In December 2025, Pi Network will stand at an unprecedented critical juncture in its development. This mobile cryptocurrency project with a massive user base is about to undergo an unprecedented "stress test"—releasing over 190 million Pi tokens. This event is not only a test of its market price resilience but also a comprehensive examination of its long-established technological vision, community belief, and token economic model. In the current cryptocurrency market, which increasingly values fundamentals and sustainability, Pi Network's unlocking acts as a lens, magnifying its achievements and concerns within the narrative of "mass adoption." This article will start from its technological core, analyze long-standing controversies, combine the latest market data and professional analysis tools to deeply interpret the impact of this supply shock, and forecast its future price trajectory and ecosystem development path.

Pi Network: Technical Architecture and Long-Term Vision

Pi Network's core vision is to build a cryptocurrency network that is accessible and widely participatory for ordinary people. Unlike Bitcoin and other cryptocurrencies that use a Proof-of-Work (PoW) mining model, Pi innovatively introduces the concept of "mobile mining," allowing users to mine cryptocurrency via a mobile app with low energy consumption through "click mining," serving as an initial method for maintaining network security and distributing tokens. This low-barrier-to-entry design is key to its rapid accumulation of tens of millions of "pioneers" (users) worldwide.

The project's technology roadmap points to a multi-phase ambitious goal: transitioning from the current centralized, enclosed

mainnet phase to a fully decentralized, open mainnet . During the enclosed mainnet phase, Pi coins mined by users cannot be freely traded on external exchanges; value transfer is primarily limited to within the ecosystem. The project team claims this is to allow ample time to build robust tools, application scenarios, and compliance frameworks before full openness.

Pi Network has recently been making frequent moves in its technological infrastructure. In addition to continuously upgrading its mainnet (such as the Protocol 23 test, aimed at making the network faster and more reliable), the project team has also invested heavily in improving identity verification efficiency. In December 2025, it introduced an AI-driven KYC (Know Your Customer) process upgrade, aiming to resolve the backlog of identity verification issues for millions of users and clear compliance obstacles for the full opening of the mainnet in the future. Simultaneously, Pi Network is actively seeking alignment with global regulatory frameworks such as the EU's Crypto Asset Markets Regulation (MiCA) and exploring obtaining ISO certification to enhance its institutional credibility.

To expand the token's utility, Pi Network is actively building its ecosystem. In November 2025, it announced a partnership with game developer CiDi Games, under which the PI token will be integrated as the primary payment, transaction, and incentive currency within CiDi's games. A new open framework to expand Pi Network is planned for testing in early 2026. Furthermore, the project has invested in OpenMind, a company specializing in artificial intelligence, to explore the potential applications of node computing power in AI, attempting to position Pi as an "AI token."

Long-standing Controversies and Core Challenges

Despite its ambitious vision, Pi Network has been surrounded by controversy since its inception, primarily concerning its transparency, centralization, and value realization.

The most fundamental controversy lies in its

value anchoring . Before the launch of the open mainnet, users' Pi holdings lacked a clear price determined by free market supply and demand. Currently, the so-called "Pi futures" or IOU (IOU) products traded on some centralized exchanges (CEXs) exhibit volatile prices and are not officially recognized by the project, raising questions about their legitimacy. This has resulted in a long-term ambiguity regarding Pi's valuation, making community confidence highly susceptible to news-driven fluctuations.

Secondly, the project's

high degree of centralization and control issues have been heavily criticized. From token distribution and KYC verification to decision-making power regarding the mainnet migration, everything is entirely in the hands of the core team. While the AI-driven KYC upgrade has improved efficiency, it has also raised concerns about compromises to user data privacy and the spirit of decentralization. The long closed mainnet period (which has lasted for several years) and delays in key milestones (such as validator rewards) (reportedly possibly postponed to the first quarter of 2026) are constantly eroding the patience and trust of early users.

Finally, there are concerns about the sustainability

of the token economic model and supply inflation . Pi's mining mechanism generated a massive amount of tokens in its early stages. Although the project team controls circulation through a locking mechanism, regular, large-scale unlocking events (such as the December unlock) create continuous supply-side pressure. If the growth of practical needs within the ecosystem (such as payments, in-game purchases, and staking) cannot keep pace with the rate of supply release, the token will face long-term devaluation pressure.

