This week, Bitcoin experienced a decline of 0.1%, briefly falling below 116,000 USDT before swiftly recovering. Ethereum increased by 6.47%, supported by sustained net inflows, and outperformed other major altcoins. In July, ETH ETFs recorded a record $5.4 billion in net inflows, while The Ether Machine added 15,000 ETH, indicating on-chain activity aligned with institutional trends. Sui’s total value locked (TVL) rose to $2.2 billion, doubling since the start of the year, with monthly active addresses increasing by over 130%. Solana’s decentralized exchange (DEX) volume has decreased nearly 70% from its January peak, reflecting a slowdown in ecosystem activity. Deputy Secretary for Justice of Hong Kong: Stablecoin Ordinance Will Create a Trustworthy Market Environment with Three Pillars. OpenSea introduced Creator Studio 2.0 to enhance multi-chain publishing capabilities. EigenDA launched its V2 mainnet, increasing throughput by approximately 6.7 times compared to V1. Additionally, CBOE is progressing with ETP listings for leading tokens such as SOL and XRP, with potential approval as early as Q4.

Key Updates

-

Bitcoin’s annual transaction volume surpasses Visa for the first time, moving towards a global value settlement network

-

White House Releases AI Action Plan: "Winning the Race: America's AI Action Plan"

-

Goldman Sachs and Bank of New York Mellon jointly launched tokenization solution for money market funds

-

Ethereum lending scale exceeds $30 billion, reaching an all-time high

Market Overview

-

BTC

— This week, BTC dropped 0.1%. BTC price fluctuated between $114,790 and $119,790, attempting to break through upper resistance. However, from July 30 to 31, BTC experienced a notable pullback, dropping rapidly from around $119,000 to below $116,000. This drop was accompanied by a significant surge in trading volume, indicating strong selling pressure. After hitting the local low, BTC quickly stabilized and rebounded, currently trading around $118,678.4.

-

ETH — This week, ETH rose 6.47% this week. At the start of the week, ETH moved upward between $3,800–$3,900, briefly reaching a high near $3,940. A clear correction followed between July 29 and 30, with the price dropping quickly from the peak to around $3,720. The pullback was accompanied by rising trading volume, also indicating notable selling pressure. After stabilising at the bottom, ETH began a rebound and is currently back at $3,868.04. During the rebound, it formed a new consolidation range between $3,760–$3,840.

-

Altcoins — This week, mainstream altcoins generally showed an upward trend. The median price change for the top 100 cryptocurrencies by market cap was 3.40%.

-

ETF & Derivatives — On the ETF front, BTC ETFs have seen net outflows in the past 3 days, due to BTC consolidating around $120,000 and declining 7-day returns. ETH ETFs, however, have experienced 14 consecutive days of net inflows, as ETH has led altcoin gains over the past 7 days, with its price briefly breaking $3,800. In the futures market, over the past 24 hours, BTC and ETH contracts saw liquidations of $67.14 million and $149 million.

-

Macro Data — The initial estimate for the U.S. One-year inflation expectation in July is 4.4%, lower than the market expectation of 5.0%. This data reflects consumers’ expectations of easing inflationary pressures, potentially allowing more flexibility for Federal Reserve monetary policy adjustments.

-

Stablecoins — The total market capitalization of stablecoins increased to $266.55 billion, indicating further inflow of off-chain funds.

Top Categories

The cryptocurrency industry continued to rise this week, with market sentiment remaining optimistic and most mainstream altcoin sectors gaining. According to Coingecko data, Liquid Staking Protocol, Stablecoin Protocol, and RWA Protocol sectors all showed upward trends this week, rising 18.5%, 25.2%, and 255.4% respectively over the past 7 days.

Stablecoin Protocol

A stablecoin protocol is a system designed to create and manage stablecoins, which are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar. These protocols ensure stability through various mechanisms, such as maintaining reserves of the pegged asset, using algorithms to adjust supply, or employing a combination of both. This sector rose 13.8% over the past 7 days, with Spark SPK, Pinto PINTO and Ethena ENA gaining 285.4%, 131.9%, and 19.3% respectively.

