The sharp decline of cryptocurrency-linked equities, exemplified by BitMine Immersion Technologies' (BMNR) 9.17% drop in a single session, has ignited urgent debates about the sustainability of the Digital Asset Treasury (DAT) model. This investment thesis, where publicly traded companies hold cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) as primary treasury assets, evolved from a niche strategy into a frenzied market narrative in 2025. Once celebrated as a revolutionary bridge between traditional finance and the crypto ecosystem, DAT companies are now facing a severe confluence of collapsing valuations, intense regulatory scrutiny, and eroding investor confidence. This article examines whether the DAT model is experiencing a terminal rupture or a necessary, painful correction. By analyzing the mechanics of "treasury stocks," their market performance, the critical yet flawed mNAV metric, and shifting investor sentiments, we explore the profound challenges and potential evolutionary path forward for this controversial segment of the market.

BMNR stock price (timeframe: 1 day). Source: Robinhood

Understanding Digital Asset Treasury (DAT) Companies and "Treasury Stocks"

A Digital Asset Treasury (DAT) company is a publicly listed entity that allocates a significant portion, or even the majority, of its corporate treasury reserves to cryptocurrencies. Pioneered by

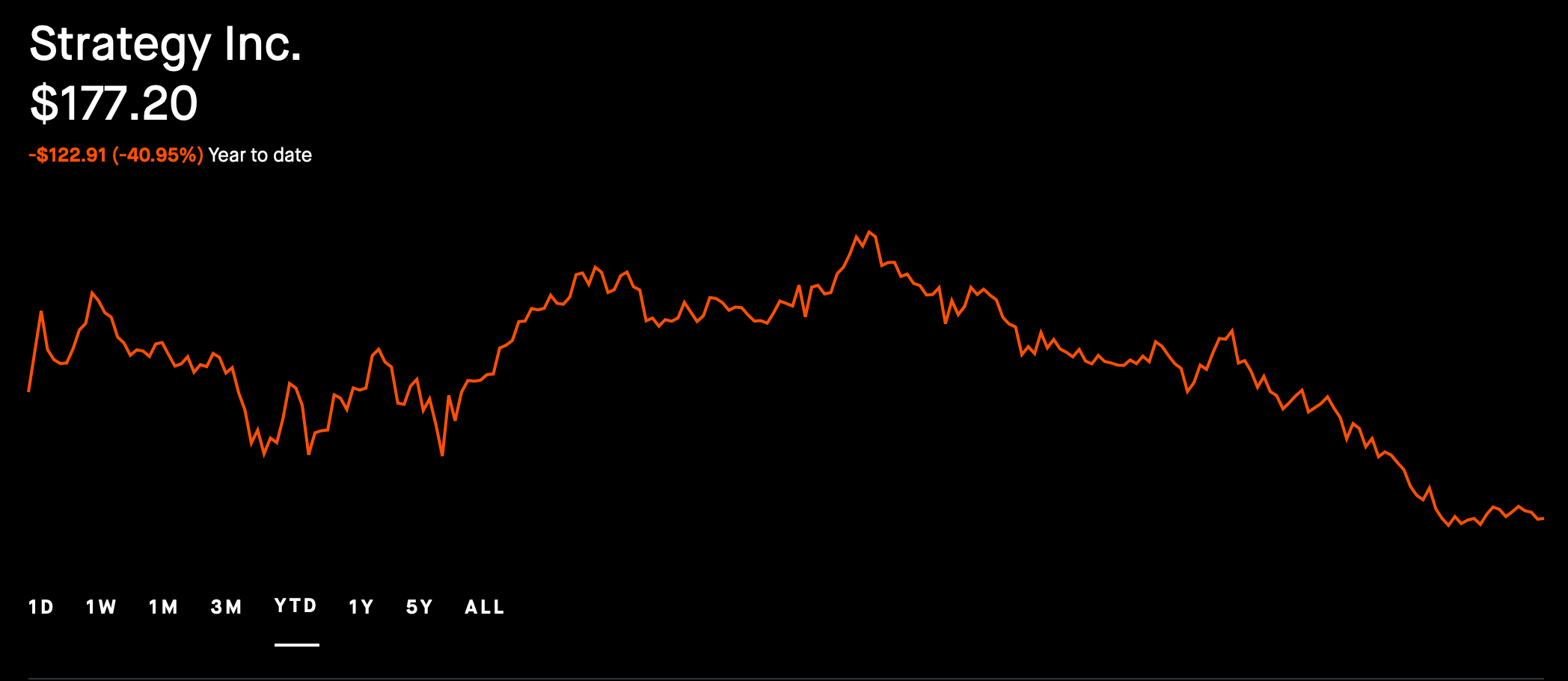

MicroStrategy (now Strategy) with Bitcoin, the model promised a dual appeal: it allowed companies to gain exposure to a potentially appreciating digital asset class, while providing traditional equity investors a regulated vehicle to indirectly invest in cryptocurrencies without directly holding them.

