Altseason refers to a short time frame when capital shifts from Bitcoin (BTC) to altcoins or alts, leading to a notable and rapid rise in the prices of most cryptocurrencies. Altcoin season, commonly known as 'Altseason', is characterized by massive gains and high volatility. It's essentially a great time for non-Bitcoin maxis.

During a relatively brief period—typically weeks or months—the values of altcoins soar as investors move their funds from Bitcoin to other coins. As prices begin to climb and the altcoin season index trends upward, FOMO—fear of missing out—investments come into play. This creates a cascading effect that further drives altcoin prices to extraordinary levels for a limited time.

A scale with ratings of 0 to 10 or 0 to 100 would be better. Well, the problem is solved. We already have a tool on the market designed specifically to track the performance of altcoins. This tool is called the

altcoin season index. It helps in making the perfect decision at the right time. However, the real problem lies in mastering the tool for increased opportunities. In this article, we will learn everything about the altcoin season index, how it works, and the right way to use it for better investments.

What is the Altcoin Season Index (ASI)?

The altcoin season index is a tool that is designed to track the performance of altcoins. It works by comparing the prices of altcoins with bitcoin for a particular period of time (almost six to nine months).

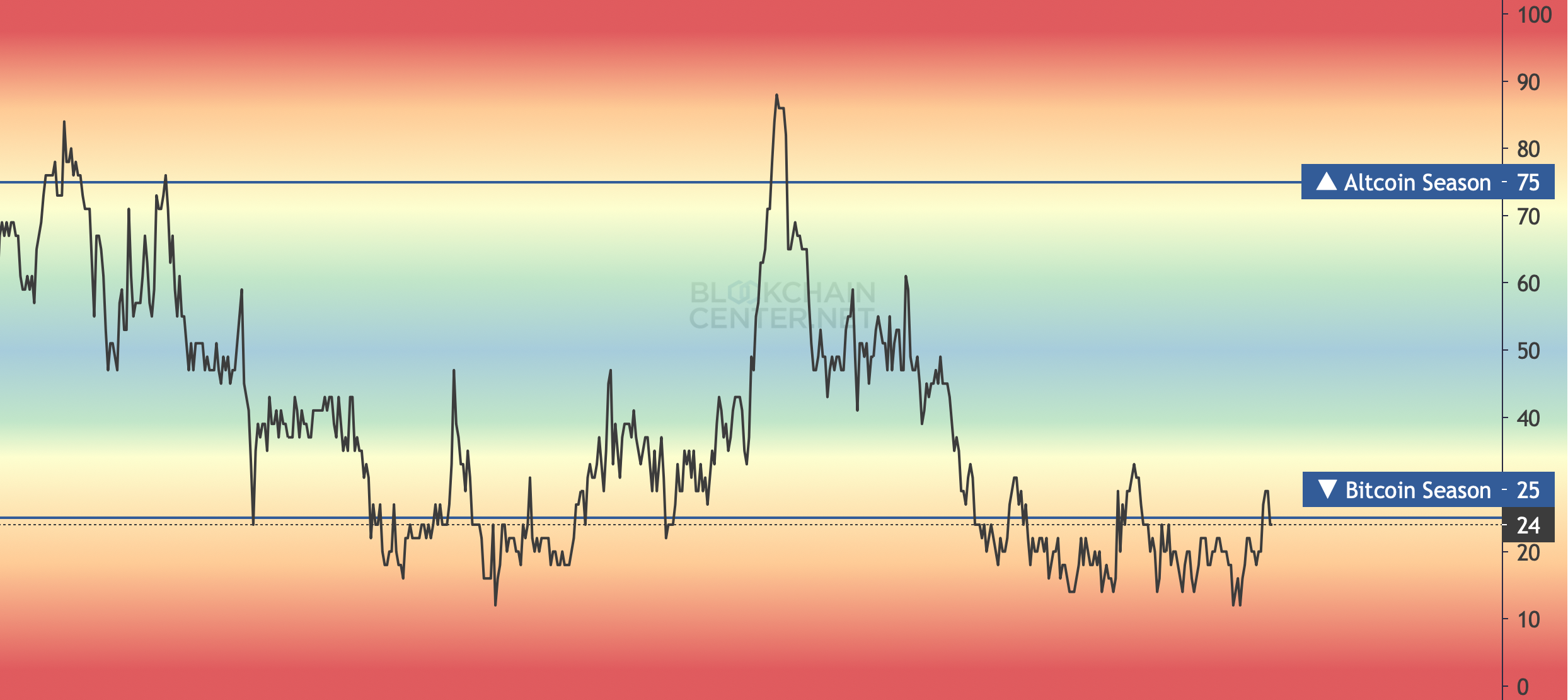

This index makes it easy for crypto investors to understand market trends and sentiment. This understanding helps investors make better and more profitable decisions. It works by rating the performance of altcoin on a scale of 0 to 100. A high rate indicates better performance and a low rate refers to low performance.

This index chart is called the “altcoin season index chart,” and it is available online on various websites. However, in order to understand this chart and make wise use of its rating, you need to have a basic understanding of the altcoin season and its importance.

Source: Blockchaincenter

Understanding the Altcoin Season

Altcoin season is considered a better time to make investments. It is a season when 75 percent of altcoins from the list of top 50 have better performance than Bitcoin. Here, better performance means they have a price growth higher than Bitcoin.

Altseason occurs when investors start choosing other coins over Bitcoin for their investments. It usually happens during a period of technical innovation or the development of new altcoins. During this time, these 75% of altcoins can experience a significant increase in their prices and values, which helps them attract potential investors.