RWA Protocol

RWA Protocol tokenizes real-world assets (such as real estate, bonds, etc.) through blockchain technology, significantly enhancing asset liquidity and accessibility, and building a bridge between traditional finance and the digital economy. Its core value lies in enabling digital management and trading of assets through smart contracts, lowering investment thresholds and increasing transparency. This sector rose 8.2% over the past 7 days, with Centrifuge and Ondo gaining 11.9% and 9.7% respectively.

Liquid Staking

Liquid Staking is a mechanism that tokenizes staked assets, unlocking liquidity for otherwise locked tokens. It allows users to earn staking rewards while still participating in on-chain activities like DeFi. This mechanism has become a key infrastructure component in the DeFi ecosystem. The sector increased by 17.5% over the past week, with Cronos zkEVM CRO and Babylon up by 18.9% and 17.5%, respectively.

Weekly Market Focus

Deputy Secretary for Justice of Hong Kong: Stablecoin Ordinance Will Create a Trustworthy Market Environment with Three Pillars

Hong Kong's Deputy Secretary for Justice, Zhang Guojun, stated that the Stablecoin Ordinance, which will take effect on August 1, will establish a clear and transparent legal framework through three pillars: a licensing system, asset reserve management, and technical and behavioral supervision, fostering an orderly and healthy stablecoin market. He noted that the ordinance will help strengthen international market confidence in Hong Kong as a global financial center.

Zhang Guojun also mentioned that Hong Kong will continue to deepen its cooperation with the mainland and international markets in the future, using legal and other professional services to support Chinese and foreign companies in developing their businesses in Hong Kong.

OpenSea Launches Creator Studio 2.0 to Enhance Multi-Chain Creator Issuance and Display Experience

OpenSea has officially launched Creator Studio 2.0, providing creators with a comprehensive tool for multi-chain NFT creation and issuance. The updated platform supports the creation of NFT collections across up to 20 blockchains, allows for scheduling issuance times, and offers customization options for display pages to facilitate sharing and storytelling. This enhancement aims to lower barriers to content creation, increase expressive capabilities, and strengthen OpenSea’s position within the Web3 creator ecosystem. The feature is now fully integrated into the latest version of OpenSea’s platform and is broadly accessible.

With Creator Studio 2.0, OpenSea is evolving from a single trading platform into a multi-chain infrastructure provider for NFT creation and issuance. In a competitive environment where platforms like Blur emphasize trading efficiency and airdrop incentives, OpenSea seeks to differentiate itself by supporting creators and fostering a vibrant content ecosystem. This approach is designed to improve platform engagement, increase the share of original content, and mitigate user traffic migration. Additionally, with the rapid growth of on-chain NFT activity across projects such as Ordinals, Ethereum Layer 2 solutions, and Solana, unified entry points and cross-chain issuance are emerging as key industry trends. The new features and expanded support in Creator Studio 2.0 will further promote professionalism and scalability within the Web3 content creation landscape.

Ethereum at 10: From Genesis Block to a $458.7B Ecosystem Defining the Smart Contract Era

It’s been 10 years since ethereum, the network that introduced smart contracts to the crypto world, mined its genesis block on July 30, 2015. Now the second-largest cryptocurrency behind BTC with a market capitalization of $458.7 billion, the blockchain has come a long way since its initial goal to become a censorship-resistant global computer not controlled by any single party.

Over its 10-year history, ethereum has evolved through a series of defining stages: breakthrough upgrades, financial experimentation, cultural mania, and increasing institutional adoption. It has also attracted scrutiny from regulators and weathered internal fractures and external competition.

ETH has evolved from a white paper idea into the most widely used platform for stablecoins, real-world assets, DeFi, and now even ETFs — signaling mainstream acceptance,” Kelly Ye, deputy chief investment officer of Avenir Group, told Sherwood News. “It proves Ethereum is no longer just experimental; it’s a successful proof of concept for moving traditional finance onto blockchain rails.”

While the path to mainstream acceptance hasn’t been exactly smooth, each major milestone and mishap has, in its own way, been key to bringing Ethereum to where it is today.

