The

explosive growth

of memecoins on the Solana blockchain has created a dynamic and often unpredictable ecosystem, where platforms rise and fall with startling speed. In this highly competitive landscape, one platform managed to

challenge the established order

and temporarily redefine the rules of memecoin issuance. LetsBonk.fun (also known as BonkFun) emerged from the BONK community in April 2025 as a revolutionary force in Solana's memecoin launchpad space. It positioned itself as a

community-centric alternative

to the dominant Pump.fun, promising greater transparency, fairer revenue distribution, and genuine ecosystem support. At its peak in July 2025, LetsBonk achieved what many thought impossible: it

briefly overtook

Pump.fun in market share, capturing over 70% of the Solana memecoin launchpad market and generating more than $1 million in daily protocol revenue. However, its dominance proved

short-lived

, and by August 2025, the platform had experienced a dramatic decline, graduating only five tokens in a 24-hour period compared to Pump.fun's 170+. This article examines the fascinating story of LetsBonk and its innovative features, meteoric rise, startling decline, potential future, as a case study in the volatile world of cryptocurrency platforms where community trust, technological innovation, and market dynamics collide with unprecedented intensity.

What is LetsBonk?

LetsBonk.fun is a

decentralized launchpad platform built on the Solana blockchain, specifically designed for creating and launching memecoins. Born from a partnership between the

BONK community (one of Solana's earliest and most influential memecoin communities) and

Raydium (a major Solana-based decentralized exchange), the platform was officially launched in April 2025. Unlike its competitors, LetsBonk was conceived as a community-driven project with a mission to address widespread issues in the memecoin space, including fraudulent tokens, opaque operations, and extractive economic models that primarily benefited platform operators rather than participants.

The platform was designed to make memecoin creation

accessible to everyone, requiring no coding experience or deep technical knowledge. Its intuitive interface allowed users to create and deploy tokens in just three simple steps, dramatically lowering the barrier to entry for creators and speculators alike. Once created, tokens were automatically listed on Raydium and integrated with Jupiter's trading routing, providing

immediate liquidity and market access—a crucial feature in the fast-paced memecoin market where timing can be everything.

Beyond its technical functionality, LetsBonk distinguished itself through its

unique economic modeland philosophical approach to platform development. Rather than maximizing profit extraction for the platform's operators, LetsBonk implemented a transparent revenue-sharing mechanism that redirected a significant portion of platform fees back to the BONK ecosystem and token holders. This design reflected a fundamental belief that users should not be mere "tools for pacing" but rather "co-builders" who participate in and benefit from the value they help create.

Underpinning LetsBonk's operations was a commitment to

genuine project support that went beyond mere token issuance. The platform provided substantive assistance to promising projects, such as establishing project libraries and assisting with exchange listings. In one notable case, LetsBonk invested over $600,000 to support the $USELESS project's application for listing on mainstream exchanges—a level of support rarely seen in the memecoin space. This commitment to ecosystem development, combined with its community-first ethos, quickly made LetsBonk a formidable challenger to Pump.fun's long-standing dominance in the Solana memecoin ecosystem.

Technical Features and Innovation

LetsBonk's rapid ascent in the highly competitive memecoin launchpad space was largely attributable to its

innovative technical features and user-centric design approach. The platform's core innovation was its revolutionary

three-step token creation process that democratized memecoin issuance. Unlike traditional token launch processes that required smart contract expertise and significant technical knowledge, LetsBonk allowed anyone with a Solana wallet to create a token within minutes by simply providing a name, symbol, description, and logo image. This streamlined process eliminated the barriers that had previously prevented less technically inclined users from participating in token creation.

A particularly innovative aspect of LetsBonk's technical architecture was its support for

multiple bonding curves, which gave creators greater control over their token's economic model. Users could select from various curve types (linear, S-curve, exponential) and adjust parameters to determine how their token's price would respond to changes in supply. This flexibility allowed creators to design more sophisticated tokenomics that aligned with their specific project goals, whether they sought rapid initial price appreciation or more gradual, sustainable growth.

