The year 2021 witnessed the fierce competition among Layer 1 blockchains, while 2024 marked the carnival frenzy of Meme coins. So, where will the market's main narrative head in 2025?

This question on platform X finds its answer clearly revealed by mainstream capital: With the successful legislation of

the GENIUS Act

and stablecoins formally incorporated into the US sovereign regulatory framework, a new multi-dimensional financial narrative blending "Stablecoins × RWA × ETF × DeFi" is forcefully emerging. In this profound evolution of cross-chain finance, the core focus is no longer Bitcoin or Meme coins, but the contest between the old and new orders represented by Ethereum and Solana. These two public chains exhibit fundamental differences in their technical architectures, compliance strategies, scaling paths, ecosystem building models, and even their value foundations.

Currently, the question that which will determine the future landscape, has entered a critical stage where capital is fiercely placing its bets with real money.

Capital Preferences: From "BTC" to "ETH or SOL"

In contrast to earlier crypto bull markets that were influenced by macroeconomic monetary factors leading to widespread increases and decreases, the market in 2025 exhibits clear structural differentiation. Top projects no longer rise together; instead, capital is focusing on specific areas of competition, highlighting a survival-of-the-fittest scenario.

The clearest indication of this shift is reflected in the evolving strategies of institutional buyers:

ETH: Multiple US-listed Companies Begin Establishing Large-scale Ethereum Asset Treasuries

-

On July 22, GameSquare announced raising its digital asset treasury authorization to $250 million and added 8,351 ETH to its holdings, explicitly aiming to "allocate high-quality Ethereum ecosystem assets to achieve stablecoin yields";

-

SharpLink Gaming accumulated an increase of 19,084 ETH this month, bringing its total holdings to 340,000 ETH, with a market value exceeding $1.2 billion;

-

A new wallet address bought over 106,000 ETH via FalconX in the past 4 days, worth nearly $400 million;

-

The Ether Machine announced plans to complete a backdoor listing with 400,000 ETH, securing over $1.5 billion in financing support from top institutions including Consensys co-founders, Pantera, and Kraken, aiming to become the "largest public ETH production company."

SOL: Buying Scales Are Astonishing

-

Listed company DeFi Development Corp announced increasing its holdings by 141,383 SOL, bringing its total holdings close to 1 million SOL;

-

SOL treasury company Upexi announced a purchase of 100,000 SOL for $17.7 million, raising its total holdings to 1.82 million SOL, with unrealized gains already exceeding $58 million;

-

According to CoinGecko data,

PENGU's market cap has reached $2.785 billion, surpassing BONK ($2.701 billion), becoming the largest Meme coin by market cap within the Solana ecosystem.

These trends suggest that ETH and SOL have emerged as the favored foundational assets for institutional multi-asset allocation. Nevertheless, their investment strategies exhibit notable differences: ETH is utilized as an "on-chain treasury with a robust asset foundation plus an institutional-grade asset suitable for spot ETFs"; SOL is being framed as the "high-performance consumer application chain + the primary arena of the new Meme economy".

These two investment approaches reflect the market's two primary future narratives: ETH serves as the financial engine being incorporated into the institutional framework, while SOL represents the speculative avenue for capital's bold investments.

ETH: Fulfilling Its Mission as a Financial Asset

In the last two years, the Ethereum narrative encountered skepticism regarding its potential stagnation. Issues such as staking yields not showing significant improvement after the Merge, the fragmentation of the Layer 2 ecosystem, consistently high Gas fees, and the migration of projects like dYdX and Celestia have led to diminished market expectations for ETH.

However, the truth is that ETH has not disappeared; rather, it has solidified its position as the primary asset closely tied to institutional narratives. Its foundational support is rooted in strong institutional synergy across three key dimensions:

RWA Core Hub Status Established

The total amount of RWA issued on-chain currently exceeds $25 billion, with over 50% occurring on the Ethereum mainnet and its L2 networks. Core products including BlackRock's BUIDL, Franklin Templeton's BENJI, Ondo's USDY, and Maple's cash funds all use ETH as a key peg layer or liquidity medium (e.g., WETH). The larger the RWA scale, the more indispensable ETH becomes.

