Solana has emerged as one of the most prominent layer-1 blockchain platforms, renowned for its exceptional throughput capabilities and rapidly expanding ecosystem. Since its inception, Solana has aimed to solve the blockchain trilemma, achieving scalability, security, and decentralization without compromising performance. The network's unique architecture and growing institutional interest have positioned it as a formidable competitor to established platforms like Ethereum. Recent developments, including technological upgrades, regulatory progress toward a spot Solana ETF, and robust on-chain activity, underscore its potential to become a foundational infrastructure for the next generation of decentralized applications (dApps). This article provides a comprehensive analysis of Solana's technology, use cases, tokenomics, and market trajectory, offering insights into its evolving role in the broader cryptocurrency landscape.

What is Solana?

Solana is an open-source, high-performance blockchain designed to support decentralized applications and cryptocurrencies at scale. It utilizes a unique combination of Proof of History (PoH) and

Proof of Stake (PoS) consensus mechanisms to achieve high transaction throughput without sacrificing security . PoH functions as a cryptographic clock, timestamping transactions before they are bundled into blocks, thereby reducing consensus overhead and enabling validators to process transactions in parallel. This architecture allows Solana to process over 65,000 transactions per second (TPS) with average transaction costs as low as $0.00025, significantly lower than those of many competing blockchains .

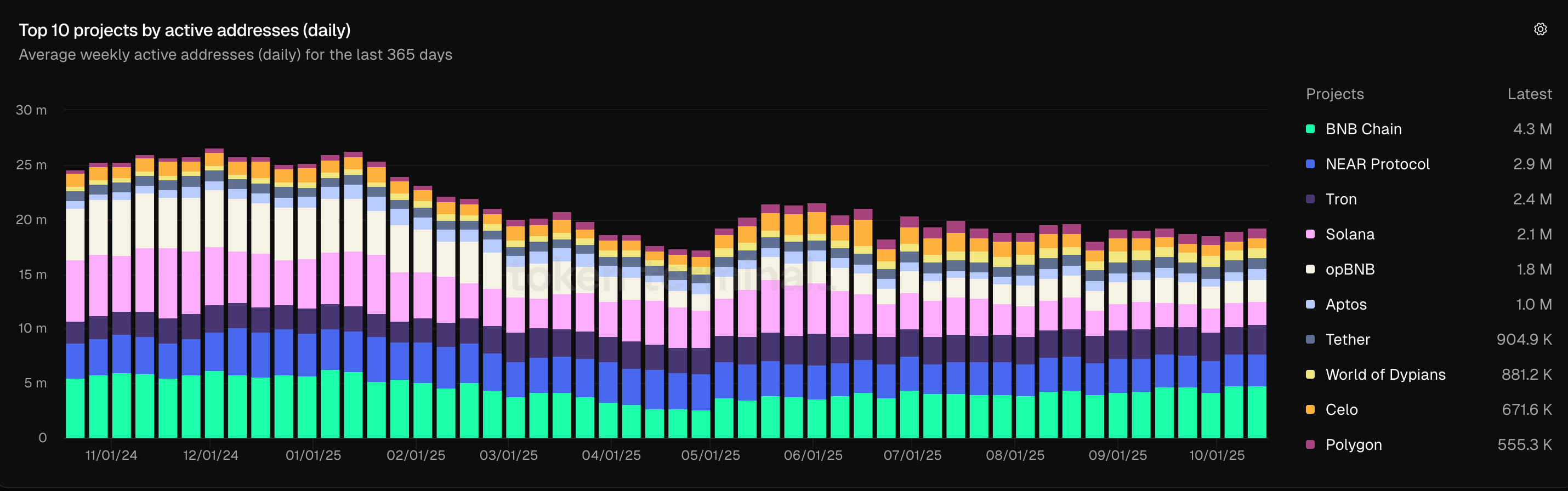

The network has attracted a diverse and active developer community, with more than 1,000 full-time developers contributing to its protocol and ecosystem . Solana's versatility is reflected in its support for a wide array of applications, spanning decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and decentralized physical infrastructure networks (DePIN). Its ability to handle high-volume, low-cost transactions has made it a preferred platform for retail and institutional users.

