The world of cryptocurrency witnessed another seismic celebrity entry on August 21, 2025, when Kanye West (now known as Ye) launched his much-anticipated meme coin, YZY MONEY (YZY), on the Solana blockchain. This move marks a dramatic reversal for the rapper, who previously criticized celebrity-backed cryptocurrencies for "preying on fans with hype". The token’s launch triggered an 800% surge within minutes, catapulting its market capitalization to $3.2 billion before experiencing a precipitous collapse. This article explores the mechanics of YZY’s launch, market reactions, criticisms, and broader implications for the cryptocurrency industry.

The Launch of YZY: A "New Economy" Built on Chain?

Kanye West announced YZY as the foundational element of his YZY Money initiative, which he described as a "new economy, built on chain." The project comprises three integrated components:

-

YZY Token: The native currency designed to power transactions within the YZY ecosystem.

-

Ye Pay: A payment processor aiming to reduce transaction fees for merchants.

-

YZY Card: A debit card enabling global spending in both YZY and USDC.

The tokenomics reveal a total supply of 1 billion tokens with a highly controversial distribution model.

To combat sniper bots, West’s team deployed 25 contract addresses, randomly selecting one as the official token contract. Despite this anti-sniping mechanism, blockchain analysts immediately flagged critical issues.

Market Reaction: Volatility and Frenzied Speculation

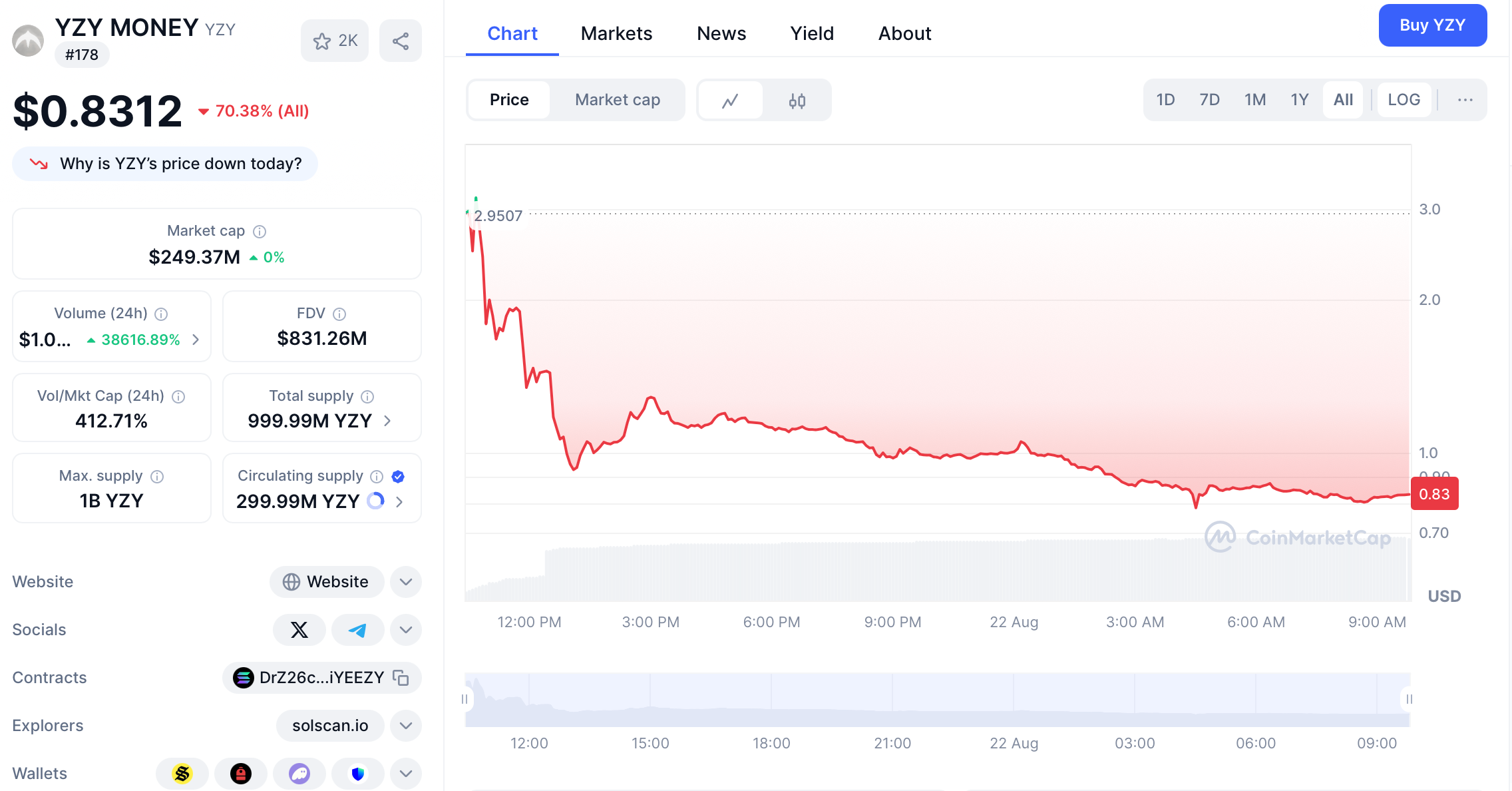

The token's market debut triggered a whirlwind of speculative activity that demonstrated both the immense power of celebrity influence and the inherent volatility of meme coins. Within the first 40 minutes of trading, YZY's price surged to $1.86, establishing a market capitalization exceeding $3.2 billion. This initial euphoria proved short-lived as the token experienced a dramatic 66% correction, falling to $0.91 within hours, with hourly volatility exceeding 30%. Trading volume exploded to $947 million within the first 24 hours, sufficient to secure listings on several secondary exchanges.

