The cryptocurrency market has witnessed a historic moment as Bitcoin (BTC), the flagship digital asset, shattered its previous all-time high (ATH) record set in August 2025. After weeks of consolidation, Bitcoin embarked on a powerful rally in early October 2025, catapulting to unprecedented price levels over $126,000. This remarkable surge reignited bullish sentiment across the digital asset landscape, with market capitalization scaling new peaks and institutional interest reaching fever pitch.

The breakthrough, which saw Bitcoin's valuation momentarily overtake corporate behemoths like Amazon, underscores the asset's growing stature in the global financial ecosystem. This report delves into the dynamics behind Bitcoin's record-breaking performance, analyzing the key drivers, market sentiment, and expert projections shaping its trajectory. As Bitcoin enters what is historically its strongest seasonal period, the rally highlights a potent mix of institutional adoption, macroeconomic factors, and technical momentum fueling its ascent.

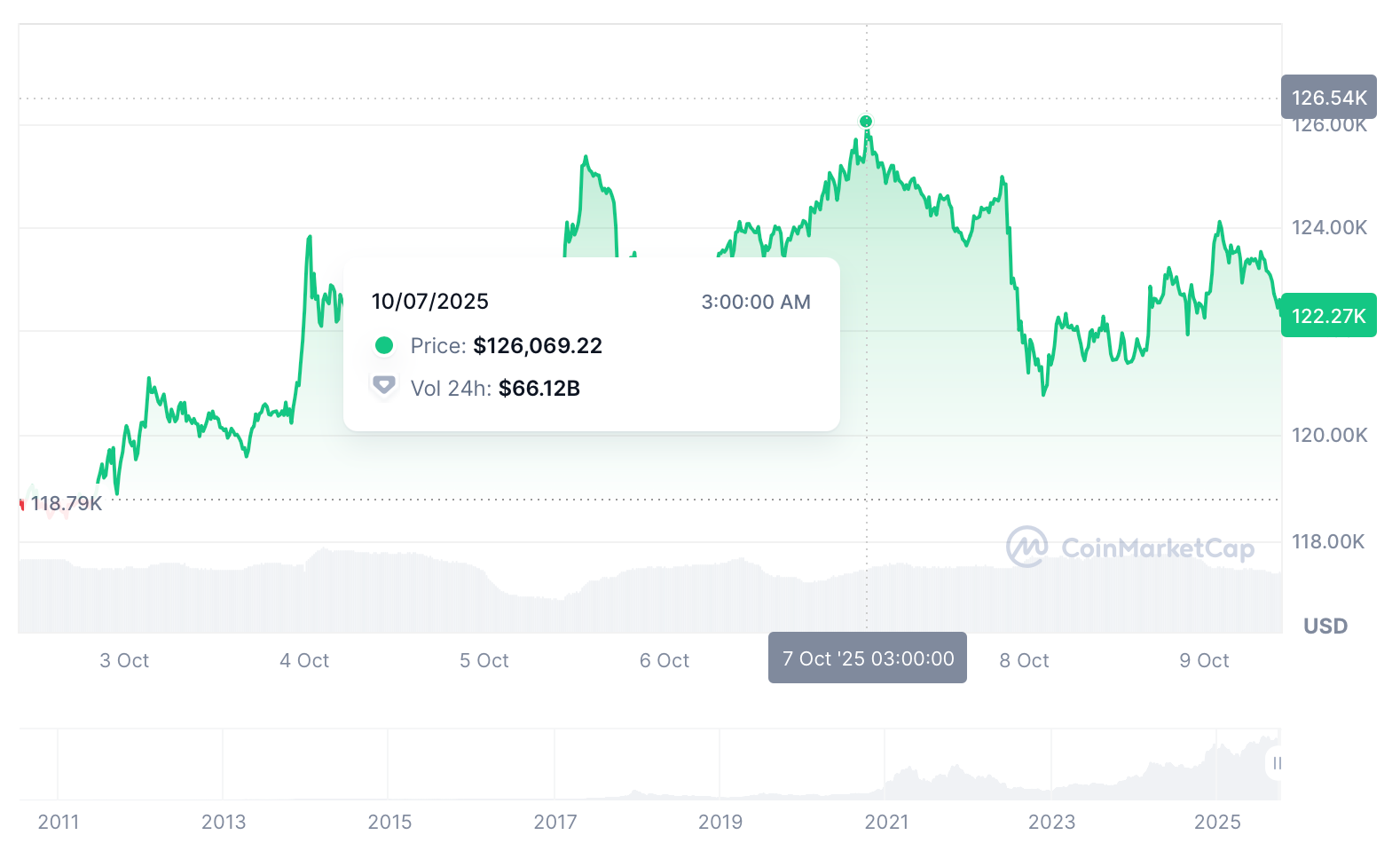

BTC price reaches $126,000 on October 7th. Source: CoinMarketCap

Bitcoin's Price Breakthrough

After nearly two months of extended consolidation, during which

BTC even dipped below $110,000 on several occasions, the asset staged a spectacular rally in the first week of October 2025. Bitcoin finally snapped out of its sideways trajectory, decisively breaking past its August peak of approximately $124,480. The cryptocurrency rocketed to just under $126,000 on Binance during the early trading hours of Sunday, October 5, marking a significant milestone.

The price action throughout September had been volatile. Bitcoin initially spiked to $118,000 following the U.S. Federal Reserve's interest rate cut, but the momentum proved short-lived as prices retreated below $109,000 within a week. However, the latter part of September and early October saw a dramatic reversal. From September 29 to October 3, Bitcoin added over $10,000, setting the stage for the final push past its previous record. According to Bitcoin Magazine Pro, Bitcoin climbed over 13% in just one week, bouncing back from $109,000 at the end of September to a staggering $125,750.

This price surge propelled Bitcoin's market capitalization to approximately $2.5 trillion, briefly surpassing Amazon's market valuation and inching closer to silver's market cap among global assets. The rally demonstrated remarkable resilience, with Bitcoin flipping the $120,000 resistance level into support—a critical psychological and technical barrier that had capped price advances multiple times since mid-August.

