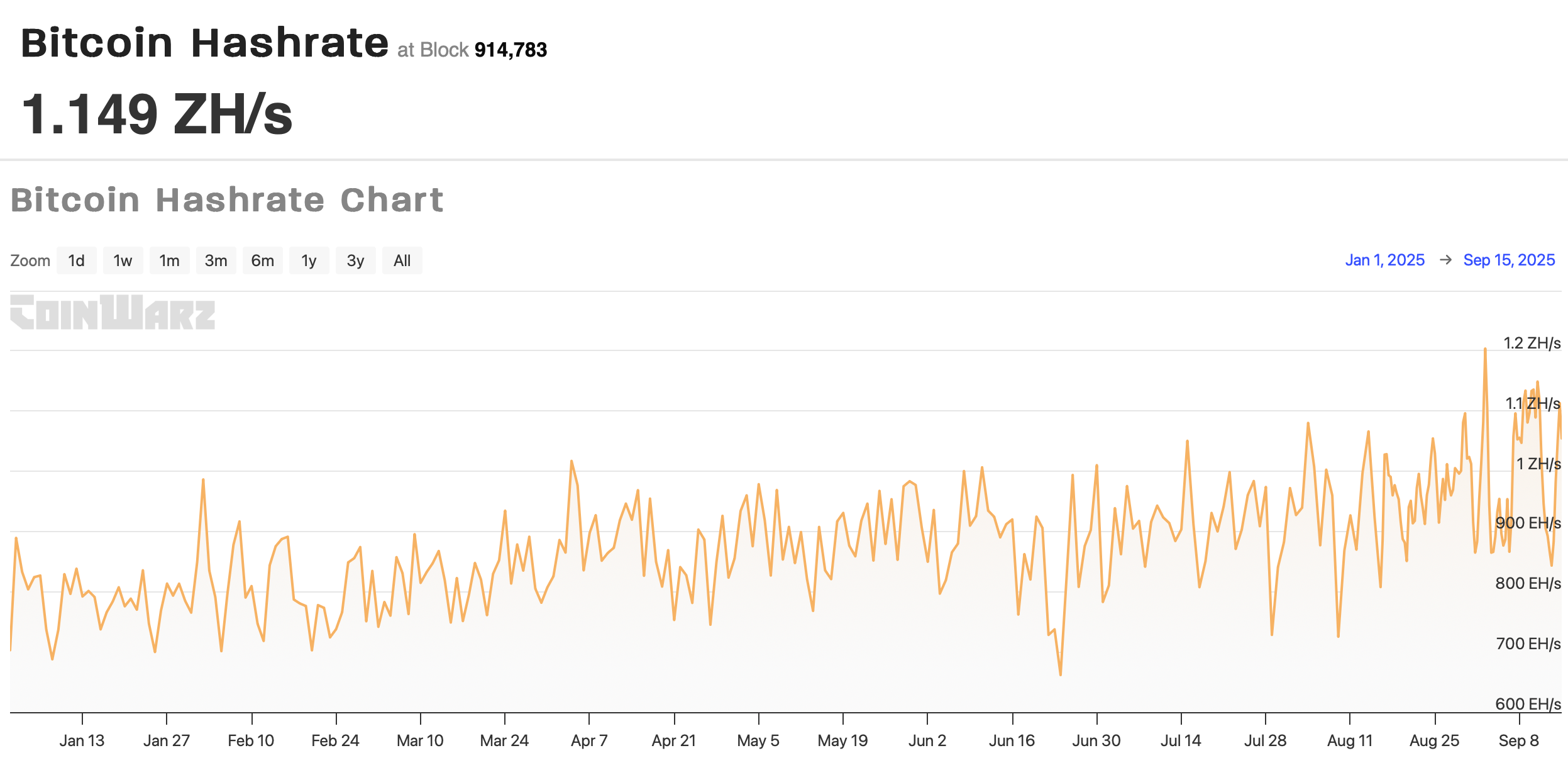

The computational power securing the Bitcoin network has recently reached unprecedented levels, pushing the hash rate to a staggering 1.057 zettahash per second (ZH/s) in September 2025. This milestone, equivalent to over 1.057 quintillion hashes per second, represents a monumental achievement in the history of the Bitcoin blockchain, reflecting both growing miner confidence and escalating network security.

