On December 15th, the cryptocurrency market experienced a significant and widespread correction this week. Instead of the anticipated "year-end rally," the market presented a picture dominated by "extreme fear," driven by a combination of cooling macroeconomic monetary policy expectations and internal structural pressures. The broad decline, led by Bitcoin, not only triggered large-scale leveraged liquidations but also exposed the market's hesitation and fragility at key resistance levels. Meanwhile, U.S.-listed spot XRP exchange-traded funds (ETFs) have recorded 30 consecutive trading days of net inflows since their debut on Nov. 13. On December 11, 2025, a pseudonymous Aave DAO delegate named EzR3aL posted an open letter in the Aave governance forum questioning where swap fees were going. U.S. Financial regulators have taken major steps to integrate digital assets into the traditional banking system through new custody guidance, charter approvals, and blockchain infrastructure pilots.

Crypto Market Overview

BTC (-0.66% | Current Price: $89,622.09)

Today's decline in Bitcoin is not an isolated event, but rather a technical correction after recently hovering below a key resistance level. After rebounding more than 17.5% from its November lows, BTC's recovery momentum encountered a "wall" at the critical resistance zone of $93,347-$94,236. This area holds multiple technical significance, including the annual opening price, the May low, and the 61.8% Fibonacci retracement level, making a breakthrough crucial for confirming a trend reversal.

With today's price falling below $88,000, market focus has shifted to the support levels below. The $85,929-$86,291 area (the 61.8% retracement level of the late November rebound) has become the primary line of defense. If this level is breached, the next important support is at $83,712-$84,000 (near the annual low weekly closing price). A decisive break below this area could restart the downward trend since October, potentially testing the $78,342-$79,127 range. Standard Chartered recently significantly lowered its short-term expectations for Bitcoin, believing that the buying momentum from digital asset treasuries has been exhausted, and pushing its $150,000 price target back to the end of 2026.

On December 12th, Bitcoin exchange-traded funds (ETFs) registered a total net inflow of $49.1 million, with BlackRock's IBIT saw an inflow of $51.1 million.

ETH (+0.29% | Current Price: $3,120.22)

Compared to Bitcoin, Ethereum faces a more complex situation. Technically, ETH has followed the general market downturn, with its price currently around $3,073. The solid fundamental progress is at odds with the weak market price. Some analysts believe that if the increased liquidity resulting from a potential Federal Reserve interest rate cut coincides with the anticipated momentum from a spot Ethereum ETF, ETH could still challenge the target range of $3,550-$3,600 in December. However, in the short term, it still needs to overcome the pressure from macroeconomic factors and market sentiment.

On December 12th, ETH ETFs experienced a total net outflow of $19.4 million, with BlackRock's ETHA saw an inflow of $23.2 million.

Altcoins

Today, the altcoin market broadly followed Bitcoin's correction. Major altcoins such as

SOL,

XRP, and

DOGE saw declines of between 2% and 4%. However, a longer-term perspective reveals significant divergence: over the past year,

BNB stood out with a 32.02% increase, demonstrating its strong resilience backed by its exchange ecosystem; while during the same period,

ETH and

XRP fell by 13.24% and 9.07%, respectively. This indicates that tokens with strong utility and profitability fundamentals are more resistant to declines when the overall market is under pressure.

The Fear and Greed Index has plummeted to 24, clearly entering the "fear" zone. Historically, sustained extreme fear often signals the formation of a medium-to-long-term market bottom, but it also means that short-term volatility may intensify.