Current Market Conditions and Signs of Pressure

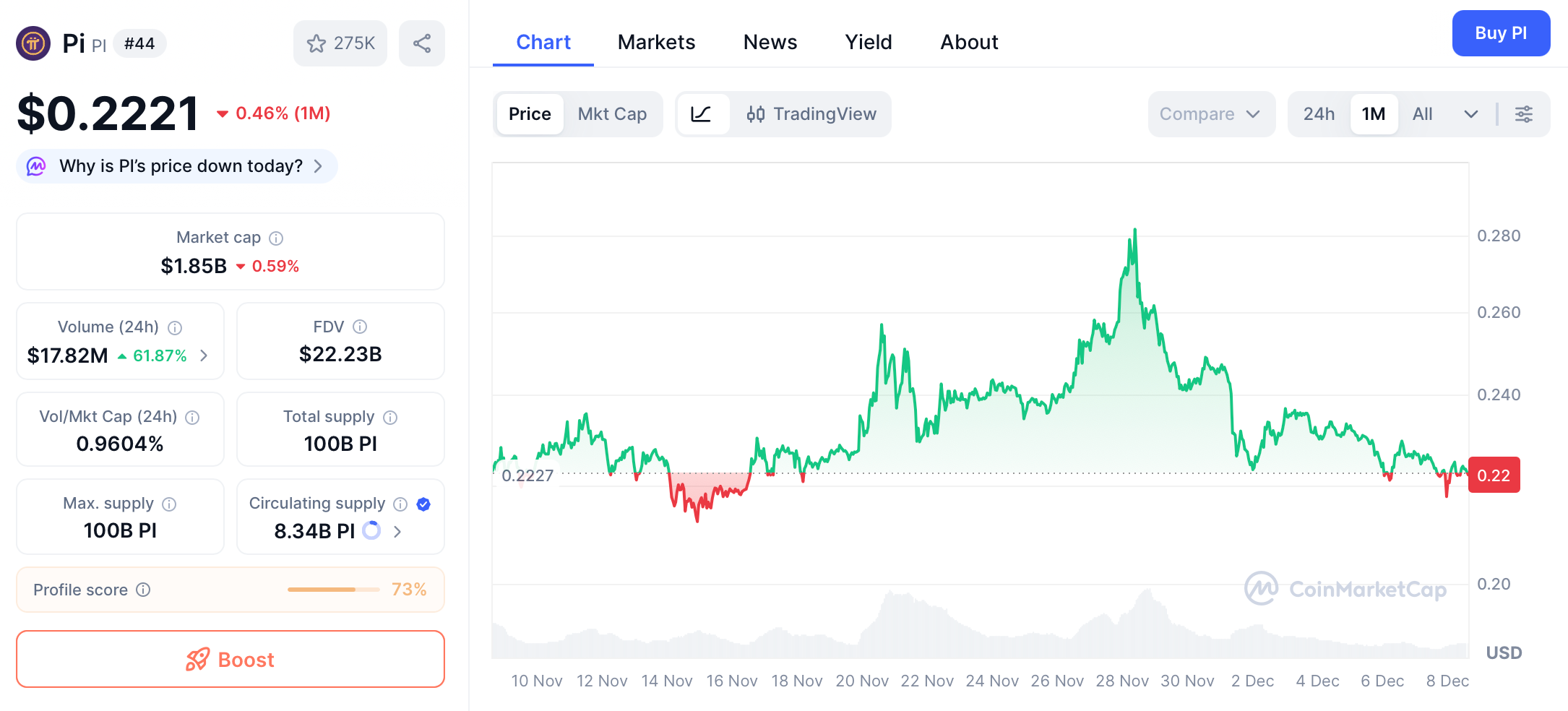

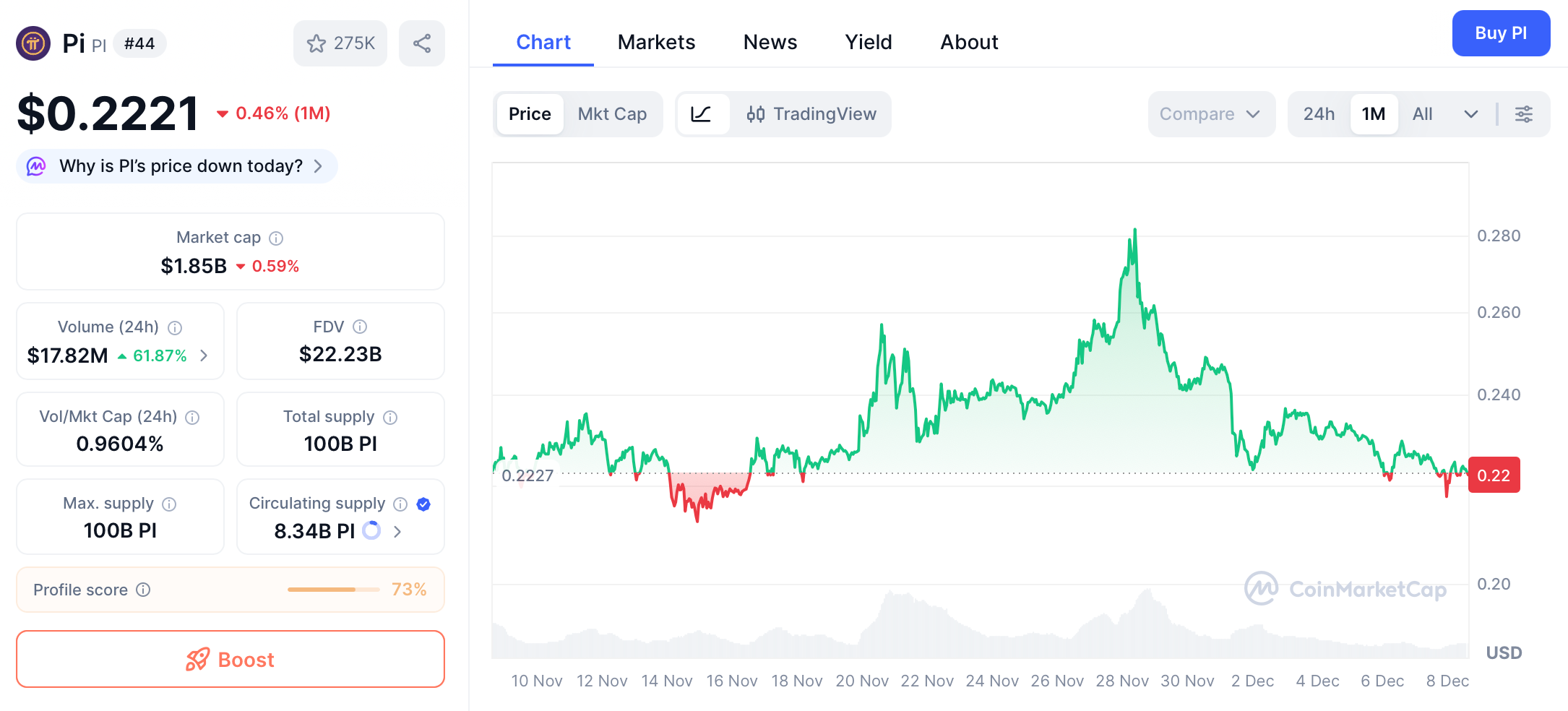

In late November 2025, PI's price on some exchanges' IOU trading pairs exhibited a fragile balance. A brief surge was briefly triggered by positive news regarding the CiDi Games partnership, but the gains quickly faded. By the end of November, PI's price was fluctuating narrowly between $0.22 and $0.23, forming a gradually converging "symmetrical triangle" pattern on the technical chart, which typically foreshadows a significant directional breakout.

However, multiple on-chain and market indicators have issued clear bearish warning signals:

-

Exchange inflows surge : Ahead of the December unlock, Pi wallet balances on centralized exchanges (CEXs) saw a significant increase. For example, in one 24-hour period at the end of November, net inflows reached 1.71 million PI, indicating that holders were rushing to transfer their tokens to exchanges in preparation for a potential sell-off. Data shows that the total amount of PI held on CEXs has reached approximately 430 million.

-

Technical indicators are weakening : Despite attempts to rebound, the Relative Strength Index (RSI) has fallen back from overbought territory, indicating waning buying momentum. Multiple unsuccessful attempts to break through key moving averages (such as the 100-day EMA) suggest significant upward resistance.

