The blockchain landscape is witnessing a paradigm shift as major stablecoin issuers, led by industry titans, begin constructing their own dedicated blockchains. This move transcends mere technical upgrades, representing a strategic bid for sovereignty, economic control, and user primacy. With Tether announcing plans for its own chain and Circle’s CCTP interoperability protocol effectively creating a cross-chain standard for USDC, the question arises: as stablecoins—the lifeblood of DeFi—begin to build their own highways, does the foundational platform for most of them, Ethereum, risk being sidelined? This article explores the phenomenon of stablecoin chains, analyzes their design and incentives, assesses the threat to Ethereum, and identifies potential opportunities for everyday users in this evolving ecosystem.

What is a Stablecoin Chain?

A stablecoin chain is a blockchain network specifically designed and often operated by a stablecoin issuer to facilitate the native issuance and transaction of its stablecoin. Unlike general-purpose blockchains like Ethereum or Solana, which host a vast array of decentralized applications (dApps), the primary focus of a stablecoin chain is to optimize for the performance, cost-effectiveness, and sovereignty of its native stablecoin. The key distinction lies in the value capture model. On a general-purpose chain, the value of the native token (e.g., ETH, SOL) accrues from the collective activity of all applications built on top. On a stablecoin chain, the value primarily accrues to the stablecoin itself and its issuer, who controls the underlying infrastructure. These chains often prioritize features like high transaction throughput, low fees, and seamless integration with the issuer's other services, sometimes at the cost of decentralization or a broad dApp ecosystem in their initial phases.

Overview of the Stablecoin Public Chains

Currently, stablecoin public chains can be roughly categorized into three types based on their leaders and design objectives:

Chains Led by Top Issuers: Driven by the largest stablecoin issuers, aiming to control core infrastructure.

Chains Backed by Exchanges: Launched by exchanges with large user bases, focusing on payment and trading experiences.

Chains Built by DeFi-Native Projects: Initiated by well-known DeFi protocols, dedicated to serving their own stablecoins and financial ecosystems.

| Stablecoin Public Chain |

Issuing Institution |

Characteristic Positioning |

Gas Token |

Development Stage |

| Arc |

Circle |

Circle's self-built settlement layer, enabling USDC to have a controllable clearing network |

USDC |

Testing network to be launched soon |

| Tempo |

Stripe, Paradigm |

"Payment-first" public chain, supporting multi-stablecoins, aiming to support global payment flows |

