Wormhole (W) has recently garnered increased attention within the cryptocurrency industry, driven by a series of significant developments that underscore its expanding role in cross-chain interoperability. Recent integrations now enable Bitcoin Layer 2 assets such as sBTC and STX to transfer across different blockchains using Wormhole’s Native Token Transfers (NTT). Additionally, Algorand has adopted the same standard to enhance multichain liquidity. These developments have contributed to a surge in interest in the protocol and its native token.

With prior momentum from a major airdrop and a $225 million funding round, Wormhole is establishing itself as a vital component in the evolving multi-chain ecosystem.

This article provides an overview of Wormhole, explaining its functionality, exploring the drivers behind its growing popularity, and discussing potential future developments for the W token.

What Is Wormhole (W)?

W is the Wormhole platform’s governance token, which also serves as a protocol. The goal of $W, like all governance tokens, will be to empower token holders to steer and influence the protocol’s direction through on-chain governance via a dedicated decentralized autonomous organization (DAO).

Launched on April 3rd, the W token is set to be among the tokens launched with a market valuation of almost $3B, placing it among the top 60 cryptocurrencies according to CoinGecko’s ranking.

The token was introduced originally on the Solana blockchain. It will be natively issued on Ethereum and layer-2 networks later to help holders delegate W tokens on Solana or any of the compatible Ethereum-based chains in a process known as the “first-ever” multi-chain governance system.

How Wormhole (W) Works and Core Technical Advantages

Wormhole functions as a decentralized cross-chain messaging protocol that securely connects over 40 blockchain networks:

1. Core Bridge Contracts

Wormhole deploys immutable smart contracts, called Core Bridges, on every supported blockchain. These contracts detect and emit events when tokens are locked, data is sent, or contract calls are triggered.

2. Guardian Network

A decentralized group of 19 validators, known as Guardians, observes activity across all connected chains. When an event occurs, each Guardian independently signs a message validating that event.

3. Verifiable Action Approval (VAA)

Once a supermajority of Guardians (at least 13 out of 19) sign off, their signatures are aggregated into a cryptographic proof called a Verifiable Action Approval (VAA). This VAA confirms that the event is legitimate and ready to be executed on another chain.

4. Message Relay

Any network participant (usually a relayer) can submit the VAA to the target chain’s Wormhole contract. The contract verifies the signatures and triggers the corresponding action, such as minting an asset, updating contract logic, or transferring tokens.

5. Advanced Modules

On top of this messaging layer, Wormhole supports a range of modular services:

Token Bridge: For transferring assets between chains using lock-and-mint or burn-and-mint mechanisms.

Native Token Transfers (NTT): For issuing native tokens across multiple chains with a unified supply.

Wormhole Queries: For fetching on-chain data across blockchains.

Multichain Governance: For enabling protocol-wide governance decisions across supported ecosystems.

Wormhole’s architecture enables developers to build truly interoperable applications, bypassing the limitations of single-chain systems and unlocking real-time cross-chain functionality across DeFi, gaming, NFTs, and beyond.

Table: Wormhole’s Security Stack vs. Traditional Bridges

| Feature |

Wormhole NTT |

Standard Token Bridges |

| Security Model |

13/19 Guardian signatures |

Centralized validators |

| Transfer Mechanism |

Burn/mint |

Lock-and-mint |

| Fee Structure |

No liquidity pools |

Slippage + LP fees |

| Upgrade Control |

Developer-owned contracts |

Protocol governance |

Wormhole (W) Latest News & Updates: Multichain Expansion Accelerates in 2025

Wormhole has made major strides in 2025, reinforcing its role as a leading cross-chain protocol. Several key developments have drawn attention from both retail and institutional players:

Stacks Integration: Bitcoin Layer 2 network

Stacks now uses Wormhole’s Native Token Transfers (NTT) to move its sBTC and STX tokens across supported chains like Solana and Sui. This unlocks native Bitcoin-backed liquidity in broader DeFi ecosystems without wrapped assets.

Algorand Adopts NTT: Algorand has integrated Wormhole’s NTT through a partnership with Folks Finance. This move allows Algorand-based assets to be issued and transferred natively across 40+ networks, boosting interoperability and multichain liquidity.

Ripple Partnership: In June 2025, Wormhole partnered with Ripple Labs to bring asset and message bridging to the XRP Ledger and its EVM-compatible sidechain. This expands Wormhole’s reach into institutional-grade blockchain infrastructure.

