures the platform evolves in a direction that benefits its most staunch supporters.

Staking: A staking mechanism is likely to be implemented to secure the network further and reward long-term token holders. Staking could provide rewards from protocol fees or offer privileged access to services within the ecosystem, incentivizing holding and reducing circulating supply.

Cross-Chain Compatibility and Blockchain Integrations

The "omni-chain" attribute of Sign Protocol is not merely a feature; it is a core tenet of SIGN's value proposition. The project recognizes that for attestations to be truly global and useful, they cannot be siloed within a single blockchain environment.

Sign Protocol is designed from the ground up to be blockchain-agnostic. It initially launched on the Ethereum Mainnet and leverages the security and decentralization of the Ethereum ecosystem. However, to ensure scalability and affordability, it has expanded to other networks, including

Coinbase's Base and

Linea. This strategic multi-chain deployment allows users to choose the most suitable and cost-effective chain for their specific attestation needs without being locked in.

This cross-chain philosophy is crucial for widespread adoption. It enables governments, enterprises, and dApps to interact with the protocol regardless of their underlying blockchain preference. For instance, a government digital identity attestation created on a permissioned chain could be verified by a dApp on Ethereum. This interoperability positions SIGN as a universal layer of trust, a necessary infrastructure for a multi-chain future.

Key Products in the SIGN Ecosystem

The strength of SIGN lies in the clear utility and market need for its two primary products.

Sign Protocol: This product aims to become the backbone for digital trust. Its use cases are vast. Governments could use it to issue digital passports or business licenses, creating tamper-proof public records. Universities could issue verifiable digital diplomas. DAOs could use it for attestations of membership or contribution. By providing a standard, open-source framework, Sign Protocol lowers the barrier to entry for any entity needing to issue verifiable credentials, positioning itself as critical digital public infrastructure.

TokenTable: This platform has already achieved significant early adoption, serving high-profile projects like

Axelar, Moonbeam, and QuickNode. TokenTable solves a critical problem in crypto: the lack of trust in token distribution. By using non-custodial, auditable smart contracts, it ensures that vesting schedules are immutable and transparent. Team and investor tokens cannot be dumped unexpectedly, and airdrops can be executed fairly. This transparency builds immense trust with communities and investors, making TokenTable an essential tool for any serious Web3 project planning a token launch. Its existing customer base is a strong validation of its product-market fit and provides a tangible revenue stream to the ecosystem.

