The

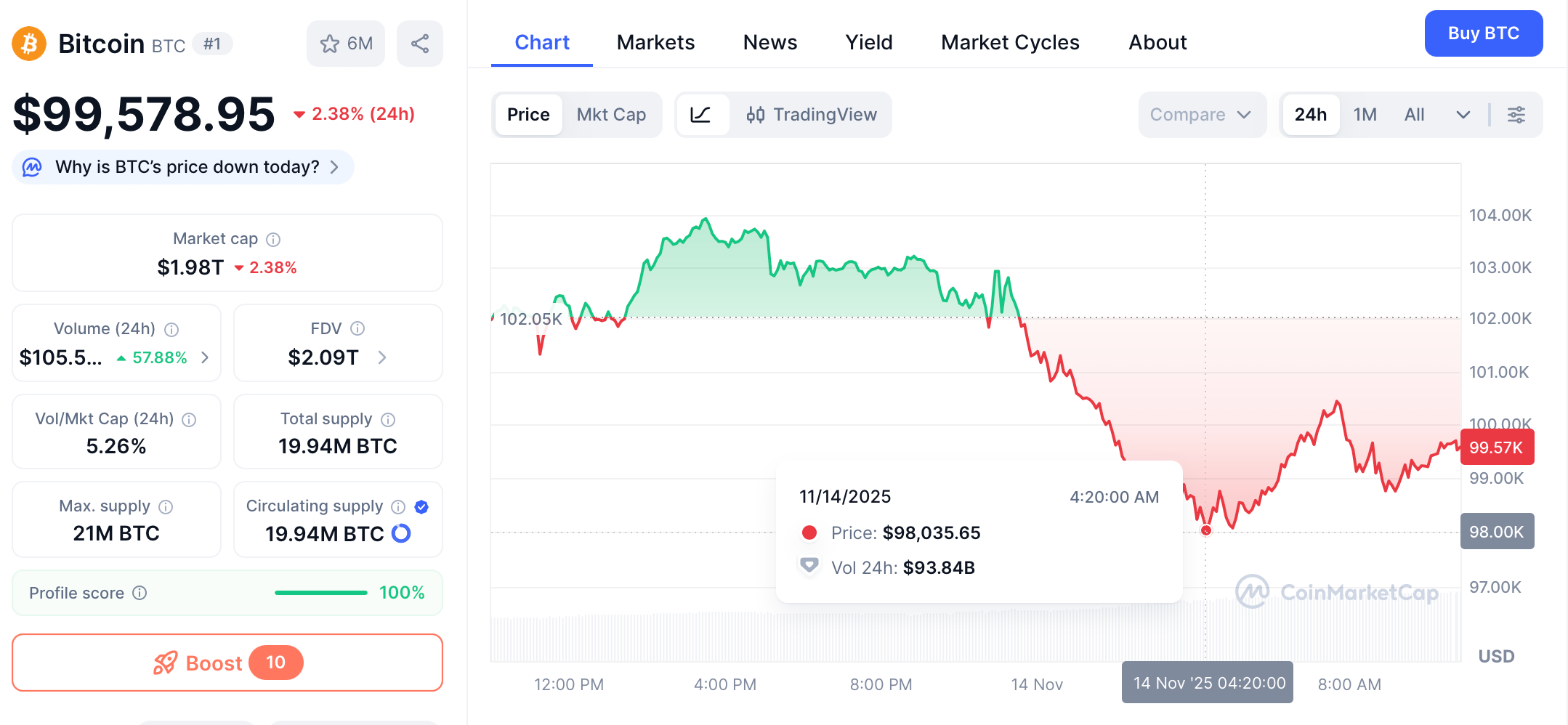

43-day U.S. government shutdown

, the longest in American history, officially concluded on November 12, 2025, when the House passed a temporary funding bill subsequently signed by President Trump. This political stalemate had frozen vital economic data, delayed federal salaries, and disrupted regulatory functions, creating a cloud of uncertainty over financial markets. Everything is getting back on track, but the market doesn't seem to be experiencing a strong rebound despite the government's reopening – BTC briefly fell below $101,000 again early this morning, and the overall market is trending downwards. Besides the improved macroeconomic environment, the crypto market seems to need more catalysts to generate stronger upward momentum.

Why US Government Shut Down?

Historically, since 1976, the US government has shut down 21 times, but the shutdown that began on October 1, 2025, broke the previous record of 35 days.

This record-breaking shutdown stemmed from the failure of Republicans and Democrats to reach an agreement on a new budget in October. The main point of contention was healthcare spending; Democrats demanded an extension of the expiring tax credit to allow millions of Americans to continue enjoying lower Medicare costs, while Republicans insisted on cutting health and government healthcare-related spending to control the budget.

