The cryptocurrency market is exhibiting unmistakable signs of an impending altcoin season, with technical indicators, capital rotation patterns, and regulatory catalysts converging to create fertile ground for outsized gains beyond Bitcoin. As

the total crypto market capitalization surges past $4 trillion

—a historic milestone achieved in mid-July 2025—altcoins like Ethereum (ETH), XRP, and Solana (SOL) have spearheaded a rally that has seen double-digit weekly gains across major tokens. With Bitcoin dominance hovering near 64.5% (its highest since 2021), historical patterns suggest this metric’s reversal could unleash pent-up demand for altcoins, potentially triggering a market phase where 75% of top altcoins outperform BTC over 90 days. This article examines the technical foundations, catalytic events, and high-conviction sectors shaping what analysts predict could be the most explosive altseason since 2021.

Altcoin Season Is Around The Corner

Altcoin Index is Approaching the Threshold

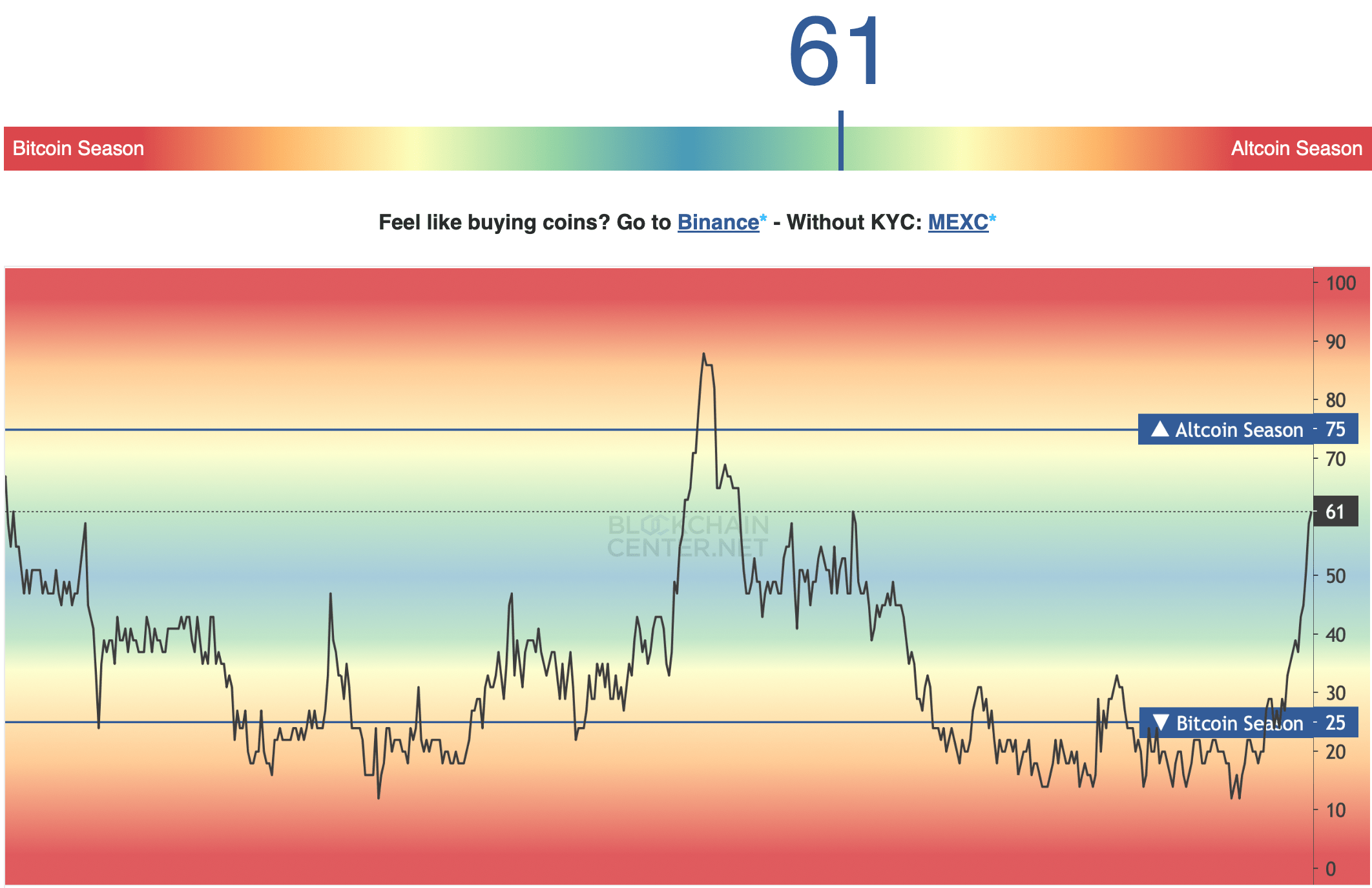

The altcoin season index is currently approaching the critical altseason threshold. The index tracks the performance of altcoins relative to Bitcoin.

It signals whether the broader crypto market is entering a phase where altcoins outperform BTC. At the time of writing, the indicator sits at the midpoint, warranting stronger performance from the altcoins to breach the threshold, indicating an altcoin season.