YZY Price Charts. Source: CoinMarketCap

High-profile traders and industry figures contributed to the trading frenzy. Arthur Hayes, co-founder of BitMEX, publicly disclosed his investment in YZY, citing its liquidity profile and short-term potential. Leverage trader James Wynn analogized YZY to Trump's meme coin, which had quadrupled in value over 28 hours, stating: "Aped $YZY on a 60% pullback. $TRUMP ran from $4bn to $15bn in 28 hours. 4x." However, as insider selling intensified following the initial surge, the market capitalization plummeted to approximately $1.3 billion, erasing billions in paper value and leaving many retail investors with significant losses

Criticisms and Concerns: Insider Dominance and Structural Risks

Despite West’s vision of decentralization, YZY faced scathing criticisms:

Insider Control: On-chain data revealed that 94% of the supply was held by insiders, with a single multisignature wallet initially controlling 87% of tokens15. Coinbase director Conor Grogan underscored this as a red flag for manipulation.

Liquidity Manipulation: The liquidity pool consisted only of YZY tokens—not USDC—allowing developers to unilaterally adjust liquidity and potentially execute pump-and-dump schemes.

Pre-launch Insider Trading: Blockchain analytics firm Lookonchain identified wallets that purchased YZY before the official launch, with one profiting $3.4 million by spending $24,000 in priority fees to front-run retail investors.

Regulatory and Ethical Risks: The token’s concentration and lack of technical roadmap drew comparisons to failed celebrity projects like Javier Milei’s LIBRA and Trump’s TRUMP token, both of which collapsed over 80% from their peaks.

Celebrity Tokens Controversy

YZY's launch exemplifies a broader trend of celebrity-backed cryptocurrencies that have repeatedly demonstrated sustainability issues despite initial enthusiasm. The political token sector provides instructive parallels, particularly Argentina's President Javier Milei's endorsement of LIBRA, which soared to a $4 billion market capitalization before collapsing after he deleted his promotional social media posts. Similarly, tokens associated with Donald Trump and Melania Trump experienced catastrophic declines of over 80% from their peak valuations.

These projects consistently exhibit recognizable patterns: extreme initial volatility, concentrated ownership structures, minimal functional utility, and ultimately significant retail investor losses. Kanye's entry into this space is particularly noteworthy given his 2023 rejection of a $2 million token promotion deal and his public warning that such projects fundamentally exploit fan trust. Industry analysts speculate that his dramatic reversal may stem from financial pressures following severed relationships with major brands including Adidas and Balenciaga, suggesting potential financial motivations overriding previous ethical objections.

Industry Response

The cryptocurrency community displayed characteristically divided reactions to YZY's launch. Supporters argued that West's unparalleled cultural influence and integrated product ecosystem (including Ye Pay and YZY Card) could potentially foster long-term utility beyond mere speculation. High-profile investors pointed to the initial trading volume and market capitalization as evidence of legitimate market interest rather than purely speculative gambling.

Skeptics offered substantially more critical assessments. CryptoQuant CEO Ki Young Ju compared YZY's structure to historical pump-and-dump schemes, urging investors to exercise extreme caution given the token's fundamental characteristics. Regulatory experts highlighted potential securities law violations given the token's centralized control and profit-seeking structure. In response to mounting criticism and volatility, West injected $34 million into the liquidity pool, establishing price bounds between $3.17 and $4.49 to stabilize trading. While this intervention temporarily reduced volatility, analysts noted that it failed to address the underlying centralization risks and structural vulnerabilities.

Conclusion

Kanye West’s YZY token embodies the dual nature of celebrity-backed cryptocurrencies: capacity to attract massive attention and liquidity, juxtaposed with profound risks of manipulation and instability. While the project’s vision of a decentralized financial ecosystem is ambitious, its execution—marked by insider dominance, opaque governance, and extreme volatility—underscores the need for greater transparency and regulatory oversight.

For now, YZY remains a speculative asset whose fate hinges on West’s ability to deliver tangible utility beyond hype. As the crypto market grapples with the influence of celebrity culture, YZY serves as a reminder that innovation must be grounded in fairness and technical rigor—not just star power.

References:

AInvest. (2025, August 21). Kanye West's YZY Token Surges 800% on Launch Amid Liquidity and Control Concerns. https://www.ainvest.com/news/kanye-west-yzy-token-surges-800-launch-liquidity-control-concerns-2508/

AInvest. (2025, August 21). Kanye West's YZY Crypto Surges 66% Then Crashes 54% in 24 Hours. https://www.ainvest.com/news/kanye-west-yzy-crypto-surges-66-crashes-54-24-hours-2508/

Invezz. (2025, August 21). Kanye West launches YZY token as insider trading allegations emerge. https://invezz.com/news/2025/08/21/kanye-west-launches-yzy-token-as-insider-trading-allegations-emerge/

FinanceFeeds. (2025, August 21). Kanye West’s YZY Meme Coin Soars to $3B, Crashes Amid Insider Concerns. https://financefeeds.com/kanye-wests-yzy-meme-coin-soars-to-3b-crashes-amid-insider-concerns/

Benzinga. (2025, August 21). Kanye West Launches Solana-Based 'YZY Money'—Token Surges Over 800% Despite Rapper's February Claim That 'Coins Prey On Fans With Hype'. https://www.benzinga.com/crypto/cryptocurrency/25/08/47250736/kanye-west-launches-solana-based-yzy-money-token-surges-over-800-despite-rappers-february-c

CoinTelegraph. (2025, August 21). Kanye West YZY memecoin hits $3B, but falls after insider concerns. https://cointelegraph.com/news/kanye-west-memecoin-pumps-3b-launch-then-falls-amid-insider-concerns?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.