Any stablecoin |

Testing network launched |

| Stable |

Bitfinex, Tether |

Home ground for USDT, focusing on daily payments and institutional clearing |

USDT |

Testing network launched |

| Plasma |

Tether |

Sidechain anchored to Bitcoin, featuring zero-fee transfers |

USDT, BTC |

Testing network launched |

| Converge |

Ethena, Securitize |

RWA + DeFi field, undertaking institutional capital on-chain |

USDe, USDtb |

Testing network not launched yet |

Arc @arc: Circle’s first self-owned public chain

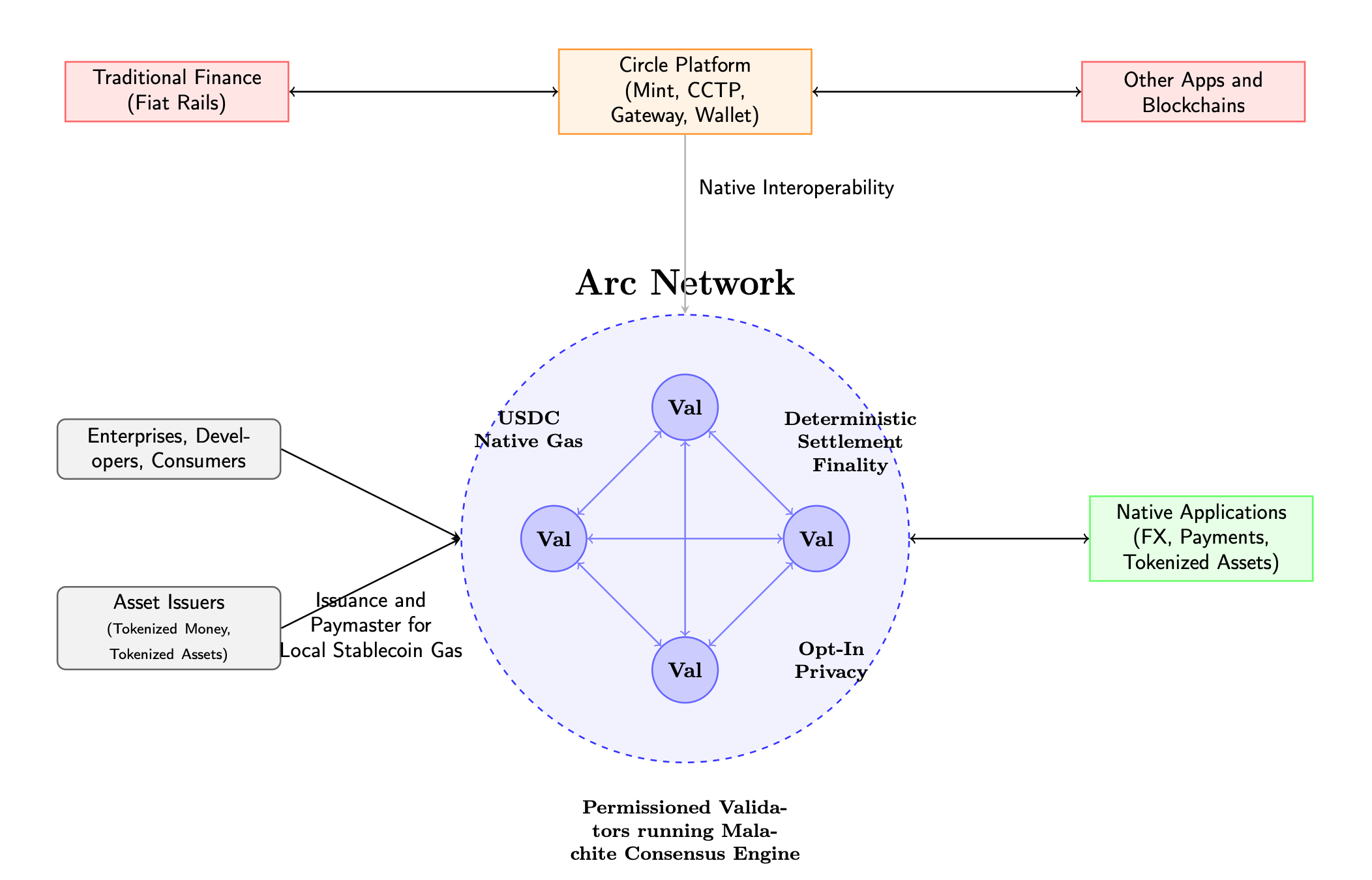

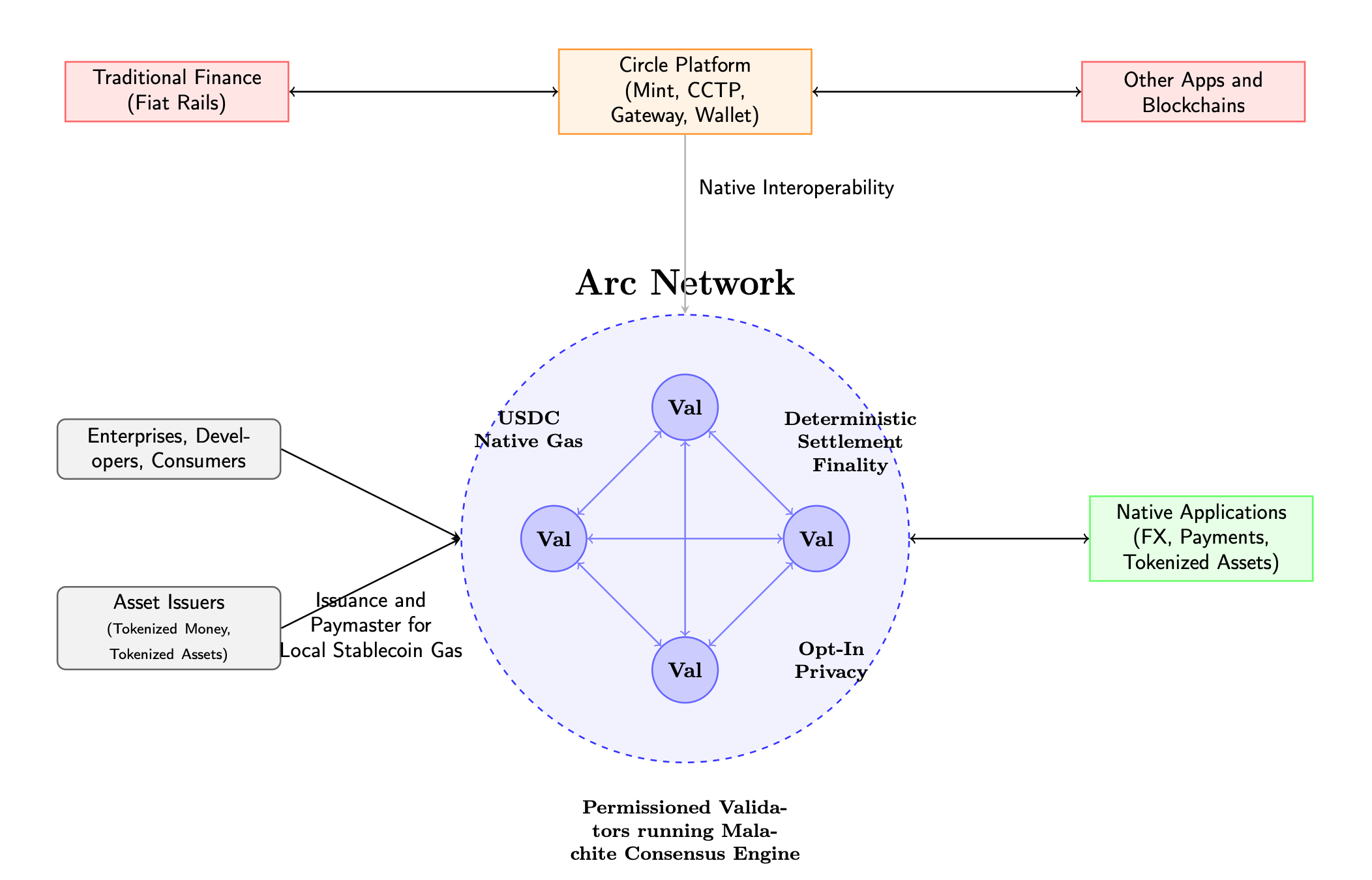

The architecture of Arc, highlighting its core components, native applications, and connectivity to the

broader financial ecosystem.

As the world's second-largest stablecoin issuer, Circle's launch of Arc is no surprise. While USDC has a massive market, its transaction fees are subject to volatility on Ethereum and other public blockchains. The emergence of Arc reflects Circle's ambition to build its own "settlement layer."