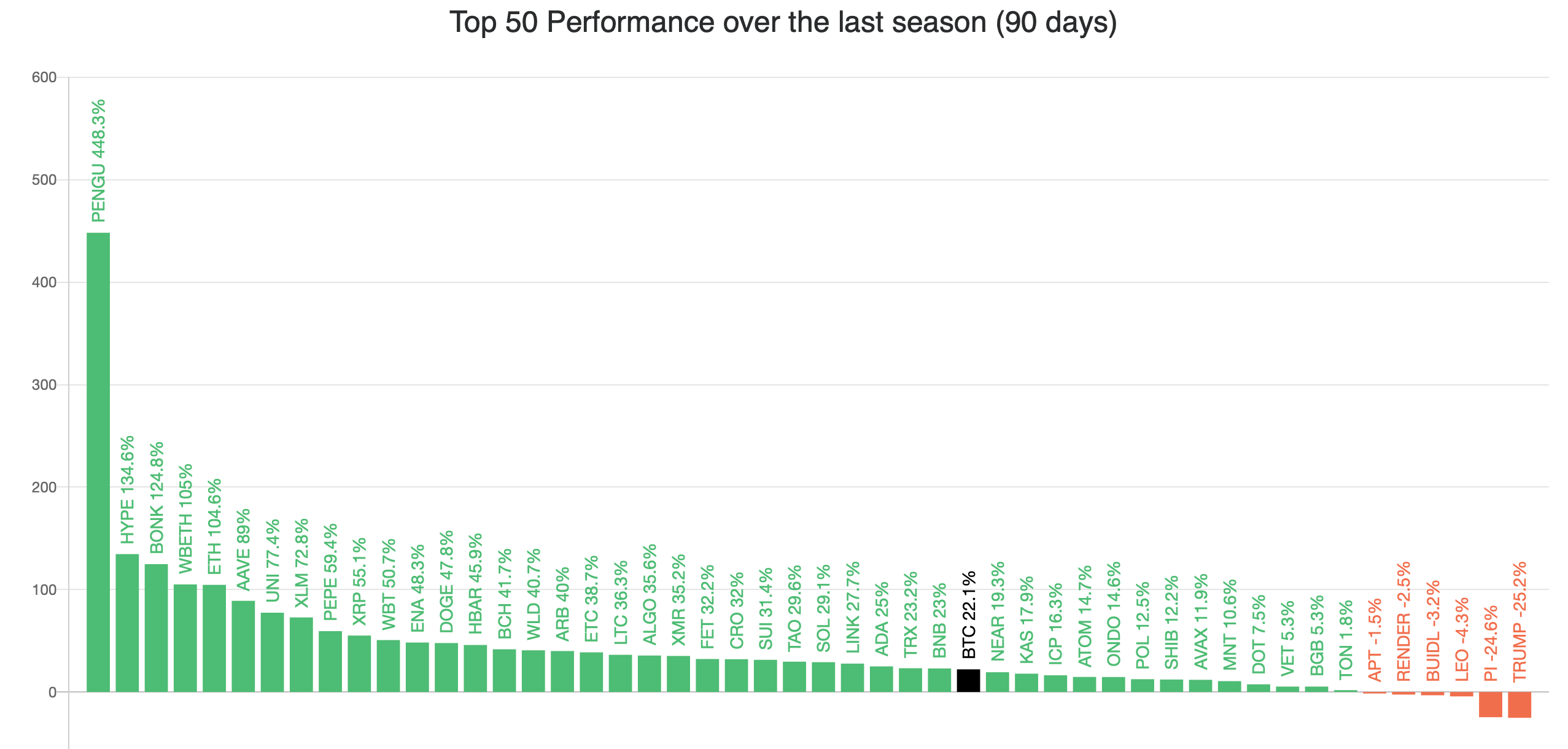

Recent capital inflows are increasingly favoring altcoins over Bitcoin, further supporting positive market sentiment. An altcoin season is typically confirmed when 75% of the top 50 cryptocurrencies—excluding stablecoins and asset-backed tokens—outperform Bitcoin over a 90-day period. Currently, only 50% of these altcoins have exceeded Bitcoin’s returns, indicating potential for additional growth before a full altcoin season is underway.

Additionally, Ethereum’s 27% increase this week alone has driven several other tokens to multi-month