The cryptocurrency landscape witnessed a seismic event in mid-August 2025 when OKX executed the largest token burn in crypto history, permanently removing 278,999,999 OKB tokens from circulation. This radical deflationary move reduced OKB’s total supply by 93%, from 300 million to 21 million tokens, mirroring Bitcoin’s scarcity model while integrating it with a high-performance Layer 2 ecosystem. Coupled with the decommissioning of OKTChain and the strategic upgrade of X Layer (OKX’s zkEVM-based Ethereum L2), this overhaul triggered a 200% price surge within hours and ignited debates about sustainable tokenomics in the "CEX + L2" era. This article analyzes the technical architecture, market impact, and future implications of OKX’s bold maneuver, contextualizing it within the competitive battle among exchange-backed blockchains.

Definition of Token Burns in DeFi

Token burning, which is the permanent removal of tokens from circulation—serves as a deflationary mechanism to enhance scarcity and potentially increase value. Unlike buybacks (where tokens are temporarily held in reserves), burned tokens are irrecoverably sent to cryptographically verifiable dead addresses, reducing total supply irrevocably. For exchange tokens like OKB, burns historically aimed at:

-

Counterbalance inflation from staking rewards or platform incentives

-

Signal financial health by utilizing exchange revenue for buyback-and-burn programs

-

Align investor interests by converting platform success into token appreciation

OKX’s burn diverged fundamentally. Instead of incremental quarterly burns (e.g., Binance’s BNB model), it executed a singular, structural reset of OKB’s tokenomics. By burning 93% of the total supply—65.26 million from buyback reserves and 213+ million via contract revocation, OKX shifted OKB from a utility token into a scarcity-driven asset with Bitcoin-like fixed supply. Crucially, the smart contract upgrades disabled minting and future burns, embedding the 21 million cap into immutable code.

How the Burn and Ecosystem Unification Worked

The OKB burn was not an isolated event but the cornerstone of a sweeping technical overhaul integrating tokenomics, chain infrastructure, and utility.

Smart Contract Reformation

OKB’s Ethereum-based contract underwent two critical modifications:

Minting Function Removal: Eliminated ability to create new tokens, preventing future inflation.

Burn Function Disabling: Ensured the 21 million supply cap became permanent, as manual burns could no longer alter it. This transformed OKB into a truly decentralized asset, with no entity, including OKX, could manipulate its supply.

OKTChain Decommissioning and Asset Migration

OKTChain, which is the OKX’s Cosmos SDK-based Layer 1, was phased out to consolidate resources into X Layer, its Ethereum-aligned zkEVM L2. The migration involved:

Token Conversion: OKT holders exchanged tokens for OKB at a fixed rate (1 OKT ≈ 0.105 OKB), based on average prices from July 13-August 12.

Unified Gas Token: OKB replaced OKT as the exclusive gas token across OKX’s ecosystem, including X Layer.

X Layer’s PP Upgrade

Concurrently, X Layer integrated Polygon CDK’s latest zkEVM validium technology, achieving:

-

5,000 TPS throughput (vs. ~15 TPS for Ethereum L1)

-

Near-zero gas fees for users and developers

-

Full Ethereum compatibility, allowing seamless dApp migration.

Table: Technical Transformation of the OKX Ecosystem

| Component |

Pre-Burn State |

Post-Burn State |

| OKB Supply |

300M tokens, inflatable |

21M fixed cap, immutable |

| Core Chains |

OKTChain (Cosmos L1) + X Layer (L2) |

X Layer as sole chain |

| X Layer Throughput |

~500 TPS |

5,000 TPS |

| Token Roles |

OKT (gas on OKTChain), OKB (exchange) |

OKB unified gas/utility token |

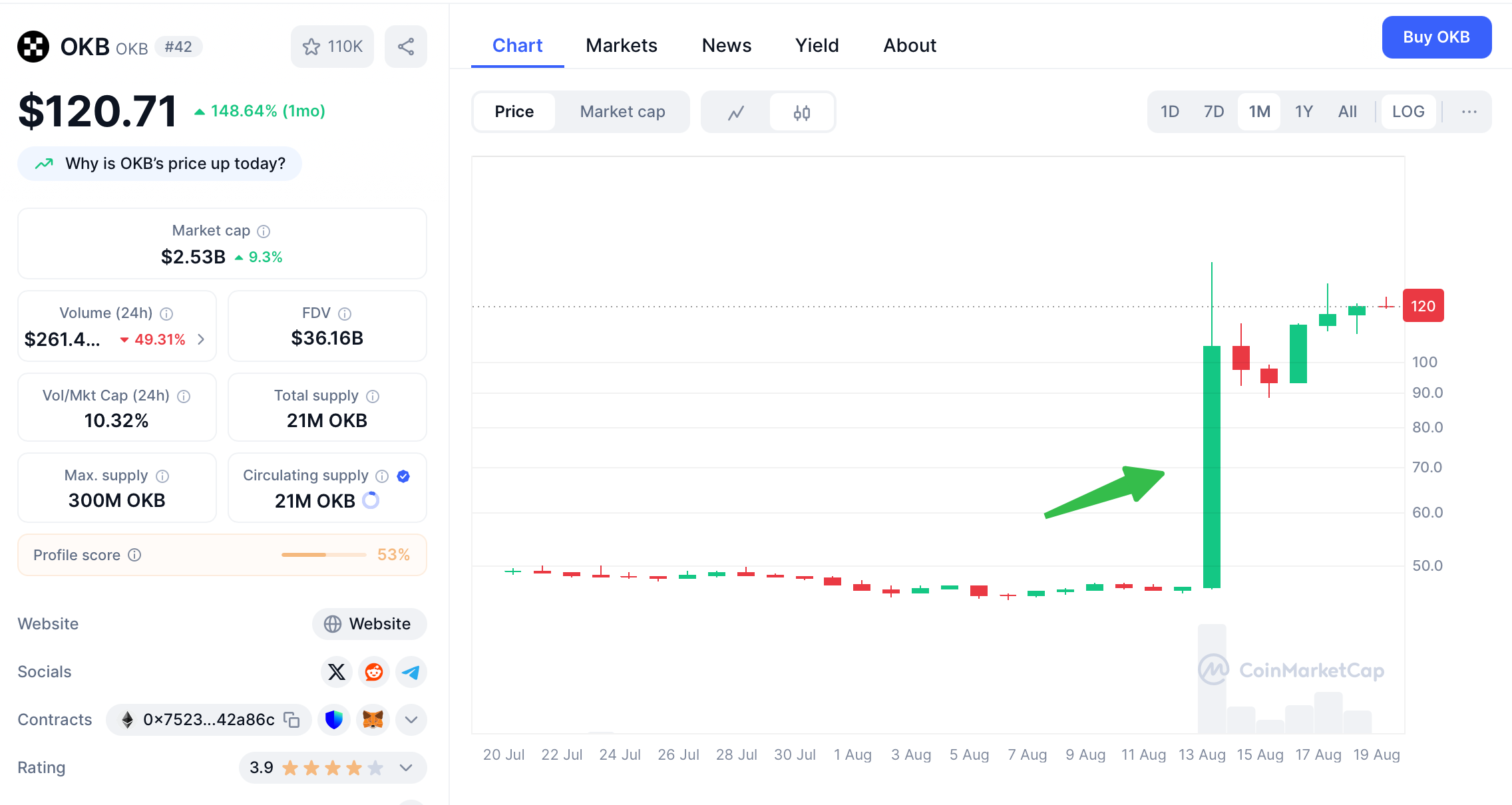

Market Response

The burn triggered extreme volatility, revealing market euphoria and underlying risks.

The Surge and Correction Cycle

Phase 1 (Aug 13–14): Within hours of the announcement, OKB rocketed 200% from $46 to $142.88, peaking at $165 by August 17.

Phase 2 (Aug 15–16): Profit-taking drove a 25% correction to $96–$103 as analysts questioned sustainability.

Phase 3 (Post-Aug 17): Prices rebounded to $125.07 (+160% net gain) amid altcoin momentum and Ethereum’s rally past $4,500.

Liquidity and On-Chain Shifts

-

$58M net inflows flooded exchanges, signaling heightened trading activity.

-

Whale accumulation surged, with the top 100 holders increasing positions by 25% (absorbing ~60M tokens).

-

Liquidation risks concentrated at $92.60, creating a critical support threshold.

Divergent Analyst Views

Bull Case: VanEck and Borderless Capital likened OKB’s scarcity-utility balance to "digital gold with cash flow," projecting $150+ if X Layer adoption accelerates.

Bear Concerns: Manual Guevarra and AInvest warned of overbought RSI levels and "supply shock overhang," noting that 93% of tokens burned were already inactive reserves.

Table: OKB Price Dynamics Post-Burn (Mid-August 2025)

| Date |

Price |

24h Change |

Catalyst |

| Aug 12 |

$46 |

Baseline |

Pre-announcement |

| Aug 13 |

$142.88 |

2 |

Burn + X Layer upgrade news |

| Aug 15 |

$96 |

-33% |

Profit-taking, market skepticism |

| Aug 17 |

$125.07 |

+160% (vs. pre-burn) |

Altcoin season momentum |

| Aug 18 |

$111.87 |

-3.72% |

Short-term correction |

Opportunities and Challenges for OKB and X Layer

OKX’s restructuring positions OKB as a hybrid asset combining scarcity with utility but faces adoption and competitive hurdles.

Growth Catalysts

X Layer Adoption: Integration with OKX Pay and RWA partnerships could drive demand for OKB as gas. TVL growth from $650M to ~$2B+ would validate the chain’s DeFi focus.

Institutional Interest: OKX’s rumored U.S. IPO would boost credibility and attract TradFi capital.

Token Utility Expansion: Discounts on trading fees, governance rights, and Jumpstart launchpad access enhance OKB’s intrinsic value.

Material Risks

Regulatory Scrutiny: Philippines and Thailand regulators have already flagged OKX for unauthorized operations; U.S. SEC oversight could escalate post-IPO.

L2 Competition: Coinbase’s Base and Binance’s BSC dominate exchange-chain activity. X Layer needs 100+ dApps to rival them (currently ~50).

Selling Pressure: OKT conversions could release 19M+ OKB into markets if holders exit .

Key Developments to Monitor

Beyond price, these factors will determine OKB’s long-term viability:

X Layer’s DeFi Integration: Success of liquidity incentives for developers and users migrating from OKTChain. TVL targets above $1B by Q4 2025 would signal traction.

Ethereum ETF Spillover: Rising ETH prices could lift L2 tokens like OKB, especially if spot ETF volumes exceed $3B/month.

CEX Token "Burn Wars": Binance’s BNB and Bitget’s BGB are enhancing burns with staking and chain utility. OKB’s fixed supply differentiates it but requires proven demand.

RWA Tokenization: X Layer’s focus on real-world assets (e.g., tokenized commodities) could unlock enterprise demand, leveraging OKX’s 60M-user base.

Conclusion

OKX’s record-breaking burn transcends tokenomics theater—it represents a strategic bet on unified blockchain ecosystems. By merging Bitcoin-style scarcity with Ethereum-aligned utility via X Layer, OKX positions OKB as more than an exchange coupon; it becomes the economic lifeblood of a vertically integrated Web3 stack. While short-term volatility persists, the burn’s success hinges on X Layer’s adoption. As Hasu, Flashbots’ Strategy Lead, observed: "Crypto markets chronically misprice supply until utility validates scarcity". For OKB, validation requires proving that 21 million tokens can fuel a 5,000 TPS economy spanning DeFi, payments, and RWAs. If achieved, this could redefine how exchanges build chains—and how chains capture value.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.