The Fully Diluted Valuation (FDV) is a critical metric in cryptocurrency investment analysis, representing the theoretical total market value of a project if its maximum token supply were fully issued and circulating at the current market price. This metric contrasts with market capitalization (which uses only circulating supply) to reveal potential future dilution risks, inflationary pressures, and valuation sustainability. In 2025, FDV remains indispensable for evaluating projects with significant locked or reserved tokens—such as those backed by venture capital—where high FDV relative to market cap often signals imminent sell pressure during token unlocks, impacting price stability and long-term investor returns.

What is the Fully Diluted Market Cap?

The fully diluted market capitalization or fully diluted valuation is a term that refers to the total value of a cryptocurrency, assuming its entire token supply is in circulation. In traditional finance, the fully diluted market cap considers all possible dilutions that could arise from stock options, convertible bonds, warrants, and other sources of equity conversion.

The metric recognized that cryptocurrencies may have outstanding tokens that are yet to be released into circulation. These tokens are often held by development teams to be released according to a schedule announced at launch. Upon release of these coins, the token’s price could be affected adversely.

The fully diluted market cap thus assumes that all the coins have been released and FDV only reflects the maximum possible market value at the current price, not the future valuation. The actual market value of the token after unlocking depends on market supply and demand (such as selling pressure intensity, ecological demand growth). The fully diluted market cap does not present a final picture. Instead, the valuation of a coin is more dependent on changes in the total supply or inflation-combating mechanisms.

Example: Bitcoin’s Fully Diluted Market Cap

In 2025, Bitcoin’s fully diluted market capitalization (FDV) provides a practical example of this valuation metric. With Bitcoin’s limited maximum supply of 21 million coins and approximately 19.5 million coins currently in circulation, the FDV calculation demonstrates the theoretical total value if all coins were available today.

At Bitcoin’s current price of $119,098 (as of July-2025), the calculation works as follows:

-

Current Market Cap: 19.89 million BTC × $119,098 = $2.34 trillion

-

Fully Diluted Market Cap: 21 million BTC × $119,098 = $2.5 trillion

The difference between these two figures ($100 billion) represents the potential value of Bitcoin that has yet to be mined. This relatively small gap (approximately 6.4%) between market cap and FDV indicates Bitcoin’s mature tokenomics and minimal inflation pressure, making it a relatively stable store of value compared to many newer cryptocurrencies.

Bitcoin’s halving events, which occur approximately every four years with the most recent in 2024, have historically reduced new supply entering circulation, supporting the token’s price. This mechanism creates scarcity despite approaching the fully diluted supply, demonstrating why FDV is just one factor in cryptocurrency valuation.

Various platforms track Bitcoin’s FDV alongside other metrics to provide investors with comprehensive market data. The relatively small difference between Bitcoin’s market cap and FDV is considered a positive indicator by many analysts, suggesting the cryptocurrency has minimal inflation risk compared to projects where this gap is substantially larger.

For investors assessing Bitcoin’s long-term value proposition in 2025, the FDV metric helps contextualize Bitcoin’s actual scarcity compared to its theoretical maximum supply, supporting investment decisions with quantifiable data.

Before making any investment decision, whether in cryptocurrencies or stocks, you must

do your own research (DYOR). It is essential that you gather information on the value of the coin and the potential success it could attain. Compared to traditional finance, there are fewer metrics for measuring these factors in the cryptocurrency industry. One such metric is market capitalization or market cap. Market capitalization refers to the total value of a cryptocurrency over a time period. The market cap is achieved by multiplying the coin’s price by the number of coins in circulation. However, the market cap metric presents some limitations in estimating the future performance of an asset.

Another metric known as the fully diluted market cap (FVD) is often considered as a solution for this limitation. Instead of merely considering coins in circulation, the fully diluted market cap considers the cryptocurrency’s total supply. This article discusses the fundamentals of the metric, how to calculate a coin’s fully diluted market cap, and its importance to crypto investors.

How to Calculate the Fully Diluted Market Cap

To calculate the fully diluted market cap of a cryptocurrency, two factors must be considered. First, the maximum supply of the coin, and second, the current price of a coin. As such:

FDV= maximum supply of a coin x current token price

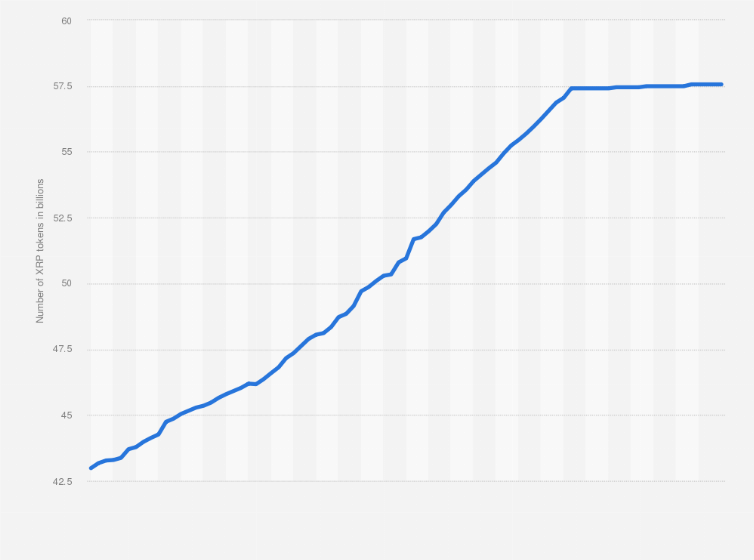

XRP has a circulating supply of 59,182,189,917 and a total supply of 100 billion.