highs. If more altcoins continue to outperform Bitcoin in the coming weeks, the threshold for an altcoin season could be achieved as early as next month.

Bitcoin’s Domination Wavers

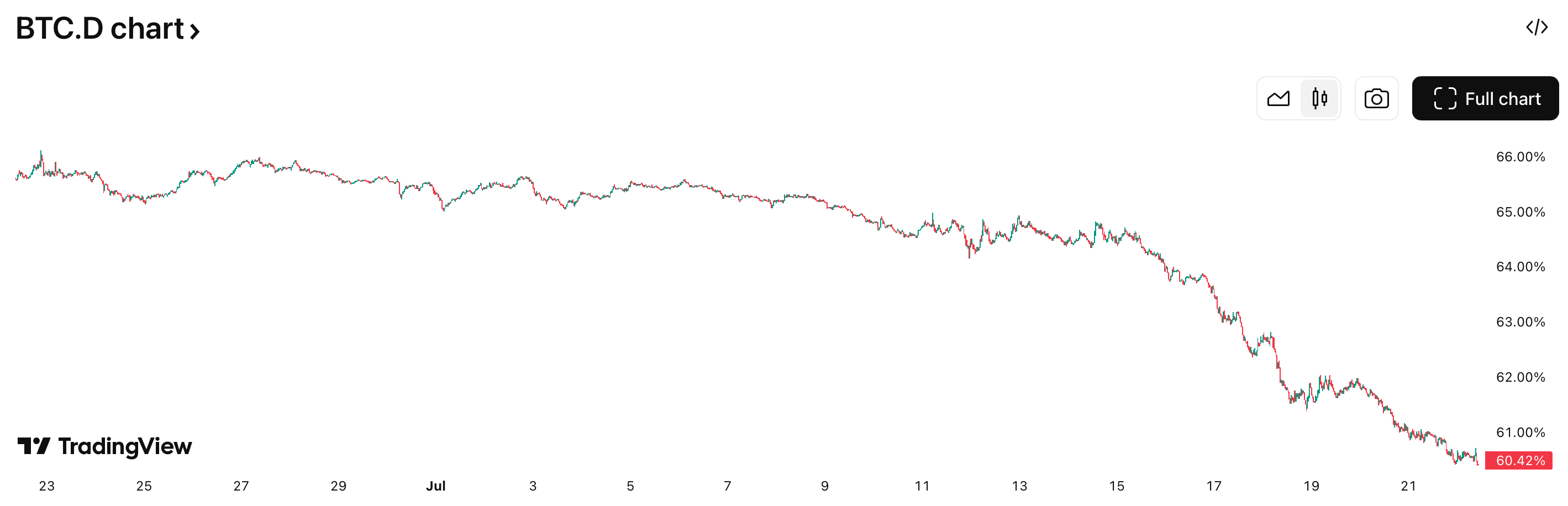

Bitcoin's market dominance has decreased significantly since July started, declining by 6.5% from 66.61% to 60.41%. This represents the lowest level in approximately four and a half months and indicates a growing investor interest in alternative cryptocurrencies.

A decline in dominance is often considered an early indicator of an upcoming altcoin season.

