Uniswap stands as a cornerstone of the decentralized finance (DeFi) ecosystem, revolutionizing how users exchange digital assets without relying on traditional intermediaries. As an automated market maker (AMM) protocol primarily on the Ethereum blockchain, it has processed over $2 trillion in cumulative trading volume since its inception in 2018. In August 2025 alone, its monthly trading volume surged to a record $143 billion, highlighting its dominant position despite market volatility and a 23% price drop from its August peak. Uniswap's journey from a conceptual protocol to the largest DEX underscores its role in promoting financial inclusivity, transparency, and innovation. However, it faces ongoing challenges, including regulatory scrutiny from bodies like the U.S. Securities and Exchange Commission (SEC) and intense competition from other DeFi projects. This article explores Uniswap's technology, native token UNI, founder Hayden Adams' inspiring story, and its future trajectory in the rapidly evolving crypto landscape.

What Is Uniswap?

Uniswap is a decentralized protocol built primarily on the Ethereum blockchain that enables users to swap ERC-20 tokens without the need for a central intermediary or traditional order book. Instead, it relies on an Automated Market Maker (AMM) model, where liquidity pools—funded by users—facilitate trades algorithmically based on a constant product formula (x*y = k). This design allows permissionless trading, meaning anyone can list tokens or provide liquidity, fostering an open and accessible financial system. As of 2025, Uniswap dominates the DEX market with a 55.5% share and has expanded beyond Ethereum to its own Layer-2 solution, Unichain, to address scalability and high gas fees.

The protocol operates through multiple versions, each introducing significant upgrades:

V1 (2018): Launched as the first AMM on Ethereum, though it required all trades to route through ETH.

V2 (2020): Introduced direct ERC-20/ERC-20 pairs and flash swaps, enhancing flexibility and efficiency.

V3 (2021): Revolutionized AMMs with concentrated liquidity, allowing liquidity providers (LPs) to allocate capital within custom price ranges, boosting capital efficiency by up to 4000x.

V4 (2025): Introduced hooks (customizable smart contract plugins) and singleton contract architecture, reducing pool creation costs by 99% and enabling dynamic fee structures and on-chain limit orders.

Uniswap's governance is community-driven through its UNI token, empowering holders to vote on protocol upgrades and treasury management. Despite its success, Uniswap faces challenges, including regulatory pressures, such as the SEC's 2024 Wells Notice alleging it operates as an unregistered securities exchange and competition from rivals like Curve and PancakeSwap. Nonetheless, its commitment to decentralization and innovation continues to shape the future of DeFi.

How Does Uniswap Work?

Uniswap operates on a decentralized automated market maker (AMM) model, eliminating the need for traditional order books and intermediaries. At its core, the protocol uses liquidity pools—smart contracts holding reserves of two tokens—to facilitate trades. These pools are funded by liquidity providers (LPs) who deposit an equal value of two tokens into a pool. In return, they receive LP tokens representing their share of the pool and earn a portion of the trading fees (typically 0.3% per trade). This mechanism ensures continuous liquidity for traders while incentivizing participation.

