When entering the crypto world, you may have heard the term “market cap,” which stands for market capitalization. Whether you are interested in crypto professionally or as a hobbyist, understanding the nuances of crypto space and the factors influencing the future of crypto can help you make educated decisions for your future. The crypto market cap has significant implications for financial markets, with higher caps being more stable for investment. If you’re entering a career in crypto, a deep understanding of the crypto market cap and how it influences investment strategies and long-term market predictions can make you an asset in your field.

In this article, we’ll dive into the details of Bitcoin's market cap, explore its impact on

Bitcoin price, and analyze its role in the broader context of financial markets and asset valuation.

What is Market Cap in Cryptocurrency?

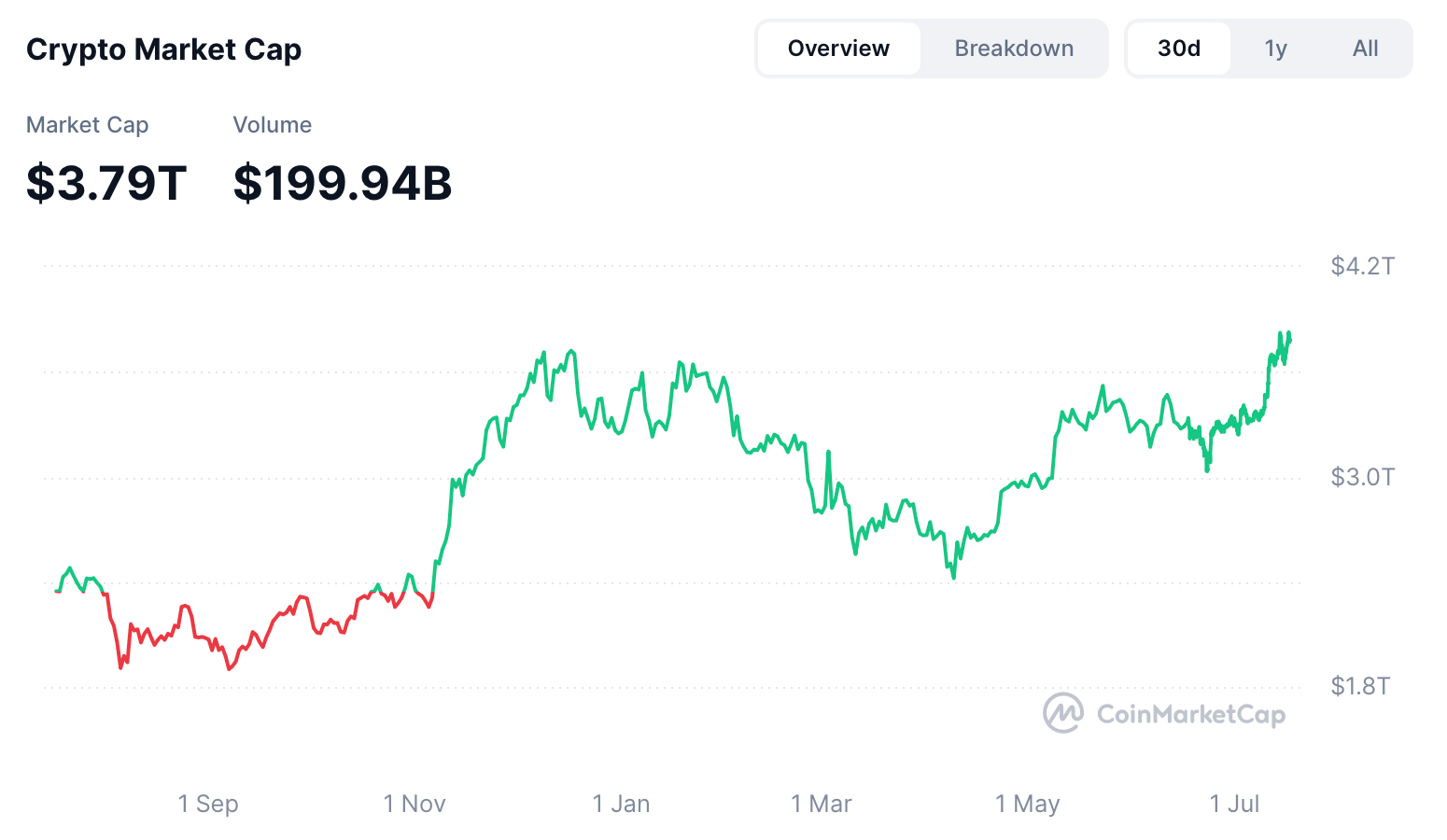

Source: CoinMarketCap

In the simplest terms, market capitalization, or market cap, is a measurement of the total value of a cryptocurrency. For Bitcoin, it represents the combined value of all Bitcoin tokens currently in circulation. Market cap is calculated by multiplying the current Bitcoin price by the total number of Bitcoins that have been mined and are available for trading. This formula gives investors a snapshot of the total value of Bitcoin at a given time, providing an indicator of its market size and, in some respects, its stability.

