One project that is generating significant buzz is

YieldBasis (YB)

, a protocol launched by Michael Egorov, the founder of Curve Finance. With its ambitious goal of eliminating impermanent loss—a fundamental pain point for liquidity providers—YB has attracted substantial attention and investment ahead of its recent exchange listings. This article explores YB's core technology, tokenomics, and market potential, providing a thorough overview of this intriguing DeFi innovation.

What is YieldBasis?

YieldBasis (YB) is a decentralized finance protocol engineered to boost capital efficiency and yield generation for Bitcoin and Ethereum holders . Founded by Michael Egorov, the creator of Curve Finance, YB represents another attempt to solve core DeFi challenges using sophisticated mechanism design .

The protocol enables users to deposit BTC or ETH to earn trading fees while mitigating the risk of impermanent loss through an automated market maker (AMM) mechanism . Operating across Ethereum and BNB Smart Chain, YB offers a more stable and accessible way for users to earn optimized, sustainable yields in DeFi .

YB launched in early 2025 on the Ethereum mainnet, using Curve's crvUSD and leverage to enhance returns while maintaining risk control through deep liquidity and proven infrastructure . The protocol has already secured significant support, including a $60 million crvUSD credit line from Curve DAO specifically for launching Bitcoin liquidity pools.

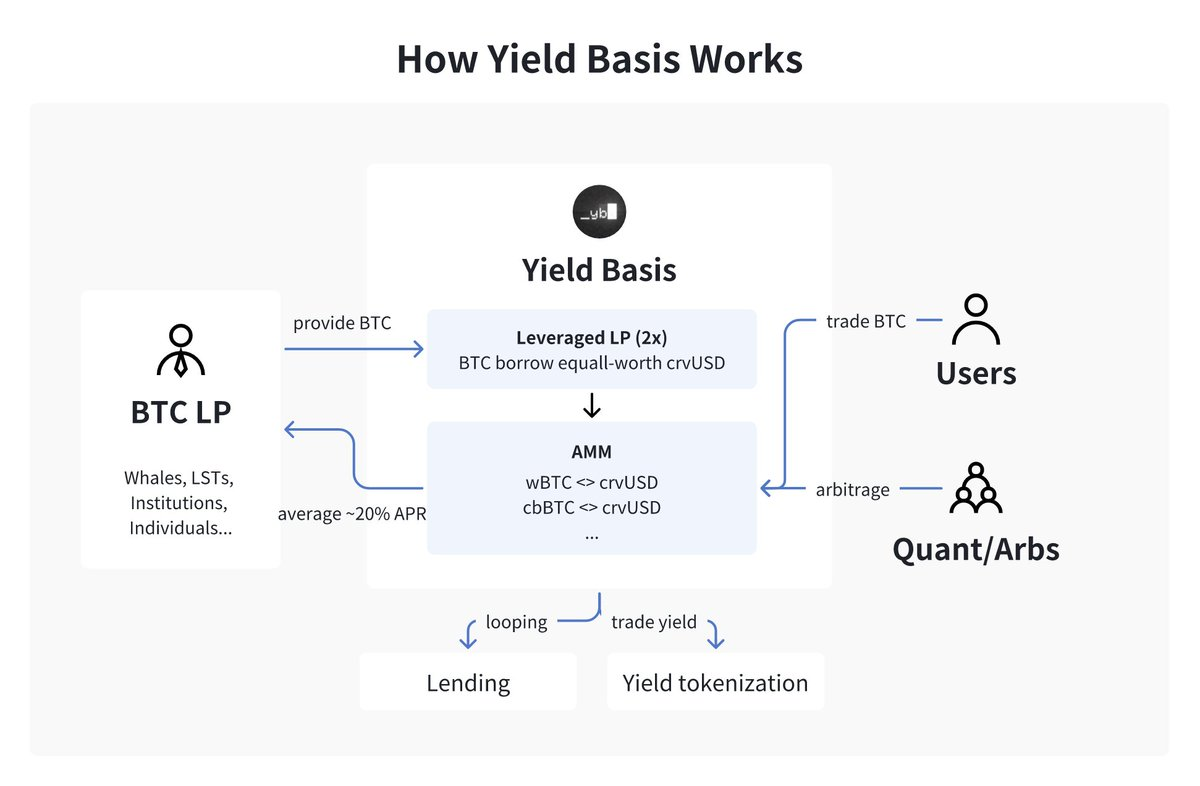

The Core Mechanism of YB

Solving Impermanent Loss Through Leverage

YieldBasis employs several innovative mechanisms to address impermanent loss, with its

"Leveraged Liquidity"approach being central to its value proposition . The protocol utilizes a delta-neutral approach to mitigate impermanent loss, effectively turning volatility into manageable funding risk .