Macro Data

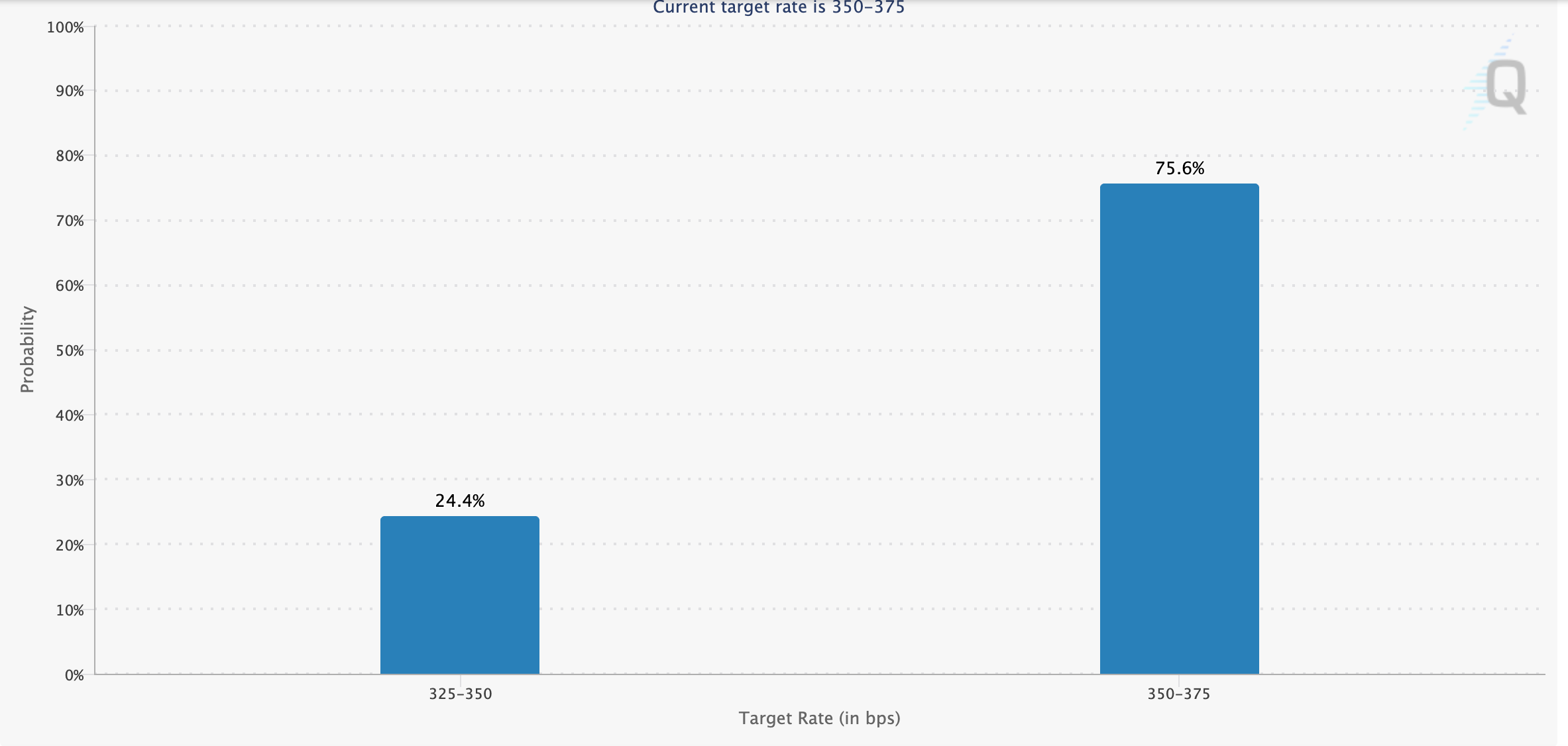

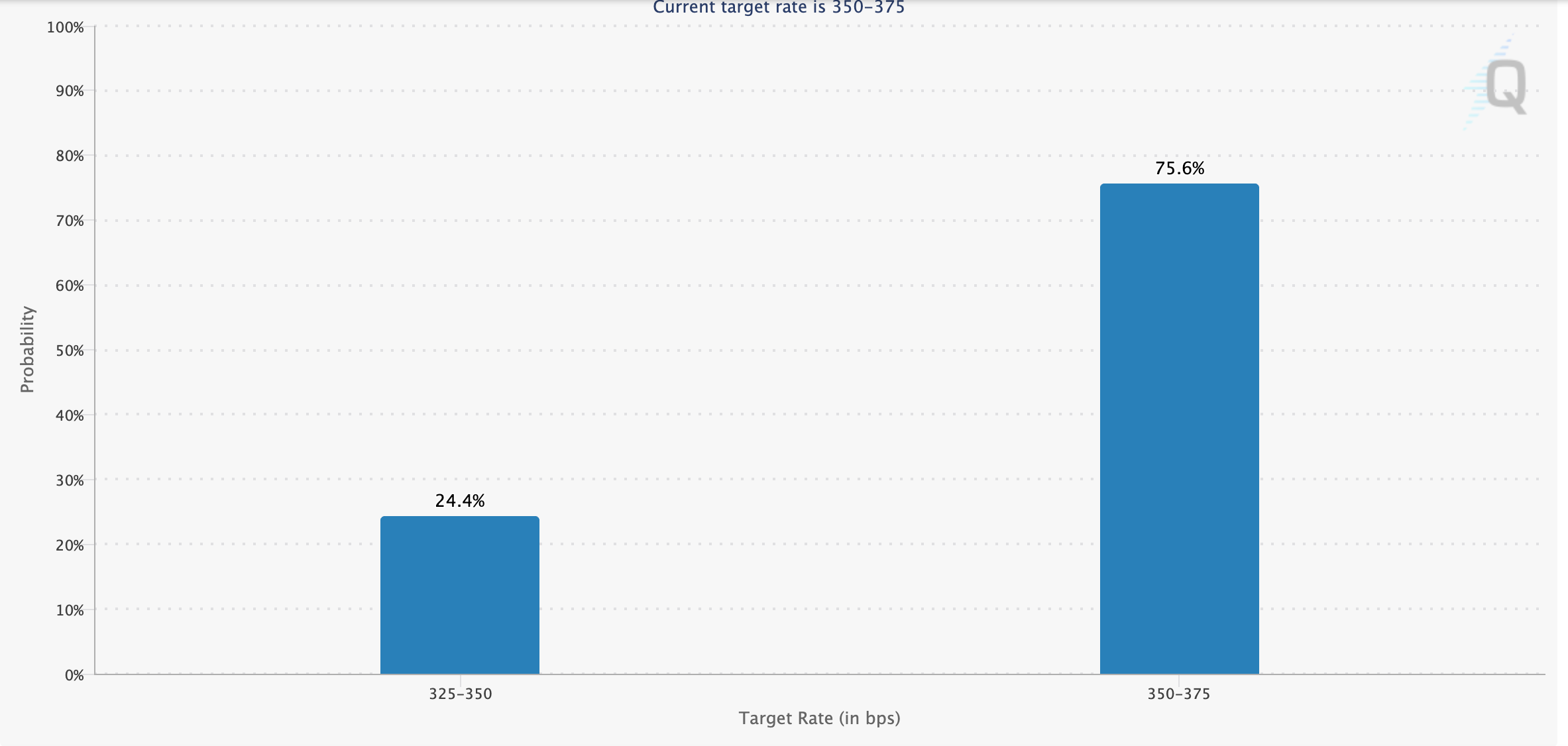

Despite the Federal Reserve's interest rate cut at its December meeting, its "hawkish" guidance on the 2026 interest rate path (the dot plot suggesting only one rate cut) disappointed the market. According to the

CME FedWatch tool, the market's expectation of another rate cut in January 2026 has fallen to 24.4%, while the probability of maintaining interest rates unchanged is as high as 75.6%. This significant cooling of monetary easing expectations directly weakened the attractiveness of risk assets such as Bitcoin, and is considered by analysts to be the main reason for today's sell-off. At the same time, market speculation about former Federal Reserve Governor Kevin Warsh potentially being nominated as the next chairman adds further uncertainty to future policy.

