Understanding Bitcoin's Key Resistance Levels

Bitcoin's price movement remains a focal point for traders and investors as it approaches key resistance levels at $108,000, $112,000, and the $120,000–$130,000 range. These levels have historically acted as important barriers, impacting market sentiment and guiding Bitcoin's price direction. A breakthrough beyond these resistance zones could indicate a substantial change in the cryptocurrency's price trend; however, recent data indicates that such advances may encounter considerable obstacles.

The $108,000 Resistance Level: A Persistent Barrier

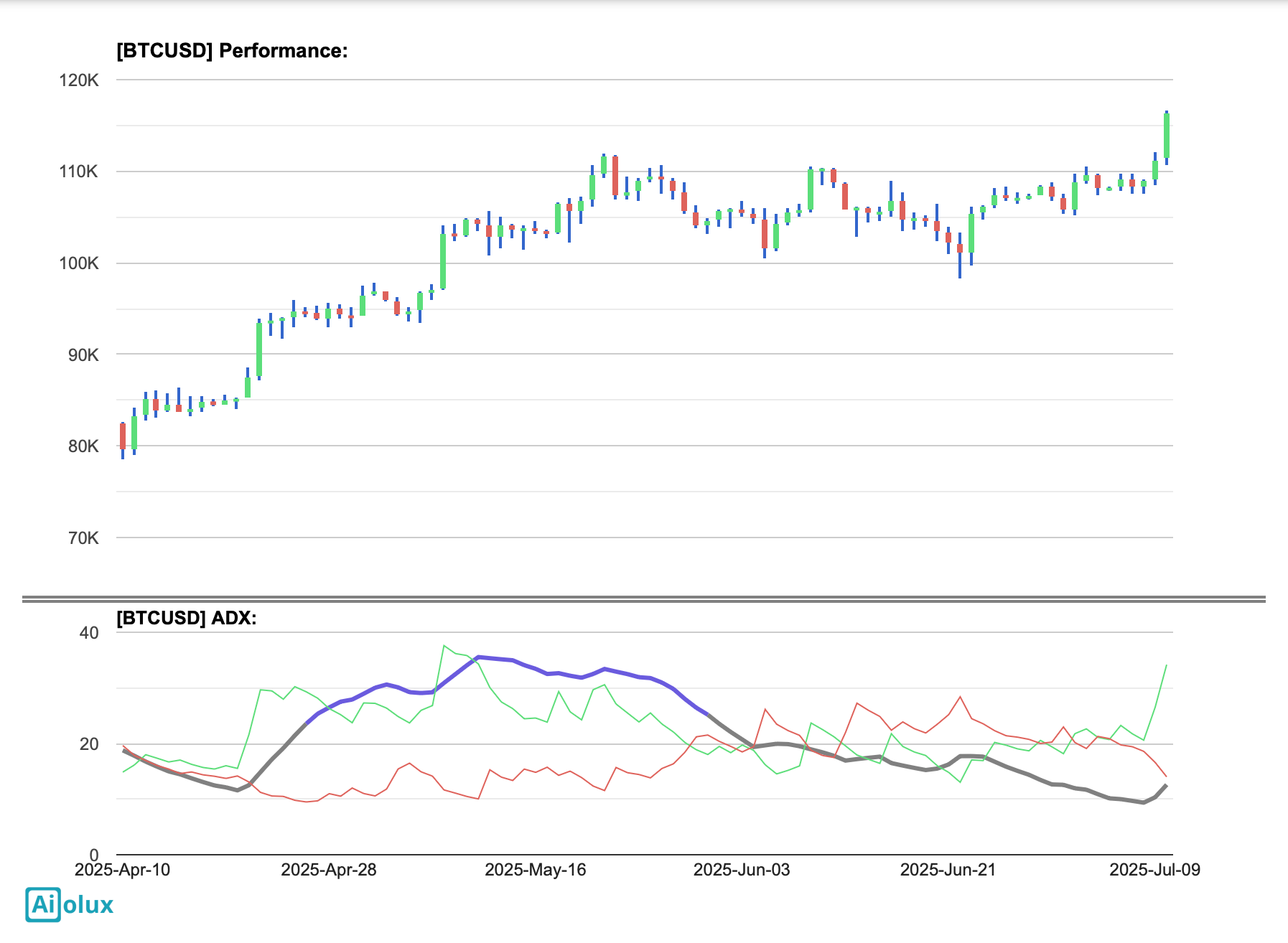

The $108,000 resistance level has been tested multiple times, yet Bitcoin has struggled to sustain upward momentum. Short-term price action remains dominated by bearish sentiment, with technical indicators such as the Average Directional Index (ADX) and Squeeze Momentum Indicator signaling weak trend strength. This suggests that Bitcoin may continue to face difficulty in overcoming this level in the near term.