The recent rally in Ethereum has played a considerable role in this shift, while Bitcoin's price has remained relatively stable at approximately $118,301. Despite the reduction in market share, Bitcoin’s price has not experienced a downward trend, suggesting a healthy market transition rather than a sell-off. The asset continues to consolidate just below the $120,000 mark.

If altcoin investors begin taking profits due to recent gains, selling pressure could stall the rally. Many tokens are at multi-month highs, and any sharp sell-off could reverse gains. This might delay the onset of a true altcoin season, pushing it further into Q3 2025.

Latest Altcoin Leaders and Breakout Movers

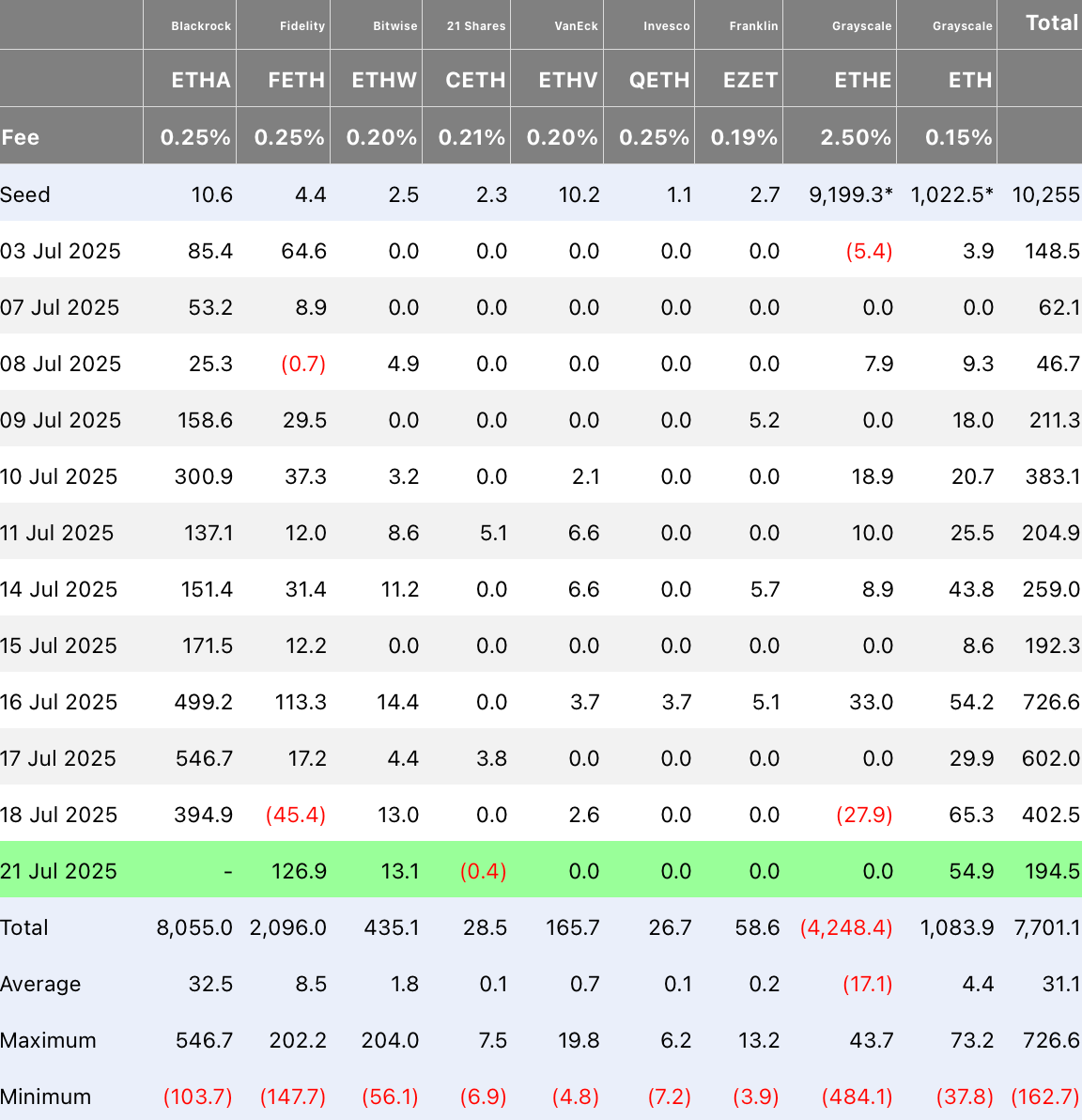

July Ethereum ETF Flow (US$m) Source: Farside

Ethereum has emerged as an institutional cornerstone, with its price surging to $3,846 amid record-breaking staking activity. Nearly 29% of all ETH supply—worth approximately $134 billion—is now locked in staking contracts, creating unprecedented supply scarcity. This momentum accelerated following spot ETH ETF approvals, which attracted $7.7 billion in net inflows during July alone, elevating their collective market capitalization to $13.27 billion. Simultaneously, XRP has shattered expectations, rallying to $3.55—a 71% monthly surge—fueled by regulatory clarity and expanding adoption in cross-border payments by over 70 financial institutions.

Solana continues to dominate in user growth and DeFi activity, processing 3 million daily transactions—eight times Ethereum’s throughput—while maintaining a Total Value Locked (TVL) of $9.16 billion. Though currently trading at $201 (down from its January 2025 peak of $294), SOL’s ecosystem benefits from surging meme coin activity and platforms like Pump.fun, positioning it for renewed upside. Beyond these giants, tokens like Polygon (MATIC) and Ondo (ONDO) have posted 30%+ weekly returns, driven by Layer-2 scaling innovations and real-world asset tokenization narratives, respectively. This broad-based strength propelled the CoinDesk 20 Index—a basket of leading digital assets—to a 35% monthly gain, underscoring the deepening capital rotation into altcoins.