Product and Network Growth: Wormhole upgraded its Portal app for faster, user-friendly bridging. Meanwhile, its Guardian validator set now includes names like Google Cloud and AMD. The protocol has processed over 1 billion cross-chain messages and over $60 billion in lifetime volume.

These milestones signal growing adoption of Wormhole’s multichain tech and increased demand for secure, native token interoperability.

Wormhole (W) Market Sentiment & On-Chain Trends in 2025

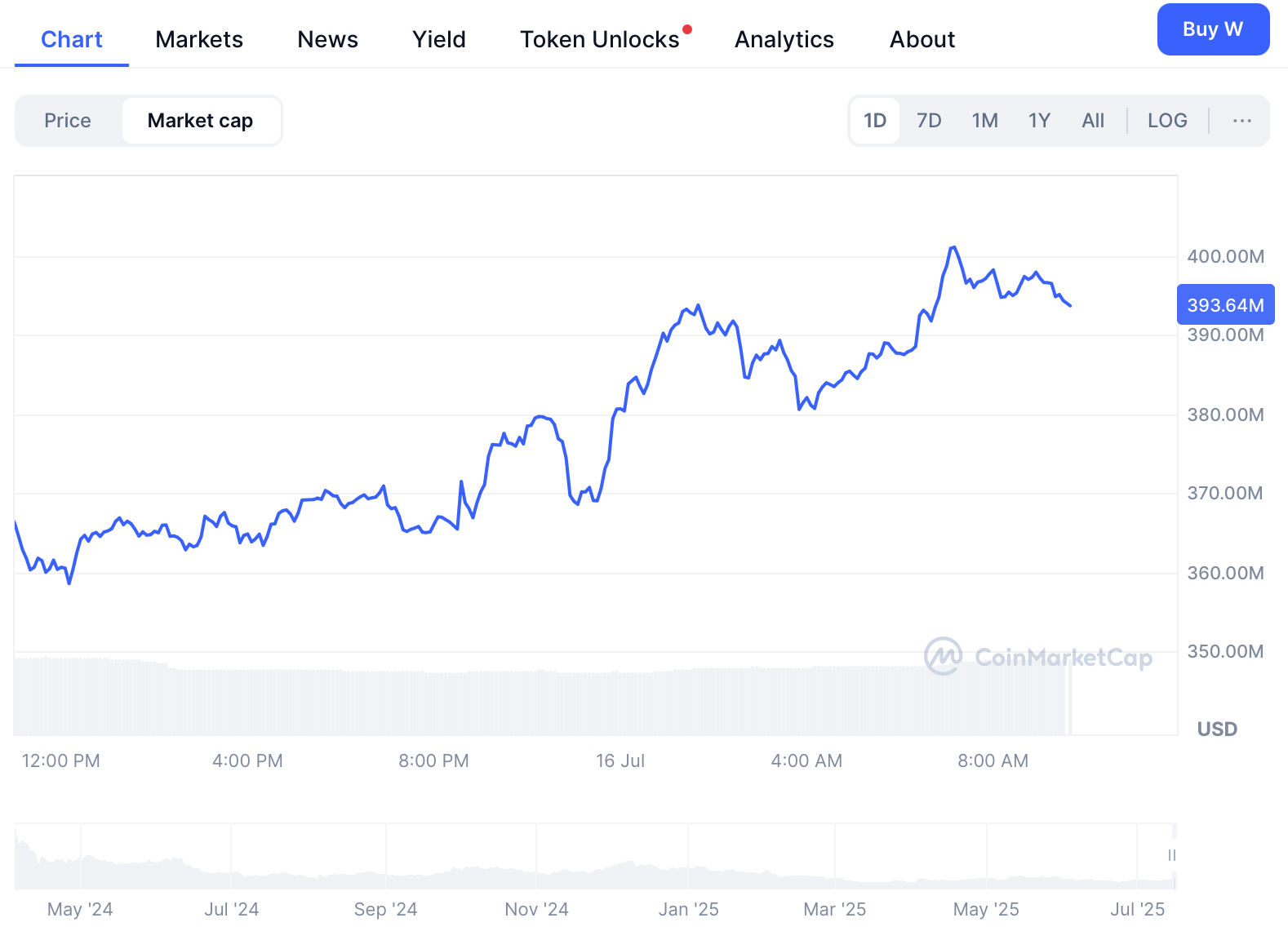

Wormhole (W) Market Cap

Source: CoinMarketCap

Wormhole (W) has seen a noticeable uptick in activity following its recent integration. Key data reflects rising engagement but also cautious sentiment among holders:

Trading Volume: Daily volume has increased to $85–86 million, indicating stronger short-term demand and higher market participation.