Key Drivers Behind the Rally

Institutional Demand and ETF Inflows

A monumental wave of institutional demand, particularly through U.S.-listed spot Bitcoin ETFs, served as the primary catalyst for Bitcoin's record-breaking performance. Reports indicated weekly net inflows into these funds reached approximately $3.24 billion—the largest influx for 2025 and the second-largest in history. This substantial institutional participation underscores a shifting landscape where traditional finance channels are becoming significant conduits for Bitcoin exposure.

The impressive ETF flows coincided with notable developments in the product ecosystem. BlackRock's expansion of Bitcoin ETP offerings in the U.K. further signaled growing institutional adoption. As one analyst noted, "This rally has pushed Bitcoin back into the conversation alongside major asset classes," highlighting the asset's ongoing maturation within the global financial system.

Macroeconomic Factors

Macroeconomic developments created a favorable backdrop for Bitcoin's ascent. The U.S. Federal Reserve's interest

rate cut in September, which lowered the federal funds rate to 4%-4.25%, initiated a global liquidity easing cycle that traditionally benefits non-traditional assets like Bitcoin. Additionally, the U.S. government shutdown that commenced on October 1 triggered safe-haven flows, with investors seeking alternatives to traditional assets during periods of fiscal uncertainty.

Geoffrey Kendrick, head of digital assets at Standard Chartered, emphasized the significance of the government shutdown, noting, "This year Bitcoin is trading with 'U.S. government risk,' best reflected in its relationship with the U.S. Treasury term premium". This sentiment was echoed by market observers who noted that Bitcoin's role as a potential "digital gold" was being amplified by the fiscal gridlock in Washington.

Seasonal Trends and Market Sentiment

The timing of Bitcoin's breakout aligned with what traders colloquially refer to as "Uptober"—a period where Bitcoin has historically produced strong positive returns. Analysts pointed out that over the past decade, October has consistently generated average returns exceeding 21%, creating a favorable seasonal setup for continued strength. This historical pattern, combined with the technical breakout above key resistance levels, created a powerful momentum that attracted both retail and institutional participants.