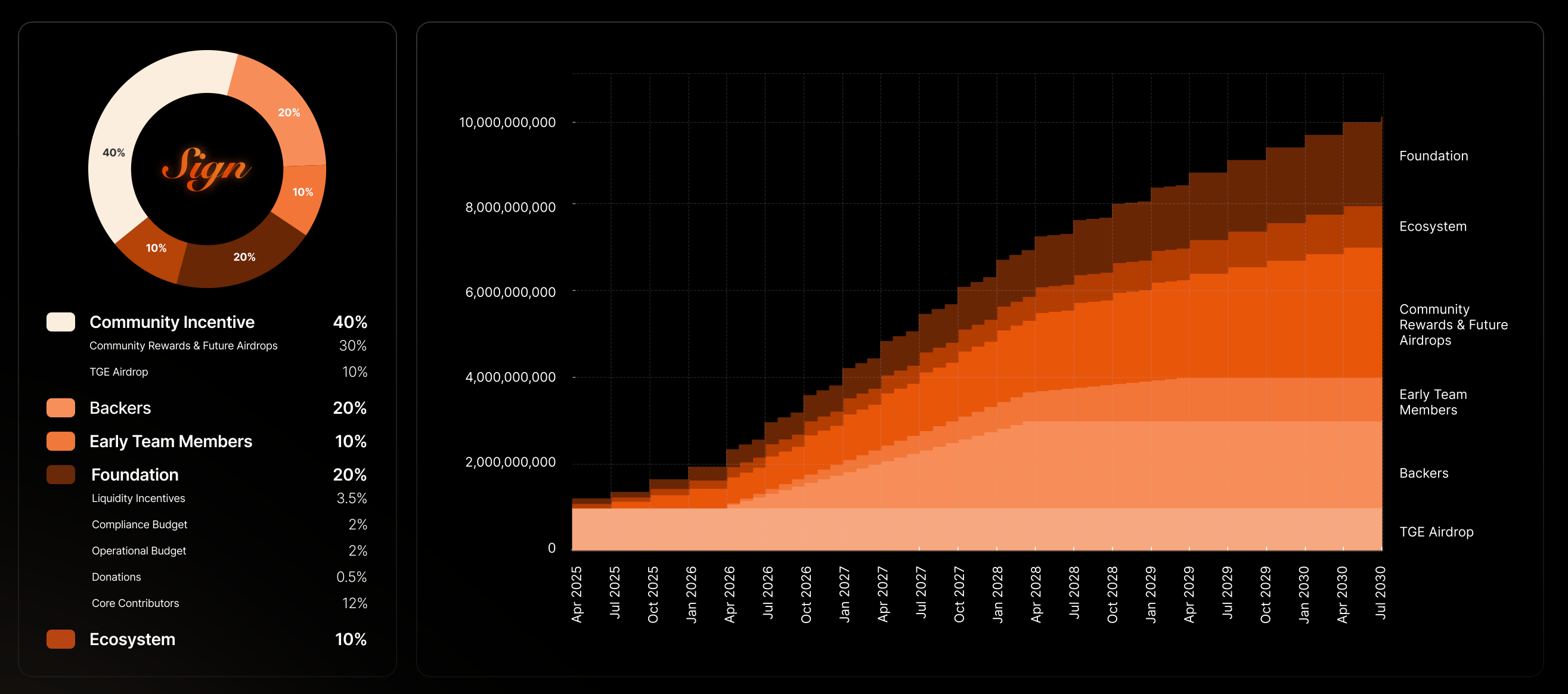

SIGN Token Unlocks and Allocation

The SIGN token has a defined allocation plan, with a significant token unlock scheduled for September 28, 2025. The table below breaks down its tokenomics and the upcoming unlock event.

Short-Term and Long-Term Price Predictions

SIGN price broke out on September 23rd. Binance founder

CZ (Changpeng Zhao)

subsequently retweeted the message, revealing that he had “made several connections and introductions” in the project, and confirmed that Sign was a company in the portfolio of his venture capital firm YZiLabs. Source: CoinMarketCap

Short-Term (Next 6-12 Months): Short-term price action for SIGN will be heavily influenced by three factors: the overall crypto market sentiment, milestones achieved on the project's roadmap, and the continued adoption of TokenTable. Positive announcements, such as integrations with major blockchain networks or partnerships with recognizable enterprises using Sign Protocol, could act as catalysts. The token's price may exhibit volatility, correlating with Bitcoin's movements. However, the recurring usage of TokenTable by a growing list of projects could provide a solid base level of demand, potentially offering some resistance against broader market downturns.

Long-Term (2-5 Years): The long-term valuation of SIGN is intrinsically tied to the success of its two-pillared strategy. If Sign Protocol gains traction as a standard for verifiable credentials, especially in the burgeoning real-world asset (RWA) tokenization space, it could unlock massive, sustained demand for the token. Simultaneously, if TokenTable becomes the industry standard for token distribution, its fee generation will create a powerful value accrual mechanism for the SIGN token. In a bullish scenario, where both products achieve significant market penetration, SIGN could evolve into a blue-chip infrastructure asset. The token's value would be driven by the combined fees from a global attestation network and a dominant token distribution platform.

Factors Influencing SIGN’s Price

Several key factors will determine the price trajectory of the SIGN token.

Adoption of TokenTable: The most immediate and measurable factor is the growth in the number and quality of projects using TokenTable. Each new customer represents recurring revenue and validates the business model, directly impacting token demand.

Sign Protocol Traction: The longer-term growth driver is the adoption of Sign Protocol. Partnerships with governments, major enterprises, or widely-used dApps would be significant bullish indicators, demonstrating the protocol's utility beyond the crypto-native space.

Competitive Landscape: The space for token distribution tools and attestation protocols is competitive. SIGN must maintain its first-mover advantage in token distribution and continue to innovate in the attestation space to fend off competitors. Its ability to execute its roadmap flawlessly is critical.

Regulatory Environment: As SIGN ventures into areas like digital identity and credentials, it may encounter regulatory scrutiny. A favorable regulatory framework that recognizes blockchain-based attestations could be a major boost, while restrictive regulations could pose challenges.

Market Cycles: As an altcoin, SIGN's price will inevitably be affected by broader cryptocurrency market cycles. A bull market can amplify positive project news, while a bear market can suppress prices even with strong fundamentals.

Conclusion

SIGN presents a unique and compelling investment thesis in the crypto infrastructure layer. Unlike projects with speculative utility, SIGN is building two products with clear, demonstrable market needs. TokenTable already has early product-market fit, providing a tangible foundation and revenue stream. Sign Protocol, while more ambitious and longer-term, has the potential to tap into a massive market for verifiable credentials and digital trust.

For investors, SIGN offers a balanced risk-reward profile. The short-term viability is underpinned by TokenTable's adoption, while the long-term upside is leveraged to the success of the omni-chain attestation protocol. The primary risks involve execution, competition, and regulatory hurdles. However, if the team can successfully navigate these challenges and execute its vision, SIGN has the potential to become an indispensable piece of Web3 infrastructure, with its token reflecting that fundamental value. As always, thorough personal research and an understanding of personal risk tolerance are essential before any investment.

References:

Sign. (n.d.).

$SIGN Token: Official information on blockchain tools, token economics, and ecosystem. Sign.

https://sign.global/sign

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.