From an infrastructure perspective, LetsBonk offered

deep ecosystem integration that provided immediate utility for newly created tokens. Through its partnerships with Raydium and Jupiter, every token launched on LetsBonk automatically received a liquidity pool on Raydium's decentralized exchange and was integrated into Jupiter's trading routing system. This meant that tokens were immediately tradable upon creation, addressing the liquidity challenges that had plagued earlier token launch platforms. Additionally, the platform integrated with AlphaScan's Launchpad filter, which helped new tokens gain visibility among traders.

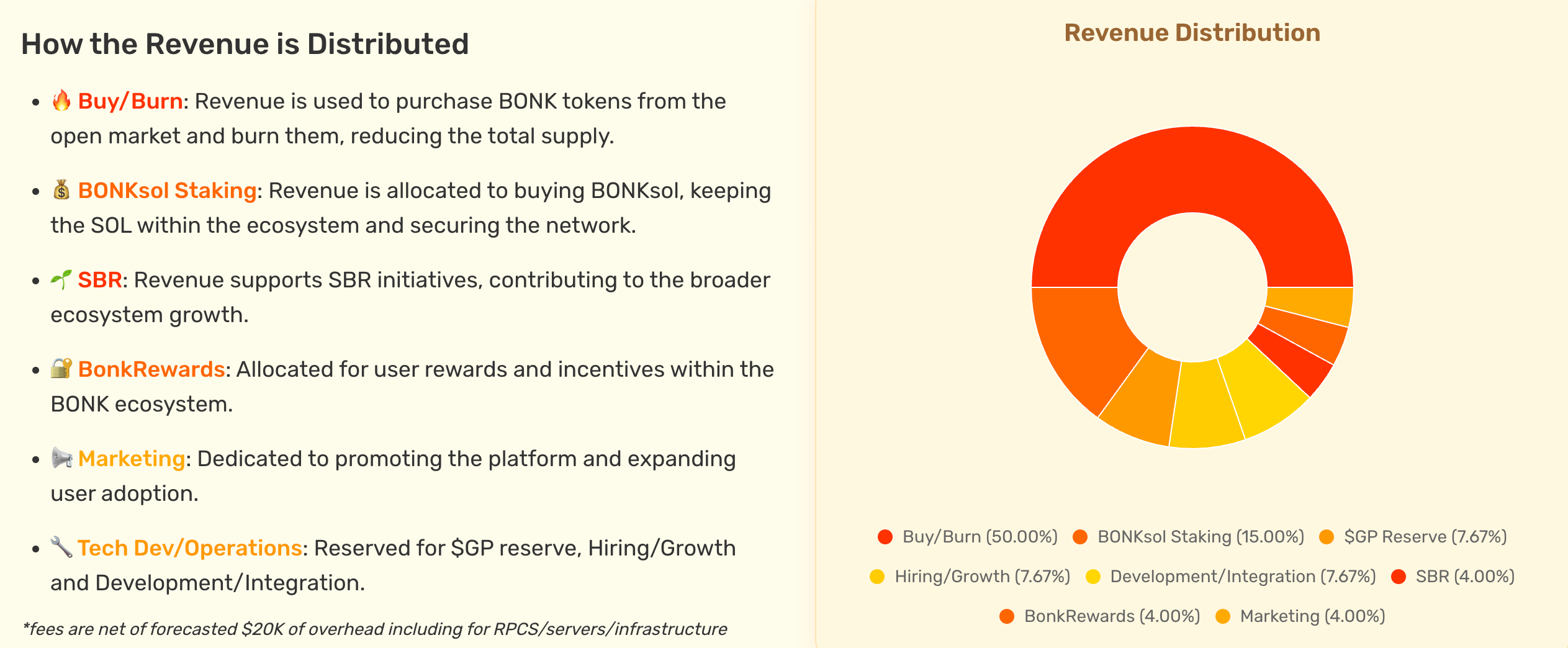

Perhaps LetsBonk's most revolutionary technical feature was its

transparent revenue allocation mechanism, which was hardcoded into the platform's smart contracts. Unlike competitors that operated with opaque economic models, LetsBonk automatically distributed all platform fees according to a predefined scheme:

Dashboard Overview. Source: letsbonk.fun

This automated redistribution system ensured that value flowed back to the community rather than being extracted solely by platform operators, creating a

self-reinforcing economic loop that benefited all participants in the BONK ecosystem.