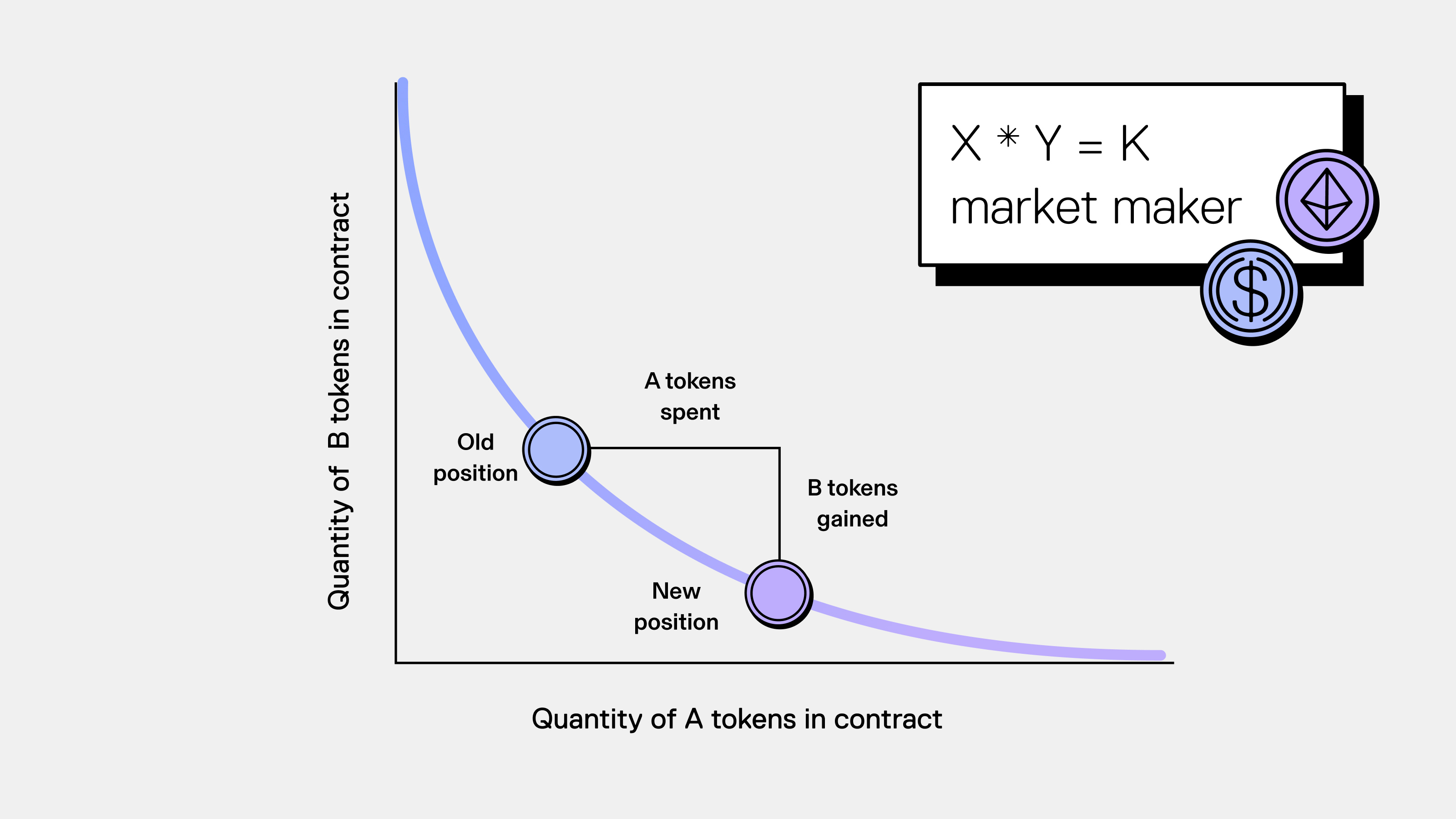

The pricing of assets on Uniswap is governed by the constant product formula x * y = k, where xand y represent the reserves of two tokens in a pool, and k is a constant. This formula ensures that the product of the reserves remains unchanged during trades, leading to predictable price slippage based on trade size relative to pool liquidity. For instance, larger trades in a small pool incur higher slippage, protecting LPs from excessive imbalances while maintaining market efficiency.

The constant product formula: x * y = k. Source: Uniswap Blog

Uniswap V3 introduced concentrated liquidity, allowing LPs to allocate capital within specific price ranges rather than across the entire price curve (0 to ∞). This innovation increased capital efficiency up to 4000x, enabling LPs to earn higher fees by focusing on active price ranges. However, it also introduced greater complexity and risk, such as impermanent loss if prices move outside their designated range, potentially leaving LPs with a less valuable asset mix. Despite this, over half of V3 LPs reportedly incurred losses after accounting for fees and impermanent loss, highlighting the trade-offs between risk and reward.

