A dispute has erupted within the Aave ecosystem over a significant revenue shift after Aave Labs replaced ParaSwap with CoW Swap on its trading platform. This change has reportedly cost the Aave DAO around $200,000 per week in lost revenue, totaling an estimated $10 million annually. While Aave Labs defends the move as a strategic improvement, Aave governance members are raising concerns about its impact on the community and future decision-making.

What's Aave?

To understand the gravity of the conflict, one must first appreciate what Aave has built. Launched in 2017 as ETHLend and rebranded in 2018, Aave has grown into the undisputed leader in decentralized lending, often described as one of DeFi's "few resounding successes". At its core, Aave is an open-source, non-custodial liquidity protocol that allows users to lend and borrow a wide array of cryptocurrencies without traditional financial intermediaries. It operates by creating liquidity pools where users, known as liquidity providers, deposit their assets to earn interest, while borrowers can draw from these pools by providing over-collateralization.

The protocol's technological sophistication is a key to its dominance. Aave pioneered the "flash loan," a unique feature that allows users to borrow assets without collateral, provided the loan is taken and repaid within a single blockchain transaction. This innovation unlocked complex strategies like arbitrage and collateral swapping. The protocol also utilizes an algorithm-based interest rate model that dynamically adjusts between stable and variable rates based on pool utilization. Critical to its risk management is the "Health Factor," a metric that triggers the automatic liquidation of undercollateralized positions to protect the protocol from bad debt. Aave's governance is vested in its native AAVE token, which holders can stake in a security module to earn rewards and, crucially, vote on all protocol upgrades and parameter changes.

The Anatomy of Aave's Revenue

Aave's financial model is multifaceted, generating substantial and consistent revenue that forms the backdrop of the current dispute. According to DefiLlama, the protocol generates an average of approximately $2 million per week, or over $108 million annually. This revenue stems from three primary streams:

Borrowing Interest: A share of the interest paid by borrowers is directed to the protocol treasury.

Flash Loan Fees: Aave charges a 0.09% fee on every flash loan transaction, a significant revenue source given the protocol's scale.

Liquidation Penalties: When a borrower's position is liquidated, a penalty fee is applied, part of which goes to the protocol.

This revenue accrues to the Aave DAO treasury, a massive war chest that funds development incentives, security bounties, and grants. The treasury's health is directly tied to the value of the AAVE token, creating a powerful alignment of incentives—or so it seemed. The recent controversy reveals a potential fourth, and contentious, revenue stream: fees generated by the official Aave application interface.

CoW Swap and the Allegation of "Stealth Privatization"

The crisis was ignited on December 12, 2025, by a post on the Aave governance forum from a delegate using the pseudonym "EzR3aL". The post detailed a critical on-chain discovery: swap fees generated through a newly integrated service, powered by CoW Swap on Aave's official web interface, were no longer flowing to the communal DAO treasury. Instead, they were being directed to a separate, independent address.

This represented a stark departure from the past. For years, Aave's interface had integrated a service from Paraswap. In mid-2022, Paraswap instituted a referral program that directed surplus revenue from swaps executed through Aave's frontend back to the DAO treasury. However, in mid-2025, Aave Labs began rolling out a new interface widget powered by CoW Swap. EzR3aL's analysis indicated this new integration included an explicit fee of 15 to 25 basis points on swaps. By tracing transactions, they estimated that the funds accruing to the independent address could be worth at least $200,000 per week since the integration went live, amounting to over $10 million annually—revenue the community believed was rightfully theirs.

The response from a leading community figure was swift and severe. Marc Zeller, head of the influential Aave Chan Initiative (ACI), labeled the situation "extremely concerning". He accused Aave Labs of orchestrating a "stealth privatization of approximately 10% of Aave DAO's potential revenue," arguing that the company was leveraging the brand and intellectual property paid for and owned by the DAO itself. Zeller asserted that service providers like Aave Labs have a "fiduciary duty" to act in the best interests of AAVE token holders and that there was a long-standing, tacit understanding that monetization of the official

aave.com frontend would benefit the treasury.

Alarms Raised on Vaults, Horizon, and the Future v4 Engine

What began as an investigation into swap fees rapidly expanded into a comprehensive audit of the economic relationship between Aave Labs and the DAO. Zeller and others raised alarms about several other Aave Labs-linked products where revenue flows appeared opaque or misaligned.