The system is built around two key components:

-

2x Leveraged AMM Structure: This mechanism enables LP positions to track BTC price on a 1:1 basis, effectively eliminating the asset shrinkage problem typically caused by price fluctuations .

-

Automated Rebalancing System: The protocol automatically conducts arbitrage operations to ensure user exposure remains aligned with spot prices, reducing the need for manual management .

How the System Operates

The user experience with YB is intentionally straightforward, encompassing three simple steps: deposit tokens, earn yield, and exit when desired . The technical process, however, involves several sophisticated stages:

-

Users deposit BTC, and the protocol mints ybBTC

-

The protocol automatically borrows crvUSD and deposits it into Curve pools

-

Users can either hold un-staked ybBTC to receive BTC trading fee收益 or stake ybBTC to receive YB token rewards

-

Upon exit, users burn ybBTC, and the system automatically closes positions, repays debt, and returns BTC plus accumulated interest

This automated process eliminates the need for manual leverage maintenance or risk management, allowing users to simply deposit BTC and enjoy automated leveraged yields.

Why YieldBasis Stands Out

Addressing a Critical DeFi Challenge

Impermanent loss remains one of the most significant barriers to broader participation in DeFi liquidity provision, particularly for institutional players and large BTC/ETH holders . By specifically targeting this pain point, YB addresses a genuine need within the ecosystem rather than offering incremental improvements.

The protocol's value proposition is particularly relevant for long-term BTC and ETH holders who wish to maintain asset exposure while earning additional yield—without taking on additional volatility risk .

Strong Founder Pedigree and Ecosystem Support

Michael Egorov's involvement provides immediate credibility to the project, given his proven track record with Curve Finance . This founder advantage has translated into tangible ecosystem support, most notably the $60 million crvUSD credit facility from Curve DAO .

The deep integration with Curve's ecosystem provides YB with instant liquidity depth, an established user base, and proven technical infrastructure . This relationship is further reinforced by the allocation of 7.5% of YB tokens directly to Curve DAO .

Market Reception and Performance Expectations

Even before its official exchange listings, YB demonstrated remarkable market demand. The token saw

7x oversubscription on Legion platform and significant premium in pre-trading markets, with prices reaching $1.4 compared to the institutional financing price of $0.20 .

Based on backtested data, YB aims to provide target APY between 10-20% for liquidity providers, substantially higher than traditional AMMs while mitigating the main risk factor.