In August 2025, LetsBonk further enhanced its technical capabilities through a

strategic integration with PandaTool, a leading Web3 trading and token tool provider. This partnership brought sophisticated functionality to the platform, including seamless token creation, strategic bundle buying (allowing creators to purchase tokens through multiple wallets before MEV bots), proactive market cap management tools (enabling coordinated buying, selling, and wash trading), and high-efficiency batch trading capabilities. These professional-grade tools previously unavailable on competing platforms gave LetsBonk users a significant advantage in the highly competitive memecoin market.

Market Performance and Analysis

LetsBonk's market performance represents one of the most dramatic stories of rapid ascent and decline in the recent history of cryptocurrency platforms. The platform's

initial growth metrics were nothing short of spectacular. On its launch day in April 2025, LetsBonk attracted an astonishing 800,000 users who created approximately 2,700 tokens, generating $3 million in trading volume within the first 24 hours alone. This explosive start demonstrated pent-up demand for a more community-focused alternative to Pump.fun and established LetsBonk as an immediate force in the memecoin launchpad space.

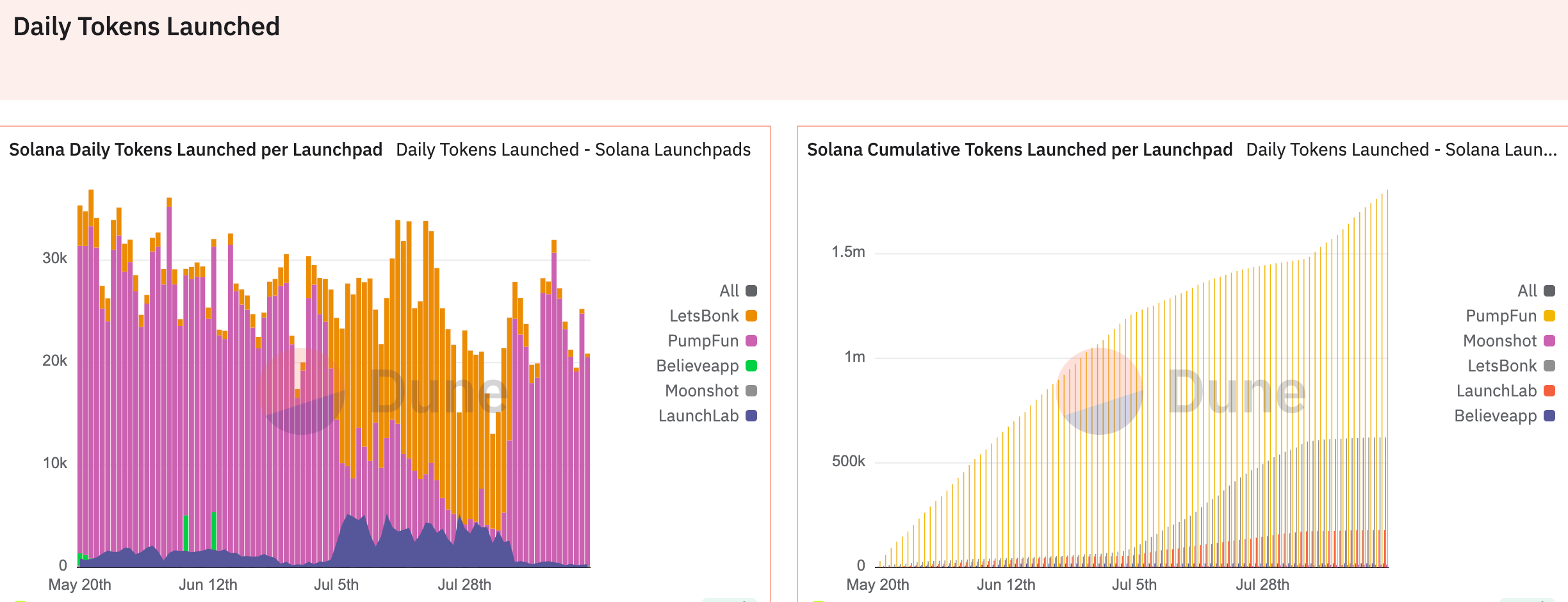

Daily Token Launched. Source: Dune

The platform's growth trajectory continued its

meteoric rise through June and July 2025. By early July, LetsBonk had achieved what many thought impossible—it temporarily surpassed Pump.fun in market share, capturing over 70% of the Solana memecoin launchpad market. At its peak, the platform was graduating more than 200 tokens per day and generating over $1 million in daily protocol revenue, placing it among the top 20 blockchain protocols by revenue. This remarkable achievement was particularly impressive given that Pump.fun had dominated the space for more than a year and had accumulated over $700 million in fee revenue since its inception.

The impact of LetsBonk's success extended beyond the platform itself to significantly influence the

broader BONK ecosystem. The platform's mandatory allocation of 30% of all fees to BONK repurchases created substantial buying pressure on the token. According to analysis from prominent crypto investors, LetsBonk was generating over $500,000 daily for BONK buybacks at its peak, creating consistent upward pressure on the token's price. This mechanism helped drive BONK's market capitalization from $1 billion to $1.6 billion during July 2025, representing a 60% increase that directly correlated with LetsBonk's expansion.

However, LetsBonk's market dominance proved

alarmingly short-lived. By early August 2025, the platform began experiencing a dramatic decline in all key metrics. Data from Dune Analytics revealed a stunning collapse in platform activity—where LetsBonk had been graduating 200+ tokens daily in July, by August 20 it managed to graduate only 5 tokens in a 24-hour period, compared to Pump.fun's 170+ graduations during the same timeframe. Market share figures told an equally grim story: from its peak of 70%+ in July, LetsBonk's share of the Solana memecoin launchpad market plummeted to just 1.7% by late August, placing it a distant fifth behind Pump.fun (63.6%), Heaven (27.9%), and Bags (3%).

Table: LetsBonk Market Share Decline (July-August 2025)

| Time Period |

Market Share |

Daily Token Graduations |

Platform Ranking |

| Early July 2025 |

70%+ |

200+ |

1st |

| August 5, 2025 |

43.90% |

~100 |

1st |

| Mid-August 2025 |

~10% |

~50 |

3rd |

| August 20, 2025 |

1.70% |

5 |

5th |

This

precipitous decline coincided with a broader cooling of the Solana memecoin market from its January 2025 peaks, but LetsBonk's drop was significantly more severe than the overall market contraction. The platform's transaction volume and active wallet counts plummeted in parallel with its token graduation statistics, suggesting a comprehensive exodus of both creators and speculators. The dramatic nature of this reversal highlights the extreme volatility and fickleness of the memecoin market, where platform loyalty is minimal and users rapidly migrate to wherever they perceive the greatest opportunity or lowest risk.

Industry Reception and Community Response

The industry's response to LetsBonk has been

mixed and evolutionary, reflecting the platform's dramatic journey from humble beginnings to market dominance and subsequent decline. Initially, the cryptocurrency community greeted LetsBonk with

skepticism and caution, which was understandable given the proliferation of memecoin launchpads making similar promises of decentralization and community benefits. However, as the platform demonstrated its unique value proposition through tangible actions rather than mere rhetoric, sentiment gradually shifted toward cautious optimism and eventually enthusiastic adoption.

