The cryptocurrency market this week has been dominated by macroeconomic sentiment and significant outflows from spot ETFs. However, underlying on-chain data and technical analysis suggest potential for a rebound, with Bitcoin showing resilience and the upcoming Fed decision poised to be a major catalyst. Meanwhile, S&P lowered USDT's score in its ability to maintain price peg to the U.S. dollar to 5 (weak) from the previous 4 (constrained). Grayscale is moving to list the first U.S. exchange-traded fund (ETF) tracking Zcash, a once-niche privacy coin that surged into the crypto mainstream in 2025. Ethena's USDe, the crypto-native synthetic stablecoin that generates yield through perpetual funding rates, has recently seen its total value locked decline from $14.8 billion in October to $7.6 billion.

Market Overview

BTC

:

Bitcoin dropped 0.66% over the week, now standing at $91,251.97. BTC broke strongly through the $87,000-$88,000 consolidation range on the morning of the 27th, quickly surging above $90,000, with a daily gain of over 3%. Technically, the 5-day moving average (MA5) turned upwards and crossed the 10-day and 30-day moving averages (MA10 and MA30), with the MA10 subsequently following suit, forming a typical short-term bullish alignment. The MA30 also began to rise slowly, further confirming the strengthening trend. Currently, the three moving averages are in a bullish divergence structure, with $88,000 near the MA30 acting as a key short-to-medium-term support level. A break below this level could signal the end of the short-term upward trend. Overall, with market sentiment continuing to recover, BTC is expected to continue its push towards $92,000.

ETH

: Ethereum increased 0.36% over the week, now standing at $3,027.98. ETH surged in tandem with BTC on the morning of the 27th, breaking through the $3,000 mark and reaching a high of $3,050, a daily gain of over 3%. Technically, the 5-day, 10-day, and 30-day moving averages are all in a bullish alignment, with the 30-day moving average (around $2,960) forming a key medium-term support level, providing momentum for steady upward movement. Overall, ETH's price action is highly correlated with BTC; if BTC can hold above $90,000, ETH is expected to continue its upward trend towards the $3,100-$3,150 range. If BTC experiences a pullback, ETH may retest the $3,000 support level; if it falls below $2,960, the short-term trend may turn into a weak, range-bound movement.

Altcoins: The Crypto Fear & Greed Index was

stuck in "Extreme Fear" for over seven consecutive days, a duration last witnessed during the 2022 FTX collapse. This sentiment was mirrored in the institutional sphere, with both Bitcoin and Ethereum spot ETFs witnessing massive weekly outflows of -$1.218 billion and -$500 million, respectively.

While the broader altcoin market was under pressure, performance was highly selective. The AI-themed crypto sector was a major laggard. Conversely, tokens like TNSR saw gains of over 250% following a major token burn event, demonstrating that specific catalysts can drive outsized returns even in a weak market

ETF: U.S. spot Bitcoin ETFs experienced significant outflows during the review period, with total net outflows of $11.1 billion for Bitcoin ETFs and $7.28 billion for Ethereum ETFs. This represented a dramatic shift from earlier in the year when these products saw consistent inflows. The outflows suggested institutional investors were reducing exposure to digital assets amid worsening market technicals and macroeconomic uncertainty.

VanEck's Bitcoin ETF reported a daily net outflow of $17.6 million on November 20th, though the firm continued its practice of directing 5% of profits from the ETF to Bitcoin developers. This outflow, while modest in isolation, contributed to a broader pattern of institutional caution.

Stablecoins: The total stablecoin market capitalization is at $305 billion, indicating a mild outflow of capital from the crypto ecosystem.

Stablecoins marketcap. Source: DefiLlama

Macro Data:

The Federal Reserve's Pivotal Role: Market sentiment swung dramatically based on shifting expectations for a U.S. Federal Reserve rate cut in December. Earlier in the week, hawkish tones from some Fed officials pushed the probability of a cut down to just 22%, contributing to the sell-off. However, a subsequent, unexpected dovish statement from Fed official John Williams caused a sharp reversal, with market-implied probability surging to 69.3%. The Fed is also expected to end its Quantitative Tightening (QT) program in December, which would stop draining liquidity from the system and is historically positive for risk-on assets like cryptocurrencies.