Altseason also represents a stable or bearish Bitcoin market. In simple words, during altseason, the dominance of Bitcoin decreases, and altcoins take their place as the market leader for a particular period of time.

This shows that there are two different seasons in the crypto world: the altcoin season when altcoins hold all the cards and Bitcoin dominance when Bitcoin has the upper hand.

Unlike normal seasons, altcoin season does not arrive during specific months. It just arrives at random times, and its arrival depends totally on the performance of Bitcoin.

Ratings of the Altcoin Season Index

The Altcoin Season Index is like an investor’s secret tool for success. It usually uses a range from 0 to 100 in order to describe the condition of the altcoin market in relation to Bitcoin. Below is a summary of what various ranges on the scale generally represent:

0-25: Bitcoin Season

This section indicates a very strong Bitcoin season. This rating indicates that Bitcoin is beating a good number of altcoins, which shows a bullish bitcoin market. Investors tend to view Bitcoin as a good store of value during the period.

25-50: Bitcoin Season Is Closer

Even though it is not fully a Bitcoin season, this range indicates that Bitcoin is still doing quite well compared to the altcoins. There might be a few altcoins with better performance, but the majority of altcoins are in bearish conditions. This rating mainly indicates Ethereum's momentum.

50-75: Altcoin Season Appears Closer

This is a phase where there is a clear transition as the momentum is beginning towards altcoins. More and more of the altcoins start beating bitcoin, and slowly the market’s eye starts moving towards the altcoin market.

75-100: Altcoins Are Off the Chain

This clearly is the altcoin season. A great proportion of altcoins would be making much greater profits than bitcoin, and some serious amounts of investments would be made, which would in turn get much higher ROI. This is when the “altcoin season” narrative is at its highest, where everybody is all hyped and has FOMO making the market active.

This scale is really a great invention, as it helps investors keep track of market conditions. As mentioned above, a rating between 75 and 100 indicates “altcoin season” when altcoins are performing better than bitcoin.

How to Calculate the Altcoin Season Index (ASI)?

The Altcoin Season Index is calculated carefully using defined steps: Below is a step-by-step method of calculating ASI

-

Select a time frame: Over a stretch of 90 days can help in a better understanding of medium-term trends. This timeframe is really useful in demonstrating the over-occurring fluctuations.

-

Choose a Set of Altcoins: A specific number of altcoins from the top 50 is selected for calculation. In this selection, Bitcoin. Stablecoins (like USDT and USDC) and wrapped tokens (like wBTC) are not included because they have no influence on the altcoin season.

