The convergence of artificial intelligence and blockchain technology has entered a transformative phase with the emergence of

Kite AI

, a project dedicated to building the first AI payment blockchain. Designed as a foundational infrastructure for autonomous AI agents, Kite combines verifiable identity, programmable governance, and native stablecoin payments to create a decentralized ecosystem where machines can transact and collaborate without human intervention. Launched in early 2025, Kite has rapidly gained traction, securing strategic investments from industry giants like

Coinbase Ventures

and

PayPal Ventures

and achieving listings on major exchanges such as Binance, OKX, and Upbit. This article explores Kite's technology, tokenomics, use cases, and market potential, offering a comprehensive overview of its role in shaping the future of the agentic economy.

What Is Kite?

Kite is an

EVM-compatible Layer-1 blockchain designed to power the "agentic economy", which is a digital ecosystem where autonomous AI agents operate, transact, and coordinate independently. Unlike traditional blockchains, Kite serves as both a settlement layer and a coordination layer, providing low-latency, high-throughput infrastructure tailored to AI-driven applications. Its modular architecture allows developers to customize components like the Base Layer for EVM compatibility and KiteVM extensions, ensuring adaptability for diverse use cases.

The project’s vision is to enable AI agents to perform complex tasks—such as negotiating services, verifying identities, and executing payments—securely and efficiently. By integrating native stablecoin payments and programmable governance, Kite aims to become the default infrastructure for machine-to-machine (M2M) transactions on Web3.

The Mission of Kite AI

Kite AI is building the first blockchain for agentic payments, a foundational platform where autonomous AI agents can operate with verifiable identity, programmable governance, and seamless payments. The company's purpose-built Layer-1 blockchain and Agent Passport system enable AI agents to function as first-class economic actors, creating emergent capabilities through composable interactions. Founded by AI and data infrastructure veterans from Databricks, Uber, and UC Berkeley, Kite AI has raised $35 million from top-tier investors, including PayPal, General Catalyst, Coinbase Ventures and leading blockchain foundations.

How Kite Works: The Technology Behind the Protocol

Kite’s infrastructure is built on three core technological pillars:

Proof of Artificial Intelligence (PoAI) Consensus: This novel consensus mechanism leverages AI models to validate transactions and maintain network efficiency. PoAI ensures scalability as AI systems grow more complex, while also incentivizing sustainability through token rewards.

SPACE Framework: Kite introduces the SPACE framework, which stands for

Stablecoin-native, Programmable constraints, Agent-first authentication, Compliance-ready, and Economically viable micropayments. This framework enables seamless value transfer between AI agents, with built-in compliance and authentication mechanisms.

Modular Architecture: Kite’s blockchain is highly modular, allowing developers to integrate specialized layers for specific tasks. For example, the Base Layer ensures EVM compatibility, while KiteVM supports extensions for advanced AI operations. This design facilitates interoperability and customization, making Kite suitable for applications in DeFi, supply chain management, and decentralized AI services.

Why Kite Matters: Key Features and Advantages

Kite’s value proposition lies in its ability to address critical gaps in the AI and blockchain intersection:

Machine-Native Value Transfer: By supporting instant, low-cost transactions, Kite allows AI agents to autonomously discover, negotiate, and pay for services using native stablecoins. This capability is essential for scaling M2M economies.

Verifiable Identity and Governance: Each AI agent on Kite is assigned a unique, blockchain-based identity, ensuring accountability and transparency. Programmable governance features enable fine-grained control over permissions and spending limits, reducing risks associated with autonomous operations.

Interoperability: As an EVM-compatible chain, Kite seamlessly integrates with existing Ethereum-based dApps and protocols, lowering the barrier to entry for developers.

Kite Tokenomics: Supply, Distribution, and Utility

The native

KITE token has a total supply of

10 billion tokens and serves multiple purposes within the ecosystem:

Payments: KITE is used for transaction fees, AI service commissions, and micropayments between agents.

Staking and Governance: Token holders can stake KITE to secure the network and participate in governance decisions.

Ecosystem Access: The token grants access to Kite’s modular services, such as AI toolkits and API integrations.