Beyond core AMM functionality, Uniswap has expanded with features like UniswapX, an intent-based protocol launched in 2023. UniswapX uses an auction system where users express trading intentions (e.g., "swap Token A for Token B at a minimum price"), and fillers compete to offer the best execution. This approach reduces gas costs for users, mitigates maximal extractable value (MEV) exploitation like sandwich attacks, and enables cross-chain swaps by integrating with bridges. Additionally, V4's hook system allows developers to embed custom logic into pools, supporting dynamic fees, limit orders, and novel AMM curves, further enhancing flexibility and user experience.

Overview of UNI Tokens

What Is UNI?

UNI is the governance token of the Uniswap protocol, introduced in September 2020 through an airdrop to early users. It serves as a cornerstone of Uniswap's decentralized governance, enabling holders to vote on key protocol decisions, such as fee structures, treasury management, and technical upgrades. With a maximum supply capped at 1 billion tokens, UNI has a circulating supply of approximately 753 million tokens as of 2025, giving it a market capitalization of around $7.47 billion and ranking it among the top 30 cryptocurrencies. Unlike utility tokens that provide direct access to services, UNI's primary value derives from its governance rights and speculative demand based on protocol performance.

Applications of UNI

UNI's main application is within Uniswap's decentralized autonomous organization (DAO), where holders propose and vote on changes to the protocol. Critical proposals include activating a "fee switch" that would divert a portion of trading fees (potentially generating over $90 million monthly) to UNI holders or the DAO treasury, though this remains a contentious topic due to regulatory concerns that it might classify UNI as a security. Beyond governance, UNI is used in staking initiatives; for example, partnerships with platforms like Pascal Protocol offer staking yields and incentives to holders. Additionally, UNI functions as a store of value within the DeFi ecosystem, often used as collateral in lending protocols or as liquidity in cross-chain deployments, such as the proposed integration with the Ronin chain to tap into gaming ecosystems.