-

Calculate Individual Performance: For every selected altcoin, the price change is calculated in percentage.

-

Calculate Bitcoin’s Performance: Bitcoin price change over the same duration is also calculated for comparison.

-

Determining Outperformance: Every altcoin's performance is compared to Bitcoin's performance. An altcoin outperforms Bitcoin if its percentage is higher than that of Bitcoin.

-

Calculating the Index Value: The Altcoin Season Index is calculated by comparing the performance of each of the selected altcoins with bitcoin. Altcoin season occurs when 75% or more of the chosen altcoins have a higher performance rate than Bitcoin.

Key Points:

-

Threshold: The 75% threshold is a key signal. When the outperforming altcoins are sufficiently higher than this limit, a shift in the market towards altcoins is anticipated.

-

Dynamic Nature: Due to the ASI changing frequently, the pricing is never static. While it primarily focuses on the previous 90 days of the perspective, this view is constantly changing due to new developments.

-

No Guarantee: The ASI is an indicator that provides information for analysis but is not meant to be an outlook. The ASI may be useful for checking for potential periods of altcoin outperformance, but it does not guarantee price movement.

With the help of this ASI indicator, investors can track the market conditions, which will help them make more profitable investments in their cryptocurrency investments.

The Right Way to Use ASI

Using the Altcoin Season Index effectively for trading involves a more active and strategic approach. Here's a breakdown with a focus on trading applications:

1. Identify potential entry points:

Rising Index with Confluence: Look for instances where the Altcoin Season Index starts to rise from 25, accompanied by other bullish signals:

Bitcoin Consolidation: Bitcoin showing signs of stability or sideways movement.

Breakouts: Altcoins breaking out of resistance levels or forming bullish chart patterns.

Increased Volume:

Rising trading volume in altcoins, indicating growing interest.

Focus on Strong Fundamentals: Don't just chase any altcoin. Prioritize projects with:

-

Strong technology and use cases.

-

Active development teams and communities.

-

Positive news and developments.

2. Time Your Trades:

Early Entry: Consider entering trades when the index is still relatively low (e.g., between 25 and 50) but showing a clear upward trend. This allows you to capture more of the potential gains.

Use Technical Analysis: Use indicators and analysis to fine-tune your investments.

-

Moving Averages: Look for price crossings above key moving averages (e.g., 50-day or 200-day).

-

RSI: Identify oversold conditions to find potential buying opportunities.

-

Support and Resistance: Enter trades near support levels and set stop-loss orders below them.

3. Actively Manage Your Trades:

Set Profit Targets: Use technical indicators and trading volumes, or even your tolerance for risks, and plan how much profit you are aiming for.

Set Trailing Stop-loss Orders: As the target altcoins experience price surges, adjust your stop-loss orders to allow for lesser exposure, meaning more potential locked-in profits.

Scale-Out Gradually: As the value of the index reaches 75 or above, you can consider taking partial profits to secure gains. Rather than viewing 75 as an upper limit and waiting for the prices to shield it, try trading between the time when the ASI rating is between 25 and 75.

4. Define Exit Parameters:

Divergence: Keep examining the ASI Scale and look out for the time when the index starts to decline while altcoin prices continue to rise. It could be a sign of weakening momentum.

Bitcoin Strength: Consider shutting down your assets when Bitcoin starts to outperform the altcoins

Index Reversal: The reverse of the index means selling alt-game assets. If the number descends below 75, then you should consider selling your alt assets and quitting the altcoin positions.

5. Adapt to Market Conditions:

Avoid Short-term Spikes: You should know that every rise in altcoin prices does not indicate altseason. You should double-check the trends with other indicators.

Stay Updated on Market Conditions: This helps in avoiding potential losses. This is because even with a high index rating, negative news or events can trigger market downturns.

Stay Flexible: Always keep yourself prepared to address the changing market conditions.

Benefits of Using ASI:

There are a number of benefits and advantages offered by the Altcoin Season Index.

-

Market Trend Insights: ASI helps identify periods when altcoins outperform Bitcoin, guiding better investment decisions.