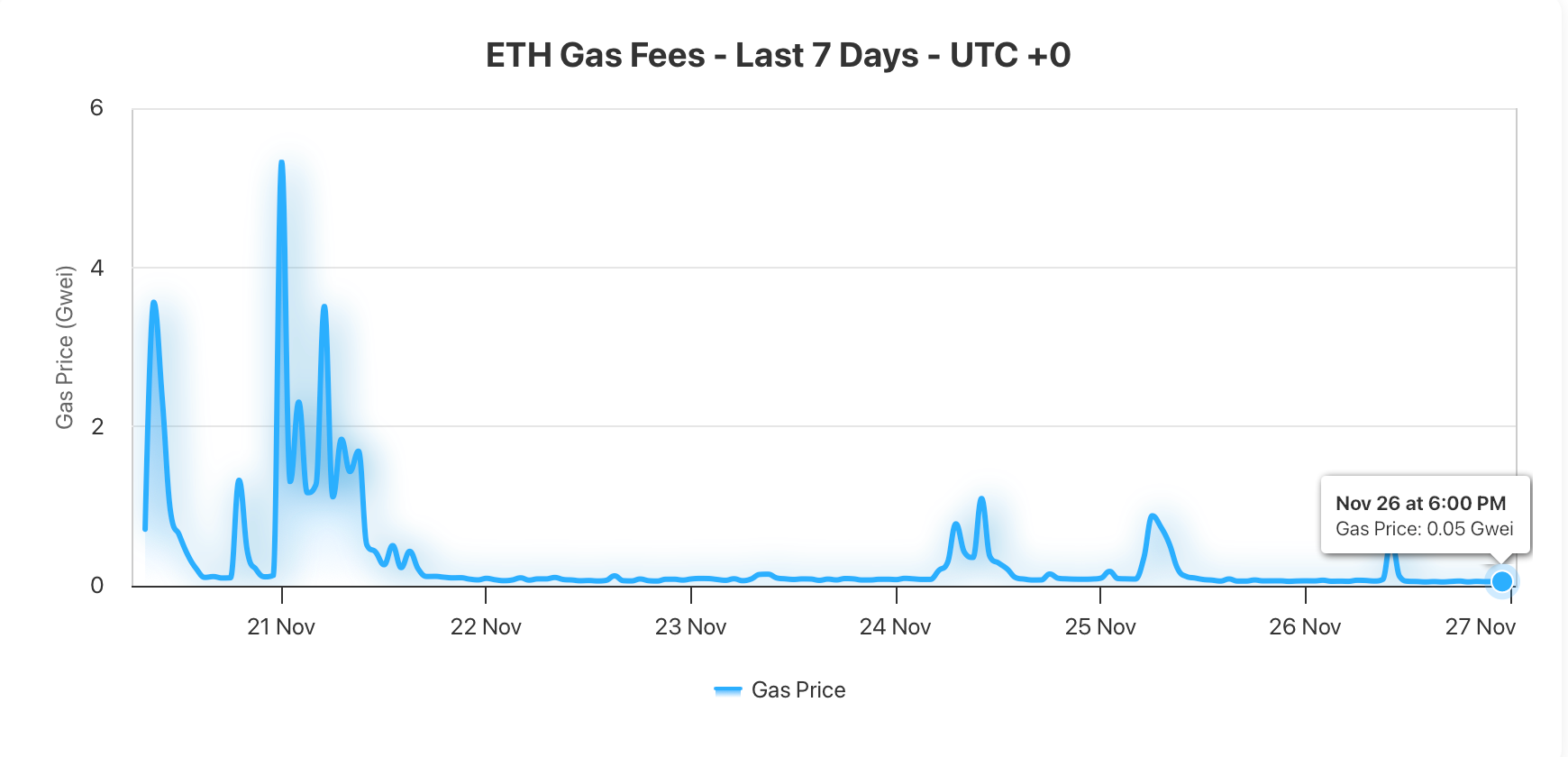

Gas Fees: Gas fees on the Ethereum network have generally remained below 1 Gwei over the past week, with a peak hourly rate of 6.96 Gwei. As of November 27, the average daily gas fee was 0.065 Gwei.

Gas fee heatmap. Source: MilkRoad

Weekly Trending Sectors & Opportunities

Based on the week's market activity, several crypto sectors have shown significant momentum. Real-World Assets (RWA) and Layer-2 solutions were among the top performers, driven by strong institutional and ecosystem developments.

For a quick overview, here are the key trending sectors and their performance highlights from the past week.

