Ethereum (ETH) has achieved a monumental milestone by surpassing its previous all-time high (ATH) of $4,878, set in November 2021, reaching

$4,953.73 in August 2025

. This breakthrough is not merely a price event but a structural shift driven by institutional adoption, regulatory clarity, and technological upgrades. Unlike the retail-driven frenzy of 2021, this rally is underpinned by

record ETF inflows, corporate treasury acquisitions, and macroeconomic tailwinds

. This article examines ETH’s price performance, catalytic drivers, regulatory developments, and future trajectory, providing a comprehensive analysis of its position as the foundational layer for digital finance.

Market Performance

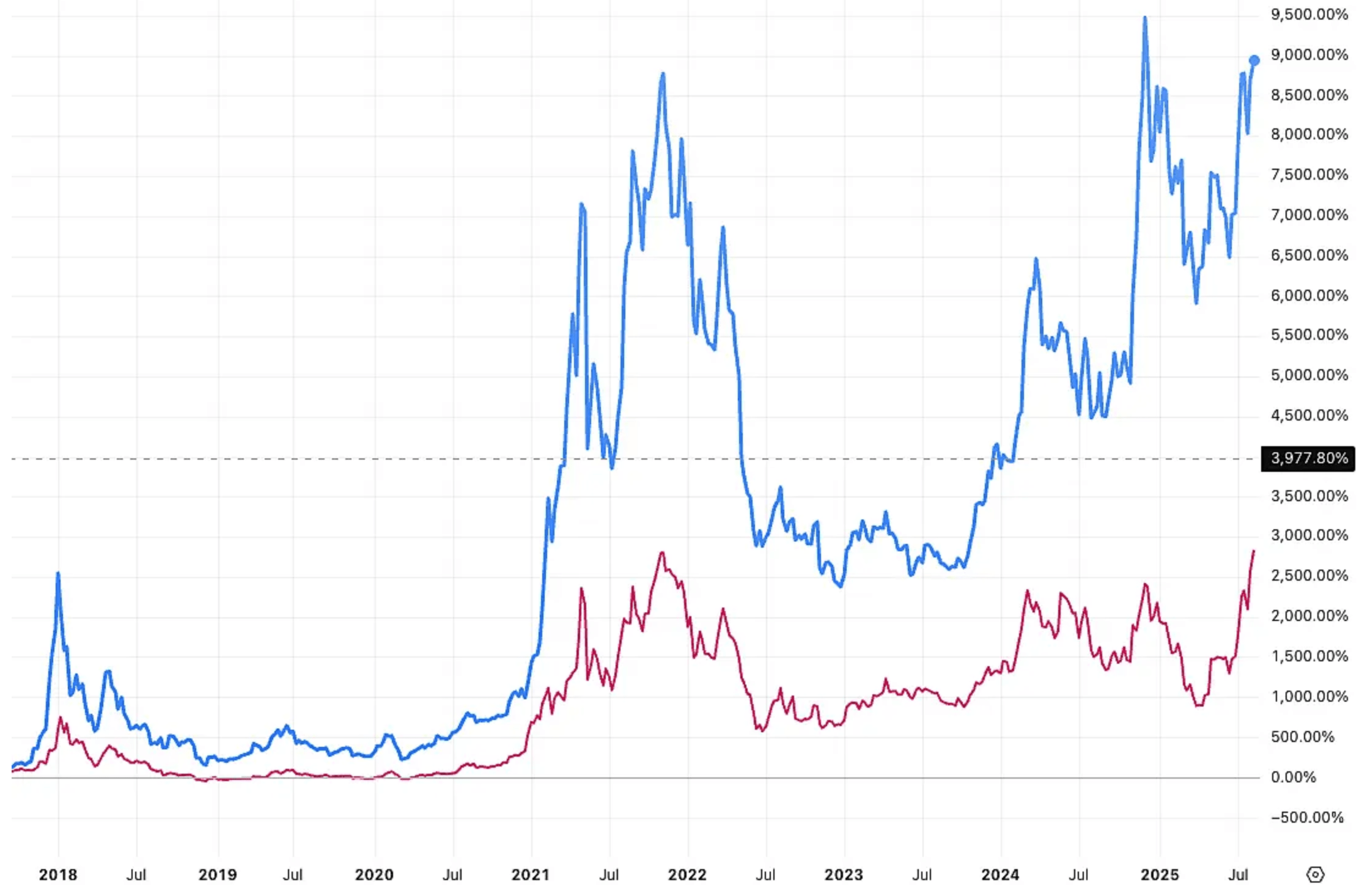

Ethereum (red) and total crypto market cap excl BTC and ETH (blue) percentage price performance. Source: TradingView

Ethereum’s price surged to

$4,953 on August 25, 2025, marking a 34% gain in 30 days and solidifying its status as the best-performing major asset of the year. The rally was accompanied by unprecedented trading volume, which spiked

147% to $81.18 billion following Fed Chair Powell’s dovish comments. Despite brief pullbacks to $4,770, ETH maintained strong support above $4,500, demonstrating resilience absent in previous cycles.

Critical on-chain metrics validate this momentum:

Exchange Balances: ETH held on exchanges plummeted to a

9-year low of 16.15 million, indicating long-term accumulation by whales and institutions.