Technical Analysis: Shifting Market Structure

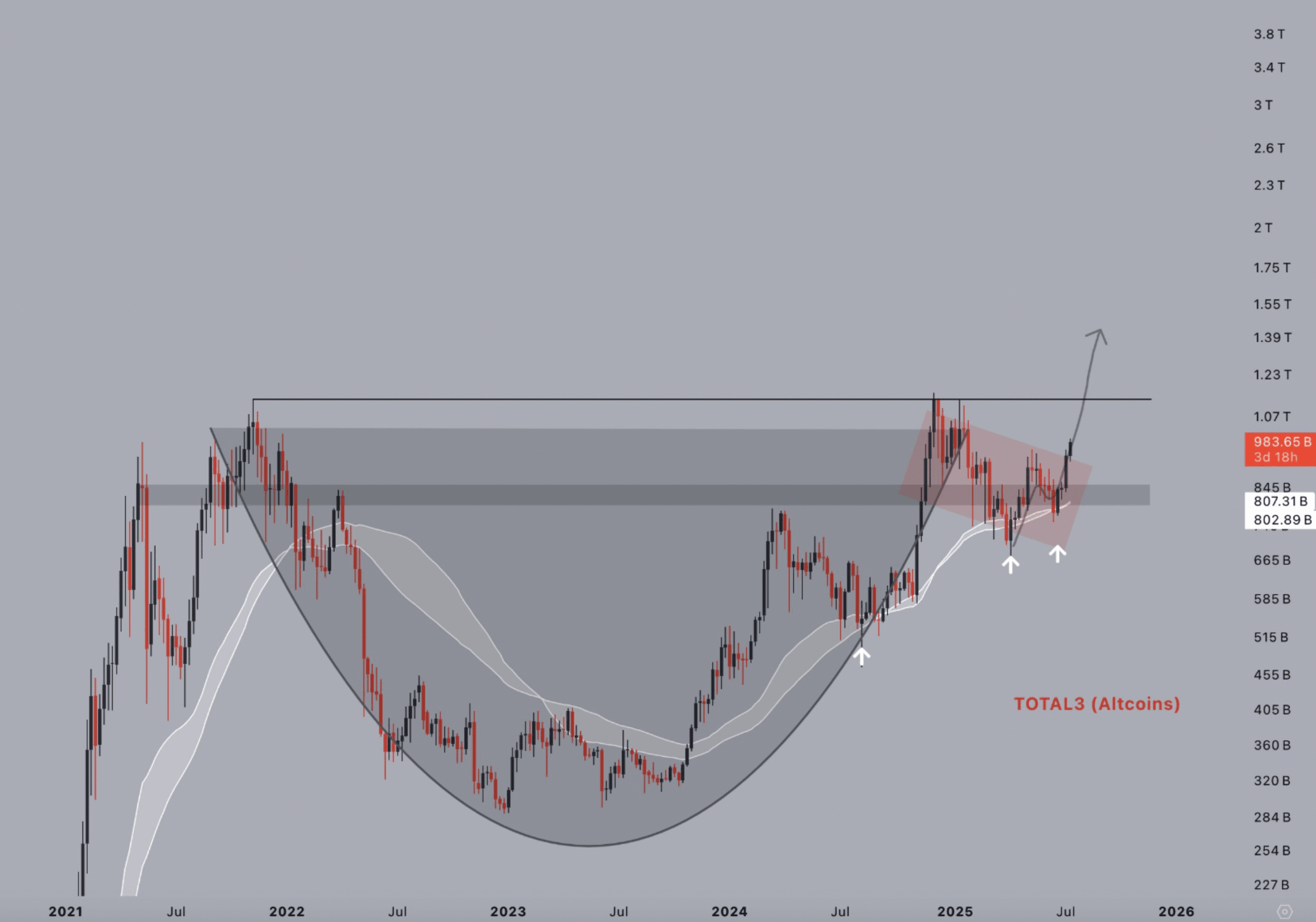

TOTAL3/USD weekly chart. Source: Jelle

The altcoin market stands at a critical technical inflection point. A cup-and-handle pattern—one of classical technical analysis’ most reliable bullish continuation structures—has completed its formation on the altcoin market cap’s bi-weekly chart. The "cup" developed between 2022 and mid-2024, tracing a U-shaped recovery as investors accumulated assets after the bear market lows. The subsequent "handle" phase materialized as a shallow descending channel throughout early-to-mid 2025, representing a consolidation before breakout. For a confirmed altseason, the total altcoin market cap must decisively breach the pattern’s neckline resistance at $813.18 billion. Such a breakout would project a technical target near $5.4 trillion—a 564% increase from current levels—by 2026.

Supporting this setup, Swissblock’s Altcoin Vector indicator shows 75% of altcoins testing resistance levels simultaneously. Historically, this concentration precedes two scenarios: a "weak altseason" (short-lived rallies amid high BTC dominance) or a "strong altseason" (sustained outperformance with capital flooding from Bitcoin to alts). The current setup resembles 2021 and 2023 breakouts, where the latter triggered full altseasons. Critical confirmation will arrive if Bitcoin dominance breaks below 54%, signaling systemic capital rotation toward higher-beta assets.

Key Catalysts for Altcoin Season 2025

Regulatory Tailwinds and ETF Inflows: The U.S. SEC’s anticipated approval of multiple altcoin spot ETFs in Q3/Q4 2025 represents the most significant near-term catalyst. Analysts attribute an 88% probability to approvals for assets like Solana and XRP by December, mirroring the