-

Aave Vaults: This product, highlighted in Aave's own documentation, was questioned for potentially including hardcoded fees that flow solely to Aave Labs. Given that Vaults are expected to play a central role in the next-generation Aave v4, the community demanded clarity on any planned revenue-sharing agreement.

-

The Horizon Initiative: Designed to onboard institutional real-world assets (RWA) like tokenized U.S. Treasuries, Horizon has been a flagship project. However, Zeller pointed out that to date, the initiative has generated only about $100,000 in visible revenue for the DAO, against roughly $500,000 in DAO-funded incentives provided to it.

-

The Aave v4 Liquidation Engine: Perhaps the most significant future flashpoint concerns the design of the liquidation engine in the planned v4 upgrade. The current v3 engine has successfully managed market volatility, generating critical revenue for the DAO from liquidation penalties. Zeller expressed concern that a proposed shift to an externalized engine could divert "tens of millions of dollars per year" away from the DAO treasury.

These broader concerns framed the CoW Swap issue not as an isolated incident, but as symptomatic of a larger pattern where value generated through the communal Aave brand and ecosystem is increasingly captured by the centralized development entity.

The Founder's Defense to the Allegations

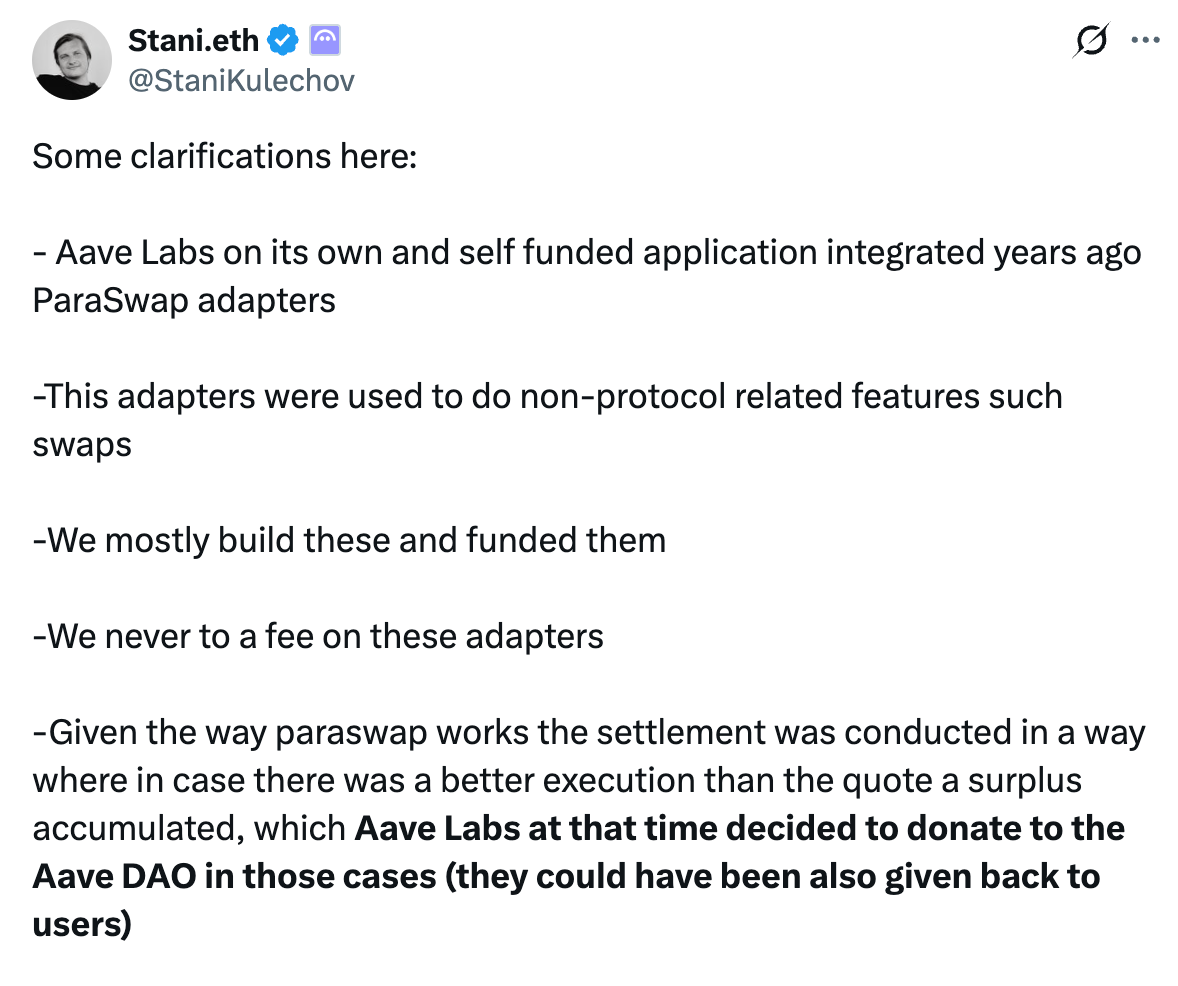

Source: Stani.eth X account

Aave founder Stani Kulechov publicly responded to the allegations, offering a starkly different philosophical perspective on the roles of Aave Labs and the DAO. Kulechov's defense rested on several key points.

He emphasized that Aave Labs has maintained and developed its own "opinionated" frontend application for over eight years, distinct from the open-source protocol. He argued it is "perfectly fine for Aave Labs to monetize its products," particularly for features that sit outside the core protocol functionality. The CoW Swap integration, with its user experience improvements, was positioned as such a value-added feature.

Countering the community's expectation of ongoing revenue, Kulechov reframed the previous Paraswap income. He stated that Aave Labs voluntarily chose "to donate" that surplus to the DAO, implying it was a discretionary act of goodwill rather than an obligated stream. This revenue, he suggested, could have instead been used for user rebates.

Kulechov's overarching argument was that Aave Labs' activities are fundamentally aligned with tokenholder interests because they focus on ecosystem growth. By building a better frontend and attracting more users, Aave Labs increases overall protocol activity, which in turn boosts the core revenue streams (like borrowing interest and flash loan fees) that do benefit the DAO. "Our goal is always to use Aave Protocol and build also features that are outside of the Aave Protocol that help to keep the users in the protocol, transact more and have competitive advantage," he concluded.