Use Cases and Features

Solana's ecosystem is characterized by its depth and diversity, hosting a broad spectrum of applications that leverage its high-speed, low-cost infrastructure. In decentralized finance, protocols like Raydium and Serum facilitate efficient trading and liquidity provision, contributing to a Total Value Locked (TVL) of approximately $11 billion . The network's minimal fees make it particularly suitable for microtransactions and high-frequency interactions, which are essential for consumer-facing dApps, NFT marketplaces, and gaming platforms such as

Pump.fun and Helium.

A key differentiator for Solana is its scalability and robust infrastructure. The network's blocks are produced approximately every 400 milliseconds, with transaction finality achieved within 12 to 13 seconds . This performance is bolstered by continuous technical improvements, such as the recent Agave V3.0 upgrade, which increased computational capacity per block and optimized runtime operations . These enhancements ensure that Solana can support demanding applications, from peer-to-peer payments to institutional settlement layers, without network congestion or exorbitant fees.

Tokenomics (SOL)

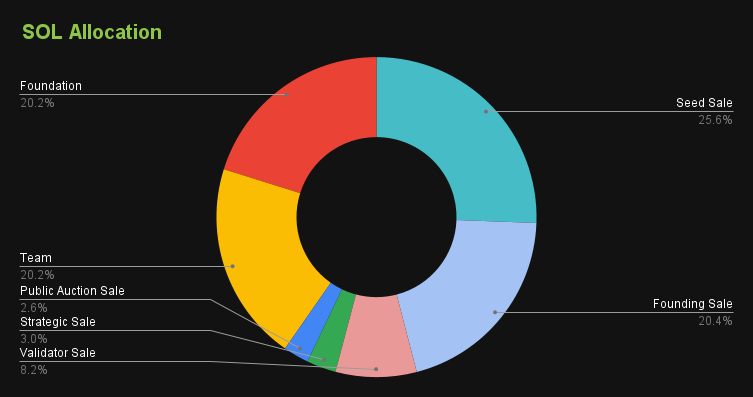

SOL is the native token of the Solana network, serving as the primary medium for transaction fees, staking, and governance. The tokenomics of SOL are designed to balance incentives for network participants with long-term sustainability. The initial distribution of SOL allocated 38% to the community reserve, 37% to investors, and 25% to the team and foundation, fostering a decentralized and aligned ecosystem .

A critical aspect of SOL's economic model is its inflation schedule. The network started with an initial inflation rate of 8%, which is programmed to decrease annually, targeting a long-term stable rate of 1.5% . This disinflationary model aims to reduce sell pressure from staking rewards over time while continuing to compensate validators and delegators. Currently, the network exhibits a very high staking participation rate, with over 80% of the circulating SOL supply staked . This not only secures the network but also reduces liquid selling pressure. Stakers earn rewards, with the annual percentage yield (APY) currently around 7-8%, which provides a yield-bearing characteristic to the asset.

Proof of Stake (PoS) and Proof of History (PoH) consensus mechanisms

Solana uses a Proof-of-Stake (PoS) consensus mechanism, a common alternative to the energy-intensive Proof-of-Work (PoW) consensus mechanism used by networks like Bitcoin. In PoS, validators are selected to create new blocks and confirm transactions based on the number of tokens they hold and the amount of tokens they are willing to "stake." This mechanism improves the network's security and energy efficiency.