Although the House of Representatives passed a temporary funding bill to avert a shutdown, a prolonged standoff in the Senate ultimately led to the formal shutdown on October 1. Even now, despite the passage of the temporary funding bill, the two parties are still arguing over federal Medicare subsidies, with Democrats failing to extend the subsidy.

The core conflict in this dispute remains unresolved.

The Influence of The Government Shut Down

The US government shutdown has not only disrupted the daily lives of Americans but also impacted the wallets of global investors. The market anticipates a negative impact.

Firstly, the shutdown prevents the normal operation of economic departments such as the Department of Labor, hindering the timely release of crucial economic data like CPI and non-farm payroll reports. This has led to unpredictable Federal Reserve decisions, casting a shadow over the market.

Secondly, the shutdown has also siphoned off market liquidity. The US Treasury's General Account (TGA) is responsible for all government spending, not only paying public sector salaries but also injecting capital into the financial markets. The shutdown has resulted in TGA funds only flowing in and not out. According to MacroMicro data, during the shutdown, TGA accumulated over $145.9 billion, with a current balance of $965.3 billion.

However, TradingView data shows that during the US government shutdown (October 1st to November 13th), the three major US stock indices did not fall significantly; instead, they rose. The Dow Jones Industrial Average rose 3.5%, the S&P 500 rose 3%, and the Nasdaq Composite rose 2.9%. Gold rose over 8.5% during the shutdown, reaching a new high of $4,355 on October 22nd.

The crypto market, however, lived up to expectations, experiencing a sharp drop. On October 11th, the crypto market witnessed the "1011" crash, setting a record for single-day liquidations exceeding $19.1 billion, with Bitcoin even falling below $99,000. While the market recovered somewhat after the "10/11" crash, it remained generally sluggish. During the US government shutdown (October 1st to November 13th), BTC fell by 14%, ETH by 20%, SOL by 30%, and BNB by 6.67%.

This shows that the US government shutdown did not have as significant a negative impact on the global market as some might have imagined. The decline in the crypto market during this period was the result of multiple factors, such as continued outflows from spot Bitcoin ETFs, the decline of DAT, weakened expectations of a Fed rate cut, and internal crises within the crypto industry.

The Shutdown Ends: Why Bitcoin's Rally Stalled

When the U.S. Senate reached a compromise to end the government shutdown on November 10. Bitcoin responded with immediate enthusiasm, surging 6.7% to reclaim

$106,000. This price rebound coincided with Bitcoin becoming a top-trending topic across social media platforms, indicating renewed retail interest amid political resolution. The current Bitcoin price reached a low of 98,000 on November 13, 18:00 UTC

The shutdown's conclusion failed to fully energize Bitcoin investors because it merely closed one chapter of uncertainty while opening others. According to market observers, the resolution of the political stalemate allowed investors to refocus on fundamental economic concerns that predated the shutdown.

Over 1 million federal employees had worked without pay during the impasse, and while their back wages would eventually be paid, the economic damage from reduced consumer spending during this period had already rippled through the economy.

The limitations of the political solution became apparent upon closer examination. The funding bill merely extends government operations through January 2026, setting the stage for another potential budget battle in just months. For cryptocurrency investors, this represents barely a breathing space rather than a permanent solution, explaining why the Bitcoin rally lost steam despite seemingly positive developments.

Behind the Market's Muted Response

The Debt Overhang and Structural Economic Concerns

Beneath the surface of the shutdown resolution loom massive structural economic issues that continue to concern investors. U.S. government debt skyrocketed during the shutdown period, climbing from $38.05 trillion to $38.17 trillion in just weeks - an increase of approximately $10 billion per day. This staggering debt burden translates to $32.82 million per taxpayer, creating a long-term anchor on economic growth that no short-term political solution can resolve.

The shutdown also exacerbated existing economic fragilities. As noted by White House economic adviser Hassett, if the government shutdown had persisted, particularly with reduced air travel affecting holiday shopping, the U.S. could have seen negative GDP growth in the fourth quarter. While this worst-case scenario was avoided, the underlying vulnerability of an economy "highly dependent on consumption by high-income groups" remains.

Inflation and Policy Uncertainty

Despite the shutdown's conclusion, inflationary pressures continue to threaten economic stability. According to Labor Department statistics, among 36 common commodities, only a handful, including sporting goods, fresh vegetables, and eggs, saw price decreases. Critical necessities like beef, vehicle maintenance, tobacco, electricity, and healthcare services all experienced price increases exceeding 4%.

This persistent inflation creates a complex environment for the Federal Reserve's interest rate decisions. The central bank faces a dilemma: if inflation is driven primarily by supply chain issues and tariff policies rather than credit expansion, then maintaining high interest rates may be the wrong tool for the problem. This policy confusion directly impacts Bitcoin, which has historically thrived in environments of monetary uncertainty but suffers when overall economic confidence wanes.