Source: Aiolux

Traders use the ADX to assess the strength of a trend. The ADX also helps determine whether the market is trending or range-bound.

Generally, ADX values below 20 indicate a non-trending or sideways market, suggesting that range-bound strategies are more effective. However, as ADX moves between 20 and 25, it signals a possible trend formation, and traders should watch for further confirmation.

When the ADX rises above 25, it confirms a strong trend, making trend-following strategies like moving average crossovers more viable. Once ADX climbs above 50, the trend is very strong. But at these levels, traders should exercise caution as the market may be overheated, and corrections may be more likely.

| ADX Value |

Trend Strength |

| 0-20 |

Absent or Weak Trend |

| 25-50 |

Strong Trend |

| 50-75 |

Very Strong Trend |

| 75-100 |

Extremely Strong Trend |

The current ADX of BTC is 12.59 (July 10th, 2025), which means the trend momentum is decreasing.

The $120,000 Resistance: A Long-Term Inflection Point

The $120,000 resistance level has been a significant barrier since April 2021, with repeated failed attempts to break through. This level represents both psychological and technical challenges for traders. Its importance in shaping long-term market structure cannot be overstated.

Historical Context:

-

Rejection Rates: High rejection rates at $120,000 underscore its significance.

-

Psychological Impact: Traders often view this level as a critical milestone, amplifying its importance in market sentiment.

Technical Analysis: Indicators and Insights

ADX and Squeeze Momentum Indicator

The ADX measures trend strength, and recent readings suggest Bitcoin's current trend lacks the momentum needed to breach resistance levels. Similarly, the Squeeze Momentum Indicator points to bearish pressure, further dampening the likelihood of a breakthrough.

EMA and Volume Profile Analysis

Despite short-term bearish signals, the Exponential Moving Average (EMA) reflects strong long-term bullish sentiment. Volume profile analysis reveals that Bitcoin is trading near active price zones, but insufficient momentum has prevented decisive breakthroughs.

Strong Market Optimism Among Traders

According to data from Polymarket, a decentralized betting platform, 46% of traders believe Bitcoin will reach $120,000 before the end of July. This striking figure reflects a significant surge in bullish sentiment within the crypto community. As Bitcoin hovers around key resistance levels, optimism is growing that a breakout could be imminent.

The belief in a $120K price point highlights how much confidence traders have in Bitcoin’s short-term performance. This sentiment is supported by recent institutional interest, increased ETF activity, and global macroeconomic trends pushing investors toward digital assets.

What’s Driving the Bullish Sentiment?

Several factors are fueling the belief that Bitcoin could hit $120K:

-

Institutional Buying – Major financial institutions continue to increase their crypto holdings. ETFs and funds are attracting billions in capital, signaling strong long-term faith in Bitcoin.

-

Market Momentum – Bitcoin has maintained steady support above $60K, with lower volatility compared to past months. If this trend continues, a sharp move to higher price levels is possible.

-

Macroeconomic Shifts – With inflation concerns and uncertain central bank policies, Bitcoin is increasingly seen as a hedge, drawing more attention from investors seeking alternative stores of value.

Historical Price Action and Psychological Barriers

Bitcoin's historical price action provides valuable insights into its resistance levels. The $120,000 level, in particular, has been a psychological barrier for traders, influencing market sentiment and decision-making. These psychological factors often amplify technical challenges, making resistance breakthroughs even more difficult.

Macroeconomic Factors and External Catalysts

Macroeconomic factors, such as geopolitical events and regulatory developments, can act as external catalysts for Bitcoin's price movement. While these factors are difficult to predict, they have historically influenced market sentiment and volatility. Traders should remain aware of these external variables when analyzing Bitcoin's price action.

Potential Catalysts for Price Movement

Whale Activity and Social Media Sentiment

Whale movements—large-scale transactions by major holders—can significantly impact Bitcoin's price. Similarly, social media sentiment often acts as a catalyst, influencing retail investor behavior and market dynamics. Monitoring these factors can provide additional insights into potential price movements.

Altcoin Market Dynamics and Bitcoin Dominance

The performance of altcoins and Bitcoin's dominance in the cryptocurrency market also play a role in resistance breakthroughs. A shift in market dynamics, such as increased altcoin activity, could either support or hinder Bitcoin's ability to breach key levels.

Conclusion

Bitcoin's journey toward breaking critical resistance levels at $108,000, $112,000, and $120,000-$130,000 is shaped by a complex interplay of technical indicators, historical price action, psychological barriers, and external factors. While long-term bullish sentiment remains strong, short-term challenges persist, making it essential for traders to consider both technical and macroeconomic variables. By understanding these dynamics, market participants can navigate Bitcoin's price movements more effectively and make informed decisions.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.