Weekly Market Focus

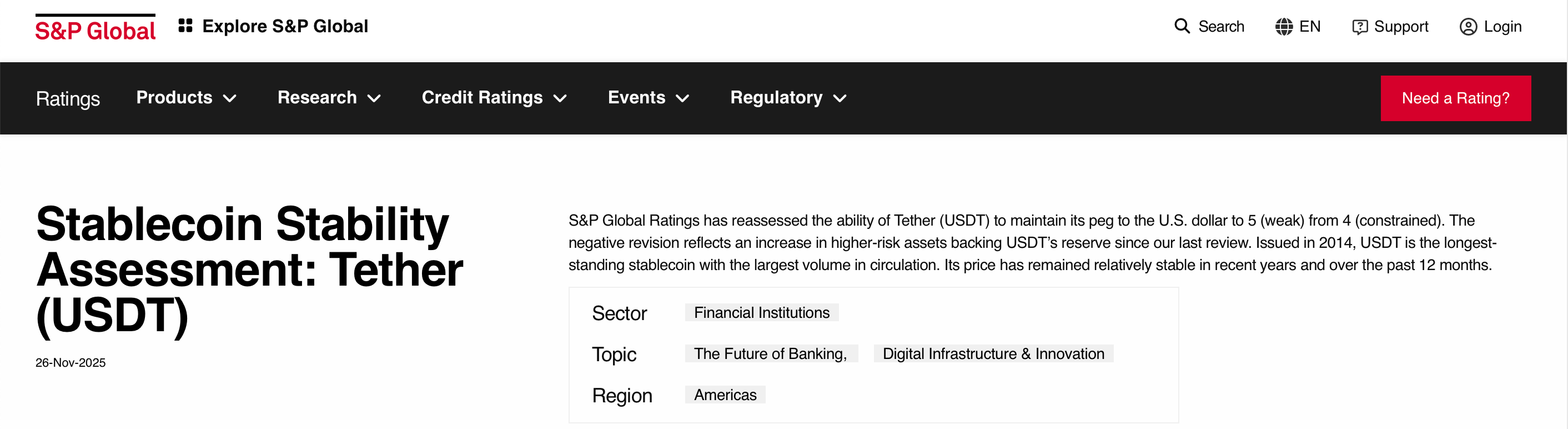

S&P Downgrades Tether's USDT, Citing Falling Bitcoin Prices as Risk

S&P Global Ratings has downgraded Tether’s flagship stablecoin USDT to the weakest possible score on its stablecoin stability scale, citing increased exposure to risky assets like bitcoin and ongoing gaps in reserve disclosure.

S&P ratings for Tether. Source: S&P Global

According to the revised assessment published on Wednesday, the ratings agency lowered USDT's score in its ability to maintain price peg to the U.S. dollar to 5 (weak) from the previous 4 (constrained), which had been assigned in December 2023. Turning back to S&P, the report noted that BTC now accounts for about 5.6% of USDT's backing, which is more than its 3.9% overcollateralization margin — raising concerns that a sharp price drop could leave the token undercollateralized.

The firm’s stablecoin reserves also include gold, corporate bonds, secured loans and other investments with varying degrees of credit and market risk, S&P added. The agency pointed to oft-cited concerns about a lack of detailed public reporting on the valuation of these assets and the creditworthiness of the banks and custodians holding them.

Tether's USDT is the largest stablecoin in circulation, with a market cap exceeding $180 billion. It plays a central role in global crypto markets, especially in emerging economies where access to U.S. dollars can be limited. For years, concerns over the stability and backing of USDT, often referred to as "Tether FUD," have sparked debate among crypto observers and regulators. Despite that, USDT’s price has maintained its price peg, a point that even S&P acknowledged in the report.

Yield compression triggers a half TVL drop in USDe despite rising onchain usage

USDe TVL. Source: DefiLlama

Ethena's USDe, the crypto-native synthetic stablecoin that generates yield through perpetual funding rates, has recently seen its total value locked decline from $14.8 billion in October to $7.6 billion, a drawdown of over 50% despite continued growth in actual usage. The decline highlights the complexities of yield-bearing stablecoins in DeFi, where leverage mechanics can amplify both growth and contraction cycles.

USDe maintains its peg by holding spot crypto collateral while offsetting short positions in perpetual futures markets, capturing the funding rate differential as yield for holders. The stablecoin currently offers roughly 5.1% APY, down from double-digit yields earlier in the year as perpetual funding rates compressed amid weaker market conditions and reduced demand for leverage.