Source: RWA.xyz

Anchor Asset for Spot ETFs & Stablecoin Policy

After the enactment of the GENIUS Act, stablecoin issuers such as Circle and Paxos have made "on-chain reserve transparency" and "short-term US Treasury collateral structures" their primary objectives. In Circle's most recent asset distribution, the proportion of WETH has increased to 6.7%. At the same time, firms like Grayscale and VanEck are hastening their efforts to launch Ethereum spot ETF products. Following Bitcoin, Ethereum is poised to be the next focal point for ETFs.

Absolute Advantage in On-Chain Lockup & Developer Ecosystem

As of July 22, the total TVL of the Ethereum mainnet and L2 networks has reached an impressive $93 billion, representing 61% of the global crypto TVL. The number of monthly active ETH developers remains steady at over 50,000, which is roughly four times that of Solana and eight times that of other Layer 1 networks. This indicates that, despite changing market narratives, ETH's position as the "primary financial layer" for on-chain asset governance, value accumulation, and liquidity distribution is supported by institutional foundations and ecosystem resilience that are hard to disrupt in the short term.

In terms of pricing, ETH is nearing the $4,000 mark. As BTC surpasses and stabilizes above $120,000, the process of rekindling market expectations for ETH is not about crafting a new narrative, but rather about rediscovering its intrinsic value.

SOL: Native On-Chain Consumption Power, The Capital Logic Behind Its Explosiveness

Compared to Ethereum's "financial hub" positioning, Solana resembles consumer infrastructure for high-frequency scenarios. Its narrative has successfully transformed from the "technically optimal chain" to a "machine for creating native on-chain hits", achieving structural breakthroughs in 2024-2025.

Native Market for MemeCoin, Not a Secondary Venue:

In the ongoing trend of "crypto consumer goods," the emergence of MemeCoins on Solana has reached unprecedented levels in both quantity and liquidity. Market analysis indicates that as of July 22, BONK, Solana's leading Meme project by market capitalization, achieved a valuation of $2.67 billion, closely followed by PENGU at $2.32 billion and TRUMP at $2.2 billion. The total market capitalization of these three projects has exceeded that of Dogecoin. By utilizing Solana's remarkably low gas fees and high transactions per second (TPS), these initiatives have created a swift cycle: "affordable experimentation → community-driven fear of missing out (FOMO) → high-frequency trading incentives." On the Solana platform, engaging with Meme has evolved into a fundamental consumption pattern for users on the blockchain.

Capital Bets on "On-Chain Activity," Not Technical Roadmaps:

The massive accumulation by listed companies like Upexi indicates that mainstream capital views SOL as a trinity of "tradable asset + user growth metric + narrative carrier". Their focus is on ecosystem activity, trading depth, and the consumption attributes of "on-chain stories," rather than technical details.