UNI Tokenomics

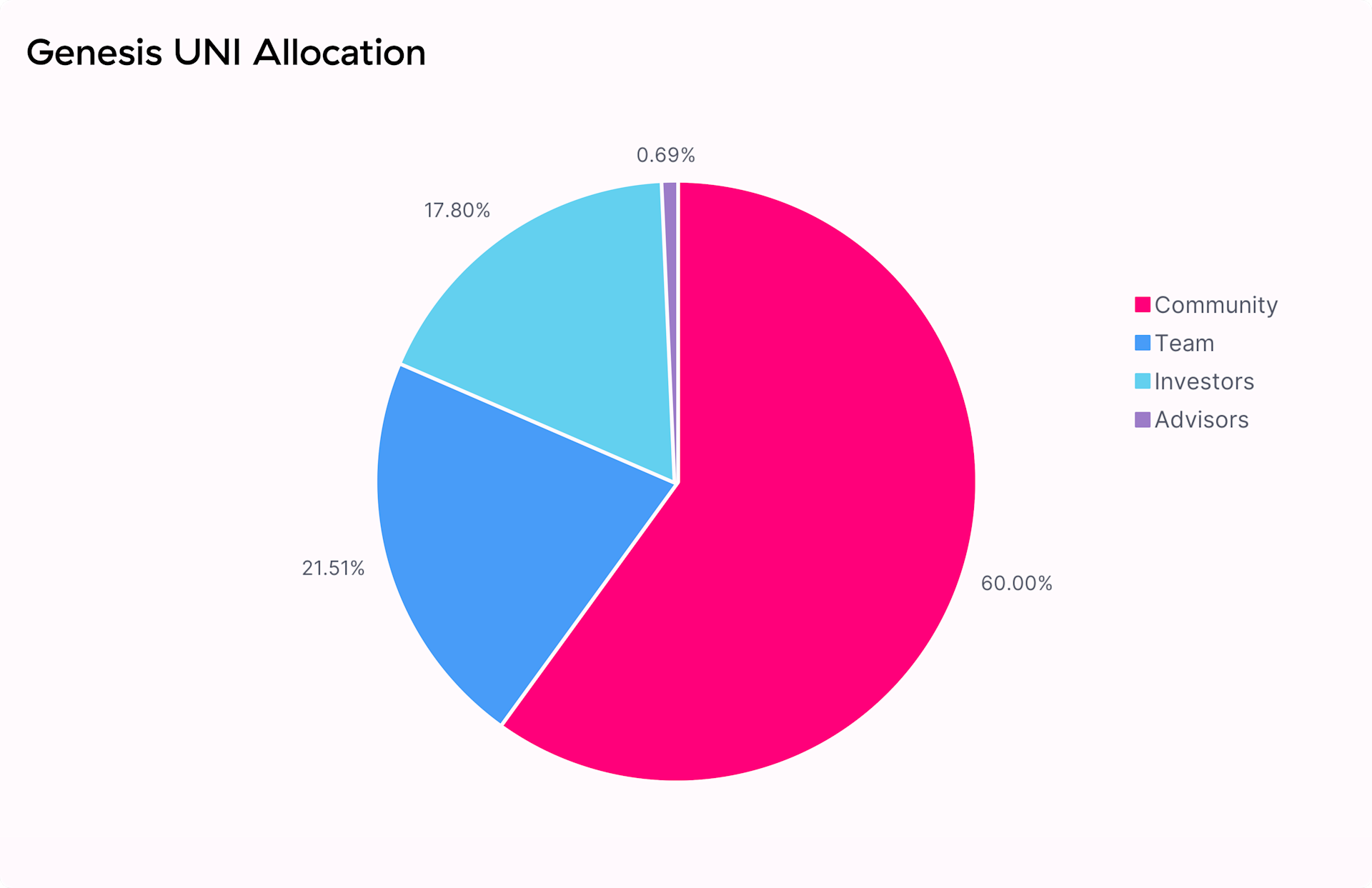

UNI Allocation. Source: Introducing UNI by Uniswap

UNI's tokenomics are designed to balance community distribution, long-term growth, and ecosystem development. The initial allocation reserved 60% for community members (including the airdrop), 21.5% for team members, 18% for investors, and 0.5% for advisors. The UNI DAO treasury holds a significant portion of tokens to fund grants, development, and initiatives, such as the 2025 proposal to register the DAO as a Wyoming nonprofit for legal clarity. Despite robust fundamentals, UNI's price has experienced volatility, declining 23% from its August 2025 peak to around $9.64 due to market-wide sell-offs and profit-taking by venture capitalists. However, on-chain data shows whales accumulating tokens, with large holders increasing their stakes to 8.77 million UNI, while exchange reserves dropped to 645 million tokens, indicating supply tightening and potential bullish momentum.

Price Prediction

Predicting UNI's price involves analyzing technical indicators, on-chain data, and fundamental developments. As of September 2025, UNI is trading at $9.64, facing immediate resistance at the $9.70–$9.80 range. A breakout above this level could propel the token toward $10.20–$10.40, representing a potential 10-15% upside. Conversely, failure to breach this resistance may trap UNI in a consolidation zone between $9.30 and $9.40, with further downside risk to $9.15 if market sentiment deteriorates. Technical indicators present a mixed signal: the Relative Strength Index (RSI) of 43.4 suggests neutral momentum, while short-term exponential moving averages (EMAs) form a supportive cluster around $9.39–$9.45, indicating underlying strength.