Despite the TVL decline, USDe usage has trended upward with more than $50 billion in onchain transaction volume last month, suggesting the token retains utility even as speculative positioning unwinds.

Homegrown NYC Startup Polymarket Allowed to Resume US Operations Following CFTC Reversal

Leading onchain betting market Polymarket is officially approved to re-enter the United States following approval from the U.S. Commodity Futures Trading Commission.

The CFTC issued an Amended Order of Designation, according to an announcement on Tuesday, “permitting Polymarket to operate an intermediated trading platform subject to the full set of requirements applicable to federally regulated U.S. exchanges.”

Polymarket was barred by the CFTC from operating in the U.S. after a 2022 enforcement case for operating an unregistered derivatives exchange. The firm has since acquired QCX, a designated contract market and clearinghouse, which laid the groundwork for its U.S. return.

Relaunching in the U.S. is perhaps the capstone to a gangbuster year for Polymarket, which has seen the firm (often alongside rival Kalshi) strike data licensing deals with organizations from Google Finance to the National Hockey League and attract investment and backing from NYSE parent Intercontinental Exchange.

The startup, founded in 2020 in New York City, is now reportedly seeking a valuation between $12-$15 billion. It was last valued at $9 billion in October. Polymarket higher-ups, including CEO Shayne Coplan, have also hinted that the platform is looking to launch a native POLY token.

Key Market Data Highlights

Grayscale Files to List First Zcash ETF in the U.S. Amid 1,000% Rally

Grayscale is moving to list the first U.S. exchange-traded fund (ETF) tracking Zcash, a once-niche privacy coin that surged into the crypto mainstream in 2025.

The firm filed an S-3 registration statement with the U.S. Securities and Exchange Commission (SEC) Wednesday morning, seeking to convert its existing Zcash Trust into a spot ETF. The move mirrors Grayscale’s strategy with other products like its Bitcoin Trust, which was the first to be converted into an ETF in 2024.

If approved, the fund would be the first Zcash ETF in the U.S. and a signal that investors are paying closer attention to privacy-preserving crypto assets, particularly in a year when broader markets have struggled.

Zcash has climbed more than 1,000% year-to-date and is up 40% in the last month alone, outperforming both bitcoin and ether. Once viewed as an experimental privacy tool, Zcash has steadily evolved into what some see as functional digital cash.

In 2025, with shielded adoption, Zcash’s version of encrypted transactions spiked. Roughly 30% of ZEC transactions now involve the shielded pool, and between 20% and 25% of the total supply is held in encrypted addresses. That growth helped Zcash surpass Monero in market capitalization, becoming the largest privacy-focused cryptocurrency.

With the ETF filing, Grayscale is betting that investors want exposure to this kind of digital privacy infrastructure — and are ready to back a coin that has, for now, outpaced the majors.

Plasma Token Has Fallen 90% from Its Earlier Peak

When Plasma, a Layer 1 for stablecoins, rolled out its mainnet in late September, it arrived on a wave of bullish enthusiasm. Its token sale had pulled in an impressive $500 million, which is ten times the original allocation, and the project positioned XPL, its native token, as the latest entrant in crypto’s favorite category of 2025: stablecoin infrastructure.

The pitch had all the familiar buzzwords often associated with new blockchains: high throughput, instant payments, seamless scalability. It touted partnerships with big names in crypto, including blockchain analytics firm Elliptic, and integrations with platforms like Binance Earn and Chainlink Scale. On paper, it had everything it needed to take the stablecoin sector by storm. Instead, Plasma delivered what may go down as one of the biggest token debut flops of the cycle.

According to CoinMarketCap, XPL reached an early high of roughly $1.67 on Sept. 27, three days after, it went live, giving Plasma a market cap north of $2 billion. But by late October, CoinDesk reported the token had crashed more than 80%, slipping to roughly $0.31. In the weeks that followed, the slide continued: XPL touched the $0.18–$0.20 range, where it trades today, an 88–90% drawdown from its early peak.