There are three core points in Arc's design:

USDC as Gas: transparent fees and no exchange rate risk.

Fast transactions and stable settlements: We promise to confirm transactions within 1 second, making it suitable for cross-border payments and large-value settlements.

Optional privacy function: Provides necessary accounting privacy for enterprises or institutions while ensuring compliance.

This means that Arc is not only Circle’s technological attempt, but also a key step for it to become a financial infrastructure provider.

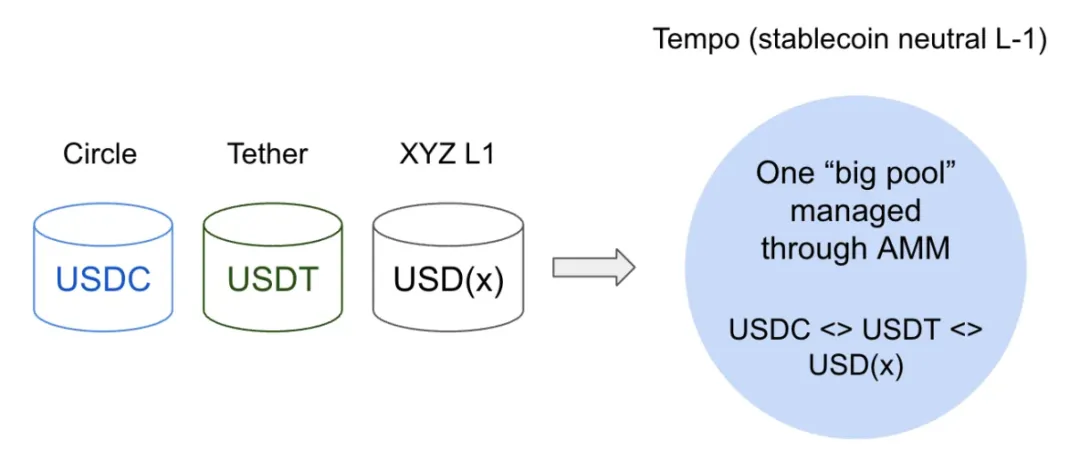

Tempo @tempo: A “payment-first” public chain

Tempo, co-incubated by Stripe and Paradigm, has a straightforward core strategy: as stablecoins go mainstream, a truly suitable payment infrastructure is needed. Traditional public blockchains struggle to support global settlement flows due to unstable fees, insufficient performance, or a too "crypto-native" experience. Tempo aims to fill this gap.