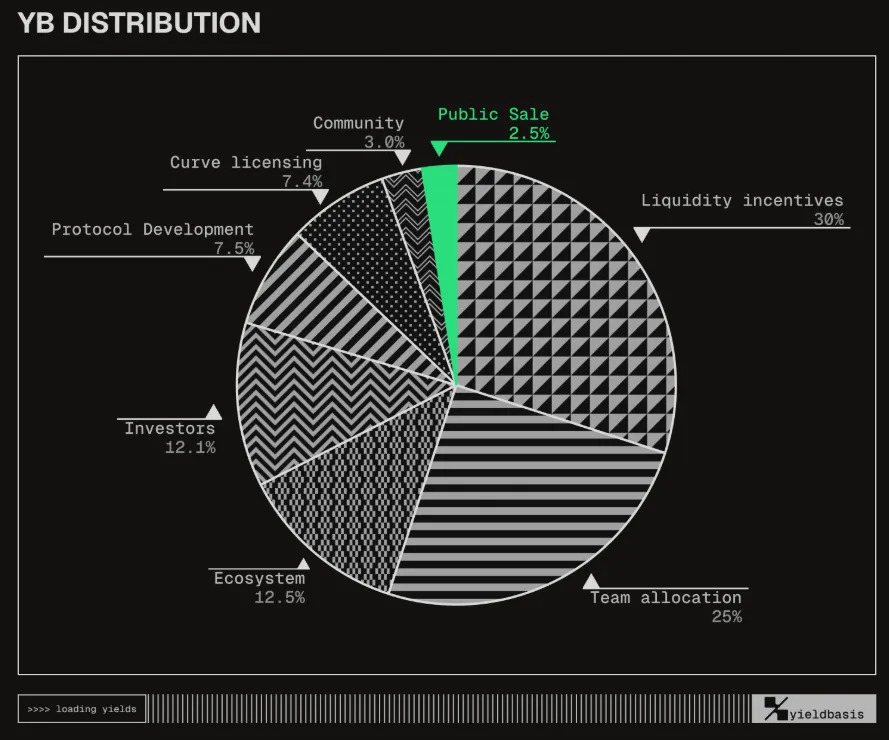

Tokenomics: Understanding YB's Economic Model

YieldBasis features a fixed total supply of

1 billion YB tokens, with approximately 300 million (30%) circulating at launch . The token distribution follows a carefully balanced structure designed to align incentives across different stakeholders:

veYB Governance Model

Similar to Curve's veTokenomics, YB implements a vote-lock mechanism where users can lock their YB tokens to receive veYB . This model aims to align long-term incentives and promote protocol stability by offering:

-

Governance Rights: Voting power on protocol parameters, fee structures, and liquidity incentive directions

-

Fee Sharing: veYB holders receive distributions from protocol fees

-

Yield Multipliers: Locking YB can boost rewards by up to 2.5x compared to standard staking

The lockup mechanism is designed to encourage long-term thinking and reduce selling pressure from token holders seeking quick profits.

Use Cases and Features

Primary Applications

YB serves several distinct use cases within the DeFi ecosystem:

-

Loss-Free Liquidity Provision: BTC holders can provide liquidity to earn passive fees without exposure to impermanent loss

-

Institutional Treasury Management: Organizations can tokenize treasury positions while earning yield on otherwise idle assets

-

Yield Optimization: Users can stake veYB to maximize returns through the protocol's multiplier effects

-

Hedging Strategies: Maintain BTC exposure while earning additional yield without taking on significant price risk

Protocol Features

Key features that distinguish YB from traditional liquidity provision protocols include:

-

Zero Impermanent Loss Design: The core innovation of using leveraged liquidity to neutralize IL

-

Full Automation: Users deposit assets and the system handles all complex operations automatically

-

Multi-Chain Operation: Deployment on both Ethereum and BNB Smart Chain for broader accessibility

-

Sustainable Yield Generation: Returns sourced primarily from trading fees rather than inflationary token emissions

Should You Invest in YB?

Investment Considerations

YB presents a compelling but complex investment case with several conflicting factors to consider:

Bullish Factors:

-

Addresses a genuine, persistent pain point in DeFi

-

Strong founder pedigree with proven DeFi expertise

-

Deep Curve ecosystem integration provides immediate liquidity and user base

-

High market demand evidenced by 7x oversubscription and significant pre-listing premiums

Risk Factors:

-

High Initial Valuation: With a fully diluted valuation of $1.4 billion at launch and a 7x premium to institutional prices, much optimism may already be priced in

-

Technical Execution Risk: The novel mechanism remains unproven at scale; any implementation issues could significantly impact token value

-

Token Unlock Pressure: Team and investors collectively hold 50% of tokens, creating potential future selling pressure as locks expire

-

Ecosystem Dependency: Deep integration with Curve creates potential contagion risk if Curve itself faces challenges

Investment Approaches

Different investor profiles might consider distinct approaches:

Short-term Traders: Given the significant pre-listing premiums, short-term traders might consider taking profits if prices spike substantially above pre-listing levels

Long-term Investors: Those believing in the protocol's long-term potential might wait for product validation through TVL growth and protocol revenue metrics before establishing positions

Risk Management: Given YB's early stage and high valuation, position sizing should reflect the elevated risk profile, with investments limited to capital that investors can afford to lose

Conclusion

YieldBasis represents an ambitious attempt to solve one of DeFi's most persistent challenges, impermanent loss through innovative mechanism design and leveraged liquidity. The project benefits tremendously from its founder's pedigree, deep Curve ecosystem integration, and early market enthusiasm.

However, the protocol faces significant challenges, including its high initial valuation, unproven technology at scale, and future token unlock overhangs. While the fundamental value proposition addresses a genuine market need, investors should carefully consider both the potential rewards and substantial risks.

As with many innovative DeFi protocols, YB's long-term success will depend on its ability to deliver on its technological promises, achieve meaningful adoption, and generate sustainable protocol revenue, all while navigating an increasingly competitive and regulated landscape.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.