Market Cap & Supply: W’s market cap stands around $340–350 million, with a circulating supply of 4.65 billion tokens. The fully diluted valuation (FDV) is approximately $730 million.

Bridge TVL & Usage: Wormhole’s total value locked in bridged assets is between $2.5–2.8 billion. Daily bridge volumes hover at $30–35 million, with the network processing over 1 billion cross-chain messages to date.

Holder Distribution: Roughly 92% of addresses are holding at a loss, and 88–89% of circulating supply is concentrated in large wallets, indicating heavy whale influence and potential price sensitivity.

Institutional Adoption: Major names like Circle and Uniswap use Wormhole’s infrastructure. The Guardian set now includes Google Cloud and AMD, strengthening its institutional profile.

Despite strong protocol usage, the W token’s market sentiment remains mixed due to underwater holders and high concentration. Still, its growing utility and ecosystem traction signal long-term potential.

Price Analysis & Market Outlook

As of July 2025, W trades at $1.98, up 13.55% in 24 hours but down 80.53% from its all-time high of $52.277. Technical and fundamental factors suggest cautious optimism:

-

Technical Patterns: A double-bottom formation near $0.05 could trigger a 200% rally to $0.20 if the $0.117 neckline breaks. The 4-hour MACD shows bullish momentum, though RSI nears overbought territory17.

-

Divergent Price Predictions:

| Source |

2025 Forecast |

2030 Outlook |

ROI Potential |

| CoinDataFlow |

$8.48 |

$37.45 |

4.14 |

| Gate.io |

$1.98 (avg) |

$9.30 |

3.69 |

| Technical Targets |

$0.20 (ST) |

— |

2 |

Short-term trader projections (e.g., +383% by June 2025) clash with conservative exchange forecasts, reflecting W’s high-risk profile

Wormhole (W) Price Prediction in 2025: What’s Next After the Latest Rally?

Wormhole (W) Price

Source: CoinMarketCap

After a quiet period in Q2, Wormhole’s native token W is showing renewed momentum, thanks to a wave of ecosystem integrations and growing cross-chain utility. As the token regains attention, investors are asking: where could W go next?

1. Short-Term Price Action

W is currently trading between $0.07 and $0.08, showing signs of a recovery following bullish July news. If the token breaks above $0.09, it may target the next resistance at $0.12. However, downside support remains near $0.06, making short-term movement largely dependent on ecosystem engagement and broader market sentiment.

2. Mid-Term Outlook (Q3–Q4 2025)

With Native Token Transfers (NTT) now living on chains like Stacks and Algorand, and institutional backing growing, analysts are watching for a sustained trend shift. If adoption continues and more chains activate native W support, W could trade in the $0.15 to $0.20 range by late 2025, especially if DeFi usage picks up.

3. Long-Term Potential

Longer-term forecasts remain cautiously optimistic. Should Wormhole succeed in establishing W as a governance and staking asset across multiple chains, and if the crypto market enters a broader bullish phase, W could eventually retest its April 2024 all-time high of $1.61. Still, this scenario hinges on value capture mechanisms becoming clearer and widely adopted.

While risks remain, particularly due to high whale concentration and a majority of holders still in loss territory, the foundation for long-term value appears stronger than ever. If Wormhole continues building across chains while improving token economics, W may have a solid path to recovery and growth in the months ahead.

Conclusion

Wormhole’s trajectory hinges on near-term catalysts: Coinbase listing momentum, Ripple-powered transaction growth, and DAO-led governance activation. While a rally to $5 by 2025 (+5,500%) seems improbable1, strategic entries at support levels ($0.05–$0.06) offer asymmetric upside.

For investors, W represents a bet on blockchain interoperability’s inevitability—a narrative gaining steam as institutions like Ripple prioritize cross-chain functionality. Yet, rigorous risk management is essential given its volatility and macro sensitivity. As multichain apps become the norm, Wormhole’s technical edge and expanding ecosystem could solidify its role as Web3’s connective tissue.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.