Therefore, Tempo has several distinctive features from its design:

Any stablecoin can be used as Gas: stablecoin swaps are achieved through the built-in AMM.

Low Fees & Predictable: Equipped with payment channels, notes, and whitelist functions, it is closer to the real payment system.

Extreme performance: Targeting 100,000 TPS, sub-second confirmation, suitable for scenarios such as payroll, remittances, and micropayments.

Compatible with EVM: Based on Reth architecture, the developer migration cost is low.

Its partners are also quite influential, including Visa, Deutsche Bank, Shopify, and OpenAI. This makes Tempo more like an open US dollar payment network than an appendage of a single stablecoin. If successfully implemented, it may even become the prototype of an "on-chain payroll system."

While Tempo prioritizes payments, its level of decentralization has sparked some discussion. Currently, Tempo's design focuses more on the attributes of a "consortium chain" rather than a "public chain," and its nodes are not fully open, resulting in a weaker level of decentralization.

Stable @stable: USDT’s home turf

Stable is a payment chain built specifically for USDT, supported by Bitfinex and USDT0. Its goal is to make USDT flow more smoothly in daily financial activities.

In terms of design, Stable does several things:

USDT native Gas: Transaction fees are paid directly with USDT, and point-to-point transfers are completely gas-free.

Confirmation in seconds: taking into account both small-value payments and large-value fund flows.

Enterprise-level features: including batch transfer aggregation and compliant privacy transfers.

Consumer experience: The supporting wallet connects to bank cards and merchants for payment.

Developer-friendly: compatible with EVM and provides a complete SDK

The keyword of Stable is implementation, and the focus is on how to make USDT more naturally integrated into daily scenarios such as cross-border remittances, merchant acquiring, and institutional clearing.

Plasma @PlasmaFDN: Bitcoin Sidechain

Unlike Stable, Plasma takes a different approach. As a Bitcoin sidechain, it relies on the security of BTC while focusing on stablecoin payments.

In terms of design, Plasma has the following main features:

Bitcoin native bridge: BTC enters the EVM environment without custody and directly participates in the stablecoin ecosystem.

USDT zero-fee transfer: The ability to complete USDT transfers for free is its biggest selling point.

Custom Gas Tokens: Developers can choose to pay with stablecoins or eco-coins.

Optional privacy function: suitable for salary payment and institutional liquidation.

Compatible with EVM: Based on Reth architecture, the developer migration cost is low.

In July, Plasma officially launched its public sale, with the token $XPL. Ultimately, the total subscription amount exceeded $373 million, with over 7 times oversubscription. This market enthusiasm has already given it a shot in the arm.

Converge @convergeonchain: The convergence point of RWA and DeFi

The previous chains are essentially still centered around “stablecoin clearing and payment.” Converge’s ambition is different: its goal is to bring RWA and DeFi onto the same chain.

In terms of design logic, Converge has three key points:

High performance: Block generation in 100 milliseconds, pushing performance to the limit in collaboration with Arbitrum and Celestia.

Stablecoin native Gas: USDe and USDtb are used as transaction fees.

Institutional-grade security: Backed by the ENA Network (CVN) for additional protection.

In short, Converge aims to solve the problem of "how to bring in large funds safely and efficiently." Its partners include familiar DeFi protocols such as Aave, Pendle, and Morpho, and it will also support the integration of RWA assets such as Securitize.

Design Paths: A Comparative Look at Key Projects

Different stablecoin projects are approaching this concept with varying philosophies, reflecting their unique positions in the market.