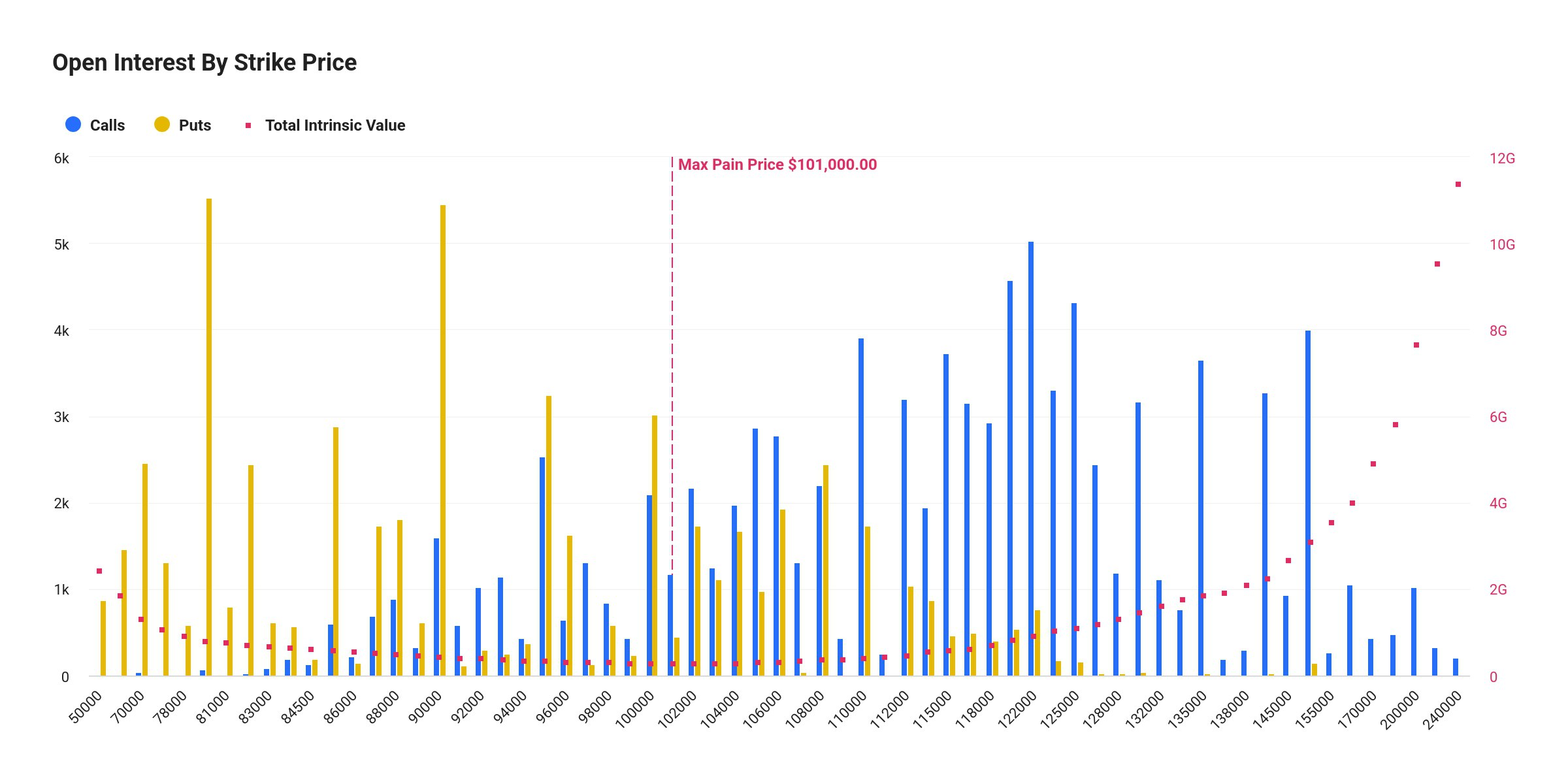

Bitcoin Faces $13.3B Monthly Options Expiry as BTC Trades Well Below Max Pain

OI by strike price. Source: Deribit Data

Bitcoin heads into Friday’s monthly options expiry after a sharp correction that sent BTC down 35% to $81,000 before recovering to $87,000. The correction has made the options market a focal point again, especially with positioning turning more defensive.

According to Deribit data, a total of 153,778 BTC is set to expire, broken down by 92,692 BTC in call open interest and 61,086 BTC in put open interest. Which represents a combined notional value of roughly $13.3 billion and a put call ratio of 0.66, showing that calls still outnumber puts but downside protection has grown.

A call option gives the right to buy BTC at a set strike and reflects a bullish bet, while a put option gives the right to sell and often acts as insurance against declines.

The max pain price sits at $102,000, 17% above the current spot price, illustrating how far BTC has drifted from the level at which option sellers would incur the least total loss. Deribit data shows $3.4 billion of contracts are currently in the money, about 26% of total exposure, while $10 billion remains out of the money, roughly 74%, highlighting how heavily traders positioned for moves outside the current range.