Proof of History (PoH) complements Solana's PoS system, a unique feature that helps the network achieve high throughput and low latency. PoH works by creating a historical record that proves events occurred at a specific point in time, adding a layer of time verification to the transaction process. The combination of PoS and PoH enables Solana to process transactions quickly and efficiently, significantly reducing the time and computing power required to confirm transactions. This efficiency is a key factor in Solana's ability to process thousands of transactions per second (TPS). This reward mechanism encourages more users to stake their tokens, thereby improving the security and stability of the network.

Solana's implementation of PoS represents a significant advancement in blockchain technology, providing a scalable and environmentally friendly alternative to traditional PoW systems. It is the cornerstone of Solana's architecture, enabling the network's rapid growth and adoption.

| Consensus mechanism |

Proof-of-Work |

Proof-of-Stake |

Proof-of-History |

| Description |

In Proof-of-Work, miners use computational power to create new blocks. |

Proof-of-Stake relies on validators selected based on the crypto assets they commit as collateral. |

Proof-of-History employs a Verifiable Delay Function to verify the time elapsed since the previous block. |

| Rewards |

Miners earn rewards and transaction fees. |

Validators can receive periodic returns based on their staked crypto assets. |

Participants are rewarded with transaction fees for each block they validate. |

| Primary function |

Validation by solving computationally intensive puzzles (mining). |

Validation by verifying ownership of cryptocurrency staked. |

Validation by timestamps. |

| Security vs efficiency |

High security but is inefficient and costly. |

More efficient but less secure. |

Enhances scalability while building upon existing consensus mechanisms. |

| Energy consumption |

Consumes high energy. |

Consumes less energy compared to PoW. |

Energy efficiency as energy-intenstive computations are not required. |

Technical Improvements

Solana's development roadmap is aggressively focused on enhancing network performance, resilience, and decentralization. The Agave V3.0 upgrade, launched in late 2025, marked a significant leap forward. It increased the network's transaction throughput by 30-40% and raised the compute units (CU) per block by 233%, enabling the network to handle more complex transactions efficiently. Furthermore, it drastically reduced validator startup time to just 200 seconds, lowering the barrier to entry for new network participants and promoting greater decentralization.

Another major initiative is the development of Firedancer, an independent validator client. By diversifying the software clients that validators can run, Solana mitigates the risk of single-client failures and enhances overall network reliability. The upcoming Alpenglow upgrade is also highly anticipated, as it is expected to reduce block finality times dramatically to between 100 and 150 milliseconds, a speed that rivals traditional web2 experiences. Most recently, a new proposal, SIMD-0266, introduced the "p-token" program, which could reduce token program computation usage by up to 98%, freeing significant block space for other transactions.

How Solana Compares to Other Blockchains?

Compared to Ethereum, which currently uses a Proof-of-Work (PoW) mechanism (although it will transition to PoS in Ethereum 2.0), Solana's unique architecture and consensus mechanism significantly improve transaction speeds and reduce costs. Ethereum's current TPS is significantly lower than Solana's, resulting in higher transaction fees, especially during periods of network congestion. Solana's ability to handle tens of thousands of TPS at a very low cost makes it an attractive platform for developers and users seeking efficiency and scalability.

While Ethereum boasts a larger ecosystem and more developed infrastructure, Solana is rapidly growing, attracting developers with its high performance and low-cost transactions. While the launch of Ethereum 2.0 may narrow this performance gap, Solana's unique features, such as Gulf Stream and Sealevel, provide it with a competitive advantage. The security model also differs; while Ethereum is about to transition to Proof-of-Stake (PoS) for improved energy efficiency and scalability, Solana's integrated PoH adds an additional layer of security and efficiency, distinguishing it from Ethereum and other PoS blockchains.

In summary, while Ethereum remains the dominant force in blockchain space, Solana, backed by its innovative architecture and consensus mechanism, offers a compelling alternative for applications that require high throughput and low transaction costs.