In 2025, this strategy exploded in popularity, particularly around Ethereum. A wave of companies, ranging from technology firms to those in entirely unrelated sectors, announced pivots to become "Ethereum Treasury" stocks. These companies do not merely hold ETH passively; many actively engage in staking, restaking, and deploying assets within decentralized finance (

DeFi) protocols to generate yield, aiming to transform their holdings into a productive asset.

Prominent examples of Ethereum-focused DATs include:

-

BitMine Immersion Technologies (BMNR): Positioned as the world's largest corporate holder of Ethereum, with a declared ambition to accumulate 5% of ETH's total supply.

-

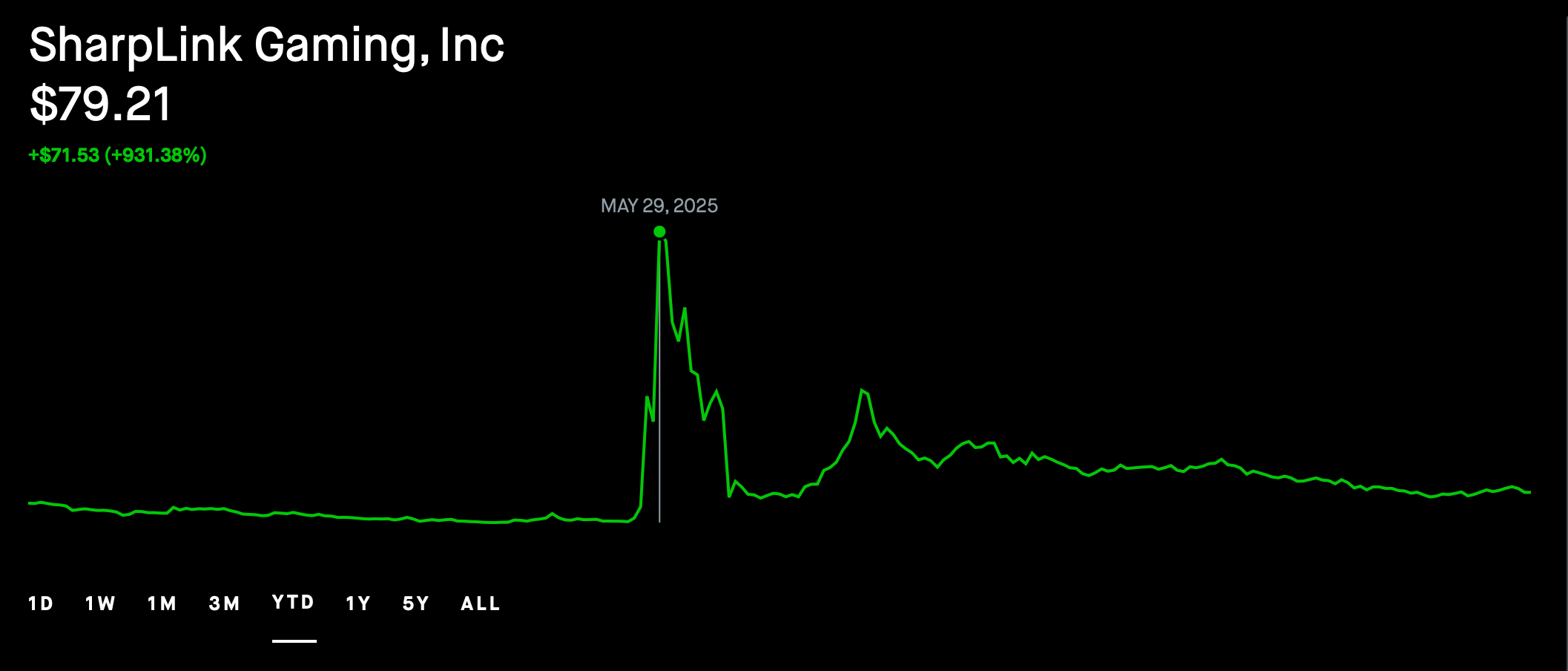

SharpLink Gaming (SBET): A former online marketing firm that pivoted to holding and staking nearly all of its substantial ETH treasury.

-

The Ether Machine: A special purpose acquisition company (SPAC) entity formed with the explicit mission to buy, stake, and restake ETH.

-

Others: Bit Digital (BTBT), ETHZilla Corporation, and BTCS Inc. are among the key players, each employing varied strategies from institutional staking to complex DeFi integrations.