Open interest is most concentrated at the $80,000 strike, the largest bearish cluster on the board. Calls stack up at higher strikes, especially above $120,000, but these are far from being exercised with spot deeply below those levels.

Sentiment remains fragile and deeply in fear, while large out-the-money positions dominating, BTC could remain volatile into Friday as market makers adjust hedging flows around key strike levels.

CoinCatch New Listings

CoinCatch Weekly Event

🦃 Thanksgiving Treat: Download App, Trade 1U & Win $3,000 in Real Cash!

📅 Event Time: 2025.11.27 (UTC+8) - 2025.12.7 (UTC+8)

🚀 How to Unlock Draw Entries

-

Spot Trade ≥ 1 USDT → 1 Draw Entry

-

Futures Trade ≥ 10 USDT → 1 Draw Entry

-

First Deposit ≥ 10 USDT → 1 Draw Entry

-

Share the Event & Invite Friends → 1 Draw Entry

🎯 Mandatory Steps to Claim Your Prize (Must Complete All 3):

-

-

Stay active in the App for at least

3 minutes

-

🎁 The Ultimate Prize Pool

Physical Prizes

-

iPhone 17 Pro Max

-

PlayStation Plus Premium 12-Month Subscription

-

Xbox Game Pass Ultimate 12-Month Subscription

-

NBA League Pass Premium Annual Subscription

Platform Bonuses

-

$20 Trading Bonus

-

$100 Position Bonus

-

$200 Position Bonus

Exclusive Crypto Airdrops (First 500 participants only)

-

1 ETH

-

100,000 PEPE

-

66,666 SHIB

-

888 BOME

-

888 MEW

Black Friday Extravaganza: Win Gold 🔥 + Get 200% Deposit Cashback!

📅 Event Time: 2025.11.27 (UTC+8) - 2025.12.3 (UTC+8)

✨ Black Friday Limited-Time Offer:

🔥 Advanced Mission: Futures Trading Volume Challenge

-

Futures Trading Volume ≥

50,000 USDT →

+1

Mystery Box unlock

-

Futures Trading Volume ≥

100,000 USDT →

+1

Mystery Box unlock

-

Futures Trading Volume ≥

500,000 USDT →

+3 Mystery Boxes unlock

🎁 Rewards Explained

Prize pool includes:

-

Metalor 1 oz Gold Bar (worth $4,500)

-

Raleigh One e-Bike (worth $2,595)

-

MacBook Pro (worth $1,699)

-

Apple Watch Hermès (worth $1,299)

-

LEGO Millennium Falcon™ (worth $850)

-

Hot coins with a maximum worth of $100

-

Up to 500 USDT trading bonus

-

Up to 10,000 USDT in position bonus

Each completed task earns you a chance to win a prize; the more tasks you complete, the more chances you have!

💎 Top Up & Get 200% Back

-

Make a net deposit of

100 USDT and maintain it

≥

5 days to unlock a

200 USDT Position Bonus.

-

Make a net deposit of

1,000 USDT and maintain it

≥

5 days to unlock a

2,000 USDT Position Bonus.

💸 Trade to Earn Up to 20,000 USDT

Complete the following futures trading volume to unlock rewards:

| Futures Trading Volume (USDT) |

Position Bonus (USDT) |

| 10,000 |

100 |

| 50,000 |

200 |

| 200,000 |

500 |

| 500,000 |

1,000 |

| 2,000,000 |

5,000 |

| 10,000,000 |

20,000 |

Token Unlocks Next Week

Tokenomist data indicates that from November 21 – November 24, 2025, several major token unlocks are scheduled. Some of them are:

HYPE will unlock approximately $352.64 million worth of tokens over the next seven days, representing 2.66% of the circulating supply.

SUI will unlock approximately $68.07 million worth of tokens over the next seven days, representing 1.19% of the circulating supply.

EIGEN will unlock approximately $22.36 million worth of tokens over the next seven days, representing 10.79% of the circulating supply.

The concentration of these unlocks within a single week created a supply overhang that further challenged altcoin prices. Historical analysis suggests that token unlocks, particularly those representing large percentages of circulating supply, often lead to price pressure as recipients take profits, especially in downward-trending markets. The scale of these unlocks, ranging from 1% to over 40% of market capitalization, presents a significant test for altcoin market liquidity and absorption capacity.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial

advice.