Solana ETF Approval Details

The potential approval of a spot Solana ETF in the United States is a pivotal event that the market is closely watching. The approval process has entered a critical phase, with the U.S. Securities and Exchange Commission (SEC) engaging with asset managers like Fidelity, VanEck, and Grayscaleon details of their S-1 registration statements. A key focus of the discussions has been the structure of the ETF, particularly the inclusion of in-kind redemptions and a staking mechanism that would allow investors to earn rewards on the underlying SOL tokens.

Market sentiment regarding approval is highly optimistic. Analysts from Bloomberg have estimated the probability of approval to be as high as 90% . This optimism is fueled by the SEC's adoption of a "universal listing standard," which has streamlined the approval process for commodity-based ETFs. Furthermore, the regulatory environment has improved, with the SEC having "in principle" dropped its case against Coinbase, removing a significant legal obstacle. An approved Solana ETF is projected to attract substantial institutional capital, with predictions of over $8 billion in inflows, potentially catalyzing a significant price rally for SOL.

Solana Price Analysis and Prediction

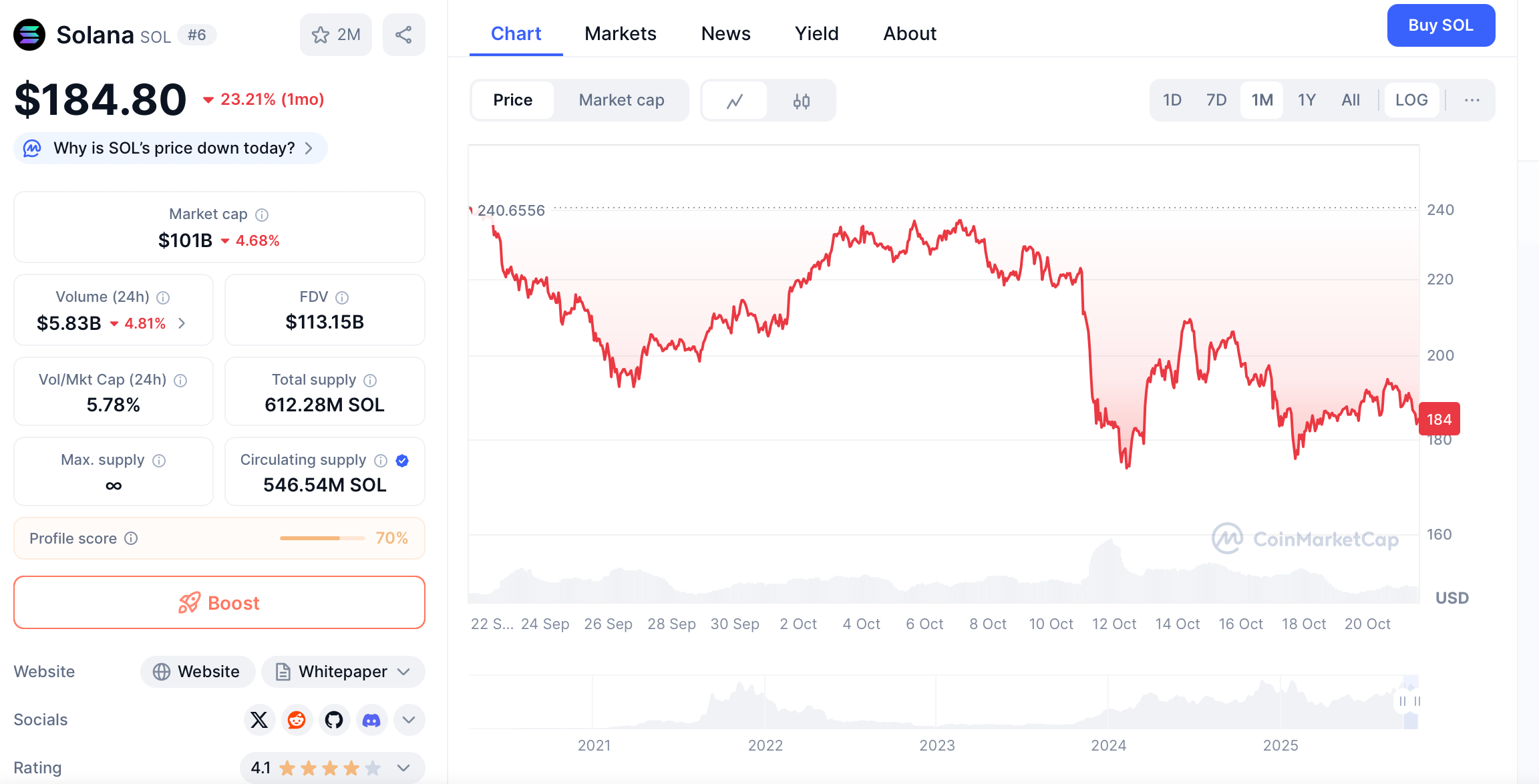

Solana's price action in 2025 has been dynamic, characterized by both significant gains and periods of correction. After finding a strong support level around $120, SOL rallied to test a key resistance zone between $200 and $220 multiple times. As of late October 2025, SOL was trading around $180, navigating market volatility while showcasing resilience.

Looking ahead, technical and fundamental analyses suggest a bullish outlook. Advanced AI models analyzing market data, social sentiment, and on-chain metrics have projected a potential price target of $400 for SOL, citing a measured move pattern from its consolidation phase. More conservative forecasts still point to a year-end price range between $178 and $438, with a breakout above the $300 resistance level being a critical indicator of a sustained upward trend . If a spot ETF is approved, historical precedent from Bitcoin suggests the possibility of a 30% to 50% price increase in the short to medium term.

Other Factors Influencing SOL Price

Beyond ETF speculation and technical analysis, several fundamental factors are poised to influence SOL's price. The continued growth of its ecosystem is paramount. With annualized fee revenue estimated at a staggering $5 billion, Solana demonstrates a powerful ability to convert on-chain activity into real economic value, underpinning the utility and demand for SOL.

