Cryptocurrency Market Overview

BTC (+3.88% | Current: 122,488 USDT): BTC is currently consolidating at high levels with an upward bias. After breaking through 120,000 USDT, trading volume surged significantly, confirming the validity of the uptrend. The price is now testing the 122,500 USDT threshold. A decisive breakthrough and consolidation above 122,500 USDT could pave the way toward 130,000 USDT and beyond.

Institutional Spotlight: On July 11, BTC ETFs recorded a single-day net inflow of $1.029 billion, with BlackRock's IBIT alone attracting $953 million. This signals accelerating institutional accumulation and increased portfolio allocation to Bitcoin.

ETH (+2.96% | Current: 3,048 USDT): ETH is undergoing high-level consolidation within a strong uptrend. Trading volume rose by 77%. As noted by Greenytrades on X, ETH reclaimed the $3,000 mark for the first time since January. Weekly charts show a clean break above this mid-range level, which served as support and resistance since early 2023. The reclaim of $3,000 signals a possible shift toward the upper half of that structure. Analysts suggest a move toward $3,800–$4,000 could follow if bulls hold this zone.

ETF Momentum: July 11 saw ETH ETFs secure $204 million in net inflows. BlackRock's ETHA led with $137 million, followed by Fidelity's FETH at $12 million.

Altcoins:

Major altcoins experienced minor pullbacks, yet funding rates and long/short ratios remain predominantly bullish. Short-term upside momentum appears intact. The Crypto Fear & Greed Index reads 70 (Greed) today, reflecting sustained market optimism while hinting at potential overextension risks.

Macro Snapshot (July 14):

-

S&P 500: -0.33% to 6,259.75

-

Dow Jones: -0.63% to 44,371.51

-

Nasdaq: -0.22% to 20,585.53

Commodities Update (As of July 14, 10:30 AM UTC+8): Spot Gold: $3,359/oz (+0.1% 24h)

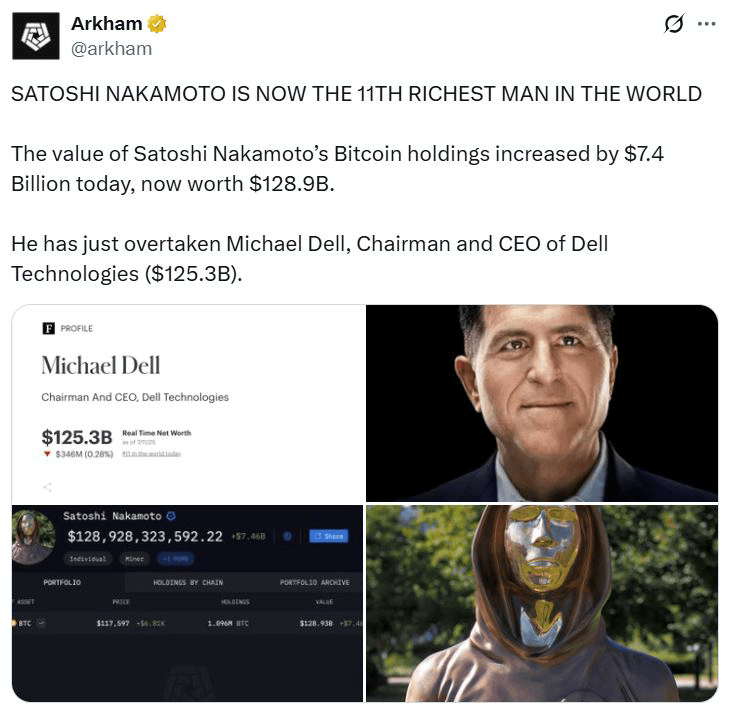

Today in crypto, Satoshi Nakamoto, the creator of Bitcoin, has overtaken Dell CEO Michael Dell as the 11th wealthiest billionaire on the Forbes rich list. Bank of England governor sounds the alarm on stablecoins, and thousands of savers face potential losses after a $2.7 million shortfall was discovered at Ziglu...

Satoshi Nakamoto Becomes 11th Richest in the World as Bitcoin Hits $120K

Bitcoin’s creator, Satoshi Nakamoto, became the 11th richest person in the world after Bitcoin tapped $120,000 on Sunday.

Nakamoto is believed to hold 1.096 million Bitcoin (BTC) across thousands of wallets, which is worth over $131 billion at current prices, according to blockchain analytics company Arkham.

This would, in theory, place Nakamoto at number 11 on Forbes’ richest billionaires list,

overtaking Michael Dell, CEO of tech giant Dell Technologies, with a net worth of $125.1 billion.

