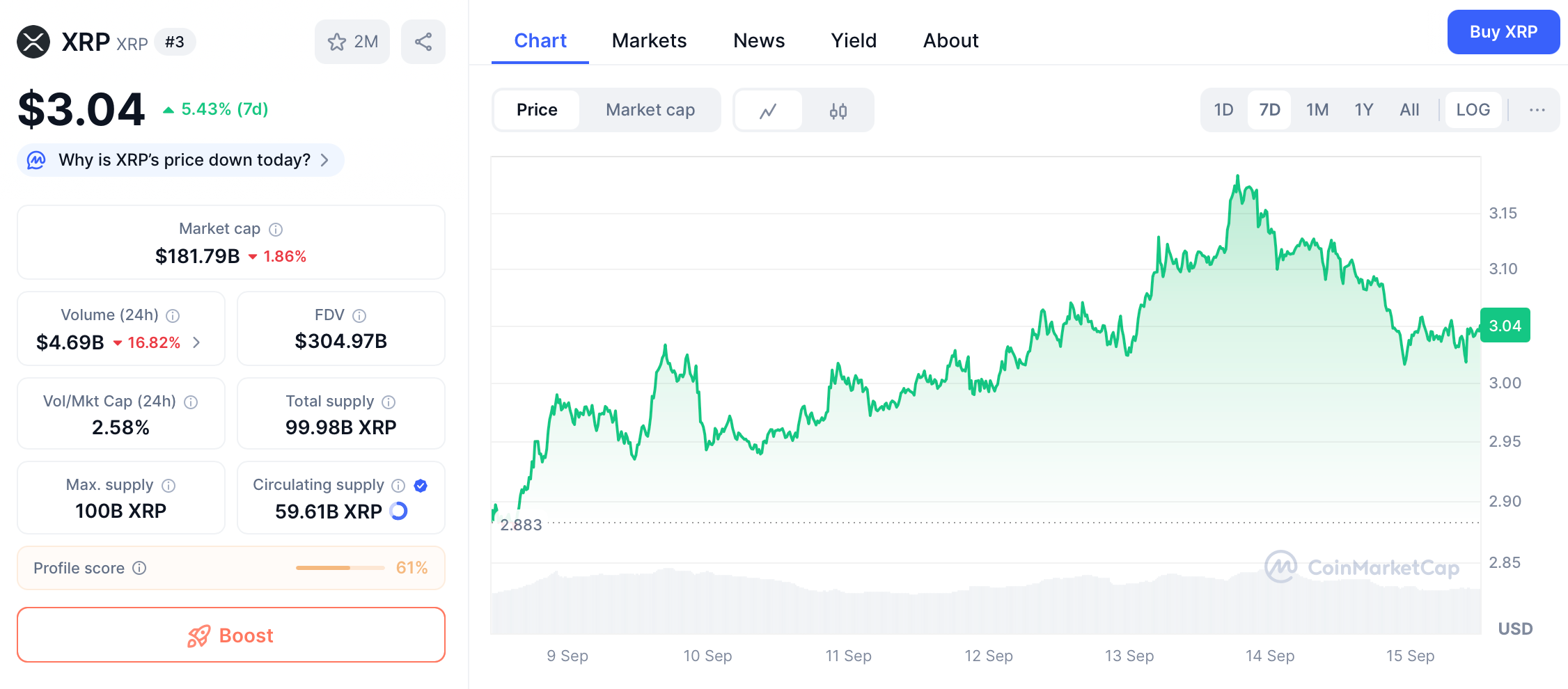

The cryptocurrency market is experiencing a significant shift in late 2025, with

XRP

emerging as one of the standout performers. As of September 2025, XRP is trading at approximately

$3.04

, showing resilience and strong upward momentum after testing support around $2.73 earlier in the month. This price surge isn't happening in isolation, it's being driven by a powerful combination of

monetary policy changes

from the U.S. Federal Reserve and growing

institutional adoption

of XRP for cross-border payments and financial services.

The convergence of these factors has created a perfect storm for XRP's valuation. With the Federal Reserve anticipating rate cuts and Ripple securing major banking partnerships globally, XRP is positioned uniquely at the intersection of traditional finance and cryptocurrency innovation. This article examines the key drivers behind XRP's recent price performance and explores what might be next for this digital asset.

XRP's Recent Price Surge

XRP demonstrated impressive performance in September 2025. After testing support around

$2.73, the cryptocurrency successfully rebounded to trade near

$3.06. This rebound followed a dramatic influx of over

1.2 billion XRP into exchange reserves on September 1, which typically signals bearish sentiment but was met with equally strong accumulation.

The network has processed

$24 million in net inflows, and the NVT ratio (which tracks valuation relative to transaction volume) has surged, indicating both increased adoption and potential short-term volatility. This combination of substantial entity accumulation and high liquidity represents a key trend for understanding XRP's recent price action.

Major Catalysts for XRP Price in September 2025

Several significant catalysts are influencing XRP's price trajectory in September 2025:

Spot XRP ETF Approval Decision: The U.S. Securities and Exchange Commission (SEC) is expected to announce its decision on multiple spot XRP ETF applications in late October 2025. Approval could fundamentally reshape institutional accessibility to XRP, potentially triggering a wave of buying similar to what followed Bitcoin's ETF approval.

