Bitcoin has formed one of its largest weekly candles in recent months, with strong momentum taking the price closer to a confirmed breakout above the $107,000 level. The current rally places the next technical target at $135,000, following Fibonacci projections. At the time of writing, BTC was trading at $117,789.

Bitcoin’s historic rally shows no signs of slowing as the world’s largest cryptocurrency shattered another record, trading at $122,917.94 at the time of writing, according to CoinMarketCap data. The 24-hour surge has lifted BTC’s price by 4.18%, pushing its market capitalization to an impressive $2.44 trillion, with daily trading volume exceeding $105.71 billion— a 132% spike in just one day.

Source: CMC

This fresh high cements Bitcoin’s position as the undisputed king of crypto. With 19.89 million BTC already in circulation and a maximum supply capped at 21 million, supply scarcity is driving further demand amid bullish sentiment and rising institutional interest.

Investors Eye $125K as Bitcoin Bulls Tighten Grip

The latest chart action shows Bitcoin breaking through multiple psychological resistance levels, with technical analysts now watching for a run toward $125,000 if momentum holds. Trading volumes have surged dramatically, with a healthy Vol/Mkt Cap ratio of 2.55%, indicating strong market liquidity and intense buying pressure.

Market watchers say the renewed rally is driven by growing confidence in Bitcoin’s role as a hedge against inflation and fiat currency volatility, especially with macroeconomic jitters persisting globally. Institutional inflows, ETF expansions, and corporate treasury allocations are further reinforcing the bullish structure.

Technical and On-Chain Signals Support the Uptrend

Technical indicators continue to show strength. RSI is currently at 72, indicating strong buying pressure, while MACD remains in a bullish trend. Trading volume surged by 93% in the past 24 hours, with over $123 billion in activity recorded.