The market is converging into an increasingly narrow trading range at the end of the year, and a decisive breakout is imminent. Looking ahead, investors should focus on the following three main themes: Pay attention to the Bitcoin range breakout. The short-term fate of the market depends on the direction of Bitcoin's breakout from its current range. If the price can recover and strongly break through the strong resistance of $94,236, a new upward trend is likely to begin, targeting $98,000 and even $102,200. Conversely, if it effectively breaks below the $83,712 support, it may trigger a deeper correction to the $78,000 area. The light trading volume at the end of the year may amplify volatility, so caution is needed. Be wary of unlocking pressure and pay attention to the ETH/BTC exchange rate. The massive altcoin unlocking wave in December will be an important factor suppressing the market, especially the prices of related projects. Meanwhile, closely monitor the

ETH/

BTC exchange rate. A rise in this ratio usually means that funds are starting to rotate from Bitcoin to Ethereum and other altcoins, which could be a prelude to an "altcoin season." The current divergence between Ethereum's strong fundamentals and weak price may create conditions for this rotation. Interest rate cut expectations and ETF progress. Market expectations for the Fed's 2026 interest rate path will continue to dominate risk sentiment. Any data showing controlled inflation or economic weakness could rekindle interest rate cut expectations, thereby boosting the market. On the other hand, the official approval of the first US altcoin spot ETFs would be a landmark institutional event for the cryptocurrency market, potentially bringing in significant new capital.

On December 12th, the S&P 500 dropped 1.07%, standing at 6,827.41 points; the Dow Jones Industrial Average fell 0.51% to 48,458.05 points, and the Nasdaq Composite fell 1.69% to 23,195.17 points. The price of gold is $4,340.73 up 0.93%, at 6:00 UTC, December 15th.

Trending Tokens

ICNT Impossible Cloud Network (+46.85%, Circulating Market Cap: $66.85 Million)

ICNT is trading at $0.3998, up approximately 46.85% in the past 24 hours. Based in Switzerland and Germany, Impossible Cloud Network (ICN) is a decentralized infrastructure protocol designed to support enterprise-grade cloud services. ICN enables permissionless access to distributed hardware resources across storage, compute, and networking. The protocol aims to serve as a foundational infrastructure layer for digital applications, including artificial intelligence platforms, enterprise software, and web services. ICNT debuted on KuCoin, accompanied by trading incentives like Bitget’s 1,064,000 ICNT "CandyBomb" rewards. Listings expanded investor access, while rewards programs drove short-term trading volume (+158% to $40.7M). However, KuCoin’s delisting of ICNT margin trading on Dec 5, 2025, introduced volatility risk.

GUN GUNZ (+24.4%, Circulating Market Cap: $29.7 Million)

GUN is trading at $0.02161, up approximately 24.4% in the past 24 hours. GUNZ is a Layer 1 blockchain platform built for AAA Web3 gaming. It powers a comprehensive gaming ecosystem with services tailored to the needs of both developers and players. Originally created to support a community-driven economy for Gunzilla’s flagship title, Off The Grid, GUNZ has evolved into a full-featured platform offering blockchain-native infrastructure essential for modern game development. Off The Grid’s upcoming Steam release (teased for late 2025) has driven speculation, with 18M+ testnet wallets and 800M+ transactions signaling scalability readiness. Steam’s 120M+ active users could funnel new players into GUNZ’s economy, increasing GUN utility for in-game purchases and NFT trading. Historical data shows GUN spiked 46.6% after its Epic Games Store debut.

FORM Four (+20.67%, Circulating Market Cap: $132.5 Million)

FORM is trading at $0.3474, up approximately 20.67% in the past 24 hours. BinaryX ($BNX) is the platform cryptocurrency for the BinaryX ecosystem, which includes the DAO and all products & games utilizing $BNX. BinaryX began as a decentralized derivative trading system. Recognizing the burgeoning popularity of GameFi and interest in metaverse games, the team gradually evolved into developing decentralized video games and is now fully transitioning to being a GameFi platform offering IGO services to bridge Web2 developers to Web3. FORM’s 7-day RSI hit 22.27 (oversold) on December 14, historically a contrarian buy signal. The MACD histogram flipped positive (+0.00125) for the first time in two weeks, suggesting bullish momentum. Traders likely interpreted oversold conditions as a dip-buying opportunity, amplified by FORM’s low liquidity (turnover ratio 0.356). The price broke above the 7-day SMA ($0.308) but remains below the 30-day SMA ($0.360), indicating short-term optimism amid longer-term skepticism.

