Originally launched in 2017 as "Binance Coin," BNB has undergone a remarkable transformation, evolving from a simple utility token offering trading fee discounts into the native currency of one of the world's most utilized blockchains. This journey reflects both the innovative spirit of cryptocurrency space and the strategic vision of its creators. As we explore BNB's multifaceted nature, we will examine its technological foundations, diverse use cases, economic models, and future prospects, providing a comprehensive understanding of its significant role in the digital asset landscape. The continued expansion of the BNB Chain ecosystem and its ambitious 2025 technical roadmap position BNB as a cryptocurrency worthy of examination for anyone interested in the intersection of centralized finance and decentralized blockchain technologies.

What's BNB (Binance Coin)?

BNB was originally an ERC-20 token deployed on Ethereum. Its public launch took place on July 26, 2017, through an initial ICO by the Binance exchange. The initial circulating supply of BNB was 200 million, with the project holding 40%, angel investors holding 10%, and the remaining 50% being sold to the public at a price of 0.15 U.

In April 2019, Binance launched Binance Chain (BC) to develop more decentralized infrastructure and, as a key builder within the ecosystem, provide maximum resources and support. With the launch of Binance Chain, BNB tokens, originally deployed on Ethereum, were converted to BEP-2 tokens on Binance Chain through a 1:1 exchange, becoming the ecosystem token for Binance Chain and used to pay for on-chain transaction fees on both Binance Chain and the later launched Binance Smart Chain (BSC).

Regarding the total supply of BNB, an automatic burn mechanism is implemented. BNB is burned quarterly based on the price of BNB and the number of blocks produced on the BSC chain, until the total supply reaches 100 million. The entire burn process is transparent and can be viewed on the official website or through blockchain explorers. As of now, the total circulating supply of BNB is approximately 139 million.

What's BNB Smart Chain?

BNB Chain is a decentralized and community-driven ecosystem. Initially, it consisted of two major components - the BNB Beacon Chain (handling BNB Chain governance, including staking and voting) and the BNB Smart Chain (EVM-compatible execution chain). However, the BNB Beacon Chain will soon sunset, and all of its functionalities will be transferred to the BNB Smart Chain (BSC).

The modern version of the BNB Chain is multichain architecture consisting of three major components:

BSC: A layer-1 platform that offers robust EVM compatibility and a Proof-of-Stake Authority consensus model.

opBNB: A Layer 2 solution built using the OP Stack. Delivering high performance, processing 5-10K TPS

BNB Greenfield: Focuses on decentralized data storage with enhanced privacy and security.

How Does BNB Serve as a Utility Token?

BNB is primarily used as a utility token on the Binance platform, providing a considerable discount in fees for various trading options.

Trading fee reductions: Users benefit from a 25% discount on spot and margin trading fees and a 10% reduction on futures trading fees.

Alongside trading fee reductions, BNB offers a broad range of advantages across the Binance environment and crypto space.

BNB Vault and Binance Launchpool: Users can stake BNB to earn rewards through the BNB Vault or engage in token farming opportunities on Binance Launchpool.

Binance Launchpad: BNB holders can access exclusive token sales on Binance Launchpad, often involving early-stage blockchain projects.

Binance Pay: Binance Pay is a cryptocurrency payment technology designed by Binance. Shop with crypto or send crypto to friends and family worldwide.

Binance Loan: Users can apply for crypto loans using BNB as collateral, providing flexibility in managing their crypto assets.

Staking and Yield Earning: Staking BNB contributes to securing the BNB Chain ecosystem, and users can earn a flexible percentage yield by depositing BNB on select BNB Chain projects.

BNB has implemented an auto-burn system that's designed to reduce the total supply to 100,000,000 BNB. This program is based on BNB's cost and the total number of blocks produced on BSC in any quarter, providing visibility and reliability to its users.

What Are the Key Factors of BNB Tokenomics?

The Binance ecosystem's native token, BNB, has a distinct tokenomics-based economic model influencing its value and market activity.