In calculating the FDV of XRP, one would apply the formula above as follows:

100,000,000,000 x $3.21 = 321,000,000,000

XRP’s fully diluted market cap = $321,000,000,000

Market Cap vs. Fully Diluted Market Cap

As previously stated, the market capitalization is the more prevalent metric used to assess the popularity and success of an asset within the market. In the realm of cryptocurrencies, a substantial market cap signifies that a cryptocurrency exhibits a degree of stability amidst a generally volatile market. This indication of stability also suggests that numerous crypto investors are inclined to invest in the market.

To calculate the market cap of a cryptocurrency, one must multiply the current price of a single coin by the total number of coins in circulation.

Market cap = total No. of circulating coins x current token price

In practical terms, the price of a single ETH token is $3638.27, with a total of 120,711,164 ETH coins currently in circulation. Consequently, Ethereum’s market cap is approximately $4,372,149,676,646.

The primary distinction between the fully diluted market cap and the market cap lies in the different perspectives they provide. While the market cap offers an

estimate of the current valuation of a coin, the fully diluted market cap

gives insight into how the coin may be valued when all its coins are in circulation. Moreover, the fully diluted market cap does not consider the growth of a cryptocurrency; it merely serves as a factual representation of what a cryptocurrency’s value would appear to be once there is an increase in supply. An increase in supply triggers token inflation, which subsequently drives the price of the coin down.

Nevertheless, cryptocurrencies such as Bitcoin and Ethereum implement mechanisms to mitigate token inflation. Bitcoin employs a halving mechanism, whereas Ethereum utilizes a token burning mechanism.

What are the Implications of a Fully Diluted Market Cap?

Now that you are familiar with the concept of a fully diluted market cap, the subsequent step involves comprehending how this information is relevant and how to apply this metric in your investment decisions. The fully diluted market cap, by itself, only provides a rough approximation of a cryptocurrency’s future performance. However, when compared to the current market cap of the coin, factors such as inflationary tokenomics become apparent.

To begin with, a significant disparity between the market cap and the fully diluted market cap often indicates that

there will be considerable inflationary pressure on the coin's price as the supply expands. A substantial difference also suggests that the coin may currently be overvalued. An increase in supply is likely to depress the coin's price unless there is a strong demand for it. A notable example of a project that adopted inflationary pricing strategies and subsequently failed is the play-to-earn token

Try Hards (TRY). Despite having sold up to 36% of its total supply during the launch sale, the TRY price has plummeted by 99.74%, resulting in a negative ROI score that is nearly -100%.

What occurs when the fully diluted market cap and the market cap are nearly identical? A minimal difference between these two metrics typically indicates that the coin is fairly valued or only slightly undervalued. For example, if a cryptocurrency has a fully diluted market cap of $10 million and a market cap of $9.5 million, it is inferred that the coin is fairly valued. Ethereum serves as an example of such a coin. Although Ethereum has an unlimited supply, it mitigates token inflation through its token-burning mechanism. Essentially, as an increasing number of ETH tokens are utilized, balance is maintained by removing a portion of ETH tokens and transferring them to an unretrievable wallet, rendering them unusable.

Lastly, when there is a difference between the market cap and the fully diluted market cap, but the difference is minimal, it suggests that inflation would have little to no impact on the coin's price. This scenario also implies that the coin is undervalued, presenting opportunities for long-term growth.

Is the FDV a Reliable Metric for Crypto Valuation?

The fully diluted market cap is a significant metric for determining a cryptocurrency’s performance in the long term. It is a factor to consider when making long-term investment decisions. Comparing the market cap and fully diluted market cap can show you whether or not a cryptocurrency is a worthwhile investment.

However, it is important to note that the fully diluted market cap does not provide an accurate prediction of a coin’s performance. To make more informed decisions, you must consider the tokenomics of the coin. Factors to consider include:

-

The schedule for the release of the future coins;

-

The utility of the token;

-

Whether or not other factors like staking rewards impact circulation.

Further, a high fully diluted market cap is not the end-all, be-all of a cryptocurrency. In select cases, a cryptocurrency with a high FDV rating may continue to perform well, provided the coin remains in high demand. It might help to also analyze the price history of a coin and understand whether the project has introduced any mechanisms to combat inflation like Bitcoin and Ethereum. Finally, FDV is a useful metric but not a foolproof substitution for thorough research.

Conclusion

The FDV crypto metric can serve as a useful tool in assessing whether a cryptocurrency is overvalued. A high fully diluted valuation might indicate that the coin could face adverse effects from inflation in the future.

Nevertheless, it is essential to keep in mind that the fully diluted market cap is merely one factor to evaluate. Other significant elements, including pricing history, industry trends, and upcoming project developments, must also be taken into account when evaluating a cryptocurrency's potential worth.

Reference: