The cryptocurrency world witnessed a remarkable event in late September 2025 when Hyper Foundation, the organization behind the decentralized exchange Hyperliquid, completed the distribution of 4,600 Hypurr NFTs. These cat-themed digital collectibles, awarded to early platform supporters, immediately reached staggering valuations, with floor prices exceeding $68,000 and one rare piece selling for approximately $467,000. The narrative of a "free" NFT potentially yielding life-changing profits sparked widespread fascination and debate. This article explores the origins, distribution mechanics, market performance, and future implications of Hypurr NFTs, examining whether they represent a transformative community-building tool or a speculative bubble fueled by hype.

Project Background

Hypurr NFTs are intrinsically linked to Hyperliquid, a high-performance Layer-1 blockchain specializing in decentralized trading and derivatives. The network operates on a custom consensus mechanism called HyperBFT, optimized for low-latency transactions. A key component of its architecture is HyperEVM, an innovative execution layer that facilitates bidirectional communication between Ethereum Virtual Machine (EVM)-compatible smart contracts and Hyperliquid's core trading infrastructure. This design allows developers to build advanced DeFi applications, such as lending protocols and vault tokenization, directly atop Hyperliquid's deep native liquidity.

The NFTs were introduced during Hyperliquid’s Genesis Event in November 2024, a milestone campaign marking the launch of the platform’s native HYPE token and the HyperEVM environment. Unlike typical NFT projects that involve public minting phases, Hypurr was conceived exclusively as a commemorative gift for early adopters who actively participated in the ecosystem before its mainstream expansion.

Distribution Mechanics

The distribution of Hypurr NFTs was highly selective and automated. From the total supply of 4,600 NFTs :

-

4,313 were allocated to participants in the Genesis Event.

-

144 were reserved for the Hyper Foundation.

-

143 were distributed to core contributors, including developers and artists.

Eligibility was not universal. Only the top 5,000 Platinum-tier users from Hyperliquid’s inaugural trading season were presented with a critical choice: claim only the HYPE token airdrop or claim both the tokens and the Hypurr NFT. This "two-option" design meant that many eligible users inadvertently forfeited their NFT claim, a decision that later carried a significant opportunity cost. The distribution was conducted permissionlessly, with NFTs airdropped directly to qualified wallets without any required minting action.

To ensure fairness, Hyper Foundation implemented sophisticated anti-Sybil measures. These included clustering analyses and risk assessments to prevent any single entity from accumulating multiple NFTs through fraudulent means, thereby promoting broader distribution among genuine users.

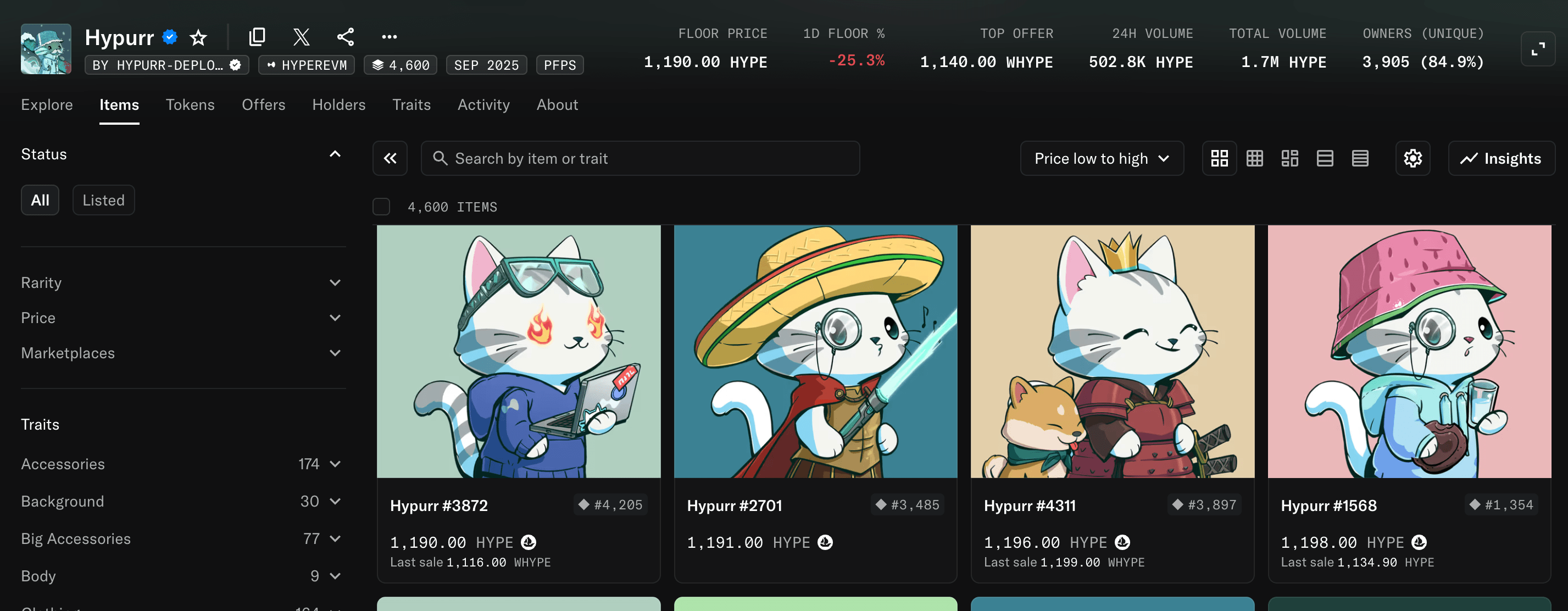

Market Performance and Initial Price Discovery

Upon distribution on September 28-29, 2025, the Hypurr NFT collection immediately captured market attention with its extraordinary valuation. The floor price—the lowest listed price for an NFT in the collection—rapidly ascended to $68,700-$76,000. Total trading volume surged to approximately $45 million within the first 24 hours on leading marketplaces like OpenSea.