BNB Overview:

Ticker: BNB

Blockchain: Binance Chain & Binance Smart Chain

Consensus Mechanism: Tendermint

Total Supply: 139.18M BNB

Max Supply: 200,000,000 BNB

Circulating Supply: 139.18M BNB

Token Allocation

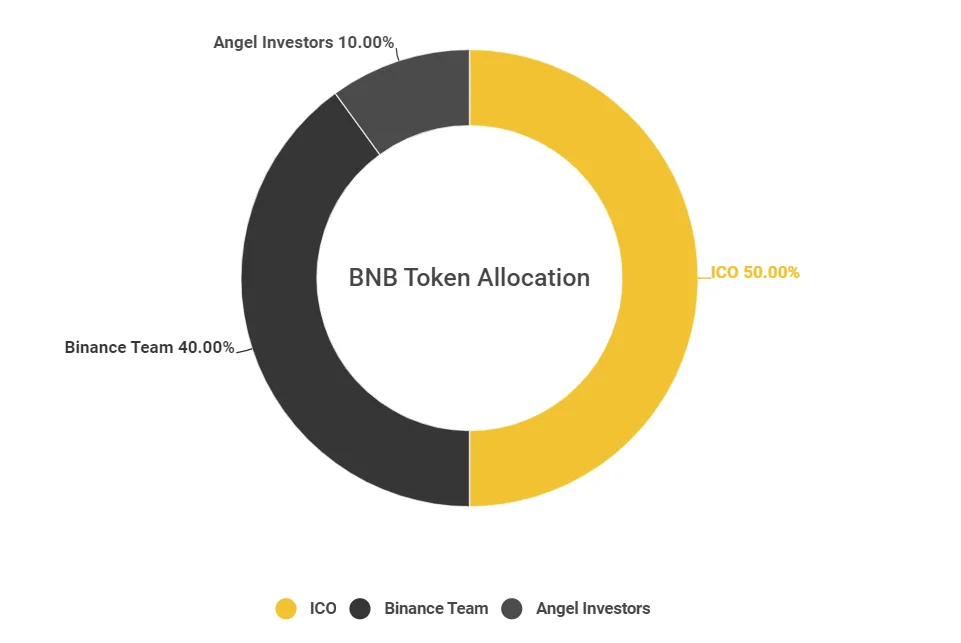

Initially, BNB had a total supply of 200,000,000, distributed as follows:

ICO: 50% – 100,000,000 BNB

Binance Team: 40% – 80,000,000 BNB

Angel Investors: 10% – 20,000,000 BNB

The finite amount of 200 million BNB tokens that were pre-mined is a critical factor in the value of BNB, with no more tokens ever being generated.

Key aspects of BNB's tokenomics include:

Token Standards

Binance supports two token standards: BEP2 and BEP20. BEP2 tokens are used for transaction fees and staking on the Binance Chain (BNB Beacon Chain). Meanwhile, BEP20 tokens are used on the Binance Smart Chain to support smart contract capabilities and other blockchain operations.

Token Burn Mechanism

BNB applies an "auto-burn" method with the goal of reducing the total amount of BNB to 100 million. This system controls the amount of BNB consumed depending on the price of BNB and the amount of blocks produced in the BNB Smart Chain per quarter. This auto-burn mechanic guarantees a deflationary supply, potentially raising the value of BNB over time.

These features of BNB's tokenomics, including a capped supply and a deflationary burn mechanism, are designed to sustain its long-term value and stability in the cryptocurrency market.

CZ's Personal BNB Holdings and Net Worth

Changpeng Zhao (CZ), the founder of Binance, holds approximately 64% of the circulating supply of BNB. This significant concentration of holdings highlights CZ's confidence in the Binance ecosystem and ties his personal net worth closely to BNB's success. Estimates suggest CZ's BNB holdings are valued at approximately $75.8 billion, positioning them among the wealthiest individuals globally.

CZ's portfolio allocation strategy—98% in BNB and only 1.32% in Bitcoin—demonstrates his long-term commitment to Binance. However, this concentrated investment approach raises questions about market stability during downturns, a topic that continues to be debated by analysts.