Institutional adoption is another powerful driver. Major asset managers like Franklin Templeton, BlackRock, and VanEck have launched tokenized funds on the Solana blockchain, signaling strong institutional confidence in its infrastructure . Furthermore, venture capital firms such as Galaxy and Multicoin Capital have allocated $1 billion to fund projects within the Solana ecosystem, ensuring its continued expansion and innovation. Finally, the evolving regulatory landscape remains crucial. The establishment of the Solana Policy Institute and the SEC's apparent shift in its stance on SOL are positive developments that could reduce regulatory uncertainty and foster a more favorable environment for investment.

Solana's Chinese Name

To strengthen its brand and foster community in one of the world's largest markets, Solana officially announced its Chinese name as "索拉拉" (Suǒ lā lā) in October 2025. The name was chosen through a community-driven contest and is intended to enhance the project's cultural resonance and accessibility for Chinese-speaking users, similar to the role Ethereum's Chinese name "Yi Ta Fang" played in its adoption across Asia .

Conclusion

Solana has firmly established itself as a high-performance blockchain capable of supporting a vast and diverse ecosystem of decentralized applications. Its unique technological architecture, which enables blazing-fast speeds and minimal costs, provides a compelling value proposition for developers and users alike. The network's robust tokenomics, characterized by a high staking rate and a disinflationary model, promotes security and long-term value accrual for SOL. With continuous technical improvements on the horizon and the potential for a landmark ETF approval, Solana is well-positioned for the next phase of growth.

While the cryptocurrency market is inherently volatile, the confluence of strong fundamentals, accelerating institutional adoption, and a clarifying regulatory environment suggests a promising future for Solana. Its journey reflects the broader maturation of the blockchain industry, moving from speculative asset to foundational technology. As Solana continues to bridge the gap between decentralized and traditional finance, it stands as a key protocol to watch in the coming years.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.