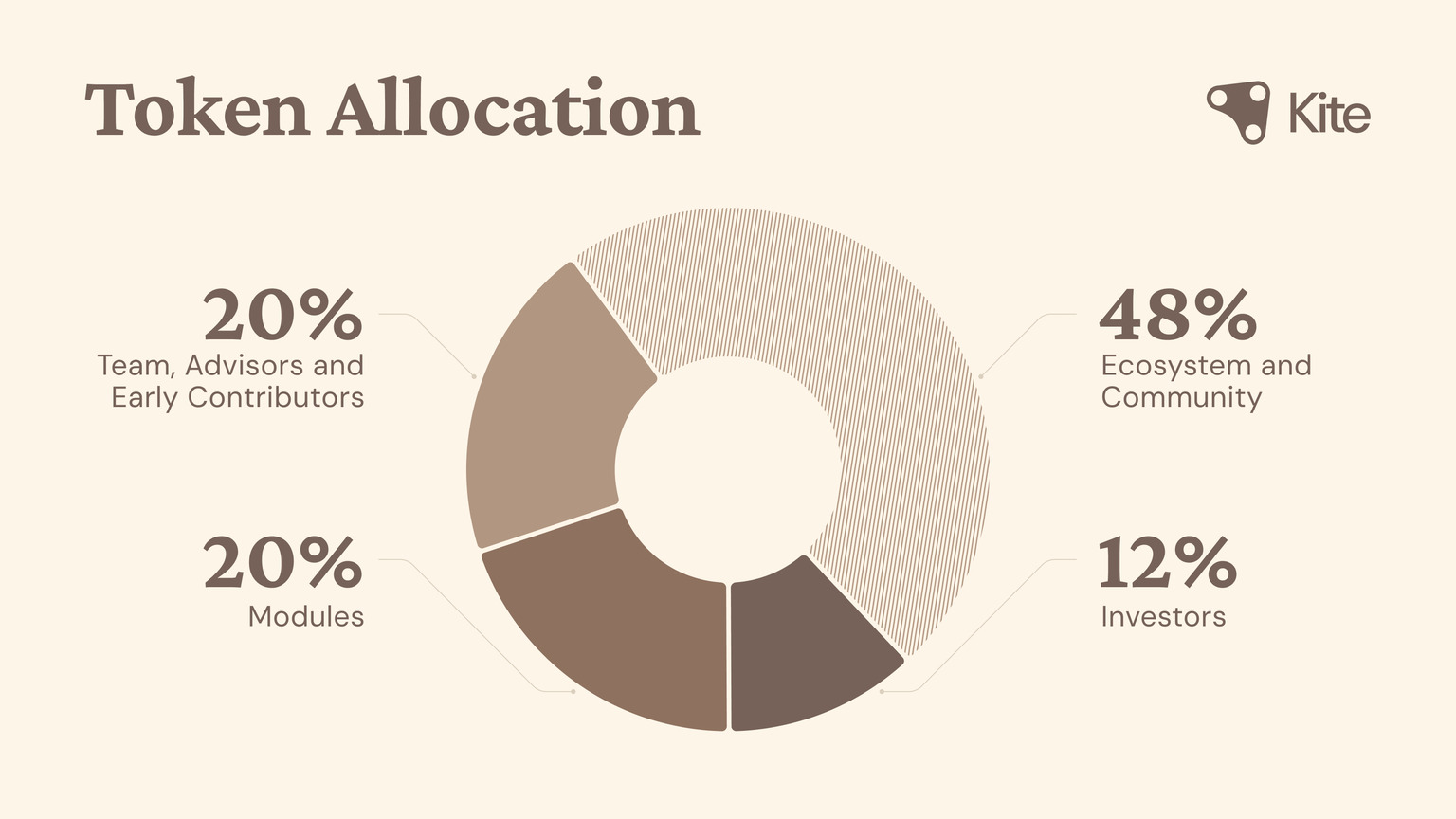

Ecosystem and Community (48%) - Ecosystem and community tokens are dedicated to accelerating user adoption, builder and developer engagement, and ecosystem liquidity. They will fund community airdrops, liquidity programs, and growth initiatives that expand participation, reward meaningful contributions, and drive Kite’s transition from launch to broad utility.

Investors (12%) - Investor tokens are distributed under structured vesting schedules to align investor interests with the network's long-term growth, ensuring that early financial supporters remain committed as the ecosystem expands.

Modules (20%) - Tokens allocated to modules will be used to incentivize the development of high-quality AI services and to expand the infrastructure that enables users to interact seamlessly with the Kite ecosystem. These funds will support developer grants, performance-based rewards, and the build-out of services that enhance both the intelligence and accessibility of the network.

Team, Advisors, and Early Contributors (20%) - Tokens allocated to the team, advisors, and early contributors align the long-term incentives of Kite’s builders with the network’s sustained success. These allocations reward early contributors, developers, and strategic advisors who are building and scaling the network, with multi-year vesting schedules that promote stability and accountability as the ecosystem matures.

Use Cases and Features: Real-World Applications

Kite’s technology enables a wide range of applications beyond traditional finance:

Decentralized AI Marketplaces: Platforms like Virtuals Protocol are leveraging Kite to create markets for AI-driven services, such as legal analysis and code review. These marketplaces use Kite’s reputation system to help users identify reliable providers.

Supply Chain and IoT Integration: Kite’s validation mechanisms ensure that automated systems in supply chains perform to specification, with reputation scores reflecting historical reliability.

Content Verification: The protocol’s identity and validation registries provide infrastructure for tracking content provenance, allowing users to verify the authenticity of media.

Is KITE a Good Investment?

While KITE’s innovative technology and strong backing make it a promising project, investors should consider both opportunities and risks:

Opportunities: Strategic partnerships with Coinbase (via the x402 protocol) and PayPal Ventures provide significant credibility. Listings on major exchanges enhance liquidity and accessibility.

Risks: The token’s fully diluted valuation (FDV) of $883 million and high initial trading volume ($263 million on launch day) indicate speculative interest, which could lead to volatility. Additionally, the AI-agent economy is still nascent, meaning adoption may take time.

Recent News and Price Analysis

KITE has dominated crypto headlines with several major developments:

Exchange Listings: In early November 2025, KITE was listed on Binance, OKX, Upbit, and HTX, driving a surge in trading volume.

Strategic Funding: The project raised $18 million in a Series A round led by General Catalyst and PayPal Ventures, followed by a strategic investment from Coinbase Ventures to advance the x402 payment protocol.

Price Action: Although pre-market predictions suggested an initial price range of $0.25–$0.45, the token’s actualperformance has been volatile due to speculative trading. Analysts caution that long-term value will depend on mainnet adoption and ecosystem growth.

Conclusion

Kite AI represents a groundbreaking fusion of AI and blockchain, positioning itself as the foundational layer for the autonomous agent economy. Its innovative technology, strategic partnerships, and robust tokenomics make it a project with significant potential. However, as with any emerging technology, investors should approach with caution, conduct thorough research, and monitor key milestones like mainnet launches and ecosystem expansions. For the crypto and AI communities, Kite offers a glimpse into a future where machines transact, collaborate, and innovate autonomously on a global scale.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.