BNB Breaks $1,000 as BSC Stablecoin Market Cap Hits Record High

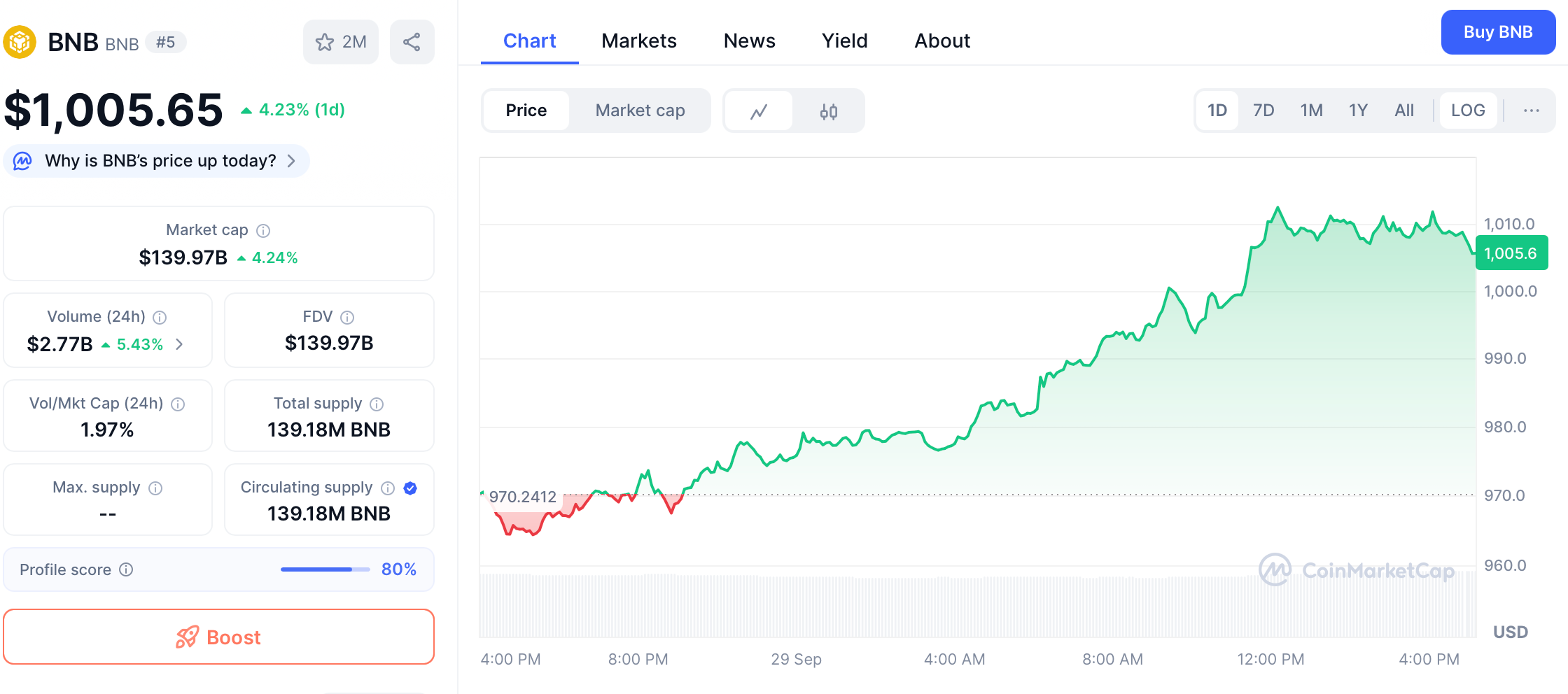

BNB Rallied and Broke Through the Key Psychological Level of $1,000 on September 29

BNB price on September 29. Source: CoinMarketCap

This price surge was not an isolated event, but rather was driven by a combination of positive regulatory developments, solid institutional inflows, and fundamental improvements within the ecosystem.

Price dynamics and market context

On September 29th, the price of BNB successfully returned to over $1,000. This rebound occurred amidst a broader cryptocurrency market rally. This price increase allowed BNB to maintain its historically high range. Previously, on September 18th, BNB had broken through the $1,000 mark for the first time, reaching a record high of $1,076.3.

Main driving factors

Improved regulatory environment: The Trump administration has adopted a more cryptocurrency-friendly policy. Meanwhile, news that Binance is in talks with the US Department of Justice to potentially end its compliance monitoring period early has significantly alleviated long-standing market concerns.

Traditional financial institutions are entering the market: global asset management giant Franklin Templeton has reached a strategic partnership with Binance to jointly develop digital asset products. Furthermore, Binance's global payment network has expanded to over 63,000 merchants, further embedding its business into mainstream financial scenarios.

Institutional hoarding: A notable trend is the acquisition of BNB by numerous listed companies and investment institutions as a strategic reserve asset, forming the so-called "BNB Treasury Company (DAT)" phenomenon. For example, the publicly listed company, now renamed BNB Network Company (BNC), holds over 418,000 BNB, while Web3 infrastructure company Nano Labs plans to invest $1 billion in BNB over three years.