CBOE Files General Listing Framework for Crypto ETPs; SOL and XRP ETPs Expected in Q4

The Chicago Board Options Exchange (CBOE) has submitted a general listing standards application for crypto asset ETPs (Exchange Traded Products) to the U.S. Securities and Exchange Commission (SEC), marking a clearer compliance path for crypto trading products on U.S. equity markets. The standards will apply to crypto assets that have been futures-tracked on compliant derivatives markets (e.g., Coinbase Derivatives) for over six months, covering major tokens like SOL and XRP, with support for related staking mechanisms. Solana ETP approval is expected by October 10 at the latest, followed by XRP ETP in Q4. Meanwhile, the NYSE and Nasdaq may quickly respond with similar filings.

This general listing framework from CBOE is seen as a critical compliance extension following the spot Bitcoin ETF. Unlike prior single-asset ETF application routes, this unified “six months of futures tracking” threshold creates a standardized process applicable to major crypto assets, greatly reducing approval uncertainty. It is expected to promote ETP launches for SOL, XRP in Q4 and may pave the way for staking ETPs for ETH, and productization of second-tier assets like AVAX and LINK.

Key Market Data Highlights

Ethereum ETFs Hit Record Inflows in July; The Ether Machine Adds On-Chain Amid Institutional Entry Surge

Ethereum treasury strategy firm The Ether Machine recently increased its Ethereum holdings by approximately 15,000 ETH, raising total holdings to 334,757 ETH—ranking it among the top on-chain Ethereum treasuries. Valued at about $50 million at current prices, the firm still holds $407 million in deployable capital, demonstrating strong long-term capital management capability and confidence in Ethereum’s medium- to long-term prospects.

This accumulation is part of a broader institutional trend of steadily acquiring Ethereum. Since the launch of spot Ethereum ETFs in 2024, traditional asset managers such as BlackRock and Fidelity have expanded their allocations. In July 2025, ETF net inflows hit a record $5.4 billion—surpassing the total inflows of the previous 11 months combined—highlighting growing institutional consensus on Ethereum as a “blue-chip digital asset.”

Overall, The Ether Machine’s continued accumulation not only reflects firm belief in Ethereum fundamentals but also serves as an on-chain indicator of accelerating institutional capital deployment. With ETFs driving Ethereum’s asset class transformation, such treasury actions have become important signals for long-term capital flow trends.

TVL on the Sui Chain Increases to 2.2 Billion USD, Nearly 480% Growth Since the Beginning of the Year

According to DefiLlama data, Sui’s total on-chain TVL surpassed $2.2 billion, nearly doubling from its yearly low, setting a new all-time high. The surge began following the May 22 contract exploit incident at Cetus—the largest DEX aggregator on Sui—which resulted in over $223 million liquidity loss. The team promptly paused the protocol, initiated asset recovery and governance reforms, ultimately reclaiming most assets via community voting and moving to open-source governance, which restored ecosystem transparency and market confidence.

On-chain fundamentals have simultaneously improved. Artemis data shows Sui’s daily active addresses rebounded from about 300,000 post-incident low to 2.6 million, increasing over 130% monthly, reflecting real capital inflows and user return. Meanwhile, SUI has attracted institutional attention; Nasdaq-listed Lion Group bought 350,000 SUI in June and increased holdings to over 1.01 million in July, worth $4.3 million; Everything Blockchain Inc. also added SUI to its $10 million crypto portfolio.

Solana DEX Volume Falls Nearly 70% from Year-Start Peak, Ecosystem Activity Temporarily Cooling

DefiLlama data shows Solana DEX’s monthly trading volume peaked over $260 billion in January 2025 but has since declined by nearly 70% by July. This pullback mainly results from the fading meme coin and speculative frenzy that fueled Solana’s high-frequency trading earlier this year, with a sharp drop in short-term capital and bot activity. Additionally, cross-chain capital has flowed back to the Ethereum ecosystem, driven by steady spot ETF inflows, with Layer 2 and restaking protocols diverting significant trading volumes, causing a temporary cooldown in Solana DEX activity.

