What is DYOR?

DYOR, short for ‘Do Your Own Research,’ serves as a vital reminder for those entering the world of cryptocurrency with real money. It stresses the importance of personally looking into things rather than blindly trusting information from random sources like Twitter, Facebook, or YouTube influencers.

Cryptocurrency markets can be tempting with promises of quick wealth, but many people enter without fully grasping the potential risks.

DYOR advocates for an examination of investment opportunities, studying market trends, analyzing financial statements, and considering potential risks before committing funds. This approach not only minimizes the risk of financial loss but also fosters a deeper understanding of how markets function.

Why is DYOR Important in Crypto?

Cryptocurrency technology and its markets can be volatile when compared to traditional finance options such as bonds, stocks, or cash bank deposits. Several factors can impact the value of a digital currency, including technological advancements, regulatory changes, and market sentiment.

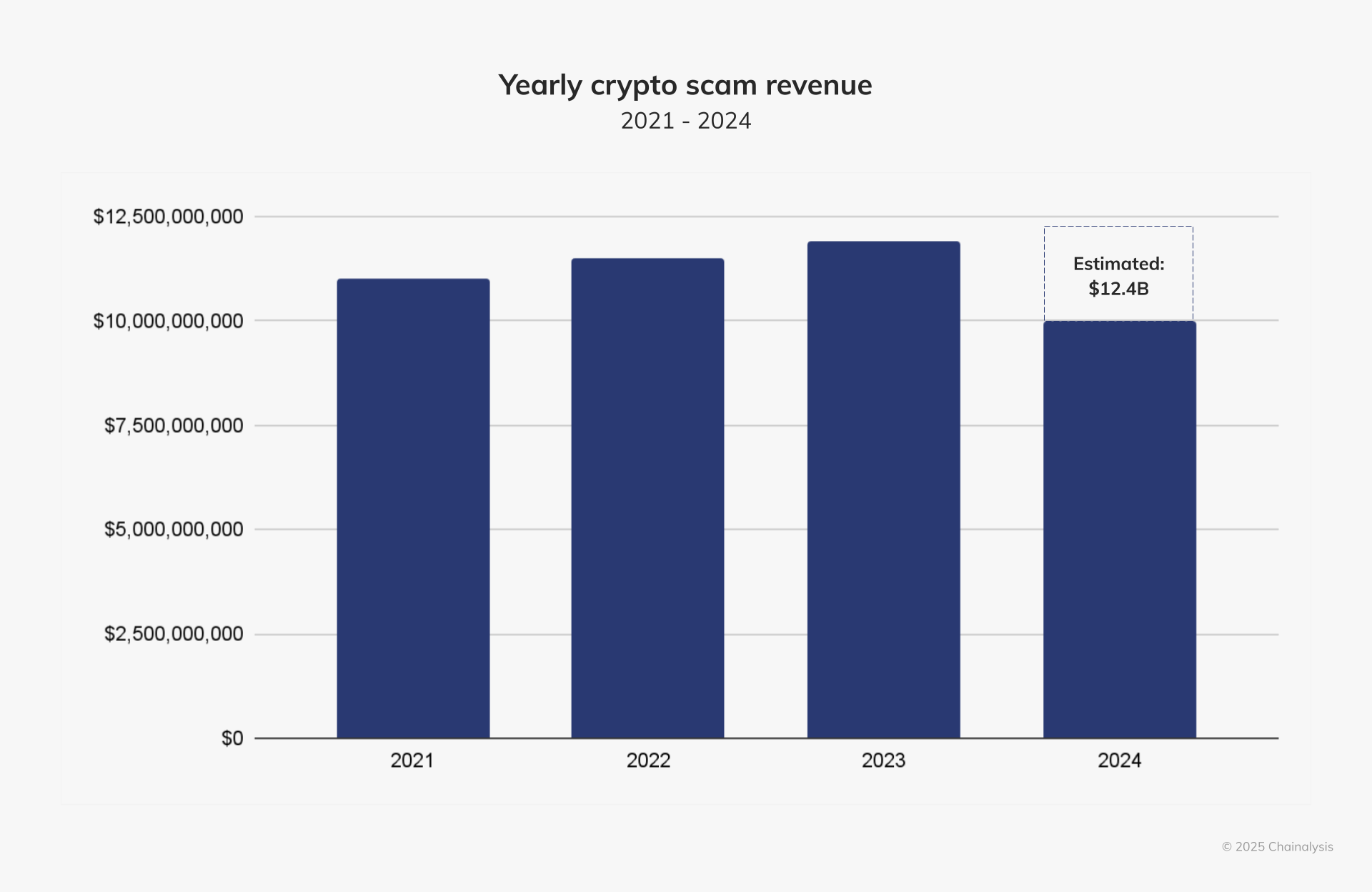

The crypto world offers excellent opportunities to earn money — if you play your cards right. However, crypto scams take advantage of this by promising quick riches. Of course, their promises are entirely fake, designed to draw people in.