Tether’s Strategic Pivot: As the largest stablecoin issuer, Tether’s approach appears focused on consolidation and control. Announced plans for a Tether chain can be seen as a move to reduce reliance on third-party blockchains, capture the value currently paid as gas fees on other networks, and tightly integrate its suite of products like USDT, XAUT (gold-backed token), and its digital asset education initiatives. The chain will likely prioritize stability and regulatory compliance, potentially leveraging a Proof-of-Stake (PoS) consensus with carefully vetted validators. This path emphasizes creating a walled garden where Tether controls the entire user experience.

Circle’s Interoperability-Centric Vision: In contrast, Circle, the issuer of USDC, has taken a more open approach with its Cross-Chain Transfer Protocol (CCTP). Instead of building a single, sovereign chain, CCTP is a permissionless protocol that allows USDC to be burned on one chain and minted on another without relying on traditional bridges. This design effectively makes every chain supporting CCTP a "USDC chain." This strategy reinforces USDC's position as a neutral, multi-chain reserve currency and avoids direct competition with the platforms it operates on. Circle’s vision is not to replace chains like Ethereum but to create a standardized monetary layer that spans across them, capturing value through protocol fees.

Ethena’s Synthetic Dollar on Ethereum: It's crucial to note that not all projects are building independent chains. Ethena, which issues the USDe synthetic dollar, has doubled down on Ethereum as its foundational layer. Its recent integration with the Symbiotic restaking protocol allows USDe to be used as collateral to secure other applications in the ecosystem. This path leverages Ethereum’s deep security and network effects, positioning the stablecoin as a core component of the Ethereum monetary system rather than a competitor.

Does This Threaten Ethereum’s Dominance?

Most stablecoin transactions occur on Tron, Solana, Polygon, and L2 networks. Tempo’s entry could directly compete with these ecosystems.

Stablecoin transactions by blockchain. Source: Ignas on X

The emergence of stablecoin chains presents a nuanced challenge to Ethereum. On one hand, they pose a long-term existential threat by potentially fragmenting liquidity and activity. If major trading pairs and DeFi activity migrate to dedicated, low-fee stablecoin chains, Ethereum could see a reduction in its core transactional volume and gas fee revenue, which is critical for validator incentives and security.

However, Ethereum’s position is far from precarious. Its primary advantage is network effects and security. Ethereum boasts the largest developer community, the most valuable dApps, and the deepest liquidity pool beyond pure stablecoin trading. The security provided by its massive staked ETH is currently unrivaled by any new stablecoin chain. Furthermore, projects like Ethena demonstrate that the most innovative stablecoin designs can still choose to build

onEthereum, reinforcing its status as a settlement layer. The immediate threat may not be replacement but rather the gradual erosion of Ethereum’s monopoly as stablecoin chains and other Layer 2 solutions create a more multi-chain world where Ethereum is one hub among many.

Opportunities for the Average User

For everyday users, this competition breeds opportunity. The proliferation of stablecoin chains is likely to lead to fierce competition on user experience. Users can expect significantly lower transaction fees, faster settlement times, and potentially lucrative incentive programs as these chains compete for liquidity and users. Airdrops of new governance tokens to early users of these chains are a distinct possibility, mirroring the growth strategies of other networks.

Users may also benefit from new financial primitives. The tight integration between a stablecoin and its native chain could enable novel features that are difficult to implement on general-purpose chains, such as instant, fee-less transactions or sophisticated automated savings strategies directly within the wallet interface. The key for users will be to remain agile, carefully assess the security and decentralization trade-offs of these new chains, and diversify their activities to capture opportunities while managing risk across multiple ecosystems.

Conclusion

The trend of stablecoins building their own chains is not a winner-takes-all battle but a sign of the market's maturation towards specialization. Ethereum is unlikely to be dethroned in the near term due to its immense security and ecosystem depth. However, it will no longer be the only game in town. The future points towards a multi-chain landscape where sovereign stablecoin chains coexist with general-purpose L1s and L2s. In this environment, Ethereum’s success will depend less on being the sole platform for stablecoin transactions and more on maintaining its role as the most secure and trustworthy settlement layer for high-value transactions and innovative dApps. The competition, ultimately, will benefit users through better products, lower costs, and continuous innovation.

References:

Liao, G. Y., Mayer, R., Soghoian, A., Jain, S., & Tierney, E. (2025, August).

Arc: An open Layer-1 blockchain purpose-built for stablecoin finance [PDF file]. Circle.

https://6778953.fs1.hubspotusercontent-na1.net/hubfs/6778953/Arc%20Litepaper%20-%202025.pdf

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.