Despite this, Solana’s infrastructure and protocol innovation remain resilient. Leading DEXs like Raydium and Jupiter still maintain significant market share, and demand for on-chain staking, MEV revenue, and liquid staking token products continues growing. The current volume decline is mainly a cyclical market sentiment shift rather than ecosystem deterioration. Should new token launches, DeFi innovation, and ecosystem incentives restart, Solana’s on-chain liquidity is expected to rebound and DEX volume regain upward momentum.

CoinCatch New Listings:

Futures:

Spot:

Cryptocurrency:

TREE/USDT (

Fee: Zero-fee Trading)

CoinCatch Weekly Events:

Celebrate 10 Years of Ethereum: Trade ETH Spot with Zero Fees!

Event Period: From July 29, 2025, 10:00:00 to August 12, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

New Spot Listing: Trade TREE/USDT Spot with Zero Fees!

Event Period: From July 31, 2025, 06:00:00 to August 7, 2025, 16:00:00 (UTC)

Event Details:

Fee: Zero-fee Trading

Duration: Limited Time During the Event

Welcoming August: Grab Check-in Rewards & Share $1M Registration Prize Pool Plus Roborock S8 MaxV Ultra!

📅 Event Time: 2025.7.31 (UTC+8) - 2025.8.6 (UTC+8)

💎 Event 1: Register to Receive 500 USDT

Rules: New users completing tasks during the event receive a maximum 500 USDT position bonus.

-

New users registration → 50 USDT position bonus.

-

Net deposit ≥100 USDT (must transfer to futures balance) → 100 USDT position bonus.

-

Complete 1,000 USDT futures trading volume → additional 100 USDT position bonus.

Double Reward: Users completing

10,000 USDT

futures trading volumeget doubled rewards! Maximum rewards:

500 USDT position bonus.

Total Prize Pool:

1,000,000 USDT

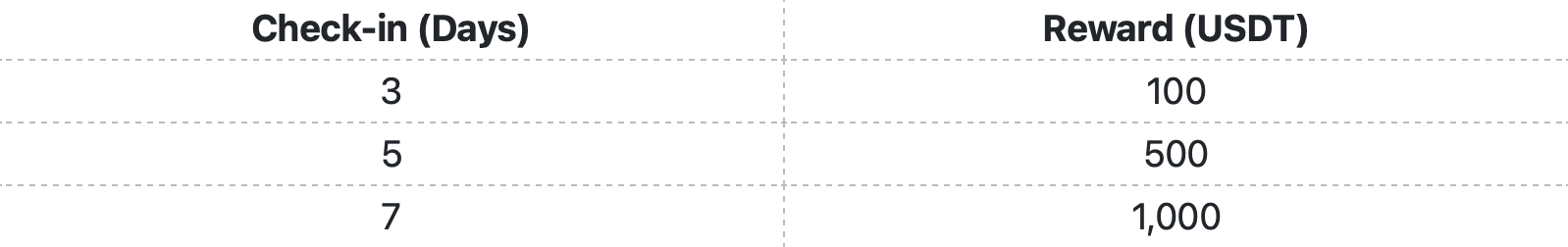

✔ Event 2: Check-in to Receive Maximum $1,000

Rules: During the event, users complete ≥

10,000 USDT daily futures trading volume

= 1 check-in. More check-in days = higher rewards (maximum $1,000). Rules below (rewards non-cumulative):

🎁 Event 3: Trade to Win Surprise Gifts

Rules:

Top 3 users by futures trading volume (minimum ≥1,000,000 USDT) during event receive:

🥇 1st place:

Roborock S8 MaxV Ultra

🥈 2nd place:

HTC VIVE Pro 2 VR Kit

🥉 3rd place:

Bose Headphones

Next Week Token Unlocks

According to Tokenomist, several major token unlocks are expected in the coming week (July 31 – August 7, 2025). The top 3 are:

SUI: $167 million worth of tokens to be unlocked, accounting for 1.3% of circulating supply.

ENA: $132 million worth of being unlocked, 3.3% of circulating supply.

OP: $22.35 million worth of being unlocked, 1.8% of circulating supply.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.