For those new to cryptocurrency, hash rate simply refers to total computational power dedicated to mining and processing transactions on a proof-of-work blockchain like Bitcoin. It's a critical health indicator: a higher hash rate means more miners are competing to validate transactions, which translates to greater network security and resilience against attacks.

However, this record-breaking hash rate is a double-edged sword. While it strengthens the network, it also intensifies competition among miners, squeezing profit margins and pushing the industry toward further industrialization and specialization. This article explores the latest trends, data, and implications behind Bitcoin's soaring hash rate, offering a clear picture of its impact on the broader cryptocurrency ecosystem.

Bitcoin Hashrate of September 15. Source: Coinwarz

Understanding Hash Rate in Cryptocurrency Mining

Hash rate is a measure of the total computational power being used to mine and process transactions on a blockchain network that uses a Proof-of-Work (PoW) consensus mechanism, like Bitcoin.

How It Works?

-

Miners use specialized computer hardware to solve complex mathematical puzzles by making numerous guesses, or hashes, per second.

-

The hash rate indicates how many guesses a miner or the entire network can perform in one second.

-

A higher hash rate means that the network is more secure against attacks, such as a 51% attack, where a single entity attempts to control more than half of the network's computational power.

Measurement

Hash rate is measured in hashes per second (H/s), with larger units representing higher speeds, such as kilohash (kH/s), megahash (MH/s), gigahash (GH/s), terahash (TH/s), petahash (PH/s), exahash (EH/s), and zettahash (ZH/s).

Why It Matters?

Security: A higher hash rate enhances network security against potential attacks.

Mining Difficulty: Hash rate impacts mining difficulty; as it rises, difficulty increases to keep block production consistent.

Network Health: A high or growing hash rate indicates strong network participation and health.

Factors Affecting Hash Rate

Mining Hardware Efficiency: The quality of mining equipment influences hash rate.

Energy Costs: Electricity prices affect miners' operations and thus the overall hash rate.

Cryptocurrency Price: Higher prices can attract more miners, increasing the hash rate.

Mining Difficulty: The network's difficulty level impacts the computational power needed, affecting the hash rate.

The New Hash Rate Milestone

On September 12, 2025, Bitcoin's hash rate peaked at

1,057 exahash per second (EH/s), or

1.057 ZH/s, setting a new record. This continued a trend of relentless growth throughout the year. By September 14, 2025, the 7-day moving average for Bitcoin's hash rate had surged past

1.03 ZH/s, solidifying this new era of computational power.

This growth isn't isolated. The hash rate has been climbing steadily for years. To put this in perspective, back in 2017, Bitcoin's network hash rate was a mere

1 exahash per second—meaning the network is now

over 1,000 times more powerful than it was just eight years ago. This exponential growth is a testament to the increasing investment in specialized mining hardware and infrastructure worldwide, particularly in regions with favorable energy costs.

Mining Difficulty Adjusts to Hash Rate Growth

Bitcoin's protocol is designed to maintain a consistent block time of approximately

10 minutes. To achieve this, the network automatically adjusts its

mining difficulty every 2,016 blocks (roughly every two weeks) based on the current total hash rate.

With the hash rate consistently hitting new peaks, the mining difficulty has also soared to

record highs, reaching

136.04 trillion in early September 2025. This adjustment mechanism ensures that even as more miners join the network with more powerful machines, the rate of new Bitcoin creation remains stable and predictable.

Predictions for the next difficulty adjustment, expected around September 18, 2025, estimate an increase of

6.38%, which would push the difficulty even higher to

136.04T. This continuous climb in difficulty is a direct response to the relentless influx of new computational power, ensuring the network's integrity.