institutional inflow surge witnessed during Bitcoin’s ETF-driven 160% price rally in 2024. Regulatory clarity has also advanced through the GENIUS Act, establishing clearer digital asset frameworks, and diminished legal uncertainty for XRP following the SEC’s potential abandonment of its Ripple lawsuit appeal.

Macroeconomic Liquidity Infusion: The Federal Reserve’s dual policy shift—initiating rate cuts in June 2025 and terminating quantitative tightening—is injecting substantial liquidity into risk assets. This dovish pivot reduces Treasury yields, making yield-generating altcoins (e.g., staked ETH, DeFi tokens) comparatively more attractive. Arthur Hayes emphasizes this could fuel a "monster altseason," with altcoins collectively surging 50% as capital exits traditional markets.

On-Chain and Derivatives Momentum: Record-high open interest exceeding $187 billion (July 2025) signals intense speculative interest, though it also raises liquidation risks. Derivatives trading volume recently hit 11.5x spot volume—an all-time high—indicating leveraged positioning for volatility. Should ETF approvals or Fed policy shifts trigger short squeezes, liquidations could accelerate upside moves. For example, XRP faces $500 million in long liquidations if prices dip below $2.50, creating combustible fuel for rallies

Sectors to Watch for the Next Altcoin Season

Layer-2 Scaling and Zero-Knowledge Tech: Ethereum’s soaring gas fees have accelerated adoption of ZK-rollup solutions, with Polygon leading this charge. Its transition to Polygon 2.0—a unified network of ZK-powered chains—has driven MATIC’s 35% weekly gain. Similarly, Arbitrum and Optimism are capturing developer migration due to their Ethereum Virtual Machine compatibility and plunging transaction costs post-Dencun upgrade.