-

Timing Opportunities: It assists in recognizing the right moments to shift investments between Bitcoin and altcoins.

-

Portfolio Diversification: It supports the balanced allocation of funds for maximizing profits.

-

Risk Management: ASI reduces the chances of poor investments by providing clear market trends.

-

Profit Maximization: It enhances the chances of capturing higher returns during favorable altcoin seasons.

The Common Mistakes:

Investors often make mistakes while using ASI. These mistakes can lead to extreme losses, and it is important to keep them in mind while trading.

-

Depending solely on ASI: Depending on a single tool is a big no. Always double-check your stats with other tools.

-

Overtrading: Reacting to short-term price increases can often result in losses. Be careful of these short-term price movements.

-

Poor Personal Research: Many investors usually conduct poor research. This research can result in misinformation, and investors might face losses.

The only way to avoid these mistakes is by conducting thorough research before making any decision. Consider every single factor and its influence before investing.

Limitations of ASI

The crypto market is extremely volatile, and ASI might lack in offering the exact ratings. It should be used together with other tools for more accurate results. The unpredictability of the crypto world is also a challenge. Thus, you should also conduct your own research to avoid any misinformation.

Certain events, factors, and trends can also influence the prices of altcoins, and relying on a single tool can impose potential risk. Therefore, always use such tools only for help and don’t completely rely on them.

When Does Altcoin Season Start in July 2025?

As July 2025 starts, the crypto market gives mixed signals about a possible altseason.

-

Bitcoin dominance (BTC.D): Currently at approximately 64%, Bitcoin's dominance remains high. Historically, a decline below 60% has been associated with the start of altcoin seasons, as capital shifts from Bitcoin to other cryptocurrencies.

-

Altcoin Market capitalization: The total market cap for altcoins is hovering around $1.1 trillion. A breakout above the $1.3 trillion resistance level could signal renewed investor interest and potential for growth in the altcoin sector.

-

Relative strength index (RSI): Many altcoins have RSI levels in the oversold territory (below 30), suggesting potential price rebounds if buying pressure increases.

-

Macroeconomic factors: Delays in tariff implementations and potential quantitative easing measures could increase liquidity in the markets, benefiting risk assets like altcoins.

However, key obstacles remain. Sustained Bitcoin dominance could delay or dampen any altcoin rally. Our analysts also caution that any altseason may be selective, favoring altcoins with strong fundamentals over speculative plays.

Crypto equity might also compete for attention and liquidity—especially in institutional circles. In a mixed market, it could delay or suppress weaker altcoin rallies, making an altseason more selective and fundamentals-driven.

History of Past Altcoin Seasons

Previous alt seasons have significantly increased various altcoin values, with some achieving exponential rises in relatively brief timeframes.

Noteworthy alt seasons include the trends of 2017-2018 and 2020-2021. Let's examine them more closely.

This alt-season was driven by a substantial reduction in Bitcoin's market dominance, which dropped from 86.3% in late 2017 to a low of 38.69% at the beginning of 2018. During this time, Bitcoin's price fell from a then-historic peak above $20,000 to below $6,000 just a few months later.

The rise of altcoins surpassing BTC occurred as the initial coin offering (ICO) market was booming in 2017-2018. Many blockchain projects launched ICOs to gather funds by creating tokens.

The alt season of 2020-2021 emerged during the coronavirus pandemic, prompting retail investors and crypto enthusiasts to seek opportunities beyond Bitcoin. This led to the emergence of contemporary meme coins, with Dogecoin and Shiba Inu achieving unprecedented growth.

Non-fungible tokens (NFTs) also stimulated alt markets, enhancing overall sentiment within the dApp sectors. During this period, BTC's market dominance dropped from 70% to 38%, while the total market capitalization doubled from 30% to 62%. The altcoin season index hit 98 on April 16, 2021.

Final Thoughts

The altcoin season index serves as a helpful tool to monitor the crypto market. It can prove to be a great companion for investors. However, it is important to master the skill of using it perfectly. This way you will be able to make the right decision at the right time. Wishing you a safe and successful investment journey.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.