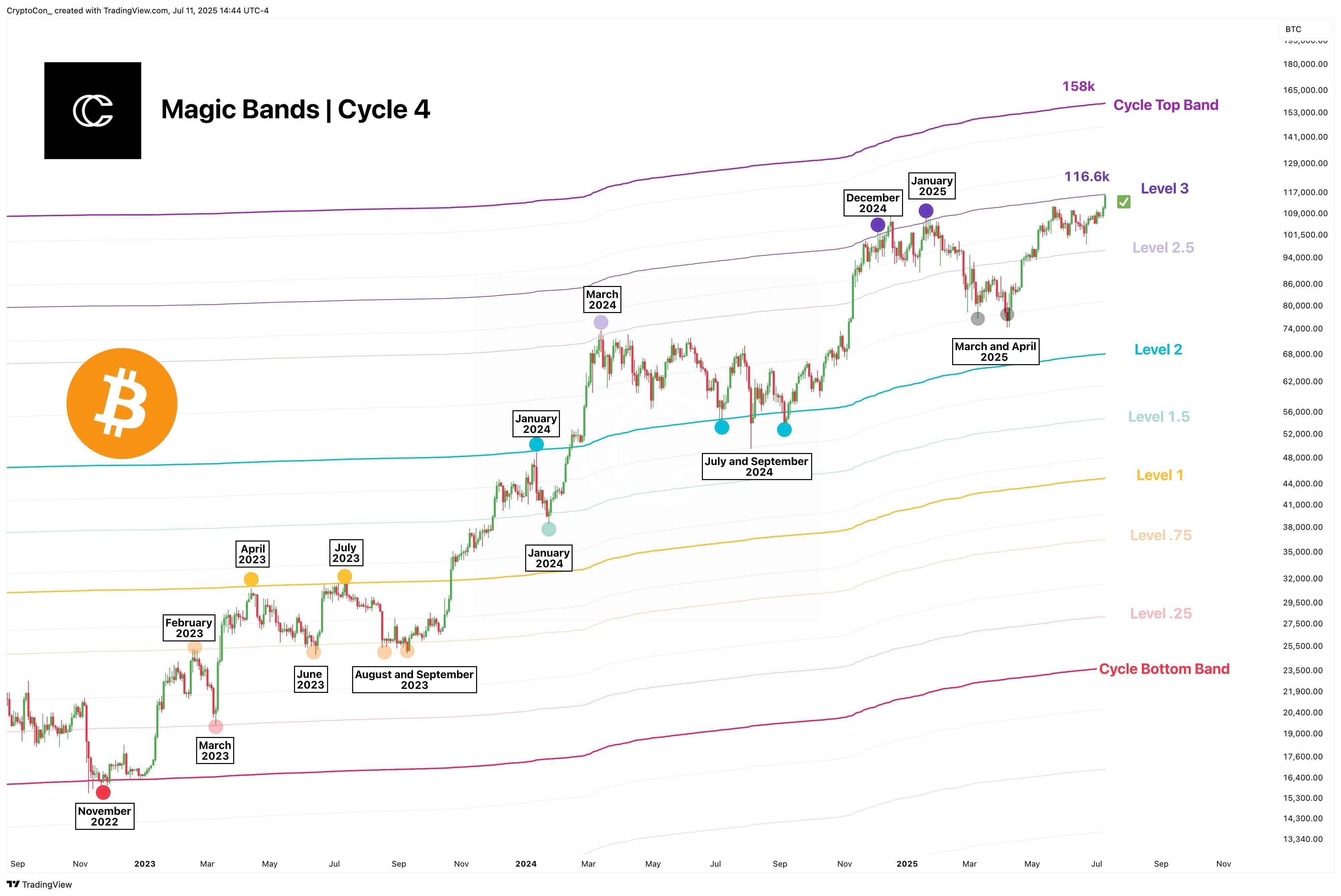

Source: CryptoCon(X)

According to an observation by CryptoCon, Bitcoin could reach $184,181 based on a recurring 5.618 Fibonacci extension seen in previous cycles. The analyst used historical cycle lows and tops to estimate this projection.

Meanwhile, short liquidations above $1.1 billion and net inflows into spot Bitcoin ETFs have added support to the current price trend. Institutional interest continues to grow, and transactions above $100,000 totaled $124.26 billion. At press time, Bitcoin is holding above key levels with $119,000 as near-term resistance and $115,220 as support.

The latest surge began after Bitcoin cleared the $115,500 resistance zone, gaining momentum as it pushed through successive barriers at $116,000 and $118,500. Bulls demonstrated remarkable strength by propelling cryptocurrency above the psychologically significant $120,000 level. The price action has now consolidated gains above the 23.6% Fibonacci retracement level of the upward move from the $116,679 swing low to the $122,550 high.

Market participants are closely watching the immediate resistance near the $122,550 level, where the all-time high was established. The first key resistance sits at $123,500, followed by potential barriers at $124,000. Should Bitcoin manage to close above the $124,000 resistance, analysts suggest the price could extend gains toward the $128,000 level.