Formula for Bitcoin Market Cap:

Bitcoin Market Cap=Current Bitcoin Price×Number of Bitcoins in Circulation\text{Bitcoin Market Cap} = \text{Current Bitcoin Price} \times \text{Number of Bitcoins in Circulation}Bitcoin Market Cap=Current Bitcoin Price×Number of Bitcoins in Circulation

Understanding the Significance of Bitcoin's Market Cap

Cryptocurrency market capitalization serves as a useful indicator for potential investors to assess the stability of a particular digital asset. Essentially, it measures the relative popularity and size of a cryptocurrency coin.

For those investing in cryptocurrencies or interested in their long-term growth prospects, coins with larger market caps often indicate greater popularity and may suggest higher potential for sustained growth. These cryptocurrencies typically have a more established track record of performance and are generally more resilient to fluctuations, allowing them to better withstand investor cash-outs without significant price declines.

This concept can be compared to a stack of paper: a single sheet is easy to tear, but a thicker stack is more resistant. Similarly, a higher market cap reflects a more robust and less manipulable asset.

In traditional stock markets, companies are categorized as “large-cap,” “mid-cap,” and “small-cap” based on their market valuations. Cryptocurrency market caps are classified in a similar manner, providing insight into the long-term trends and growth potential of specific coins. While specific thresholds may vary, general classifications include:

-

Large-cap cryptocurrencies: Market caps over $10 billion

-

Mid-cap cryptocurrencies: Market caps between $1 billion and $10 billion

-

Small-cap cryptocurrencies: Market caps under $1 billion

It is important to recognize that market capitalization alone does not indicate risk. The cryptocurrency market is highly volatile, and investors should consider multiple factors alongside market cap when making investment decisions.

What is the current crypto market cap?

As of July, 2025, the current global cryptocurrency market cap is over $3.79 trillion. Though the future of cryptocurrency is largely unpredictable, some financial experts predict the market cap could grow by 10 to 100 times its current size.

For individual coins, the market cap has an equally unpredictable future. However, large-cap coins tend to represent more stability over time. The three largest cryptocurrency coin market caps as of July 17, 2025, are:

Bitcoin (BTC)

Bitcoin has a price of $118,317 and a market cap of $2.35 trillion.

Ethereum (ETH)

Ethereum has the second largest market cap of any cryptocurrency coin. The market cap for Ethereum is $404 billion, and one coin costs $3,351.

Tether (USDT)

Tether, a stable-value cryptocurrency created to compare to the price of the US dollar, has a current market cap of $160 billion and a trading value of $1.00 per coin.

The Relationship Between Bitcoin Market Cap and Bitcoin Price

While the Bitcoin price often takes the spotlight, the market cap offers a fuller picture of Bitcoin’s worth. For instance, although Bitcoin’s price may experience fluctuations, its market cap reflects its cumulative value. This difference is essential to understanding why price alone does not convey the entire story of Bitcoin’s value. If Bitcoin’s price surges but the number of circulating coins remains constant, the market cap will increase accordingly, providing a more comprehensive look at Bitcoin's valuation over time.

Market cap can also serve as a tool for comparison within the cryptocurrency market. For example, Bitcoin and Ethereum, the two largest cryptocurrencies by market cap, are often compared. While Ethereum may see rapid price increases, Bitcoin’s larger market cap typically indicates greater stability, appealing to risk-averse investors.

What is a Liquid Market?

A “liquid market” is a market where an investor or trader can easily and quickly sell, buy, or trade a particular asset. “Liquidity,” on the other hand, defines whether you can buy or sell an asset without impacting the market price dramatically. A liquid market has a high volume of available buyers and sellers. Because of this, traders can generally sell their assets and find new assets to buy quickly. Many crypto coins have a liquid market, including Bitcoin. Markets that are “high-volume” and “liquid” are typically favored over lower-volume trading markets.

Circulating Supply vs. Fully Diluted Supply in Bitcoin Market Cap Calculations

An important aspect of the Bitcoin market cap calculation is the consideration of the circulating supply versus the fully diluted supply. The circulating supply is the number of Bitcoin currently mined and available, while the fully diluted supply includes the maximum number of Bitcoins that can ever exist — capped at 21 million by Bitcoin’s protocol. This distinction can lead to different interpretations of Bitcoin’s true market cap.

When considering Bitcoin’s market cap based on its circulating supply, we get a figure that reflects its current, active value. Using the fully diluted supply, however, gives a hypothetical view of Bitcoin’s market cap should all 21 million coins be mined. Some analysts prefer this method to gauge Bitcoin’s potential future valuation, while others argue that it’s more practical to consider the current circulating supply.

Why Bitcoin’s Market Cap is Essential in the Cryptocurrency Market

1. Relative Size and Stability

Market cap helps to contextualize Bitcoin's position in the market relative to other cryptocurrencies and even traditional assets. For example, in 2024, Bitcoin’s market cap crossed $1.7 trillion, surpassing silver’s market valuation. This growth has solidified Bitcoin as one of the top assets globally, and investors increasingly regard it as a hedge against traditional economic instability, similar to gold.