The Miner's Dilemma: Security vs. Profitability

Paradoxically, while a rising hash rate strengthens network security, it creates significant challenges for miners. The same competition that secures the network also makes it harder for individual miners to earn rewards.

Plummeting Hash Price: The "hash price" – which represents the expected daily earnings per unit of mining power (PH/s) – has been declining. It fell to approximately

$53.10 per PH/s per day in September 2025, an

8.39% drop from the previous month. This squeeze on revenue is compounded by rising energy costs in many parts of the world.

The Squeeze on Margins: As mining difficulty increases and the hash price falls, miners' profit margins are compressed. This is especially true for those with less efficient hardware or those operating in regions with high electricity costs. The situation is forcing many miners to adopt sophisticated energy management strategies, upgrade to more efficient ASIC models, or even shutter their operations.

Industrial Scale Dominance: The landscape is increasingly dominated by large-scale industrial mining operations. These corporations benefit from

economies of scale, securing cheap electricity contracts (as low as

$0.028 per kWh), accessing advanced cooling systems, and maintaining direct relationships with hardware manufacturers. This makes it exceedingly difficult for individual, solo miners to compete.

The (Almost) Impossible Dream of Solo Mining

For an individual miner, successfully mining a block alone in this environment is akin to

winning the lottery. The probability is astronomically low.

The Odds: A miner with a hash rate of

2.3 PH/s has only about a

1 in 2,800 chance of mining a block each day. Statistically, this means they could expect to find a block roughly

once every eight years.

The Jackpot: Despite the long odds, the allure remains because the reward is substantial. The current

block reward is

3.125 BTC, which, at recent prices, can be worth over

$370,000.

Occasional Success Stories: Miraculously, there are still success stories. In 2025, there were reports of solo miners with relatively small setups (some with as little as

480 GH/s) successfully mining blocks and claiming the full reward, proving that while unlikely, it is not entirely impossible. Many of these miners use "solo pools" that allow them to pool their efforts while still qualifying for the full block reward if they find it.

Hash Rate Centralization: A Growing Concern

As the hash rate grows, so does concern over its distribution. Mining power is not evenly spread across the globe but is concentrated among a few large mining pools.

Data from September 2025 indicates that the top five mining pools control a significant portion of the network's hash rate:

-

Foundry USA: ~28%

-

Antpool: ~16%

-

F2Pool: ~12%

-

ViaBTC: ~12%

-

SpiderPool: ~7%

Combined, these five pools account for approximately 75% of the total Bitcoin hash rate. This level of concentration raises questions about the

decentralized ideal of Bitcoin, as coordinated action among a few large entities could, in theory, potentially threaten network security.

The Macro View: Hash Rate and Bitcoin's Price

A high and rising hash rate is often interpreted as a

bullish signal for Bitcoin's long-term value. Miners are making a significant bet that future Bitcoin prices will justify their substantial investments in hardware and energy.

Furthermore, data shows that

miner reserves—the amount of Bitcoin held in miners' wallets—reached a

50-day high of 1.808 million BTC on September 9, 2025. This suggests that miners are

hoarding their coins rather than selling them, indicating a strong belief that prices will continue to appreciate. This behavior can reduce selling pressure on the market and contribute to a positive price outlook.

Conclusion

Bitcoin's hash rate hitting

1.057 ZH/s is a landmark event that underscores the network's incredible

security and resilience. It represents a multi-billion dollar investment in global infrastructure, creating a shield so strong that attacking the network is considered practically impossible.

However, this achievement comes with consequences. The mining industry is becoming increasingly

specialized and industrialized, pushing solo and small-scale miners to the brink of extinction. Profit margins are thinning, and the need for efficient hardware and cheap electricity is more critical than ever.

Looking ahead, the trajectory of the hash rate will remain a key indicator to watch. It reflects the health of the network, the confidence of its participants, and the evolving economics of Bitcoin mining. While challenges around profitability and centralization persist, the relentless growth of computational power continues to fortify the foundation of the world's first and most secure decentralized cryptocurrency.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.