Historical Patterns

Historical analysis reveals that Bitcoin's ambiguous response to the shutdown resolution follows broader market patterns. Looking back at three major government shutdowns in U.S. history (1995, 2013, and 2018), we see that

risk assets typically experience short-term relief rallies once uncertainty is removed.

In 2018, following a 35-day shutdown, the

Nasdaq Composite surged 13.1% over three months, significantly outperforming blue-chip indices. This demonstrates how technology-oriented and risk-on assets often lead rebounds once political gridlock resolves. Similarly, in 2013, the Nasdaq gained 9.2% over three months post-shutdown, again outperforming more traditional indices.

However, history also shows that these initial rallies can fade as markets return to focusing on economic fundamentals. In 1995, despite initial gains of approximately 6% across major indices one month after the shutdown, these advances had partially retreated within three months. The pattern suggests that while shutdown resolutions typically trigger brief euphoria,

sustained gains require solid economic foundations.

For Bitcoin specifically, the current environment mirrors aspects of the 2018 scenario, where the shutdown resolution coincided with a market bottom followed by a powerful rally. The critical difference today lies in the magnitude of outstanding government debt and inflationary pressures, creating headwinds that didn't exist in previous episodes.

The "Tariff Dividend" Wildcard

Amid the mixed signals, one potential catalyst for Bitcoin demand emerged from President Trump's announcement of a "

tariff dividend" - a plan to distribute at least $2,000 to most American adults, totaling over

$400 billion in direct payments.

This massive injection of liquidity could theoretically benefit Bitcoin in two ways. First, direct stimulus payments have historically increased retail investment in cryptocurrencies, as witnessed during previous pandemic-related stimulus rounds. Second, the program would represent yet another expansion of government spending, potentially undermining confidence in traditional currencies and strengthening Bitcoin's case as a

hedge against fiscal irresponsibility.

As BitMEX co-founder Arthur Hayes noted on social media, "The U.S. government is back to doing what it does best: printing money and handing out benefits. BTC and ZEC will rise". Anthony Pompliano of The Pomp Newsletter similarly observed that if implemented, the tariff dividend would "release powerful liquidity into the market".

However, this potential catalyst remains uncertain. The tariff dividend faces legal challenges in the Supreme Court, which is currently reviewing the legality of new tariffs. Without the revenue from these tariffs, the funding mechanism for the dividend collapses, creating yet another layer of policy uncertainty that may be tempering Bitcoin's post-shutdown enthusiasm.

Looking Ahead

As markets process the shutdown's aftermath, Bitcoin faces a complex set of crosscurrents. On one hand, the resolution removes immediate uncertainty and potentially injects fresh liquidity through fiscal stimulus. On the other, it returns attention to profound structural issues in the U.S. economy that don't favor risk assets broadly.

Technical analysis suggests Bitcoin has established important support around

$100,300, a level that now serves as a critical line of defense for bulls. A decisive break below this support could signal further downside, while sustained strength above it might enable a retest of resistance at

$111,999 and possibly

$117,552.

The reopening of government agencies also means regulatory functions will resume normal operations. The

Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), which operated with skeleton crews during the shutdown, will now return to full capacity. This could mean renewed regulatory scrutiny for cryptocurrency projects that launched or expanded during the government's hiatus.

For long-term Bitcoin investors, the post-shutdown environment reinforces the cryptocurrency's value proposition as an

alternative to traditional financial systems plagued by political dysfunction and fiscal excess. As noted by one economic commentator, "The U.S. society is being torn apart by the two parties, and the house debate and partisan fighting have made the American public sick of it". In this context, Bitcoin's appeal as a politically neutral, globally accessible store of value may ultimately outweigh short-term price fluctuations.

Conclusion

The end of America's record-breaking government shutdown provided Bitcoin with a temporary boost, but failed to ignite a sustained rally due to persistent economic concerns. The resolution merely shifted investor attention from political gridlock to more fundamental issues:

mounting government debt,

persistent inflation, and

questions about policy direction.

Historical patterns suggest that risk assets typically enjoy relief rallies after shutdowns resolve, but their medium-term trajectory depends on broader economic conditions. For Bitcoin specifically, the coming months will test its resilience amid potential stimulus-driven liquidity injections and ongoing regulatory developments.

The market's muted response to the shutdown's end speaks volumes about the depth of economic challenges facing the United States. As one investment manager noted, "Policy continuity can ensure that a country moves forward in the set direction, and excessive intervention will only increase economic operating costs". In this environment of policy discontinuity and fiscal stress, Bitcoin's long-term value proposition as

a decentralized alternative to traditional finance remains compelling, even if its short-term price action remains choppy.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.