2. Investor Confidence and Perceived Security

For many investors, market cap indicates an asset’s “weight” and thus its ability to weather market volatility. Larger market caps, like Bitcoin’s, tend to be associated with greater resilience. Although Bitcoin remains a volatile asset, its growing market cap often draws institutional investors who see Bitcoin as a safer bet compared to smaller, more volatile cryptocurrencies.

3. Liquidity and Trading Volume

Assets with larger market caps generally enjoy higher liquidity, meaning they can handle larger volumes of buying and selling without experiencing drastic price shifts. This aspect makes Bitcoin particularly attractive for institutional investors who require high liquidity for significant trades.

4. Indicator of Maturity and Adoption

As Bitcoin’s market cap grows, it signals increased adoption and a certain level of maturity within the cryptocurrency space. Institutional involvement from large firms and asset managers like BlackRock and Fidelity indicates that Bitcoin is moving beyond its experimental phase and into the mainstream financial world. A larger market cap often correlates with increased acceptance and confidence from institutional investors, contributing to Bitcoin’s perception as a stable, legitimate asset class.

Bitcoin Market Cap vs. Traditional Assets

Bitcoin’s status as a high-market-cap asset allows for meaningful comparisons with traditional financial assets like precious metals and large-cap stocks. The asset's finite supply model, combined with its growing market cap, differentiates it from inflationary assets like fiat currency. Some investors consider Bitcoin a superior store of value to traditional assets, viewing its limited supply as an effective hedge against inflation.

Bitcoin’s recent rise above the market cap of silver demonstrates its potential as a long-term store of value. However, Bitcoin’s market cap remains far below that of gold, which has an estimated valuation around $17 trillion. For Bitcoin to reach similar levels, it would need to see further adoption and substantial price increases, sparking discussions on whether it could ever replace or complement gold as a primary store of value.

Volatility and Bitcoin’s Market Cap

One unique characteristic of the cryptocurrency market is its tendency for volatility. Bitcoin’s market cap can swing dramatically with market sentiment, economic events, and global regulations. For example, Bitcoin’s market cap surged when institutional investments in Bitcoin ETFs increased, highlighting the impact that mainstream financial products can have on Bitcoin’s valuation.

Despite Bitcoin’s large market cap, its price can still be highly volatile, driven by factors like regulatory news, macroeconomic trends, and investor sentiment. While a larger market cap generally implies more stability, it’s important to remember that Bitcoin remains susceptible to market swings.

Key Takeaways for Investors

Understanding Bitcoin’s market cap provides valuable insights into its stability, market standing, and potential as an investment vehicle. As a leading cryptocurrency, Bitcoin’s large market cap signifies a level of maturity and investor confidence that smaller cryptocurrencies lack. However, it’s crucial to consider the following factors when using market cap as part of your

bitcoin investment strategy:

Bitcoin Price and Market Cap Are Related, But Not the Same: A high price does not always translate to a high market cap. It’s essential to examine both metrics together to understand the full picture of Bitcoin’s value.

Market Cap as a Stability Indicator: Bitcoin’s large market cap suggests greater stability than smaller cryptocurrencies, but it does not eliminate volatility.

Circulating

vs. Fully Diluted Supply: Recognize the difference between the current circulating supply and the maximum potential supply when analyzing Bitcoin’s market cap.

Buy Bitcoin on CoinCatch

For those interested in purchasing Bitcoin, one of the easiest and most reliable platforms is CoinCatch. As a leading cryptocurrency exchange, CoinCatch offers a user-friendly interface, competitive fees, and robust security features to ensure a seamless experience for both beginners and experienced traders. Whether you are looking to buy your first Bitcoin or expand your existing portfolio, CoinCatch provides a simple and secure way to access the world of cryptocurrency.

The CoinCatch exchange also supports a wide range of cryptocurrencies, so users can easily diversify their investments. With its advanced trading tools and analytics, CoinCatch is a great platform for those who want to stay informed about the latest market trends and make well-informed trading decisions.

In addition to

buying Bitcoin, CoinCatch also offers a suite of features designed to help users manage their cryptocurrency investments. Whether you are looking to

trade Bitcoin on margin or use advanced order types, CoinCatch provides the tools you need to make the most of your cryptocurrency journey. The platform also offers excellent customer support, ensuring that users can get assistance whenever they need it.

For anyone interested in entering the world of Bitcoin and other cryptocurrencies, CoinCatch is an excellent starting point. With its easy-to-use platform and commitment to security, it provides a trusted environment for buying and trading Bitcoin and other digital assets.

Conclusion

The Bitcoin market cap is a pivotal metric that goes beyond Bitcoin’s price, providing a broader perspective on the asset's value, stability, and market standing. For both new and seasoned investors, understanding Bitcoin’s market cap offers a foundation for making informed decisions in the cryptocurrency space. As Bitcoin continues to gain traction and compete with traditional assets, monitoring its market cap will remain crucial in gauging its role within the financial markets.

Bitcoin’s increasing market cap solidifies its place in the financial ecosystem, pushing it closer to mainstream acceptance and underscoring its potential as a long-term store of value. By keeping an eye on this key metric, investors can navigate the evolving cryptocurrency landscape with greater confidence and insight.

References

CoinCatch Team

Disclaimer: Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.