Staking Yield: 29% of ETH’s supply is now staked, generating 4–6% annual yields and reducing liquid supply.

Liquidations: The rally triggered

$388 million in ETH liquidations within 24 hours, primarily from short positions, exacerbating upward momentum.

Catalysts for the Rally: Macro, Institutional, and Technological Forces

Macroeconomic Tailwinds

Federal Reserve Chair Jerome Powell’s signal of impending rate cuts at the Jackson Hole symposium ignited risk-on sentiment. With inflation easing and capital costs declining, investors flocked to yield-bearing assets like ETH. The Fed’s dovish pivot reduced the opportunity cost of holding non-interest-bearing cryptocurrencies, accelerating institutional allocation.

Whales & Institutional Adoption

Although Powell’s endorsement of this outcome doesn’t guarantee it, whales are already showing increasing interest in ETH. Lookonchain reports that a long-term Bitcoin (BTC) holder is now swapping BTC for ETH, which has proven to be a lucrative decision.

They’ve also highlighted that another whale opened a massive $90.1 million short BTC position while maintaining a $12.75 million long ETH position. Meanwhile, institutions continue to aggressively secure ETH. Trump’s World Liberty added another $5 million worth of ETH to its holdings, following SharpLinkGaming’s $667 million purchase last week.

Technological Upgrades

The Dencun upgrade (part of the Pectra hard fork) slashed gas fees by

53–70% and boosted Layer-2 transaction capacity. By reducing L2 costs to $0.08 per transaction, Ethereum achieved a throughput of 1,000–4,000 TPS, making it viable for high-frequency settlements and tokenized assets.

Regulatory Clarity

The

CLARITY Act of 2025 reclassified ETH as a digital commodity, eliminating securities-related uncertainties and enabling banks and ETFs to integrate staking. Simultaneously, the

GENIUS Act created a federal framework for stablecoins, 50% of which are issued on Ethereum. This legislation permits FDIC-insured banks to issue stablecoins on Ethereum, potentially unlocking

$12.5 trillion in retirement assets via 401(k) integrations.

The SEC’s “Project Crypto” initiative further clarified token classifications, while the approval of spot Ethereum ETFs in July 2024 provided a regulated entry point for institutions. These developments transformed ETH from a speculative asset into a compliant institutional-grade holding.

Price Predictions

With ETH setting new records as major buyers step in, technical analysts believe an altcoin season is imminent. He highlights the total altcoin market cap forming a double cup-and-handle pattern, the first occurrence since 2021. Coupled with a rising MACD that indicates increasing momentum, this setup suggests sustained growth potential for altcoins.

Expecting a breakout from this position, the analyst believes ETH’s move past $5,000 will mark the start of the altcoin season. ETH’s technical indicators show that the leading altcoin is well-positioned to jump past the $5,000 mark. Its long/short ratio stands at 1.7 despite the recent surge, meaning the overwhelming majority of traders anticipate further gains.

Examples of analysts revising that the ETH targets upward based on structural demand:

Standard Chartered: Raised its 2025 target to

$7,500 (from $4,000), citing institutional accumulation of 3.8% of circulating supply since June 20257.

Arthur Hayes (BitMEX): Projected

$20,000 by end-2025, driven by Trump-era monetary policies and ETH’s status as an “unloved” asset.

Tom Lee (Fundstrat): Compared ETH to Bitcoin’s 2017 cycle, targeting

$16,000 long-term.

These forecasts assume continued ETF inflows, stablecoin growth (projected to hit

$2 trillion by 2028), and Ethereum’s dominance in DeFi (65% TVL share) and tokenization.

Risks and Challenges

Despite bullish momentum, ETH faces headwinds:

Leverage-Induced Volatility: High derivatives open interest ($3 billion increase post-Powell) amplifies liquidation risks.

Macro Dependence: A shift in Fed rhetoric or delayed rate cuts could trigger broad risk-asset sell-offs.

Technational Competition: Solana, Sui, and Avalanche gained 10%+ during ETH’s rally, highlighting competitive pressures.

Historical data also suggests potential September corrections, with average losses of

6.42% in previous cycles. However, institutional participation may dampen this seasonality.

Future Outlook: Ethereum as Digital Finance Infrastructure

Ethereum’s trajectory extends beyond price speculation. It is evolving into the foundational layer for:

Tokenized Assets: Traditional assets like real estate and bonds are increasingly digitized on Ethereum, leveraging its security and programmability.

DeFi and Stablecoins: With $97 billion TVL and 50% stablecoin market share, Ethereum dominates decentralized finance.

AI and Autonomous Agents: Consensys founder Joe Lubin envisions Ethereum securing transactions between AI agents, enabling unprecedented coordination economies.

The network’s ability to balance scalability, security, and compliance positions it as the “operating system” for digital finance.

Conclusion

Ethereum’s record-breaking rally is a testament to its maturation from a speculative asset to a institutional-grade infrastructure. Unlike 2021, this rally is underpinned by macroeconomic tailwinds, regulatory clarity, and tangible utility in DeFi, tokenization, and staking. While short-term volatility persists, ETH’s fundamental value proposition—as a yield-bearing asset and global settlement layer—suggests sustained appreciation. Investors should monitor ETF flows, regulatory developments, and technological upgrades to navigate this new era of digital finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.