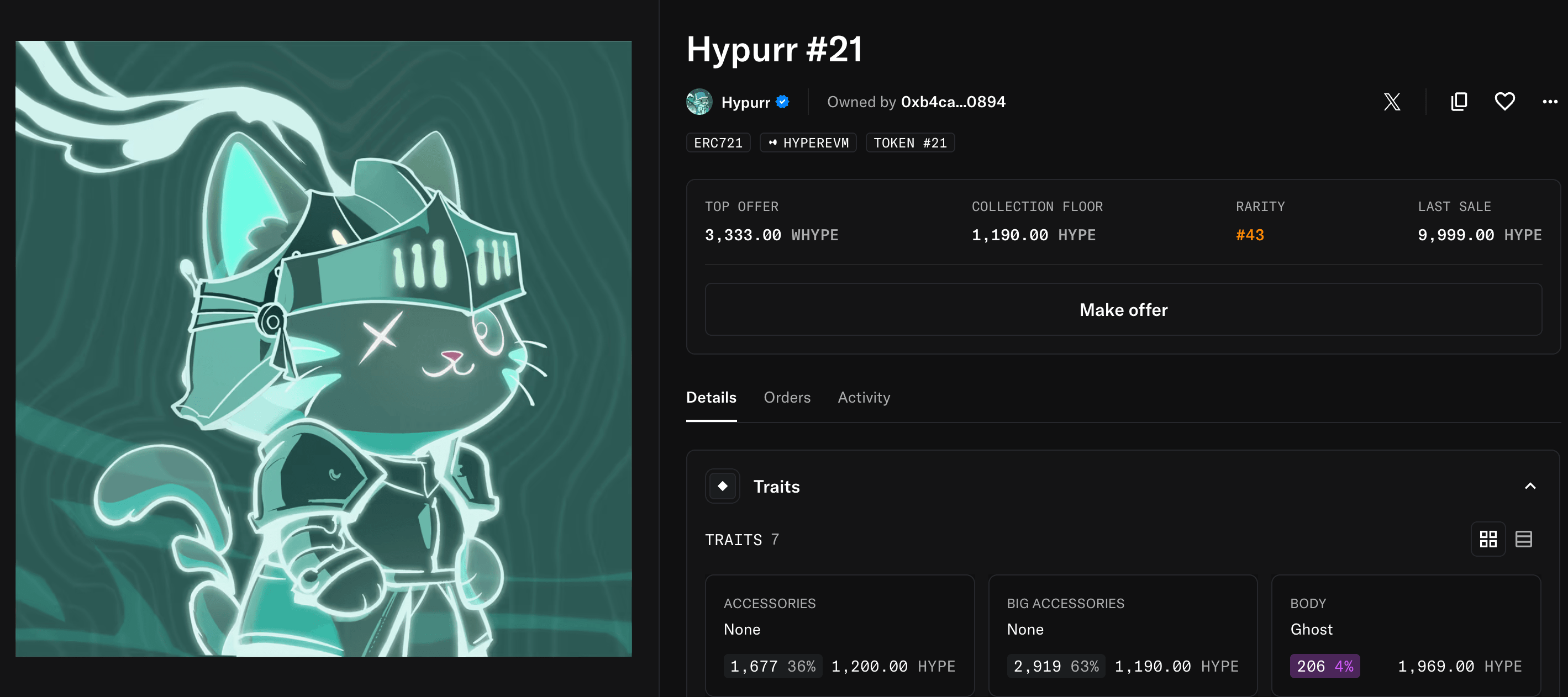

The most notable sale involved Hypurr #21, a rare NFT featuring "Knight Ghost Armor" traits, which was acquired for 9,999 HYPE tokens, equivalent to about $467,000 at the time of the transaction. This sale underscored the premium that collectors place on NFTs with rare attributes.

Price discovery began even before official distribution through platforms like DripTrade, which facilitated over-the-counter (OTC) pre-sales. Some NFTs traded for $88,000 OTC via collateralized agreements that obligated sellers to deliver the NFT upon receipt. This early trading activity demonstrated intense demand and speculative interest from large investors and crypto whales.

Utility and Value Proposition

A defining characteristic of Hypurr NFTs is the absence of officially promised utility. Hyper Foundation has explicitly stated that the collection has "no planned utility" and functions primarily as a community membership badge and commemorative artifact. Each NFT features unique artistic designs that reflect diverse community moods, hobbies, and traits, with lower ID numbers often corresponding to higher rankings in Hyperliquid’s early leaderboards, enhancing their prestige and rarity.

Despite the lack of official commitments, market speculation about future benefits is a significant driver of value. Community discussions frequently hypothesize about potential perks, such as priority access to future airdrops, governance rights, fee discounts on the Hyperliquid exchange, or exclusive access to new product launches. It is crucial to note, however, that these potential benefits remain speculative and are not guaranteed by the protocol.

From a technical perspective, because Hypurr NFTs reside on HyperEVM, they inherently possess the potential to be integrated into the platform’s DeFi ecosystem. Future applications could include using the NFTs as collateral in lending protocols or incorporating them into vault tokenization systems.

Risks and Challenges

The Hypurr NFT phenomenon is not without substantial risks. Shortly after distribution, a security breach led to the theft of eight Hypurr NFTs, worth an estimated $400,000, from compromised wallets. This incident highlighted persistent security vulnerabilities in the digital asset space.

Furthermore, the Hyperliquid ecosystem has faced recent security scrutiny, including a $773,000 exploit in the HyperDrive protocol and a $3.6 million rug pull in HyperVault. These events have raised questions about the overall security posture of projects building on the network.

The speculative nature of the NFT's value represents another significant risk. With no confirmed utility, its high valuation is largely supported by community sentiment and expectations of future benefits. A failure to meet these unofficial expectations could trigger a sharp price correction.

Market dynamics also present challenges. Although the holding distribution is relatively decentralized—with 4,031 unique holders representing 87.6% distribution dispersion, this broad distribution could lead to fragmented liquidity if many holders decide to retain their assets long-term. Additionally, the impending unlock of $12 billion worth of HYPE tokens in late 2025 could exert downward pressure on the token's price, potentially indirectly affecting NFT valuations denominated in HYPE.

Conclusion

Hypurr NFTs represent a fascinating case study in modern crypto community building. They successfully created immense economic value for early Hyperliquid adopters, generated significant ecosystem buzz, and demonstrated the potent combination of decentralized finance with digital collectibles. The project highlights how cultural significance and community status can drive valuation independently of concrete utility.

However, the long-term sustainability of Hypurr's value remains uncertain. Its future will likely be determined by several factors: the evolution of the Hyperliquid ecosystem, potential third-party utility integrations, and broader NFT market trends. For now, Hypurr stands as a powerful symbol of the rewards available to early blockchain adopters, a digital trophy that encapsulates the high-risk, high-reward nature of the cryptocurrency frontier. Whether it evolves into a cornerstone of the Hyperliquid community or becomes a footnote in NFT history will depend on how both the project and the market mature in the coming years.

References: