Many blockchain-related companies are experiencing strong growth and garnering significant market attention and investment. By incorporating blockchain technology, these companies are driving digital transformation and value creation, gradually becoming key players in the industry. We closely monitor many of these stocks and see their increasingly impressive performance in the capital markets. They are expected to usher in even greater growth opportunities in the future, driven by blockchain technology.

As the global financial regulatory landscape becomes increasingly clear, the cryptocurrency market is gradually moving from its former niche into the mainstream financial system. Since the US election, President Trump's election has had a positive impact on the cryptocurrency industry, with promises of more friendly regulatory policies, including establishing a national Bitcoin reserve and encouraging the expansion of Bitcoin mining activities in the United States. These promises have boosted market confidence. Over the following days, this sentiment began to permeate the capital markets, and against this backdrop, several blockchain stocks saw a general surge.

Currently, a growing number of listed companies have recognized the enormous potential of blockchain technology and are actively incorporating it into their strategic plans. Many blockchain-related companies have seen strong growth, garnering significant market attention and investment. By incorporating blockchain technology, these companies have driven digital transformation and value creation, gradually becoming significant players in the industry. We closely monitor many of these stocks and see their increasingly impressive performance in the capital markets. Driven by blockchain, they are expected to usher in even greater development opportunities in the future.

In recent years, the regulatory benefits brought about by the launch of cryptocurrency-related ETFs (such as the Bitcoin spot ETF) in the United States have signaled that cryptocurrencies are no longer confined to the closed digital currency market, but are becoming deeply integrated with traditional capital markets. Grayscale, a pioneer in this field, has established its Bitcoin Trust (GBTC) as a bridge for traditional investors to enter the crypto market. Data shows that as of August 18th, BlackRock's Bitcoin Spot ETF (IBIT) had nearly $87 billion in assets under management, with net inflows almost constant since the beginning of the year. Meanwhile, the Grayscale Bitcoin Spot ETF (GBTC) manages approximately $21 billion in assets, demonstrating investor interest and confidence in this emerging asset class.

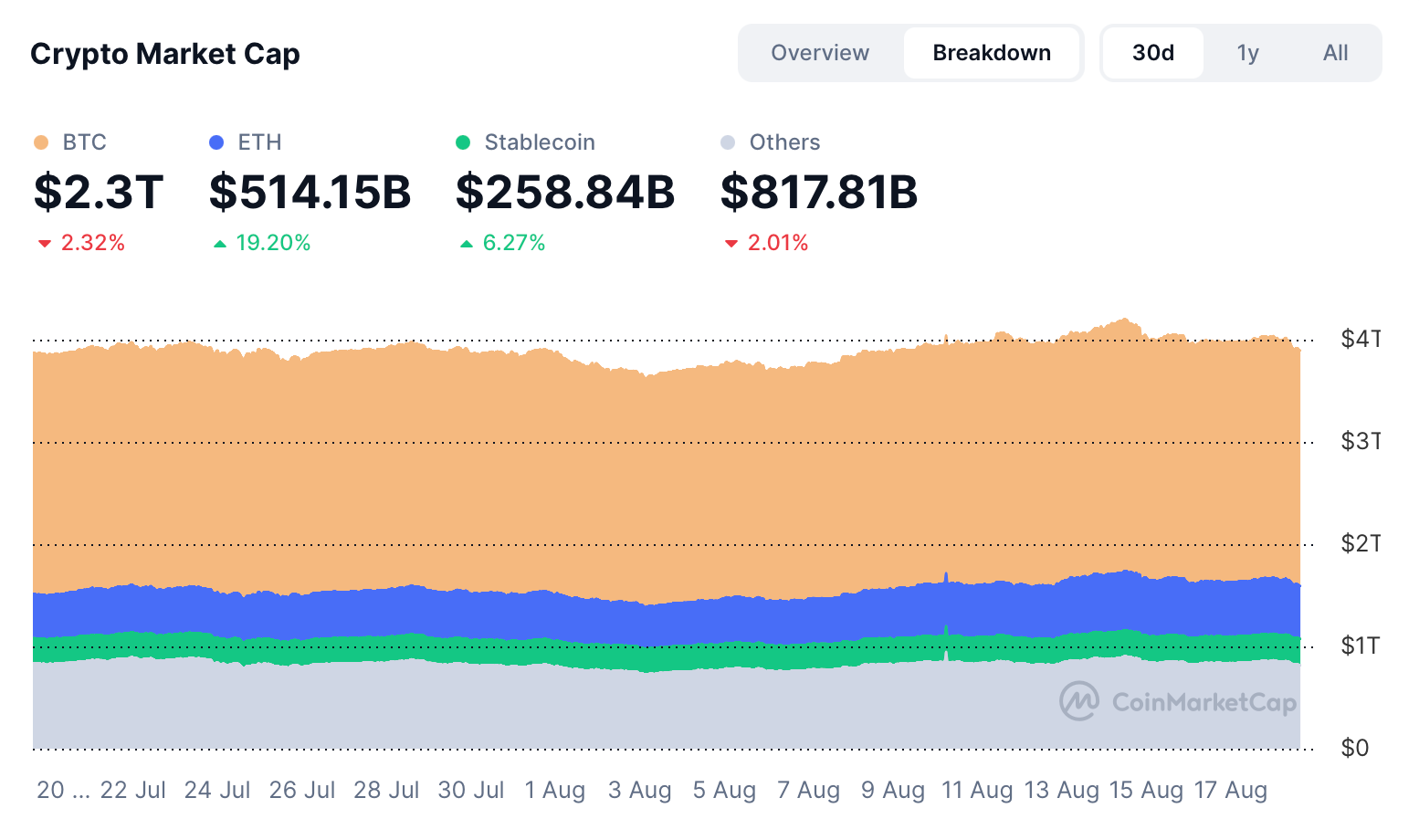

The total market capitalization of the current cryptocurrency market is approximately $3.89 trillion, which can be divided into three main parts by asset class:

This research report will briefly analyze the growth models of blockchain-related stocks, specifically how they integrate with on-chain assets, to uncover new and innovative investment opportunities. For example, MSTR's share issuance model exemplifies a typical approach of exchanging US dollar assets for on-chain assets through convertible bonds and equity issuance. MSTR's stock price has recently surged alongside Bitcoin's price, and the yield on its convertible bonds maturing in 2027 has reached a three-year high. This strategy has significantly outperformed traditional tech stocks.

Through these perspectives, we can see that the future development of the crypto market lies not only in the incremental growth of digital currencies themselves, but also in the enormous potential for integration with traditional finance. From regulatory dividends to changes in market structure, blockchain concept stocks are at a critical juncture in this major trend, becoming the focus of global investors.

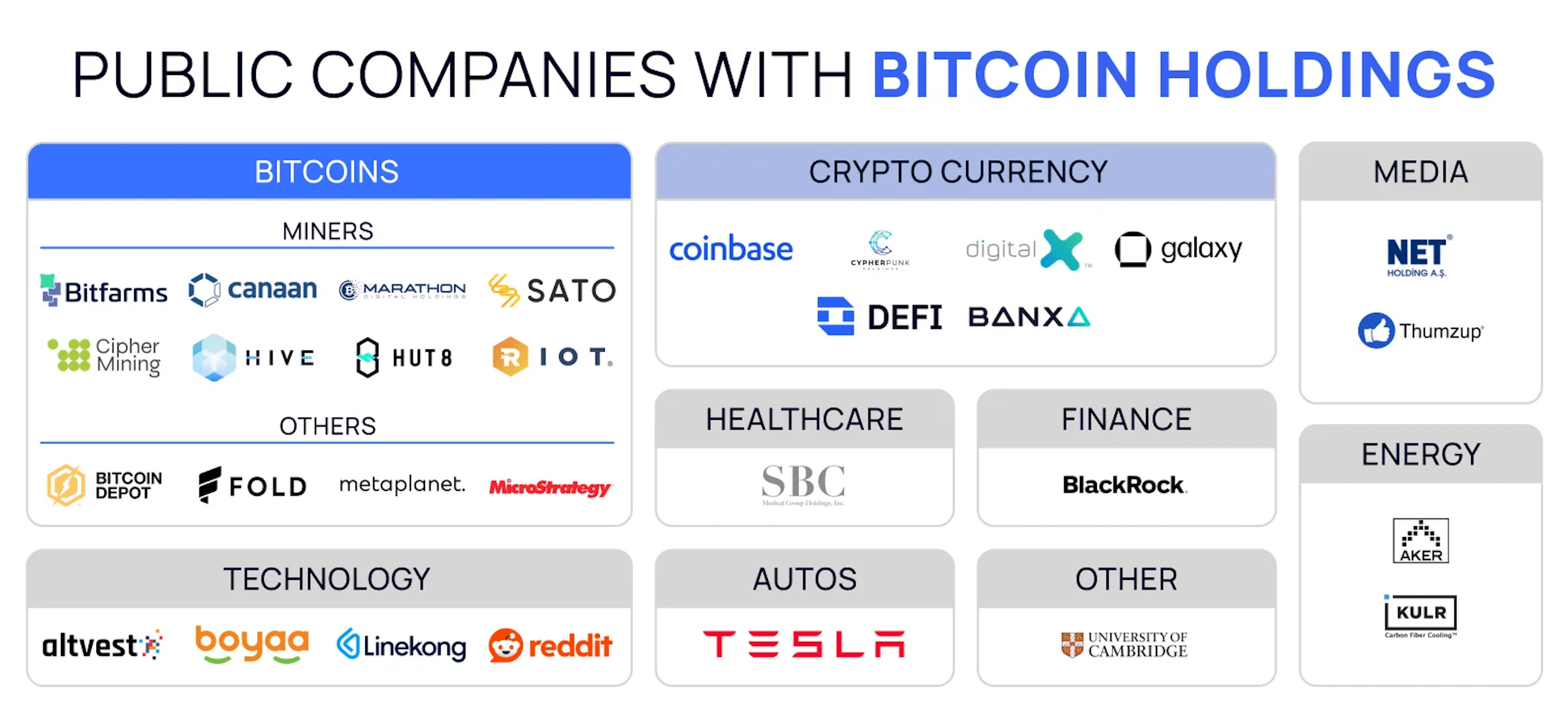

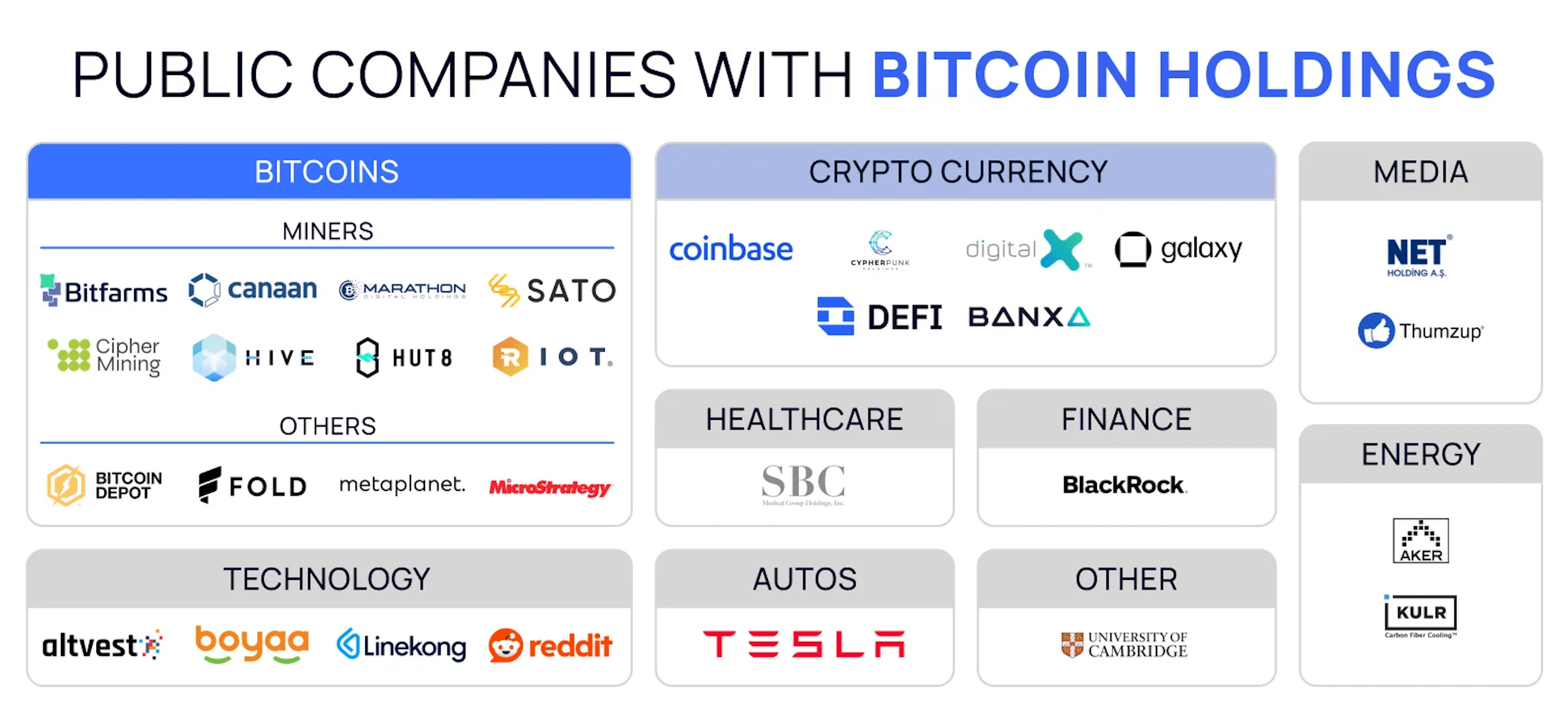

We roughly divide the current blockchain concept stocks into the following categories:

Asset-driven Concept

Regarding blockchain stocks that prioritize asset allocation, the company's strategy is to use Bitcoin as its primary reserve asset. This strategy was first implemented by MicroStrategy in 2020 and quickly garnered market attention. This year, other companies, such as Japanese investment firm MetaPlanet and Hong Kong-listed Boyaa Interactive, have also joined in, increasing their Bitcoin acquisitions. MetaPlanet announced the introduction of "Bitcoin Yield," a key performance indicator developed by MicroStrategy.

Top 20 listed companies worldwide that use Bitcoin as a company reserve asset *Data source: coingecko

Specifically, the strategy of companies like MicroStrategy is to provide investors with a new perspective to assess a company's value and investment decisions by introducing a key performance indicator, "Bitcoin yield." This metric calculates the number of Bitcoins held per share based on the diluted number of shares outstanding, without taking into account Bitcoin price fluctuations. It is intended to help investors better understand a company's purchase of Bitcoin through the issuance of additional common stock or convertible instruments, focusing on measuring the balance between the growth of Bitcoin holdings and the dilution of equity. To date, MicroStrategy's Bitcoin investment yield has reached 28%, demonstrating that the company has successfully avoided excessive dilution of shareholder interests while continuously increasing its holdings.

However, despite MicroStrategy's significant success in Bitcoin investment, the company's debt structure has raised market concerns. MicroStrategy reportedly has a total outstanding debt of $8.21 billion. During this period, the company raised funds through multiple rounds of convertible bonds, some of which carried interest payments. Market analysts are concerned that if Bitcoin prices plummet, MicroStrategy may need to sell some of its Bitcoin to repay its debt. However, others believe that MicroStrategy's operating cash flow is sufficient to cover debt interest payments, relying on its stable traditional software business and low interest rates. Therefore, even a sharp drop in Bitcoin prices is unlikely to force the company to sell its Bitcoin assets. Furthermore, MicroStrategy's stock market capitalization currently stands at $103.87 billion, and debt represents a relatively small portion of its capital structure, further reducing the risk of liquidation.

While many investors are optimistic about the company's steadfast Bitcoin investment strategy, believing it will generate substantial returns for shareholders, some have expressed concerns about its high leverage and potential market risks. Due to the extreme volatility of the cryptocurrency market, any adverse market fluctuations could significantly impact the asset value of such companies. Furthermore, their share prices trade at a significant premium to their net asset value, and the sustainability of this trend is a key focus of market attention. A correction in the share price could impact the company's ability to raise funds, and in turn, its future Bitcoin purchase plans.

Microstrategy(MSTR)

Business Intelligence Software Company

Founded in 1989, MicroStrategy initially focused on business intelligence and enterprise solutions. However, starting in 2020, the company transitioned to becoming the world's first publicly traded company to use Bitcoin (BTC) as its reserve asset, a strategy that fundamentally transformed its business model and market position. Founder Michael Saylor played a key role in driving this transformation, evolving from an early Bitcoin skeptic to a staunch supporter of the cryptocurrency.

Since 2020, MicroStrategy has continued to purchase Bitcoin through its own funds and bond financing. As of now, the company has accumulated approximately 628,946 Bitcoins, with a current market value of nearly $72 billion, accounting for approximately 3% of the total Bitcoin supply.

MicroStrategy's current business model can be described as a "circular leverage model based on Bitcoin," where it raises funds to purchase Bitcoin through bond issuance. While this model offers high returns, it also carries certain risks, particularly during periods of volatile Bitcoin prices. According to analysis, the company would only face liquidation risk if the Bitcoin price fell below $15,000. With Bitcoin currently trading over $120,000, this risk is minimal. Furthermore, the company's low leverage ratio and strong demand in the bond market further strengthen MicroStrategy's financial stability.

For investors, MicroStrategy can be seen as a leveraged investment tool in the Bitcoin market. With the expectation of steady Bitcoin price increases, the company's stock offers significant potential. However, caution should be exercised regarding the medium- and long-term risks associated with debt expansion. MicroStrategy's investment value remains worthy of attention over the next one to two years, especially for investors bullish on the Bitcoin market, as it presents a high-risk, high-reward investment.

Semler Scientific(SMLR)

Semler Scientific, a medical technology company, utilizes Bitcoin as its primary reserve asset as part of its innovative strategy. In August 2025, the company had a total of 5,021 Bitcoins, representing a total investment of approximately $579 million. These acquisitions, partially funded by operating cash flow, demonstrate Semler's commitment to strengthening its asset portfolio through Bitcoin holdings, establishing itself as a leader in asset management innovation.

Although Semler's current market value is only US$345 million, far lower than MicroStrategy, its strategy of using Bitcoin as a reserve asset has made it regarded by investors as a "mini MicroStrategy."

Boyaa Interactive

Boyaa Interactive, a Hong Kong-listed company primarily focused on gaming, is a leading developer and operator of Chinese board and card games. In the second half of last year, it began exploring the crypto market, aiming to fully transform itself into a Web3-listed company. The company has been acquiring cryptocurrencies such as Bitcoin and Ethereum on a large scale, investing in multiple Web3 ecosystem projects, and signing a subscription agreement with Pacific Waterdrip Digital Asset Fund (SPC), a subsidiary of Waterdrip Capital, to enter into strategic collaboration in Web3 game development and the Bitcoin ecosystem. The company has stated, "Purchasing and holding cryptocurrencies is a key initiative in the Group's Web3 business development and layout, and a crucial component of its asset allocation strategy." As of the latest announcement, Boyaa Interactive held 3,350 Bitcoin, totaling approximately US$387 million.

Mining Concept

Blockchain mining stocks have garnered significant market attention in recent years, particularly amidst price fluctuations in cryptocurrencies like Bitcoin. Mining companies not only benefit directly from digital currency revenue but also, to a certain extent, participate in other high-growth industries, particularly artificial intelligence (AI) and high-performance computing (HPC). With the rapid development of AI technology, demand for AI computing power is rapidly increasing, providing new support for the valuations of mining stocks. In particular, with the increasing shortage of electricity contracts, data centers, and their supporting facilities, mining companies can generate additional revenue by providing computing infrastructure to meet AI needs.

However, it's generally accepted that not all mining companies can fully meet the needs of AI data centers. Mining operations prioritize affordable electricity, often choosing locations with low prices and short-term power instability to maximize profits. In contrast, AI data centers prioritize power stability, are less sensitive to price fluctuations, and prefer long-term, stable power supplies. Therefore, not all mining companies' existing power equipment and data centers are suitable for direct conversion to AI data centers.

Mining concept stocks can be divided into the following categories:

- Mining companies with mature AI/HPC businesses: These companies not only have a presence in mining but also have mature AI or HPC businesses and are backed by technology giants like NVIDIA. For example, companies like Wulf, APLD, and CIFR not only participate in cryptocurrency mining but also integrate mining and AI computing power needs by building AI computing platforms and engaging in AI inference, thus gaining market attention.

- Mining-focused and accumulating large amounts of cryptocurrency: These companies primarily focus on mining and hold significant amounts of Bitcoin and other digital currencies. CleanSpark (CLSK) is a representative example of this type of company, with its accumulator holdings accounting for 17.5% of its market capitalization. Riot Platforms (RIOT) is another similar company, holding 21% of its market capitalization. These companies accumulate Bitcoin and other cryptocurrencies in the hope of profiting from future price increases.

- Diversified businesses: These companies not only mine and hoard cryptocurrencies but also dabble in AI reasoning and AI data center development. Marathon Digital (MARA) is a representative example of this type of company, with its hoarded cryptocurrency accounting for 33% of its market capitalization. These companies typically diversify their business to mitigate risk in a single area while improving overall profitability.

As demand for AI grows, AI computing power and high-performance computing will increasingly merge with blockchain mining, potentially further boosting the valuations of mining companies. In the future, mining companies will not only serve as digital currency miners but also potentially become crucial infrastructure providers for the development of AI technology. While this path is fraught with challenges, to prepare for this trend, many mining companies are accelerating their deployment of AI computing power and data center construction, striving to gain a foothold in this emerging sector.

MARA Holdings (MARA)

Marathon, one of North America's largest enterprise Bitcoin self-mining companies, was founded in 2010 and went public in 2011. The company is dedicated to mining cryptocurrencies, focusing on the blockchain ecosystem and the creation of digital assets. It provides managed mining solutions based on its proprietary infrastructure and intelligent mining software, primarily mining Bitcoin. Similar to Riot, Marathon experienced a 12.6% stock price drop, followed by further declines. However, Marathon's stock price has risen rapidly over the past year.

According to the latest data, MARA (Marathon Digital) has achieved a hash rate of 57.3 exahashes per second (EH/s), becoming the first publicly listed mining company to reach this level. The company expects its hash rate to increase by approximately 10 EH/s upon commissioning its new 152 MW power capacity.

Additionally, on November 18, MARA announced the issuance of $700 million in convertible senior notes, maturing in 2030. The proceeds will be primarily used to purchase Bitcoin, repurchase notes due in 2026, and support the expansion of existing businesses. MARA expects to use the net proceeds from these notes, including up to $200 million to repurchase a portion of the convertible notes due in 2026, with the remainder to purchase additional Bitcoin and for general corporate purposes, including working capital, strategic acquisitions, expansion of existing assets, and repayment of additional debt. This move further demonstrates MARA's long-term bullish stance on Bitcoin.

Core Scientific(CORZ)

Blockchain infrastructure and cryptocurrency mining services

Founded in 2017, Core Scientific Inc. operates two main business segments: equipment sales and hosting services, and self-built Bitcoin mining farms. The company generates revenue through the sale of consumption-based contracts and the provision of hosting services, while its digital asset mining segment generates revenue from operating computing equipment that processes transactions on blockchain networks and participates as part of a user pool, receiving digital currency assets in return.

Microsoft (MSFT.US) recently announced that it will spend nearly $10 billion between 2023 and 2030 to lease servers from the artificial intelligence startup CoreWeave. CoreWeave has signed a hosting agreement with Bitcoin mining giant Core Scientific for an additional 120 megawatts (MW) of high-performance computing power. Through several rounds of expansion, CoreWeave currently hosts a total of 502 MW of GPU capacity in Core Scientific's data centers. Since signing the multi-billion dollar contract with CoreWeave, Core Scientific's stock price has surged, increasing by nearly 300%. The company also plans to renovate some of its data centers to host over 200 MW of CoreWeave's GPUs.

The 12-year hosting contract is expected to generate $8.7 billion in total revenue for Core Scientific. Meanwhile, while its Bitcoin mining hashrate remained stable, its market share declined, from 3.27% in January to 2.54% in September.

Overall, Core Scientific has seamlessly capitalized on the convergence of AI and Bitcoin, two hotly anticipated themes. In particular, in the AI data center sector, Core Scientific has already secured significant contracts and actively pursued new client acquisitions, demonstrating strong growth potential. Despite a decline in Bitcoin mining market share, the company's progress in AI data centers provides strong support for its long-term stable growth, and future growth remains promising.

Riot Platforms (RIOT)

Riot Platforms, headquartered in Colorado, USA, specializes in blockchain technology development, support, and digital currency mining. Previously, the company invested in several blockchain startups, including Canadian Bitcoin exchange Coinsquare, but has now shifted its focus entirely to cryptocurrency mining.

Riot's stock price has experienced significant volatility, particularly during periods of declining Bitcoin prices, when its shares dipped 15.8%. However, despite this, the company's stock is still up over 130% over the past year.

CleanSpark(CLSK)

CleanSpark is a company focused on Bitcoin mining using renewable energy.

From a stock perspective, CleanSpark is a leading Bitcoin miner focused on renewable energy. Its green mining strategy and relatively low energy costs offer long-term growth potential. The company's acquisition of GRIID and expansion of its mining farm computing capacity demonstrate its proactive strategic planning to expand market share and enhance competitiveness. However, despite significant revenue growth, the company's substantial losses have led investors to focus on profitability and cash flow, which will be key factors influencing future stock price trends. CleanSpark's stock price is subject to significant volatility, influenced by fluctuations in Bitcoin prices and energy costs.

TereWulf(WULF)

With reduced operational risks and higher profit margins, energy companies are becoming a significant force in the cryptocurrency industry. TeraWulf, a cryptocurrency subsidiary of Beowulf Mining Plc, recently disclosed in a regulatory filing that it expects its mining capacity to reach 800 megawatts by 2025, representing 10% of the Bitcoin network's current computing power. TeraWulf specializes in providing sustainable cryptocurrency mining solutions, particularly leveraging renewable energy sources such as hydropower and solar power, and is also developing AI data centers.

TeraWulf recently announced an increase in the size of its 2.75% convertible bond offering to $425 million, with plans to use $118 million for share repurchases. The financing also includes a secondary option, allowing initial purchasers to purchase an additional $75 million within 13 days of issuance. The newly issued bonds, which mature in 2030, will be used partially for share repurchases and partially for general corporate expenses.

TeraWulf stated that it will prioritize share repurchases and continue to pursue organic growth and potential strategic acquisitions in high-performance computing and AI. Following the announcement, TeraWulf's stock price has risen nearly 30% since last Friday, outperforming Bitcoin and other mining companies. Mining companies have recently been raising capital through convertible bonds and Bitcoin-backed loans to mitigate the decline in hash rate prices following the Bitcoin halving.

Overall, TeraWulf's investments in clean energy and AI mining demonstrate strong growth potential. In the short term, the company is likely to benefit from the market's heightened interest in these areas. However, given the volatility of the mining industry and the overall market environment, long-term performance requires continued monitoring and evaluation. While TeraWulf's stock price rally is somewhat driven by hype under current circumstances, its sustainable development strategy is expected to drive further growth.

Cipher Mining(CIFR)

Bitcoin mining companies

Cipher Mining is primarily focused on developing and operating Bitcoin mining data centers in the United States, aiming to enhance the infrastructure of the Bitcoin network.

Cipher Mining recently announced an expanded credit line with Coinbase, establishing a $35 million term loan. Furthermore, Cipher Mining's AI business valuation has risen as demand for artificial intelligence (AI) technology grows in the crypto market. However, compared to peers such as CORZ, APLD, and WUFL, Cipher Mining's stock price has lagged behind. While the company's investments in Bitcoin mining infrastructure have yielded some success, its progress in developing AI technology has been slower, which may impact its stock price performance in the short term.

Iris Energy (IREN)

Bitcoin mining with renewable energy

IREN specializes in Bitcoin mining globally using green energy, particularly hydropower. Its focus on clean energy-driven Bitcoin mining is environmental sustainability, a key differentiator that sets it apart from other mining companies. Compared to traditional coal and oil-based energy sources, IREN utilizes clean energy for mining, reducing carbon emissions and lowering operating costs. IREN currently operates multiple clean energy mining facilities, particularly in clean energy-rich regions such as Canada and the United States.

IREN is also exploring cloud computing, but the prospects for this business are less clear than those of its clean energy mining operations. While cloud computing, as a business model, can reduce the demand for mining hardware and provide investors with more flexible profit paths, its revenue model and market acceptance are still in their early stages, and compared to traditional Bitcoin mining, it has yet to demonstrate significant profitability. Therefore, IREN's exploration of cloud computing can be viewed more as a pilot project, far from mature, and its valuation is unlikely to be high.

IREN's progress and potential in monetizing energy assets currently lag behind competitors such as CIFR (Cipher Mining) and WULF (Stronghold Digital Mining). These companies have made progress in effectively integrating traditional energy assets and applying clean energy, resulting in stronger market competitiveness. While IREN's unique advantages in green energy mining are significant, its monetization process lags behind CIFR and WULF, making it difficult to generate sufficient capital inflows in the short term.

8th Anniversary (8th Anniversary)

Hut 8, headquartered in Canada, is a cryptocurrency mining company primarily operating in North America. It is one of the largest and most innovative digital asset miners in North America. The company operates a large-scale energy infrastructure and adheres to environmentally friendly practices.

In the latest report, Hut 8 has a revenue of $41.3 million, net income of $137.5 million, and Adjusted EBITDA of $221.2 million; Total energy capacity under management of 1,020 megawatts (“MW”) as of June 30, 2025. A ~10,800 MW development pipeline with ~3,100 MW of capacity under exclusivity1 as of June 30, 2025; Strategic Bitcoin reserve of 10,667 Bitcoin with a market value of $1.1 billion as of June 30, 2025.

Bitfarms(BITF)

Canada-based Bitfarms specializes in the development and operation of Bitcoin mining farms and continues to expand its operations. The company recently announced plans to invest an additional $33.2 million to upgrade 18,853 Antminer T21 Bitcoin mining machines originally planned to be purchased from Bitmain to S21 Pro models. According to its third-quarter financial report, Bitfarms has amended its purchase agreement with Bitmain, with the upgraded mining machines expected to be delivered between December 2024 and January 2025. According to analysis by TheMinerMag, Bitfarms' adoption of the latest generation of mining machines has significantly reduced its mining machine costs: from $40.6 per PH/s in the first quarter to $35.5 in the second quarter, and further to $29.3 in the latest quarter.

Overall, Bitfarms has demonstrated strong growth potential by upgrading its mining equipment and optimizing its procurement strategy, reducing costs while improving mining efficiency. This strategy will not only enhance the company's profitability but also strengthen its position in the competitive cryptocurrency market. As mining equipment costs continue to decline, Bitfarms is expected to maintain its advantage in the Bitcoin mining sector, especially if Bitcoin prices rebound or market demand grows.

HIVE Digital Technologies (HIVE)

Cryptocurrency mining companies, HPC businesses.

Hive Digital recently announced the acquisition of 6,500 Canaan Avalon A1566 Bitcoin mining machines, with plans to increase total computing power to 1.2 EH/s. This move demonstrates the company's continued investment in cryptocurrency mining. However, since the end of last year, Hive Digital has clearly stated that it will shift more resources and focus to high-performance computing (HPC). The company believes that HPC offers higher profit margins than Bitcoin mining and possesses certain technical barriers to entry, enabling more sustainable revenue growth. To this end, Hive has transformed 38,000 Nvidia data center GPU cards, originally used for Ethereum and other cryptocurrency mining, into an on-demand GPU cloud service, marking a new chapter in its AI and HPC operations.

This strategic shift aligns with industry trends. Similar to other mining companies like Hut 8, Hive quickly shifted its focus to HPC and AI after Ethereum transitioned from Proof-of-Work (PoW). Today, Hive's HPC and AI businesses generate 15 times more revenue than Bitcoin mining, while demand for GPU computing is rapidly growing. According to a Goldman Sachs report, the GPU cloud service market holds promising prospects. Fortune Business Insights predicts that the North American GPU service market will grow at a compound annual growth rate of 34% by 2030. With the growing demand for AI projects, especially given the nascent development of large language model technologies like ChatGPT, nearly all businesses require significant GPU computing power to operate and develop these technologies.

From an investment perspective, Hive Digital's transformation strategy has laid a solid foundation for future growth. While the company still maintains a presence in cryptocurrency mining, the rapid development of its HPC and AI businesses has enabled Hive to gradually transition away from over-reliance on traditional Bitcoin mining, opening up more diversified and profitable revenue channels.

Infrastructure and Solution Providers

Mining machine manufacturers/blockchain infrastructure stocks refer to companies focused on Bitcoin mining hardware, blockchain infrastructure development, and related technical services. These companies primarily profit from designing, manufacturing, and selling specialized mining equipment (such as ASIC miners), providing cloud mining services, and operating the hardware infrastructure required for blockchain networks. Mining machine manufacturers are central to blockchain infrastructure, providing the hardware used to mine cryptocurrencies like Bitcoin. ASIC (Application-Specific Integrated Circuit) miners are the most common type of mining machine, specifically designed for cryptocurrency mining. Mining machine manufacturers derive revenue from two primary sources: mining machine sales and hosting and cloud mining services.

Generally speaking, the price of mining machines is influenced by a variety of factors, including Bitcoin market fluctuations, production costs, and supply chain stability. For example, when Bitcoin prices rise, miners' profits also increase, and demand for mining machines typically rises accordingly, driving revenue growth for mining machine manufacturers. Beyond mining machine production, blockchain infrastructure also includes mining pools, data centers, and other cloud service platforms that provide computing power.

For investors, mining equipment manufacturers and blockchain infrastructure companies may offer significant growth opportunities, especially during an upswing in the cryptocurrency market. While demand for mining equipment is positively correlated with Bitcoin prices, these companies also face high volatility, influenced by multiple factors including market sentiment, technological innovation, and regulatory policies. Therefore, when investing in these concept stocks, in addition to maintaining a positive outlook for the cryptocurrency market, it's also important to consider the potential risks associated with market uncertainty.

Canaan Technology (CAN)

Canaan Inc. was founded in 2013. That same year, it launched the world's first ASIC-based blockchain computing device, ushering in the ASIC era for the industry. Since then, the company has accumulated extensive experience in chip mass production. In 2016, Canaan Inc. entered mass production of its 16nm product, marking its position as the first company in mainland China to utilize advanced process technology. Since 2018, Canaan Inc. has achieved mass production of the world's first self-developed 7nm chip, as well as the K210, its own RISC-V-based commercial edge intelligent computing chip.

Since its founding, Canaan Inc. has become a significant player in the blockchain hardware sector, leveraging its leading ASIC mining technology and proprietary chips. Compared to other mining machine manufacturers, Canaan Inc. and BTDR, which offer the potential to increase mining profitability through self-produced mining machines, offer greater potential benefits. Despite the bear market over the past year, Canaan Inc.'s mining machine sales have remained high, and with the Bitcoin price rebound, future sales are expected to grow significantly.

The biggest potential positive factor is changes in mining machine prices. If prices rise—for example, due to unexpected demand or supply constraints—then the valuation multiples of mining companies could increase, creating a "Davies Double Click" effect and boosting the company's overall valuation. CAN recently signed two major institutional orders, including one from HIVE for 6,500 Avalon A1566 mining machines. This will further boost its sales and revenue growth, demonstrating market recognition and demand for its mining machines.

Judging from Canaan's fundamentals and market expectations, its current share price does not fully reflect its future potential. Assuming the Bitcoin market recovers and mining machine prices remain stable or increase, Canaan's sales revenue and profits will see significant growth, further driving its valuation upward.

Bitdeer(BTDR)

Bitdeer provides global cryptocurrency mining computing power, allowing users to lease computing resources for Bitcoin mining. The company offers computing power sharing solutions, including cloud computing power and a computing power marketplace, as well as one-stop mining machine hosting services, covering deployment, maintenance, and management to support efficient cryptocurrency mining.

Bitdeer recently released its next-generation water-cooled SEALMINER A2 mining rig, the second-generation product in the SEALMINER series. The SEALMINER A2 is equipped with Bitdeer's proprietary SEAL02 second-generation chip. Compared to the A1 series, the A2 offers significant improvements in energy efficiency, technical performance, and stability. The A2 series includes two models: the air-cooled SEALMINER A2 and the water-cooled SEALMINER A2 Hydro, designed to meet the needs of mining in various environments. Both miners utilize advanced cooling technology to optimize power consumption and hashrate performance, ensuring stable operation under high loads. According to test data, the A2 boasts an energy efficiency of 16.5 J/TH and a hashrate of 226 TH/s, slightly lower than the 13.5 J/TH of mainstream mining rigs from Bitmain and MicroBT. The company also stated that the A2 has entered mass production and is expected to add 3.4 EH/s of hashrate by early 2025. Bitdeer also plans to complete the tape-out design of the SEAL03 chip in the fourth quarter, with a target energy efficiency of 10 J/TH.

Overall, Bitdeer is in a critical period of innovation and growth, particularly in the water-cooled mining rig and computing power sharing sectors. It's worth noting that as a cloud mining platform, Bitdeer provides computing power leasing and hosting services, not just traditional mining rig sales. Unlike traditional mining rig manufacturers, cloud mining and hosting companies have greater flexibility in capital and resource allocation. They can expand their market share by providing users with on-demand computing resources and accommodate investment needs of varying sizes. Therefore, while the overall cryptocurrency market trends will impact Bitdeer's performance, the diversity and innovation of its business model are likely to ensure its relative stability amid market fluctuations.

BitFuFu (FUFU)

Cloud mining services and digital asset management services

BitFuFu is a Bitcoin mining and cloud mining company backed by Bitmain. It provides cloud mining services to users worldwide, allowing them to participate in Bitcoin mining without purchasing hardware. According to its latest financial report, BitFuFu holds approximately $197 million in digital assets, equivalent to 1,709 Bitcoins.

Additionally, BitFuFu has reached a two-year credit agreement with Antpool, a subsidiary of Bitmain, with a maximum loan limit of $100 million. This credit agreement further solidifies BitFuFu's partnership with Antpool and enhances its flexibility in capital operations. With the volatility of the Bitcoin market, an increasing number of Bitcoin mining companies, such as MARA and CleanSpark, have begun adopting financing methods such as Bitcoin-collateralized loans, flexibly leveraging their Bitcoin assets to support business development and capital expansion.

From an investment perspective, BitFuFu is backed by Bitmain and AntPool, giving them unique advantages in hardware supply and computing power. This provides BitFuFu with efficient and stable mining equipment, helping them optimize their mining farm operations and mining pool support. Therefore, BitFuFu possesses significant technological and resource advantages in the cloud mining sector, attracting more users and capital.

Overall, as the Bitcoin market gradually recovers and demand for cloud mining increases, BitFuFu is likely to benefit from this trend. Compared to traditional mining companies, cloud mining allows investors to participate in Bitcoin mining at a lower cost, making it particularly suitable for users without hardware resources.

Exchange Concept

Coinbase (COIN)

Founded in 2012 and listed on the Nasdaq in 2021, Coinbase is the first and only legally regulated, publicly listed cryptocurrency exchange in the United States. This status has made it the largest cryptocurrency exchange in the United States by trading volume, and has also attracted many institutions to choose it as the preferred platform for custodial crypto assets.

Coinbase and Circle jointly issued the USDC stablecoin, pegged to the US dollar, and expanded into diversified businesses such as staking and custody. Furthermore, Coinbase is a core holding of ARK Invest fund manager Cathie Wood, who has repeatedly publicly expressed her optimism about the company.

Coinbase's stock price is highly correlated with Bitcoin. For example, its all-time high on November 8, 2021, nearly coincided with Bitcoin's all-time high (November 10, 2021). At its recent low (November 21, 2022), its stock price bottomed out in tandem with Bitcoin's price. From its 2021 high of $368.9 to its low of $40.61, the stock price plummeted by 89%, a fluctuation even greater than Bitcoin's 78% drop during the same period, demonstrating Coinbase's leverage in the crypto market.

Over the past six months, Coinbase's stock price has fluctuated primarily due to regulatory pressure and the progress of the Bitcoin ETF approval process. While the approval of a Bitcoin ETF in 2023 was initially considered a significant positive, market concerns subsequently arose about the potential diversion of Coinbase's traditional business model, leading to a temporary decline in the stock price. Nevertheless, post-election market dynamics have benefited Coinbase.

Bakkt Holdings (BKKT)

Bakkt is a leading cryptocurrency platform dedicated to providing compliant crypto asset custody and trading services to institutional investors. The company holds a crypto asset custody license issued by the New York State Department of Financial Services (NYDFS). Following security incidents at numerous crypto asset custody platforms in recent years, Bakkt has earned trust, particularly among institutional clients, thanks to its regulatory compliance and strong regulatory background.

Bakkt, originally founded by Intercontinental Exchange (ICE), later spun off into an independent, publicly traded company, exemplifies the convergence of traditional finance and the crypto economy. Bakkt's stock price has recently experienced a significant surge, primarily due to Trump's media and technology group (DJT) plans to acquire Bakkt in full. According to the Financial Times, Trump's company, DJT, is in advanced acquisition talks with Bakkt. If successful, the acquisition would further Trump's involvement in the cryptocurrency market and provide Bakkt with financial support and additional development opportunities.

Payment Concept

Block (SQ)

A payment service provider established in 2009, formerly known as Square. As early as 2014, Square began accepting Bitcoin as a payment method, and Square has been active in the Bitcoin field since 2018. Since 2020, Block has purchased a large amount of Bitcoin for payment services and as a company asset reserve. Financial report for the third quarter of fiscal year 2024. This quarter, Block's total net revenue reached US$5.976 billion, a steady increase of 6% compared to US$5.617 billion in the same period last year. Excluding Bitcoin-related revenue, total net revenue increased to US$3.55 billion, an increase of 11% year-on-year. Net profit turned from a net loss of US$93.5 million in the same period last year to a profit of US$281 million, a year-on-year increase of 402.1%;

Square's business has strong application support, good asset reserves, and stable cash flow brought by the business. It is one of the more stable concept stocks. On this basis, influenced by the certainty of Bitcoin after Trump's election, Square has achieved a 24% increase in the past half month.

As a payment-focused stock, those interested in Blockchain can also consider PayPal. As a global payment giant, PayPal provides digital payment services to merchants and consumers worldwide. In recent years, the company has also demonstrated a strong interest in blockchain technology, with key initiatives including the 2023 launch of the PayPal USD (PYUSD) stablecoin. This Ethereum-based, dollar-backed stablecoin is a core component of PayPal's strategy for integrating digital payments with blockchain. PayPal also used PYUSD for its first blockchain investment, backing Mesh, a company focused on digital asset transfer and embedded financial platforms.

In contrast, Block's focus in the blockchain space is more focused on Bitcoin, integrating it into payment services and company asset reserves.

Conclusion

Demand for blockchain-related stocks is rapidly growing, potentially surpassing that of traditional tech stocks and cryptocurrencies themselves. As blockchain expands from its initial cryptocurrency applications to encompass broader industry solutions, market demand for related technologies and infrastructure is also increasing significantly. Compared to traditional tech stocks, blockchain-related stocks hold even greater growth potential because they not only rely on continuous technological innovation but are also closely tied to digital transformation and decentralization trends in global financial markets.

As blockchain technology matures and the regulatory environment improves, the market outlook for blockchain-related stocks will become increasingly bright. In particular, as global governments gradually clarify their regulatory policies on crypto assets, blockchain companies are expected to experience explosive growth based on compliance. We expect more traditional industries to adopt blockchain technology, driving technological innovation and further increasing market demand in this sector. Waterdrip Capital remains optimistic about the long-term development potential of the blockchain sector, closely monitoring related companies and their technological progress, and actively investing in them. In the coming years, blockchain-related stocks are expected to become one of the most attractive investment directions in the global capital market.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.