As LetsBonk began gaining significant market share in June and July 2025,

community appreciationgrew for its transparent fee structure and revenue distribution model. Users particularly valued the platform's commitment to returning value to the BONK ecosystem, which stood in stark contrast to Pump.fun's approach of converting fees to USDC and withdrawing them from the Solana ecosystem with minimal reinvestment. This community-centric economic model fostered a sense of shared ownership and collective purpose among LetsBonk users, who began viewing themselves not as mere participants but as "co-builders" in a shared ecosystem.

The platform's leadership also received praise for their

hands-on engagement style. Tom, LetsBonk's founder, became known for his "high-intensity online" presence, continuously releasing updates, responding to user feedback, fixing bugs, and introducing new features. His active involvement in community discussions and transparent communication style stood in stark contrast to the often-faceless leadership of competing platforms. Particularly notable was Tom's deliberate engagement with the

Chinese cryptocurrency community—he frequently used Chinese phrases like "nihao" in his tweets, studied Chinese culture, and actively participated in Chinese-language crypto communities. This outreach helped LetsBonk build strong support in Asia, a crucial region for memecoin trading.

Industry analysts initially expressed admiration for LetsBonk's

technical execution and rapid growth. The platform was widely acknowledged to have successfully identified and exploited weaknesses in Pump.fun's model, particularly regarding fee structures and community incentives. As one analyst noted, "LetsBonk's corner overtaking wasn't accidental. From mechanism design to founder style, what it presented was a completely different narrative from Pump.fun—not harvesting, but co-building". This sentiment was echoed by numerous industry observers who saw LetsBonk as representing a new, more sustainable approach to memecoin platform design.

However, as LetsBonk's market position rapidly deteriorated in August 2025,

industry sentiment turned decidedly negative. Critics pointed to the platform's apparent inability to retain its user base once Pump.fun implemented competitive countermeasures. Some analysts questioned whether LetsBonk had ever built a sufficient "reputational foundation" to retain creators once competition intensified. The common view shifted to seeing LetsBonk as a "flash in the pan" that capitalized temporarily on community dissatisfaction with Pump.fun but ultimately lacked the staying power to maintain its position.

The most recent development in LetsBonk's community relations has been the introduction of a

points incentive system in mid-August 2025, which was widely interpreted as a desperate attempt to win back users. The response to this initiative has been tepid at best, with many on Crypto Twitter dismissing it as a "copycat attempt" to pre-empt Pump.fun's rumored rewards program. This lukewarm reception suggests that LetsBonk may have exhausted much of the community goodwill it accumulated during its peak months, though some observers argue it's too early to judge the effectiveness of this new incentive structure.

Future Prospects and Challenges

As LetsBonk navigates the dramatic downturn in its platform activity and market position, its future prospects remain highly uncertain. The platform faces

significant challenges that will require substantial strategic shifts and perhaps even fundamental reinvention to overcome. The most immediate challenge is the

vicious cycle of declining activity—as fewer tokens are created on the platform, liquidity diminishes, making LetsBonk less attractive for both creators and speculators, which in turn further reduces token creation. Breaking this cycle will require dramatic intervention to restore confidence and attract meaningful volume back to the platform.

In mid-August 2025, LetsBonk attempted to address its decline through the introduction of a

points incentive systemdesigned to reward creators and traders. However, early reactions to this initiative have been skeptical at best, with many in the crypto community viewing it as a belated imitation of Pump.fun's rumored rewards program rather than an innovative solution. The effectiveness of such incentive structures in retaining meaningful engagement rather than attracting mercenary participants seeking quick rewards remains questionable. Given that the program was recently launched, it may be too early to judge its ultimate effectiveness, but initial signs are not promising.

To have any realistic chance of recovery, LetsBonk will likely need to implement a

comprehensive strategic revampthat goes beyond superficial incentive programs. This might include forming new strategic partnerships to enhance platform functionality, developing unique features that differentiate it from competitors, and potentially revising its economic model to better balance sustainability with attractiveness to creators. The platform's existing integration with PandaTool provides advanced capabilities like strategic bundle buying and proactive market cap management, but further innovation will be necessary to recapture market attention.