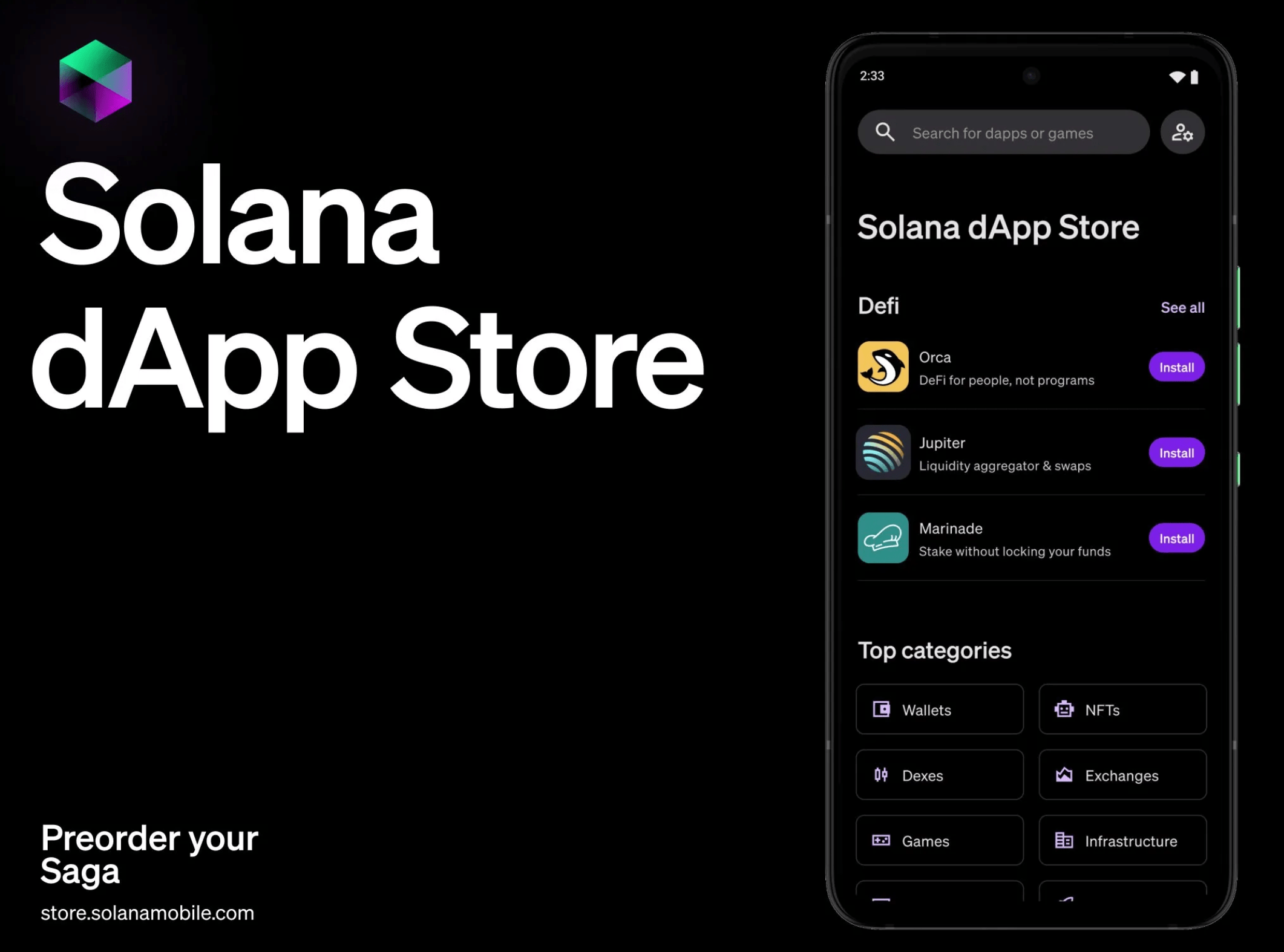

Ecosystem Products Evolving from Hits to "Foundational Consumption Layer":

From Jupiter's DEX experience and Backpack mobile wallet to the Solana phone and the upcoming Solana App Store, the ecosystem is attempting to build a closed loop closer to Web2 user habits. Native on-chain consumption (including Memes, DePIN, mini-games, community points, social media) has become Solana's "local life," creating natural consumption scenarios for SOL. Although its TVL is only 12% of Ethereum's, Solana's on-chain transaction frequency, per capita interaction volume, and total Gas consumption significantly exceed traditional L1s like Polygon and BNB Chain. It resembles more of a "daily active gateway" for crypto natives than a pure financial "pricing anchor."

Price Signal: Surpassing $200, Entering a High-Volatility Main Uptrend:

As BTC finds stability at $120,000 and ETH approaches $4,000, SOL has recently regained the $200 mark. The high volatility, coupled with intense market activity, serves as a precursor to the formation of new narratives and significant shifts in positions. What we are witnessing is not merely speculative excitement, but rather a feedback loop between "on-chain behavior" and "price reaction" that is becoming progressively shorter.

This model is driven by consumption data that fuels trading expectations – a feat that ETH cannot replicate, positioning SOL as the benchmark.