Fundamentally, UNI's price prospects are tied to protocol upgrades and adoption metrics. Uniswap's record $143 billion trading volume in August 2025 and the growth of its Layer-2 solution, Unichain, which processed $12.5 billion in dApp activity in its launch month, underscore robust usage. Proposed initiatives, such as the Ronin chain deployment for gaming liquidity and the DUNA fee-switch framework, could generate additional demand for UNI if approved by governance votes. However, regulatory overhangs—like the SEC's Wells Notice—and competition from DEXs like Curve and PancakeSwap pose risks. Long-term, if Uniswap maintains its DEX dominance and implements value-capturing features like fee redistribution, UNI could see significant appreciation, with some analysts projecting a 50% upside to $14–$15 upon breaking key resistance levels.

Hayden Adams' Story

Hayden Adams, the founder of Uniswap, embodies the spirit of innovation and resilience in the crypto space. A mechanical engineering graduate from Stony Brook University, Adams was laid off from Siemens in 2017, a turning point that led him to explore Ethereum development at the suggestion of his friend Karl Floersch, who worked at the Ethereum Foundation. With no prior blockchain experience, Adams taught himself Solidity and JavaScript within months, drawing inspiration from Vitalik Buterin's early writings on decentralized exchanges. His initial prototype, built in November 2017, featured a single liquidity provider and limited token support, but it captured the essence of what would become Uniswap: a simple, efficient AMM protocol.

Adams' journey from unemployment to success was fueled by community support and serendipitous encounters. At Devcon 3, Karl Floersch showcased Adams' work, attracting the attention of Pascal Van Hecke, who provided crucial funding and mentorship. Collaborations with friends like Callil Capuozzo (frontend development) and Uciel Vilchis (full-stack engineering) helped refine the protocol, while feedback from Ethereum luminaries like Vitalik Buterin shaped its design—including the name "Uniswap," which Buterin preferred over Adams' initial idea, "Unipeg". By November 2018, Uniswap officially launched, quickly gaining traction for its permissionless model and user-centric design.

Under Adams' leadership, Uniswap Labs raised $1.65 million in a 2022 Series B round from investors like Polychain Capital and a16z, valuing the company at $120 million by 2023. Despite this success, Adams has embraced a decentralized ethos, gradually reducing his involvement to allow the community to steer the protocol's future. He cites Vitalik Buterin's transition away from direct Ethereum control as a model, emphasizing that "even if I step back, everything will continue". This philosophy aligns with Uniswap's commitment to decentralization, as seen in its DAO-driven governance and resilience during market downturns, contrasting with the collapse of centralized entities like FTX.

The Evolution and Future of Uniswap

Uniswap's evolution from a simple AMM experiment to a multi-billion-dollar DeFi powerhouse reflects relentless innovation and adaptability. Its versioned upgrades have consistently addressed market needs: V1 introduced ETH-based swaps, V2 enabled direct ERC-20 pairs and flash swaps, V3 revolutionized liquidity management with concentration, and V4's hooks system (2025) enabled customizable pool logic, reducing gas costs by 99%. The protocol has also expanded beyond Ethereum, launching Unichain—a Layer-2 solution built on OP Stack—which processed 60% of V4 transactions within months of its 2025 debut, leveraging low fees and high throughput to attract users. These advancements have solidified Uniswap's dominance, with its cumulative trading volume exceeding $2 trillion and monthly revenue reaching $273.7 million in Q3 2025.

Looking ahead, Uniswap faces opportunities and challenges. Its foray into intent-based trading with UniswapX and cross-chain integrations could redefine user experience by offering MEV protection, gasless transactions, and seamless asset bridging. However, regulatory hurdles persist; the SEC's Wells Notice of 2024 alleges Uniswap operates as an unregistered securities exchange, potentially impacting its fee-switch ambitions and U.S. operations. Additionally, competition from DEXs like Curve (for stablecoins) and PancakeSwap (for retail users) threatens its market share, while impermanent loss remains a critical risk for LPs. Despite this, Uniswap's community-driven governance, continuous innovation, and alignment with DeFi values position it to remain a foundational pillar of decentralized finance. As Hayden Adams envisioned, it is not merely an app but "the financial infrastructure of the future".

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.