Market Impact and Reaction

Liquidation and Volatility

The violent price movement triggered significant market liquidations. According to

Coinglass data, the crypto market witnessed total liquidations of $394 million during the rally, with short positions bearing the brunt of the damage. The volatility continued as Bitcoin reached its peak, with subsequent reports indicating that over 170,000 traders were liquidated in 24 hours as Bitcoin retreated from its highs, resulting in total liquidation amounts of $645 million.

Despite these substantial figures, some analysts noted that the liquidation volume was "significantly lower than during previous high-volatility periods," suggesting that "the driving force came more from spot funds and institutional allocation than from high-leverage speculation". This indicates a potential maturation in market structure, with less reliance on excessive leverage compared to previous cycles.

Altcoin Performance and Sector-Wide Gains

Bitcoin's record-breaking performance created a rising tide that lifted most vessels in the crypto harbor. Ethereum (

ETH), the second-largest cryptocurrency, gained nearly 14% to trade around $4,500, briefly reaching as high as $4,600 and renewing hopes for a push toward $5,000 by year-end. The altcoin market broadly participated in the rally, with

XRP up 9%, Solana up 17%, and Dogecoin up 14% over the same period.

The decentralized finance (DeFi) sector also benefited from bullish momentum, adding nearly $18 billion to the total value locked (

TVL) in protocols, bringing the total to approximately $169 billion. This synchronous performance across multiple crypto sectors demonstrated the pervasive bullish sentiment emanating from Bitcoin's breakthrough.

On-Chain Data and Whale Activity

Analysis of on-chain metrics revealed intriguing patterns in investor behavior, particularly among large holders. Data from CryptoQuant highlighted that Bitcoin's "Total Whale Holdings" metric—which tracks the 30-day percentage change in Bitcoin held by whales—showed negative values through September 2025, indicating that large investors had been reducing their positions.

However, a notable shift occurred as prices stabilized near record highs. Analyst Burak Kesmeci observed that "whales have noticeably slowed their selling pace" in early October, with the "narrowing purple area in the indicator marking a gradual recovery from the negative zone". This development suggests that the most intense phase of whale distribution may be concluding, potentially paving the way for a re-accumulation phase that could support prices in the near term.

Simultaneously, the amount of Bitcoin held on centralized exchanges continued to decline, reducing the immediate sellable supply amid growing demand. This supply dynamic, coupled with substantial ETF inflows, created a recipe for sharper price movements when buying pressure intensified.

Expert Analysis and Price Projections

Following Bitcoin's record-breaking performance, financial institutions and market analysts revised their price targets to account for the strengthened outlook. Analysts at JPMorgan suggested that Bitcoin remains "undervalued compared to gold," estimating a "theoretical upside potential to $165,000" if the trend of investing in assets that hedge against fiat currency risk continues.

Geoffrey Kendrick of Standard Chartered maintained his bullish stance, indicating that "Bitcoin may reach $135,000 in the coming weeks," while reiterating his "year-end target of $200,000". Similarly, analysts at Citi Bank offered an optimistic 12-month price target of $181,000, citing Bitcoin's growing perception as "digital gold".

Technical analysts also identified potential upside targets based on chart patterns. Some pointed to Fibonacci extension levels suggesting that "Bitcoin could reach $134,000 by year-end" if the breakout momentum sustains. However, experts also cautioned about near-term risks, with QCP analysts warning that "the recent increase in leverage accompanying price volatility has raised the risk of a 'sharp collapse,' similar to what happened two weeks ago when nearly $3 billion in long positions were liquidated in the cryptocurrency market".

Conclusion

Bitcoin's surge to a new all-time high near $126,000 represents more than just a numerical record—it signifies the cryptocurrency's evolving role in the global financial landscape and its growing acceptance as a legitimate asset class. The rally, fueled by substantial ETF inflows, favorable macroeconomic conditions, and historical seasonal trends, demonstrates the maturation of Bitcoin's market structure through increased institutional participation.

While the path forward may include expected volatility and potential corrections, the fundamental backdrop remains supportive for continued strength. As Bitcoin cements its position among the world's premier assets, its performance will likely continue to influence broader digital asset markets and traditional finance alike. For investors, Bitcoin's record-breaking achievement underscores the importance of understanding both the opportunities and risks inherent in this dynamically evolving asset class.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.