Technological and Ecosystem Development: BNB Chain completed the Maxwell hard fork upgrade in June, improving network performance and reducing gas fees. Furthermore, the BNB Foundation's ongoing token burn program supports its value through a deflationary mechanism.

BSC Stablecoin Market Cap Hits Record High

DefiLlama data shows that BNB's stablecoin market capitalization currently stands at $13.22 billion, a new all-time high, and has steadily risen since early 2025. Such stablecoin activity and value increase on the BNB project suggest a bullish outlook, as it boosts network usage and can attract more users to the ecosystem, driven by Decentralized Finance (DeFi), meme coins, and payment use cases.

Stablecoins market cap ranking by chains. Source: DefiLlama

What Can We Expect in 2025?

BNB Chain’s 2025 roadmap focuses on several key areas to improve the blockchain network’s functionality and user experience.

Faster Transactions and Scalability: A major goal for 2025 is to reduce block times to sub-second speeds, improving transaction throughput. The platform aims to process up to 100 million transactions per day, making the network more scalable and efficient for both users and developers. This improvement builds on previous initiatives to enhance network performance and will address ongoing concerns about transaction delays and bottlenecks in blockchain systems.

Gasless Transactions and Payment Flexibility: BNB Chain will expand its gasless transaction functionality, allowing users to pay transaction fees using stablecoins or other supported tokens. This feature, which simplifies user experience, will extend to decentralized applications, enabling developers to cover gas fees on behalf of users, making web3 applications more accessible to a wider audience, particularly for those unfamiliar with managing gas fees.

Security and Protection Against Malicious Attacks: The platform’s continued efforts to combat Maximal Extractable Value (MEV) attacks, such as sandwich attacks, will be further strengthened. In 2025, BNB Chain’s validators will implement improvements to block voting and transaction efficiency, ensuring a more secure and fair environment for trading. These security upgrades build on the MEV protection measures already integrated into BNB Chain wallets.

AI Integration and Enhanced Developer Tools: Artificial intelligence (AI) will be more deeply integrated into BNB Chain’s ecosystem in 2025. AI-powered agents will automate tasks within decentralised applications, whilst decentralised storage solutions will provide users more control over AI-powered services. Furthermore, developers will benefit from the introduction of new AI-powered tools and SDKs to simplify the process of building dApps and enhance cross-chain liquidity.

Support for Meme Coins and Community Projects: The meme coin ecosystem, which has grown significantly within the blockchain space, will continue to receive support from BNB Chain. In 2025, the platform plans to integrate more meme tools and provide stronger support for community-driven projects, reinforcing its commitment to the diverse and evolving web3 culture.

Conclusion

BNB's journey from a simple exchange utility token to the foundation of a comprehensive blockchain ecosystem represents one of the most successful evolutions in the cryptocurrency space. This transformation demonstrates the importance of adaptability and forward planning in the rapidly changing digital asset landscape. BNB has effectively bridged the worlds of centralized and decentralized finance, creating a unique position that leverages the strengths of both approaches while offering users and developers a robust platform for various blockchain-based applications.

The future trajectory of BNB appears closely tied to several key developments, including the successful implementation of BNB Chain's 2025 technical roadmap , regulatory clarity regarding digital assets , and broader cryptocurrency market adoption. The network's focus on artificial intelligence, improved scalability, and enhanced user experience positions it well for continued relevance as blockchain technology evolves beyond its current limitations. Additionally, BNB's deflationary token economic model creates a fundamentally different value proposition compared to traditional financial assets, potentially offering protection against inflationary pressures while providing utility across multiple use cases.

For cryptocurrency participants—from developers and users to investors—understanding BNB's multifaceted nature is increasingly important given its significant role in the broader digital asset ecosystem. BNB Chain's combination of Ethereum compatibility, low transaction costs, and high throughput has made it a popular choice for decentralized application development, particularly in the DeFi, gaming, and NFT sectors . As the blockchain space continues to mature and evolve, BNB's unique position as both an exchange token and ecosystem foundation may offer insights into the future convergence of centralized and decentralized financial systems, potentially serving as a model for other projects seeking to build comprehensive blockchain ecosystems with native digital assets at their core.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.