In-depth Focus: Supply Shock Analysis of December Token Unlocking

This December unlocking event is the core source of recent market anxiety. Multiple sources confirm that the planned release of tokens is between 186 million and 190 million, worth over $46 million at current prices. This is not just a single large-scale "cliff-like unlock," but the climax of an ongoing process—data shows that an average of approximately 4.85 million PI tokens are being unlocked daily.

To understand its impact, it must be examined within the broader context of the "token unlocking" market. Analysis from research firm Messari indicates that when an unlocking event increases the circulating supply by more than 5%, it typically has a significant negative impact on token prices. In the seven days surrounding an unlocking event, related tokens generally perform poorly. For Pi Network, this unlock represents an extremely high proportion of the CEX's tradable supply (some analyses suggest as high as 43%), posing a direct threat to the current fragile market balance.

More importantly, this unlocking is not the end. Analysis indicates that a total of up to 1.4 billion PI tokens are expected to enter circulation within the next year, meaning supply pressure will persist in the medium to long term. Faced with this situation, savvy market participants are beginning to use more advanced tools for assessment. For example, CoinGecko recently launched the "Outstanding Token Value" metric, designed to assess token value based on current and near-term available supply, which is particularly crucial for projects like PI facing massive future unlocks. This metric helps traders shed the long-term dilution effect and focus on the true supply and demand relationship in the short to medium term.

Future Price Forecasts and Strategic Considerations

Taking into account technical factors, on-chain data, and fundamental events, market analysts have offered differing but cautious outlooks on the future price path of PI.

Short-term (before and after the unlocking event): The market generally expects prices to face downward pressure. Technical analysis indicates that if the price breaks below the lower boundary of the current triangle consolidation range and the 50-day exponential moving average support at $0.2446, it may further decline to the psychological level of $0.20, or even challenge the previous low of $0.2035. Sustained high inflows into exchanges are a leading indicator of this pessimistic scenario.

Medium term (next 3-6 months): Price movement will depend on the outcome of the supply-demand dynamic.

Bearish scenario : If ecosystem application development is slow and fails to effectively absorb new supply, and unlocking continues, prices may fall into a prolonged period of decline.

Bullish scenario : Several catalysts are needed: first, substantial progress in ecosystem applications from partners like CiDi Games, generating real consumer demand; second, significant breakthroughs in mainnet development, such as successfully advancing to a more open phase, boosting market confidence; and third, the overall cryptocurrency market entering a bull market, with increased risk appetite driving funds into assets like PI. A break above the key resistance level of $0.2810 could trigger a rebound towards $0.30 or even $0.322.

For investors and traders, risk management is crucial when participating in projects with large-scale unlocking events.

-

Focus on on-chain data : Closely monitor exchange inflow/outflow data and unlock schedules provided by tools such as PiScan, as this reflects holders' intentions better than the price itself.

-

Employ new valuation tools : Referencing metrics like CoinGecko's "Outstanding Token Value" to assess project market capitalization with more realistic circulating supply, avoiding being misled by fully diluted valuations.

-

Identify market signals : Experienced analysts point out that unusual, synchronized hype about a particular token on social media can sometimes be a prelude to an upcoming large-scale unlock, and caution is advised.

-

Establish clear risk control : Given the high volatility, strict stop-loss levels must be set, and chasing high prices should be avoided.

Conclusion

Pi Network's December token unlock is far more than a simple market event. It's a concentrated test of the tension between the project's long-term narrative and its current economic model. The project team's investment in technological upgrades, compliance efforts, and ecosystem building demonstrates its ambition to build a long-term future. However, the token distribution mechanism designed for rapid expansion in its early stages has now brought the specter of persistent inflation. Short-term price pain from the unlock may be unavoidable, but Pi Network's real test lies in whether its carefully cultivated ecosystem can grow rapidly enough to generate a strong enough "demand pull" to absorb and ultimately digest this continuous "supply flood." For over ten million Pi community members and external observers, the answer will determine whether Pi Network evolves from an ambitious experiment into a mature application network, or becomes trapped in an endless cycle of "coming soon" promises. The coming months will be crucial in revealing this answer.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.