A Systemic Crisis for DeFi Governance

The Aave conflict is not an isolated governance stumble; it is a manifestation of a systemic tension inherent in the "progressive decentralization" model adopted by many top DeFi protocols. This model sees a centralized founding team build and launch a protocol, with governance gradually transferred to a token-based DAO over time. The Aave dispute exposes the messy reality of this transition.

The core question is one of boundaries: What constitutes the "protocol" owned by the DAO, and what constitutes a "product" built on top by a private entity? When does the use of the protocol's brand, user base, and network effects by that private entity create an obligation to share profits? Aave Labs argues it is building on its own work; the community counter-argues that it is building on a foundation created and funded by the collective.

This crisis also reveals the practical limitations of DAO governance. Even with a massive treasury and sophisticated voting mechanisms, the community finds itself reacting to

fait accomplidecisions made by a core development team with superior information and execution power. The ability to audit and question, as demonstrated by EzR3aL, is a powerful tool, but it is fundamentally reactive.

Conclusion

The battle over $10 million is, in truth, a battle for the soul of decentralized governance. The resolution of this conflict will set a crucial precedent not just for Aave, but for the entire DeFi industry. Will the Aave DAO succeed in reclaiming what it sees as diverted revenue and establishing stricter, more transparent controls over ecosystem economics? Or will Aave Labs' vision of a more independent, entrepreneurial role within the ecosystem prevail?

The community's next steps may involve formal governance proposals to mandate revenue-sharing agreements for all frontend monetization, establish clearer fiduciary guidelines for service providers, or even fund the development of a fully community-controlled frontend. For Aave Labs, the path forward requires a delicate balance between justifying its business model and repairing a fractured trust with its most dedicated stakeholders.

As Aave marches toward its ambitious v4 upgrade, promising a unified liquidity layer and deeper integration of its GHO stablecoin, this governance rift cannot be ignored. Technology may be ready to leap forward, but the community must first decide who benefits from the value that technology creates. The outcome will determine whether Aave remains a pioneering example of community-owned finance or becomes a cautionary tale of how decentralization can be undermined from within. The future of DeFi governance is being written in this dispute, one contentious transaction at a time.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.