Ripple's Banking Charter Application: Ripple's application for a national banking charter, also expected to be decided in late October, represents another crucial catalyst. If approved, Ripple would receive federal trust bank certification, significantly enhancing its credibility and paving the way for broader institutional adoption.

Global Expansion and Partnerships: Ripple has been actively expanding its global footprint through partnerships with major financial institutions. Notably, the deepened collaboration with Spanish banking giant BBVA represents a significant milestone under the EU's MiCA regulatory framework. This partnership will provide regulated XRP custody services to BBVA's retail customers in Spain, potentially serving as a model for other European financial institutions.

Federal Reserve Rate Cuts and Their Impact on Cryptocurrencies

The Federal Reserve's upcoming meeting on September 17, 2025, is widely anticipated to result in a

25 basis point interest rate cut. Financial markets are currently pricing in a 92% probability of this modest cut, which would represent a shift in policy amid concerns about stagflation—a problematic combination of economic stagnation and inflation.

Historically, Federal Reserve rate cuts have been favorable for cryptocurrency valuations. In scenarios like March 2020, unexpected rate cuts spurred notable rallies in Bitcoin, Ethereum, and major DeFi tokens, reflecting a strong correlation with liquidity shifts. As Shane Molidor, founder of a crypto advisory platform, noted: "Bitcoin and crypto more broadly are absorbing capital as a hedge against fiat dilution and long-term fiscal instability".

This perspective underscores the growing perception of digital assets like XRP as hedges rather than purely speculative instruments, particularly in challenging economic environments characterized by currency devaluation concerns.

Technical Analysis of XRP Price Movements

From a technical analysis perspective, XRP appears to have completed a head-and-shoulders reversal pattern against Ethereum, suggesting that its period of underperformance relative to other leading altcoins may be ending.

Key technical levels to watch include:

-

Support zone: $2.73 remains a primary level that has repeatedly prevented deeper corrections

-

Short-term resistance: A break above $3.07 could open the path toward $3.65 and $4.50

-

Intermediate targets: Chart analysis suggests potential resistance between $4.10-$4.30, with broader targets at $5.5995

Risks and Challenges for XRP

Despite the optimistic outlook, XRP faces several potential risks and challenges:

Regulatory Uncertainty: The SEC continues to review multiple XRP ETF applications, having already delayed decisions on some proposals. For instance, the Franklin Templeton XRP ETF decision was extended by 60 days to November 14, 2025. Additionally, the SEC has appealed the 2023 court ruling that determined programmatic sales of XRP did not constitute securities, creating ongoing legal ambiguity.

Market Volatility: Cryptocurrencies remain highly volatile assets, and XRP is no exception. While current indicators suggest upward momentum, sudden shifts in market sentiment could lead to significant price corrections.

Execution Risk: The realization of XRP's potential depends on successful execution of partnerships and technological developments. Any setbacks in Ripple's expansion plans or technical roadmap could negatively impact price performance.

XRP Price Prediction September 2025

Most analysts project XRP's September price prediction to be between

$2.74 (lower bound) and

$3.17(upper bound), with an average price target of

$2.96. This range reflects expectations of continued volatility but also allows for potential outperformance should positive catalyst events materialize.

Long-term bulls suggest that successful ETF approval could push XRP prices above

$5, with year-end targets reaching

$10 or higher. Some particularly optimistic analyses, such as those from Egrag Crypto, propose a "Valhalla" target of

$17 for 2025, representing a potential 3,763% increase from current levels.

DeepSeek AI has projected that XRP could reach

$9 by the end of 2025, which would represent a tripling from current price levels around $3. This prediction is based on a combination of favorable U.S. policy developments, potential spot XRP ETF approvals, and continued expansion of Ripple's institutional adoption network.

Conclusion

XRP finds itself at a critical juncture in September 2025, with multiple potential catalysts converging simultaneously. The combination of anticipated Federal Reserve rate cuts, growing institutional adoption through partnerships like BBVA, and pending regulatory decisions on XRP ETFs and Ripple's banking charter application creates a potentially powerful foundation for continued price appreciation.

While short-term technical analysis suggests a September trading range largely between $2.80-$3.20, the true upside potential for XRP likely depends on positive developments in the regulatory sphere. If the SEC approves spot XRP ETFs and Ripple secures its banking charter, these events could trigger a significant revaluation of XRP's price potential.

However, investors should remain mindful of the risks, particularly regulatory uncertainties and the inherent volatility of cryptocurrency markets. The upcoming Federal Reserve meeting on September 17 will be closely watched for its potential impact on all risk assets, including cryptocurrencies like XRP.

As with any cryptocurrency investment, thorough research and careful risk management remain essential. XRP's unique position at the intersection of traditional finance and blockchain innovation makes it one of the most interesting digital assets to watch as these developments unfold throughout September and the remainder of 2025.

References:

Gate Square. (2025, September 12). Recently, XRP price shows strong upward momentum, breaking through the $3 psychological and technical threshold to reach a new high of $3.07.

https://www.gate.com/en/post/status/13698642

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.