Real-World Assets (RWA): Ondo Finance has emerged as a sector leader, tokenizing U.S. Treasury bonds and money market funds to offer yield-generating on-chain products. Its token (ONDO) has surged 30% weekly as institutional demand grows for blockchain-based exposure to traditional assets. Similarly, projects like Maple Finance and Centrifuge are expanding credit markets via tokenized loans.

Decentralized AI and Social Ecosystems: Unstaked ($UNSD) exemplifies the AI-crypto convergence, building a decentralized social platform where AI agents operate via "Proof of Intelligence" on-chain. Currently in presale with a projected 28x launch gain, it targets Q3/Q4 2025 for mainstream deployment. Internet Computer (ICP) also advances this narrative through decentralized cloud infrastructure aiming to host AI models.

High-Performance Blockchains: Solana remains the dominant player here, but competitors like Near Protocol are gaining traction through "chain abstraction"—simplifying user onboarding by masking blockchain complexities. NEAR’s developer-friendly tools and sub-second finality position it for Web3 app migration.

Conclusion

The altcoin market stands on the precipice of a historic breakout, supported by a rare confluence of technical strength, regulatory progress, and macroeconomic tailwinds. The completion of the cup-and-handle pattern, alongside declining Bitcoin dominance and ETF-driven institutional interest, creates fertile ground for a robust altseason targeting $5.4 trillion in total market capitalization. Investors should monitor three critical catalysts through Q3 2025: SEC decisions on altcoin spot ETFs (expected by December), Fed policy shifts impacting liquidity, and token unlock events that may temporarily pressure prices (e.g., $27.75 million PLUME unlock on July 21). While leveraged derivatives pose liquidation risks, particularly for SOL and XRP, strategically positioned exposure in sectors like ZK-rollups, RWA, and decentralized AI offers asymmetric upside as the altseason materializes. As capital rotation from Bitcoin accelerates, the coming months may redefine risk-reward dynamics across the crypto landscape.

FAQ

Q: What defines an altcoin season?

A: An altseason occurs when at least 75% of the top 100 altcoins outperform Bitcoin in returns over 90 days. Bitcoin dominance falling below 54% often signals its onset.

Q: Which altcoins have the highest liquidation risk?

A: Solana faces $1 billion long liquidations if prices drop below $150; XRP risks $500 million below $2.50. Hypeliquid (HYPE) has $60 million at risk below $43.

Q: How might Fed rate cuts impact altcoins?

A: Rate cuts increase market liquidity, pushing investors toward risk assets like altcoins. Arthur Hayes projects a 50% altcoin surge post-cuts.

Q: What role do altcoin ETFs play?

A: Spot ETFs (e.g., potential SOL or XRP funds) enable institutional capital inflows. Analysts attribute Bitcoin’s 2024 160% rally to similar ETFs and project identical effects for altcoins.

Q: Which sectors offer the highest growth potential?

A: Layer-2 scaling (Polygon, Arbitrum), real-world assets (Ondo), decentralized AI (Unstaked), and high-throughput chains (Solana, NEAR) lead in developer activity and user adoption.

References

BeInCrypto. (2025, July 21). Bitcoin’s Dominance Falls To 4-Month Low: Altcoin Season Imminent? Retrieved July 22, 2025, from https://beincrypto.com/altcoin-season-near-bitcoin-dominance-crashes/

Bitcoinsistemi. (2025, July 20). Watch out: Massive token unlocking events in 20 altcoins next week. Retrieved July 22, 2025, from https://en.bitcoinsistemi.com/watch-out-massive-token-unlocking-events-in-20-altcoins-next-week-heres-the-day-by-day-hour-by-hour-list/

CryptoNewswire. (2025, July 18). 5 explosive altcoins to watch in 2025 with 30% weekly gains amid $2.87T market surge. Retrieved July 22, 2025, from https://cryptonewswire.org/index.php/2025/07/18/5-explosive-altcoins-to-watch-in-2025-with-30-weekly-gains-amid-2-87t-market-surge/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.