Online criminals use hype and

fear of missing out (FOMO) to their advantage. They create a sense of urgency — a fleeting opportunity — and a now-or-never situation. Unaware of the danger, the newcomer to the industry gets drawn into the hype. They heard the stories of volatility and the importance of seizing the opportunity before it slips. They forget about caution, risk assessment, and making informed decisions. The scammer uses this information to their advantage as they proceed to rob them of their money. Before they even realize they were scammed, the scammer is long gone.

By embracing the DYOR ethos, you can understand an asset's potential for growth. You’ll start to identify any red flags, such as a lack of transparency, low liquidity, or weak security protocols, all of which can hurt your funds. And, you'll grow as a trader through the knowledge gained simply by reading about a market participant.

An added benefit of DYOR is increased confidence in your diversified portfolio. When you open positions with multiple crypto projects you believe in, you mitigate risk and spread potential losses across multiple assets.

Therefore, individual traders must use more advanced research tactics. It's essential to comprehend the effects of institutional involvement on market liquidity, volatility, and the long-term stability of different cryptocurrencies. This requires a more thorough examination of market behaviors, government regulations, and the technological strength of crypto projects.

Steps to DYOR in Cryptocurrency

Here are some DYOR steps to take before putting your money into any crypto project.

Imagine stumbling upon a project that caught your attention, whether through social media hype or a friend’s recommendation. The first step in your DYOR journey is to visit the project’s website. This initial exploration can reveal a lot about the project’s legitimacy. Spelling mistakes, bad grammar, or awkward formatting may signal red flags. The website also serves as a gateway to essential resources, with whitepaper being a key document.

The whitepaper is the heart of any cryptocurrency project. It acts as a comprehensive guide, explaining the technology, the project’s genesis, and its purpose. Reading the whitepaper is similar to receiving a pitch from the project team, outlining their goals and strategies. Pay close attention to the problem the project aims to solve and whether similar projects already exist. Evaluate if the new project offers improvements or innovations to existing solutions.

Not all cryptocurrencies have a practical purpose. It’s crucial to understand the utility of the project’s coin or token. The whitepaper should shed light on this aspect, detailing how the token fits into the project’s ecosystem.

Tokenomics, outlined in the whitepaper, provides critical information about the coin or token. Key metrics include information on the maximum supply, allocation, distribution, and vesting. While some details might be too technical for the average investor, focus on understanding the project’s goals, strategies, and the team behind it.

The people behind a project play a pivotal role in its success. Research the background of the team and developers. Platforms such as LinkedIn or a basic Google search can unveil their past experiences. Check if they have worked on successful projects before, or if the projects they were associated with have been abandoned.

A project’s associations and partnerships can indicate its credibility. Look for collaborations with reputable projects or well-established institutions. Verify these claims to ensure legitimacy.

Explore the project’s presence on various social media platforms like Twitter, Discord, Telegram, Reddit, and Medium. Analyze the engagement level, responsiveness of moderators, and what the community is saying. Be cautious of potential scams, especially on platforms like Telegram known for fraudulent activities.

Visit reputable cryptocurrency aggregators like Coinmarketcap, CoinGecko to assess market metrics. Analyze market capitalization, trading volume, and liquidity. Compare these metrics with more established competitors to gauge the project’s valuation.

Evaluate the liquidity of the coin or token and check if it’s locked. Locked liquidity instills confidence in investors that developers won’t run away with the funds. Exercise caution, particularly when engaging with liquidity pools on decentralized exchanges (DEXs).

Honeypot scams, where funds can’t be easily withdrawn, are a prevalent threat. Using tools like Honeypot.is to check if a token is susceptible to such scams.

Examine the total supply, circulating supply, and maximum supply of the coin or token. A clear understanding of these metrics contributes to informed investment decisions.

Verify if the token is listed on reputable exchanges with stringent listing requirements. Additionally, evaluate whether it is supported on popular hardware wallets, ensuring long-term safety and security.

Conclusion:

If you're new to the crypto space and trading, 'DYOR' may be the most important phrase to know as you get started in this volatile world. There's simply no substitute for careful due diligence and smart risk management as you navigate your first positions.

FAQs

What is DYOR in crypto?

DYOR is short for do your own research. It insists that traders research a project using reliable sources before committing to it. The term emerged following the ICO craze of 2016/2018 when countless scams appeared in the crypto sector.

Is DYOR a coin?

No, DYOR isn't a coin. It simply reminds traders not to trust everything in the crypto industry mindlessly. This is especially true if the offers they run into seem too good to be true.

What does DYOR mean in stocks?

Like in crypto, DYOR also exists in stock investing. It means the same — do your own research before putting money at risk.

What is the HODL slang term?

HODL is an acronym for 'hold on for dear life'. It's a term that suggests traders shouldn't sell their assets.

What does FOMO stand for?

FOMO is short for 'fear of missing out'. It's another acronym of the finance industry that describes traders' rush to buy. It suggests that traders feel compelled to rush into opening a position for fear of missing out on a great opportunity.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.