Market News

XRP Spot ETFs Rack Up 30-Day Inflow Streak in Divergence From Bitcoin, Ether

U.S.-listed spot XRP exchange-traded funds (ETFs) have recorded 30 consecutive trading days of net inflows since their debut on Nov. 13, setting them apart from bitcoin and ETH ETFs that experienced multiple days of outflows over the same period. Data shows

XRP spot ETFs have attracted fresh capital every trading day since launch, lifting cumulative net inflows to about $975 million as of Dec. 12. Total net assets across products have climbed to roughly $1.18 billion, with no single session of net redemptions recorded.

The uninterrupted streak contrasts sharply with flow patterns in more established crypto ETFs. U.S. spot bitcoin and ether funds, which, together account for the bulk of crypto ETF assets — both saw stop-start flows in recent weeks as investors reacted to shifting interest-rate expectations, equity-market volatility and concerns around technology-sector valuations. XRP-linked products, by comparison, drew steady (albeit much smaller) allocations through the same environment, suggesting demand driven less by short-term macro positioning and more by asset-specific considerations.

The consistency may point to XRP ETFs being used as a structural allocation rather than a tactical trading instrument. While bitcoin ETFs often act as a proxy for broader liquidity conditions, XRP funds appear to be capturing interest from investors seeking differentiated crypto exposure within regulated vehicles. The flow profile also reflects a broader evolution in the crypto ETF market. Rather than concentrating capital solely on bitcoin and ether, investors are increasingly spreading exposure across alternative assets with clearer use cases in payments and settlement infrastructure.

Aave DAO and Aave Labs members Clash Over $10 Million in Annual Revenue

On December 11, 2025, a pseudonymous Aave DAO delegate named EzR3aL posted an open letter in the Aave governance forum questioning where swap fees were going. Through on-chain analysis, EzR3aL traced fees to a private address controlled by Aave Labs rather than the DAO treasury. The financial impact is significant. According to the analysis, the fee diversion amounts to approximately $200,000 per week, or roughly $10 million annually. This represents about 10% of the Aave DAO’s potential revenue, which community members argue belongs to token holders.

Previously, Aave used ParaSwap for swap functionality. That arrangement sent surplus revenue to the DAO treasury without charging users explicit fees. The last weekly transfer was valued at 46 ETH, worth over $150,000 at the time.

The new CoW Swap integration, which began rolling out in mid-2025 and was fully announced on December 4, 2025, charges users fees of 15-25 basis points on swaps. However, these fees now flow to Aave Labs instead of the community treasury.

Stani Kulechov, founder and CEO of Aave Labs, responded publicly on social media and in the governance forum. He rejected the characterization of the situation as stolen revenue, arguing that previous ParaSwap fees were a “discretionary surplus” that Aave Labs voluntarily donated to the DAO.

SEC Releases Crypto Custody Guidance as Regulators Greenlight Tokenization and Bank Charters

U.S. Financial regulators have taken major steps to integrate digital assets into the traditional banking system through new custody guidance, charter approvals, and blockchain infrastructure pilots. These developments mark a significant shift toward regulatory clarity for cryptocurrency firms and institutional investors.

The Securities and Exchange Commission published an Investor Bulletin on December 12, 2025, explaining how retail investors can safely hold crypto assets. The guidance defines custody as the method through which investors store and access private keys—the passcodes that authorize transactions and prove ownership of digital assets.

The bulletin warns that losing a private key results in permanent loss of access to crypto assets. It distinguishes between hot wallets, which remain connected to the internet for convenience, and cold wallets, which use physical devices like USB drives to stay offline. Hot wallets expose users to cyber threats but enable faster transactions, while cold wallets offer stronger protection against hacking at the cost of portability.

For third-party custody options, the SEC cautioned that if a custodian is hacked, shuts down, or goes bankrupt, investors may lose access to their holdings. The agency noted that some firms rehypothecate customer assets by lending them out, while others pool customer holdings rather than segregating them individually.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.