A fundamental challenge facing LetsBonk is the

broader cooling of the Solana memecoin market since its January 2025 peak. During Pump.fun's revenue heyday in January, the platform was generating between $4 million and $6 million in daily revenue, but by July this had collapsed to around $17 million monthly. This market-wide contraction means that LetsBonk is competing for a smaller overall pie than was available during its initial growth phase, intensifying the zero-sum nature of the platform competition.

The platform's intrinsic

connection to the BONK ecosystem represents both a potential strength and a significant vulnerability. While the revenue-sharing model that benefits BONK holders was initially a key differentiator that attracted community support, it also means that LetsBonk's prospects are inextricably linked to those of BONK itself. With BONK trading at approximately $0.000022 in August 2025—down over 50% from its all-time high of $0.000058—the broader ecosystem is facing challenges that inevitably impact perception of LetsBonk.

Perhaps the most significant uncertainty facing LetsBonk is whether the crypto community's

brief experiment with alternative platform models has already run its course. The platform's initial success demonstrated clear demand for more equitable, community-focused alternatives to extractive models, but its rapid decline suggests that simply having a theoretically superior model may be insufficient to overcome the network effects and liquidity advantages of established platforms. This raises profound questions about whether any challenger can truly compete with first-movers in the memecoin space, or if the combination of user inertia, bot behavior, and liquidity requirements inherently favors incumbents regardless of their model's merits.

Conclusion

The story of LetsBonk represents a fascinating microcosm of the broader dynamics shaping the cryptocurrency industry—where innovation, community sentiment, and market forces collide with extraordinary intensity. The platform's

meteoric rise from April to July 2025 demonstrated the potent demand for more equitable and transparent models in the memecoin ecosystem. By implementing a revenue-sharing system that benefited the broader BONK community rather than solely enriching platform operators, LetsBonk briefly seemed to point toward a more sustainable and community-oriented future for memecoin creation. Its ability to rapidly capture majority market share from an established incumbent showed that users would quickly migrate to platforms that offered better value alignment and genuine ecosystem support.

However, LetsBonk's

equally dramatic decline in August 2025 serves as a sobering reminder of the formidable challenges facing challenger platforms in cryptocurrency spaces dominated by network effects and liquidity dynamics. Despite its theoretically superior economic model and strong initial community support, the platform proved unable to withstand Pump.fun's aggressive countermeasures and the fickle nature of the memecoin community. This suggests that technological innovation and fair economic models, while necessary, may be insufficient alone to disrupt established platforms with significant first-mover advantages.

The broader

implications for the cryptocurrency ecosystem are nuanced and potentially concerning. On one hand, LetsBonk's initial success demonstrated that community values and fair distribution mechanisms can be powerful competitive differentiators that attract users away even from deeply entrenched platforms. This suggests that the cryptocurrency space retains its capacity for rapid innovation and that users will reward platforms that align with crypto's foundational principles of decentralization and fair value distribution.

On the other hand, LetsBonk's inability to maintain its position raises questions about whether

extractive economic models might have inherent advantages over more equitable ones in highly competitive environments. Pump.fun's ability to deploy its substantial resources to buy back tokens and fund incentive programs—measures that would be difficult for a more redistributive platform like LetsBonk to match—highlights the potential structural advantages of retaining rather than distributing value.

Ultimately, LetsBonk's story is still unfolding. While its current prospects appear dim, the cryptocurrency landscape has repeatedly demonstrated that platforms can experience extraordinary resurrections when market conditions shift or when they implement innovative features. Whether through strategic partnerships, novel incentive mechanisms, or simply a resurgence of interest in the BONK ecosystem, LetsBonk may yet have chapters to add to its already remarkable history. Regardless of its ultimate fate, the platform has already left an indelible mark on the Solana ecosystem by proving, if only briefly, that there is appetite for a more community-centric approach to memecoin creation—a lesson that will likely influence platform design long after LetsBonk's own story concludes.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.