Hyperliquid

, a dominant player in the decentralized perpetual futures (perp) market, is making a strategic move beyond its core product. Through

HIP-4

, a newly proposed governance initiative, the protocol aims to introduce a novel financial primitive called

Event Perpetuals

. This is not merely a technical upgrade but a significant business development probe into the burgeoning prediction market space. By leveraging its robust infrastructure, Hyperliquid is attempting to capture a new market segment, potentially unlocking a path from a single-product platform to a diversified financial ecosystem. This article delves into the mechanics of HIP-4, analyzes the logic behind Event Perpetuals, and explores the risks and opportunities this move presents for Hyperliquid and the broader DeFi landscape.

The HIP-4 Proposal

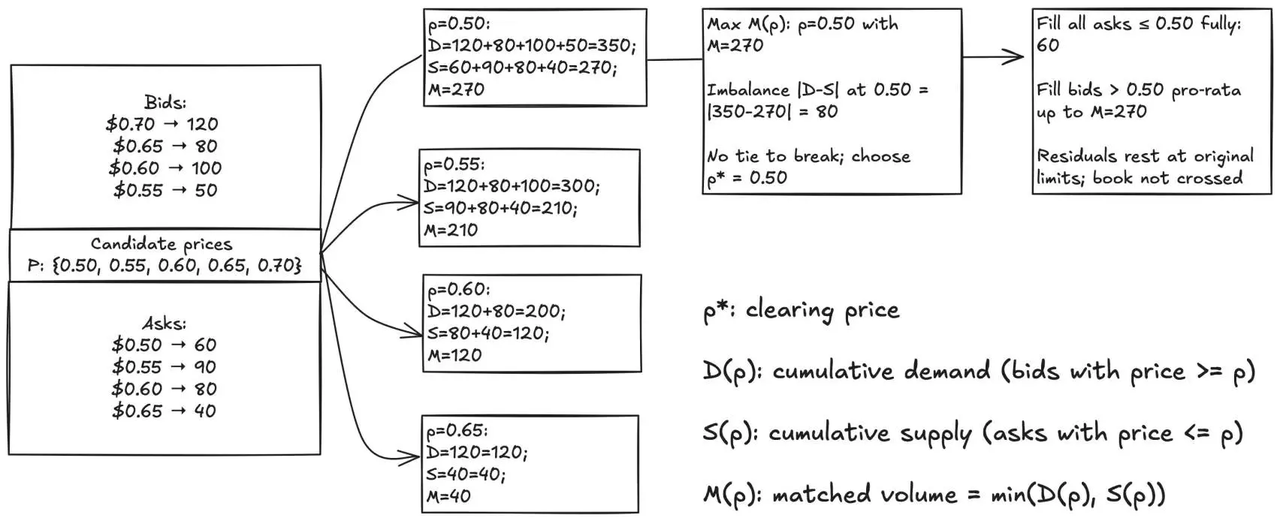

The HIP-4 proposal centers on the creation of Event Perpetuals, a financial instrument designed specifically for binary outcomes. Unlike traditional prediction markets or perpetual contracts, Event Perpetuals strip away two core mechanisms of conventional perps: the continuous oracle price feed and the funding rate mechanism. Instead, the contract's price discovery is driven entirely by market trading activity between 0 and 1, with the final settlement value determined by an oracle only at the event's conclusion.

The design incorporates several clever features to ensure stability and efficiency:

An opening auction mechanism initiates each market with

a 15-minute collective bidding period to prevent initial price chaos and establish a fair opening price. The product mandates a maximum of 1x isolated margin, eliminating leverage and significantly reducing the risk of cascading liquidations that plague leveraged perp markets. Perhaps most innovatively, the system allows for slot reuse. Once a market is settled, the same smart contract slot can be immediately redeployed for a new event, enhancing capital efficiency and allowing for rapid market iteration.

Why is HIP-4 a Clever Product Extension?

Let’s first understand a core question:

Why can't

Hyperliquid

directly add prediction markets to the existing system?

The proposal gives a vivid example: NFL game predictions.

Suppose the prediction question is "Will the Chiefs win the Super Bowl?" If using the traditional perpetual contract method, continuous oracle price feeds would be required, updating odds every 3 seconds. But here’s the problem: sports game odds do not change continuously. After a play, the odds may jump instantly. HIP-3 (Hyperliquid's existing market deployment specification) limits the price to a maximum change of 1% per tick. This means that if the game result is determined, it would take a full 50 minutes for the price to jump from 0.5 to 1.0. During this time, traders who know the result can easily arbitrage. This is why the new Event Perpetuals in the HIP-4 proposal are needed.

Event Perpetuals eliminate two core mechanisms of perpetual contracts: continuous oracles and funding rates. Prices are determined entirely by market trading, with the final result (0 or 1) confirmed only through an oracle at the end of the event.

Interesting design features include:

-

Opening auction mechanism: 15 minutes of collective bidding to avoid initial price chaos

-

1x isolated margin: no leverage, reducing liquidation risk

-

Slot reuse: new markets can be deployed immediately after market settlement, improving capital efficiency

On the surface, this is a technical innovation;

essentially, this may be a business exploration that Hyperliquid wants to undertake.

The attempt to move from a single product to a product matrix is evident. No matter how successful perpetual contracts are, they are just one product. If Event Perpetuals succeed, it means that Hyperliquid's infrastructure can support more financial products:

Today it's prediction markets. Tomorrow there could be options, and the day after it could be structured products.

More importantly, Hyperliquid has chosen a smart way to expand: letting others create markets.