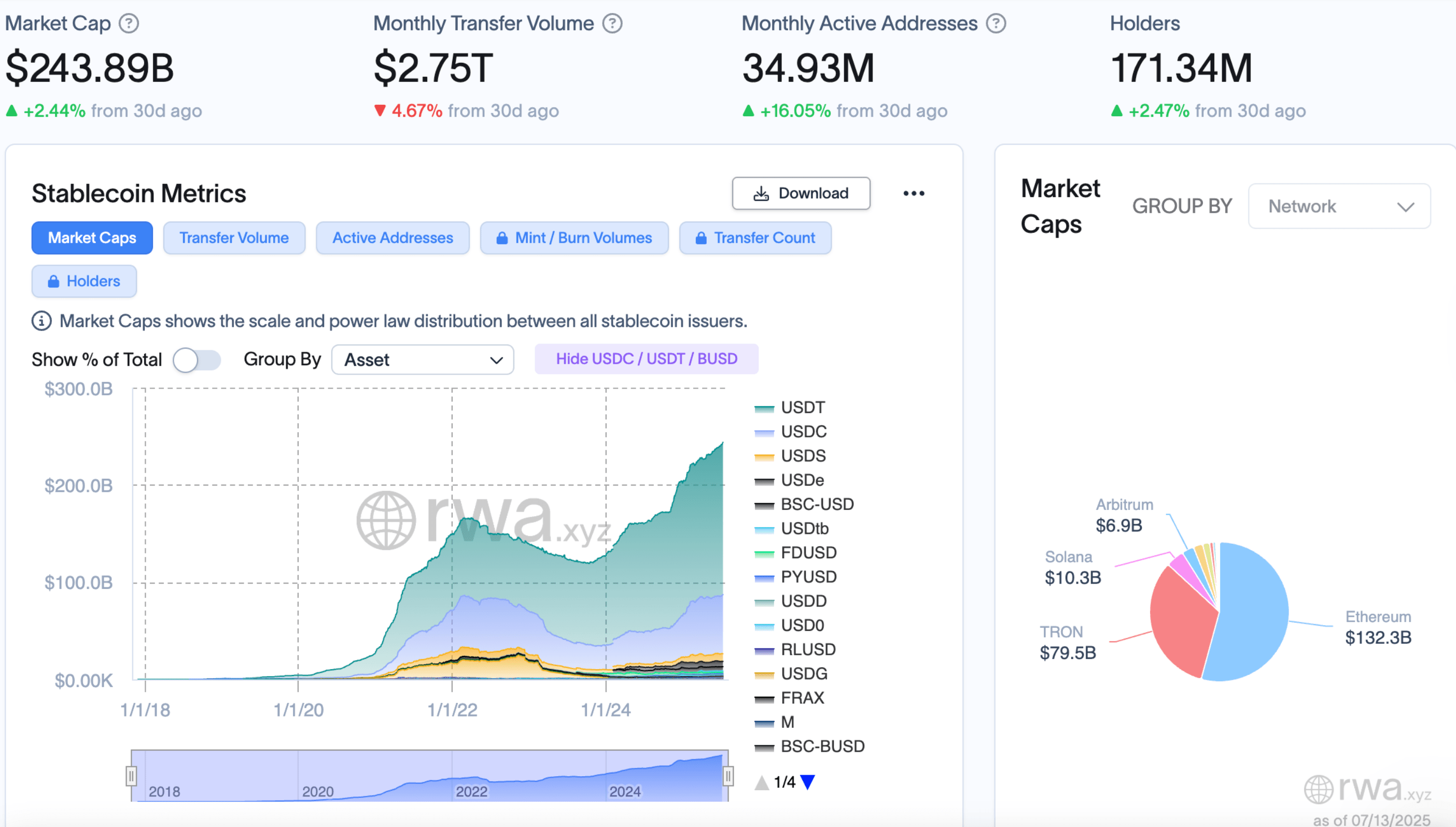

Bank of England Governor Sounds Alarm on Stablecoins

Bank of England (BOE) governor Andrew Bailey issued a warning on Sunday against banks issuing stablecoins and said the BOE should adopt tokenized deposits instead.

Bailey said that stablecoins threaten the fabric of the financial system and could cause governments to lose control of their fiat currencies.

An overview of the stablecoin market. Source:

RWA.XYZ

The BOE official added that the UK central bank should not join the European Union in pushing for a central bank digital currency (CBDC) or issuing a “digital pound.”

Bailey’s concerns have been voiced by other EU officials, who argue that US dollar stablecoins could upend the financial system or cause further damage to the euro in global currency markets.

BTC Hits New ATH Amid Declining Google Search Interest

As Crypto Week approaches, market sentiment continues to heat up with broad-based gains across major crypto sectors. BTC surged past $120,000 to set a new all-time high, while ETH consolidated within a narrow range around $3,000. Notably, Google Trends data reveals that despite Bitcoin's record-breaking prices, public search interest remains significantly lower than during the 2017 and 2021 bull market peaks.

Unlike previous cycles, this BTC rally is not driven by retail frenzy or network hype but by deeper macro forces:

-

The U.S. $5 trillion debt ceiling increase and sustained deficit spending

-

Impending crypto policy report from the Trump Task Force

-

Seasonal July tailwinds, call option buying, and short squeeze dynamics

U.S. Congress to Vote on Key Crypto Legislation

This week, the U.S. Congress will vote on pivotal crypto bills including:

-

GENIUS Act (promoting innovation)

-

CLARITY Act (regulatory certainty)

-

Anti-CBDC Surveillance State Act (restricting central bank digital currency monitoring)

These bills could reshape America's crypto landscape, though full details remain undisclosed and legislative implementation may face delays. Passage would provide clearer compliance pathways, potentially attracting institutional capital and accelerating industry maturation.

Collapsed Crypto Firm Ziglu Faces a $2.7M deficit Amid Special Administration

Thousands of savers face the grim prospect of losing their investments after administrators uncovered a 2 million pounds ($2.7 million) shortfall at Ziglu, a British cryptocurrency fintech that collapsed earlier this year.

The company, which suspended withdrawals in May, was placed into special administration last week amid mounting concerns over its financial management, according to a Sunday report from The Telegraph.

Ziglu attracted around 20,000 customers with promises of high-interest returns, particularly through its “Boost” product, which offered yields up to 6%. Launched in 2021 during a period of low interest rates, Boost became popular due to its higher returns.

However, the product was not protected or ring-fenced, allowing the company to use customer funds for day-to-day operations and lending activities. Following the Financial Conduct Authority’s (FCA) intervention in May, withdrawals were frozen, leaving savers locked out of their money for weeks.

Triple Rewards Worth $3,020,000: Cash, Gifts, Bonuses are waiting to be claimed. Unlock Your 100% WIN with sign-up & trading. Only 7 days remaining, join & dominate the rankings now!

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.