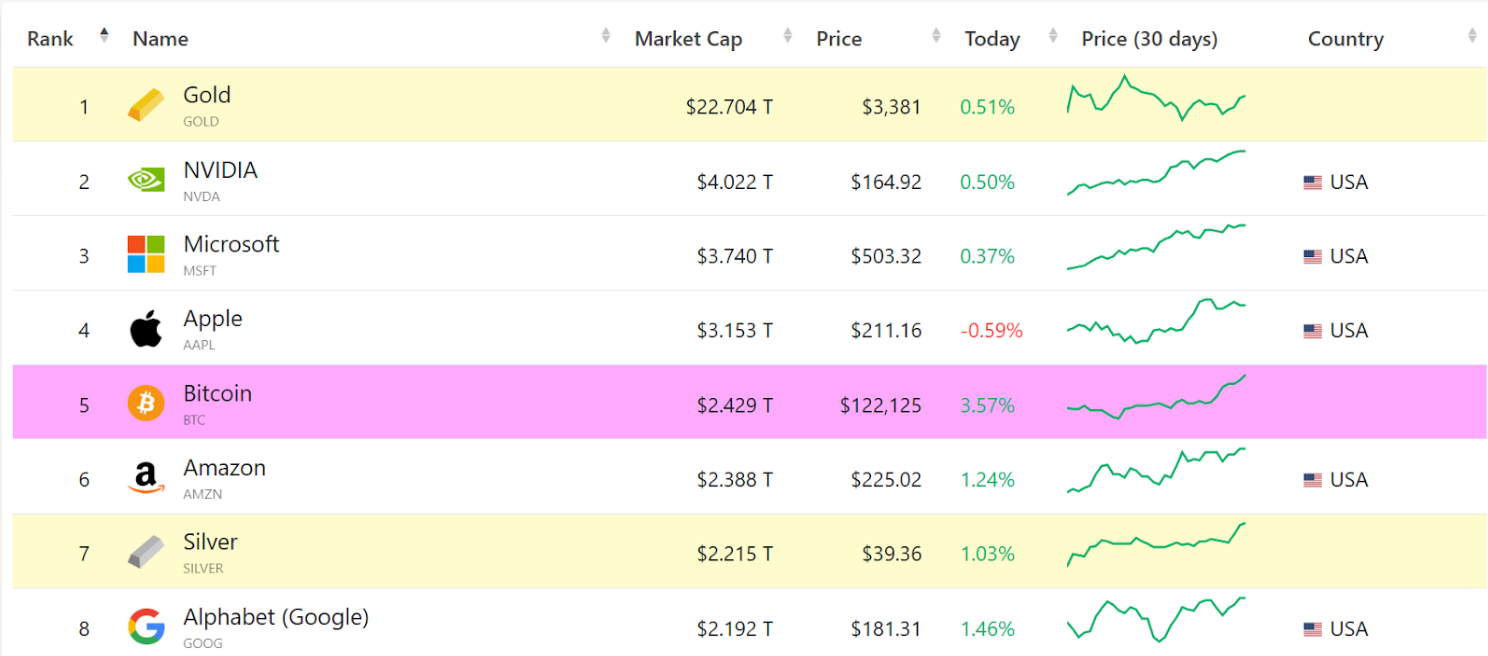

Bitcoin Flips Amazon’s $2.3T Market Cap to Become 5th Global Asset

Bitcoin has become the world’s fifth-largest asset, overtaking Amazon by market capitalization.

These gains allowed Bitcoin to surpass a $2.4 trillion market capitalization, overtaking Amazon’s $2.3 trillion, Silver’s $2.2 trillion and Alphabet’s (Google) $2.19 trillion, BTC data shows.

This means Bitcoin’s market cap was only $730 million shy of tech giant Apple, at the time of writing.

Largest global assets by market capitalization. Source: Companiesmarketcap

Bitcoin’s new record high comes amid a period of growing institutional adoption, which has seen corporate Bitcoin holding companies double since June 5. Over 265 companies are now holding Bitcoin on their balance sheets, up from 124 just weeks ago.

A total of 3.5 million Bitcoin is held in company treasuries, with 853,000 BTC, or 4% of the total supply, in public company treasuries, and over 1.4 million BTC, or 6.6% of the supply, through spot Bitcoin exchange-traded funds (ETFs).

Record-Breaking Rally Fuels Altcoin Hopes

The sustained breakout is inspiring fresh optimism across the broader crypto market. Analysts expect Bitcoin’s upward momentum to spill over into altcoins, potentially igniting a new wave of gains for Ethereum and other major tokens.

However, traders remain cautious about possible corrections after such a sharp move. With the circulating supply already near its max, any dip could be short-lived as long-term holders tighten their grip on available coins.

As Bitcoin eyes uncharted territory, market participants are advised to manage FOMO and stick to disciplined strategies rather than chase runaway rallies.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.