According to the proposal, any team that wants to create a prediction market on Hyperliquid (referred to as "Builder" in the proposal) needs to stake 1 million HYPE tokens. These Builders are responsible for:

-

Deciding what market to create (e.g., "Will Trump buy Bitcoin?")

-

Setting market parameters (settlement time, oracle sources, etc.)

-

Maintaining market operations (providing initial liquidity, promotion, etc.)

In return, Builders can earn up to

50% of the trading fees from that market.

This design is clever. Hyperliquid does not need to determine "which prediction markets will be popular," but rather lets the market decide. Teams willing to stake 1 million HYPE will naturally choose markets with liquidity potential carefully. If the market created by the Builder has no participants, the loss is the Builder's opportunity cost; if the market is popular, both Hyperliquid and the Builder win.

This also explains why there are members of the Kalshi team involved in writing this HIP-4 proposal.

They may be the kind of professional Builders that Hyperliquid wants to attract. Kalshi has mature market operation experience and knows what types of prediction markets have liquidity. If they are willing to create markets for Hyperliquid, they bring not just a market but a whole set of already validated operational methodologies. For a DEX with a TVL exceeding $2 billion, such a trial-and-error model is quite smart.

Why Prediction Markets and Why Now?

Hyperliquid's foray into prediction markets is a logical evolution driven by several factors. The perpetual futures market, while successful, is increasingly competitive. Expanding into prediction markets allows Hyperliquid to diversify its product offerings and tap into a new user base interested in speculating on real-world events, from elections to sports outcomes. More importantly, this move is a test of protocol's underlying infrastructure's flexibility. If Event Perpetuals prove successful, it demonstrates that Hyperliquid's L1 technology can support a wider array of financial products, such as options or structured products, in the future.

The timing is also strategic. The prediction market space has gained significant traction, with platforms like Polymarket seeing growing volumes. However, many existing solutions face challenges with user experience, capital efficiency, and liquidity. Hyperliquid, with its existing order book model and deep liquidity in crypto markets, is positioned to offer a more familiar and potentially superior trading experience for its existing user base.

The Builder Model Explained

A critical and innovative aspect of HIP-4 is its decentralized "Builder" model. Instead of Hyperliquid's core team curating and creating all markets, the proposal opens this function to the community. Any team wanting to create a prediction market on Hyperliquid must stake 1 million HYPE tokens. These Builders are responsible for key decisions: choosing the event topic, setting market parameters, providing initial liquidity, and promoting the market.

In return, Builders can receive up to 50% of the trading fees generated by their created markets. This model creates a powerful incentive alignment. It encourages entrepreneurial teams to identify high-demand events, effectively crowdsourcing market creation and distribution. Furthermore, the staking requirement ensures that Builders have skin in the game, promoting responsible market management and aligning their success with the protocol's health. This approach can rapidly scale the diversity of available markets without overextending the core development team.

Opportunities: Product Matrix and Ecosystem Growth

The successful implementation of Event Perpetuals presents immense opportunities for Hyperliquid. The most significant is the transition from a single-product protocol to a multi-product DeFi hub. A successful prediction market product can attract a different cohort of users who may then explore the protocol's perpetual futures offerings, creating a virtuous cycle of user acquisition and retention.

The Builder model itself can foster a vibrant sub-ecosystem. Teams specializing in market creation could emerge, competing to launch the most popular and well-designed Event Perpetuals. This not only drives innovation on the platform but also creates a new source of value accrual for the HYPE token, as demand for market creation slots could increase the token's utility and staking demand. Ultimately, this move positions Hyperliquid not just as an exchange, but as a foundational layer for on-chain financial derivatives.

Risks and Challenges

Despite the promising outlook, HIP-4 faces considerable risks. The foremost challenge is bootstrapping liquidity. While the Builder model incentivizes initial liquidity provision, each new market starts from zero. If sufficient trading volume fails to materialize across multiple events, the product could suffer from illiquidity and wide bid-ask spreads, rendering it unattractive.

Regulatory uncertainty looms large. Prediction markets, especially those based on real-world events like elections, have historically drawn scrutiny from financial regulators in various jurisdictions. The legal status of Event Perpetuals could be ambiguous, potentially creating hurdles for user participation or even threatening the product's existence in certain regions.

Finally, user adoption is not guaranteed. The concept, while simplified compared to traditional perps, may still have a learning curve for users accustomed to either standard prediction markets or perpetual futures. Convincing Hyperliquid's existing user base to engage with this new product type and attracting new users will require effective education and marketing.

Conclusion

HIP-4 and the proposed Event Perpetuals represent a calculated and strategic bet by Hyperliquid. It is far more than a simple product feature; it is a test of the protocol's capacity for innovation and ecosystem expansion. By cleverly adapting its perpetual futures infrastructure to a new use case and decentralizing the market creation process, Hyperliquid is positioning itself at the forefront of on-chain derivative innovation.

The success of this initiative will depend on the community's willingness to adopt the Builder role, the protocol's ability to navigate regulatory waters, and its capacity to bootstrap liquid markets. If these challenges can be overcome, Hyperliquid will have successfully laid the groundwork for a future where it serves as the foundational layer for a vast array of on-chain financial instruments, solidifying its position as a leader in the DeFi space.

References:

Rajiv, J., John, J., Marc, M., & Krane, K. (2025, September 17).

Interpretation of HIP-4 proposal: Is Hyperliquid going to create prediction markets? The new business strategy of DEX giants. Chaincatcher.

https://www.chaincatcher.com/en/article/2206312

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.