Whale Games & Policy Catalysts

The technical application defines a public chain's "narrative potential," while capital and policy shape its "trading capacity". This is particularly relevant after BTC surpasses $120,000, as identifying the "capital convergence zones" for the next phase becomes essential.

On-chain data indicates that since Q2 2025, three major institutions have adopted notably different strategies regarding "on-chain accumulation": Grayscale has consistently accumulated ETH from May to July, totaling 172,000 ETH (approximately $640 million), specifically to establish a foundational position for its spot ETH ETF; Jump Trading has frequently adjusted its positions on the Solana chain since June, concentrating on BONK, PENGU, and Jupiter, and has accumulated nearly 280,000 SOL across various addresses; DeFi Development Corp and Upexi, both listed companies, have regularly announced their SOL accumulation, with each now holding over 1 million SOL (total market value around $500 million), resulting in significant unrealized gains.

This situation is not merely a straightforward "win-lose" scenario, but rather a case of market stratification: ETH serves for "structural asset allocation", while SOL is utilized for "short-cycle volatility plays".

Differentiated policy tailwinds are enhancing "dual-track growth". On July 19, US President Trump officially signed the Generating Essential National Intelligence Using Secure Transactions (GENIUS) Act, which establishes the first federal regulatory framework for stablecoins in the US. Coupled with Coinbase and BlackRock submitting S-1 forms for spot ETH ETFs, the pathway for "integrating ETH into the compliance framework" is becoming increasingly evident. At the same time, the Solana team is working with exchanges such as OKX and Bybit to promote experiments in the "compliant issuance of consumer assets". For example, in July, OKX launched a dedicated Launchpad for Solana on-chain assets, implementing light KYC mechanisms for the issuance processes of Meme coins.

This "bidirectional compliance" indicates that policy benefits are being allocated differentially based on application scenarios, capital characteristics, and risk tolerance: ETH continues to absorb the market's attention.

Who Defines the Future?

Looking at the market trajectory following BTC breaking $120,000, the differentiation between ETH and SOL is no longer a linear question of "who replaces whom," but a distributed answer to "who defines the future within which cycle."

ETH: The Mid-to-Long Term Protagonist Underpinned by Structure

Bolstered by the GENIUS Act, the path for ETH's integration into the financial compliance system is clear. Whether through the advancement of spot ETFs or its role as the "clearing and settlement layer" within RWA models, it is becoming the "core asset" for Wall Street's allocation to blockchain assets.

Judging from the accumulation logic of institutions like BlackRock and Fidelity, ETH is evolving from a "Gas Token" into a "fundamental financial platform." Its valuation anchor is shifting from on-chain activity towards treasury yield models and Staking rates. ETH's victory lies not in explosion, but in sedimentation.

SOL: The Short-Term Exploiter Within Structural Fissures

In contrast to the stability of ETH, SOL has emerged as the primary arena for capital maneuvering in sectors such as high-frequency trading, Meme coin trends, end-user applications, and native consumer products (for instance, the Saga phone). From BONK to PENGU, along with JUP's governance trials, the Solana chain has established a "native narrative market" marked by significant liquidity and deep market penetration. Coupled with impressive on-chain metrics: SOL's transactions per second (TPS), cost efficiency, and user response times consistently outperform; the autonomy of the SVM ecosystem also liberates it from the internal rivalries and unnecessary development that afflict the EVM ecosystem.

More crucially, SOL stands out as one of the rare "narrative depressions" that can draw in capital while demonstrating substantial volatility. Following BTC's initiation of its primary upward trend, SOL becomes a key short-cycle option for seizing the "swift response of fund rotation."

Conclusion

For long-term capital betting on institutional transformation and the structured entry of traditional capital, ETH is the preferred choice. For short-term participants seeking to capture fund rotation and narrative explosion opportunities, SOL offers higher-tension Beta exposure. Between narrative and institution, volatility and sedimentation, ETH and SOL may no longer be opposing choices, but rather constitute the optimal combination under an era of mismatch. Who defines the future? For now, the answer may not be a single project, but the ongoing fine-tuning of this "portfolio weighting."

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.