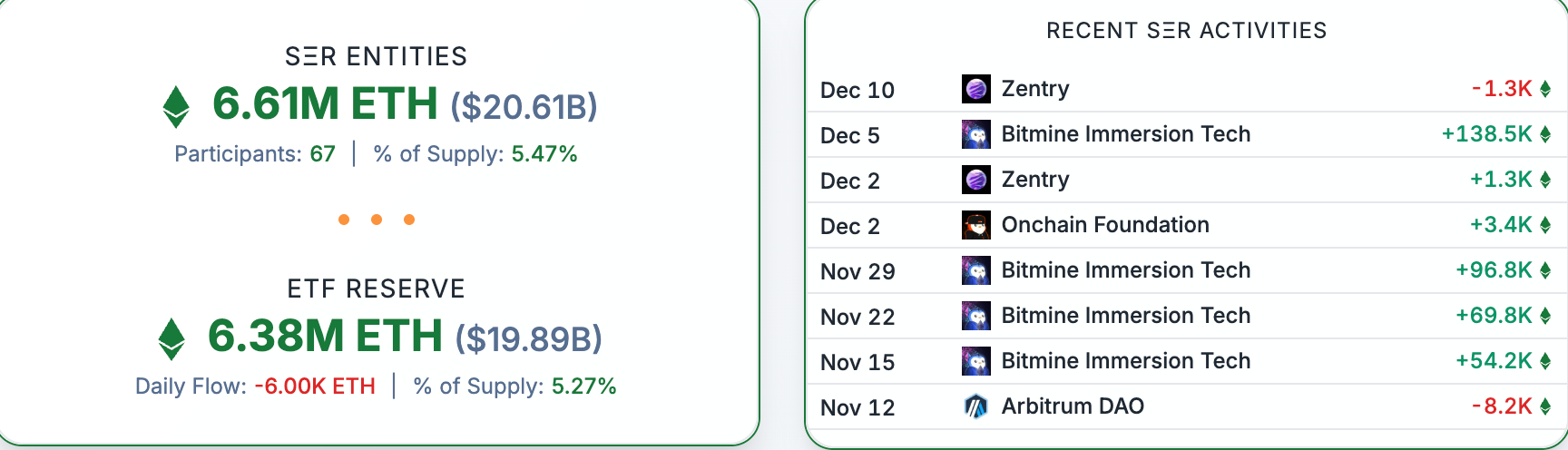

The collective scale became significant. By December 2025, Strategic ETH Reserve data indicated that companies with dedicated Ethereum treasury strategies held approximately 6.61 million ETH, valued at around $20.6 billion. Ethereum co-founder Vitalik Buterin publicly endorsed the model as a "valuable indirect holding channel" for a broader set of investors, while simultaneously warning against the dangers of excessive leverage within these structures.

ETH strategic reserve data. Source: StrategicETHReserve

Market Performance: From Meteoric Rise to Precipitous Fall

The market trajectory of DAT stocks in 2025 has been a tale of extreme volatility, characterized by explosive growth followed by a deep and widespread correction.

The first half of the year was marked by euphoria. The broader crypto equity sector soared, with one report noting a 119% cumulative gain for crypto concept stocks at mid-year, dubbing 2025 the "Year of Crypto Stocks". DAT companies were at the forefront of this surge. Announcements of treasury strategies often triggered dramatic stock price rallies, sometimes in the hundreds of percent, as the market bought into the "financial alchemy" narrative. This was fueled by a self-reinforcing cycle where rising crypto prices boosted company treasuries, attracting more equity investment.

However, the momentum reversed decisively in the latter part of the year. A broad-based sell-off engulfed the sector. Data from Bloomberg in early December revealed a sobering picture: the median stock of DAT companies listed in the U.S. and Canada had fallen 43% year-to-date, with individual cases like Greenlane Holdings collapsing over 99% and SharpLink Gaming falling 86% from its highs. Even industry bellwethers like Strategy (MicroStrategy) saw its stock decline 40%.

The decline of BMNR by 9.17% on a single Friday is a microcosm of this sector-wide distress. This poor performance starkly contrasts with the earlier exuberance and signals a fundamental reassessment of the DAT model's value proposition by the market.

The mNAV Metric: The Engine, the Gauge, and Its Flaws

At the heart of the DAT investment thesis lies a key metric: the market value-to-net asset value (mNAV) ratio. It is calculated by dividing a company's market capitalization (P) by the net asset value (NAV) of its digital asset holdings. An mNAV greater than 1.0 indicates the stock is trading at a premium to the underlying crypto assets on its balance sheet.

This premium was the essential fuel for the DAT "flywheel". With mNAV > 1, a company could issue new shares at a premium price, use the proceeds to buy more cryptocurrency, and theoretically increase the crypto holdings (NAV) per share. This, in turn, was meant to justify a higher share price, sustaining or even expanding the premium and allowing the cycle to repeat. This mechanism gave DATs what appeared to be "unlimited ammunition" during a bull market.

Recent performance, however, shows this flywheel breaking down. Analysis from September 2025 indicated that the mNAV for leading DAT companies was in steep decline. Strategy's mNAV reportedly fell from 1.6 to 1.12 within a month, and critically, two-thirds of the top 20 crypto treasury companies were trading at an mNAV

below 1—meaning their market cap was less than the value of their crypto holdings. When mNAV falls below 1, the flywheel reverses; equity issuance becomes dilutive and value-destructive, crippling the primary growth model for many of these firms.

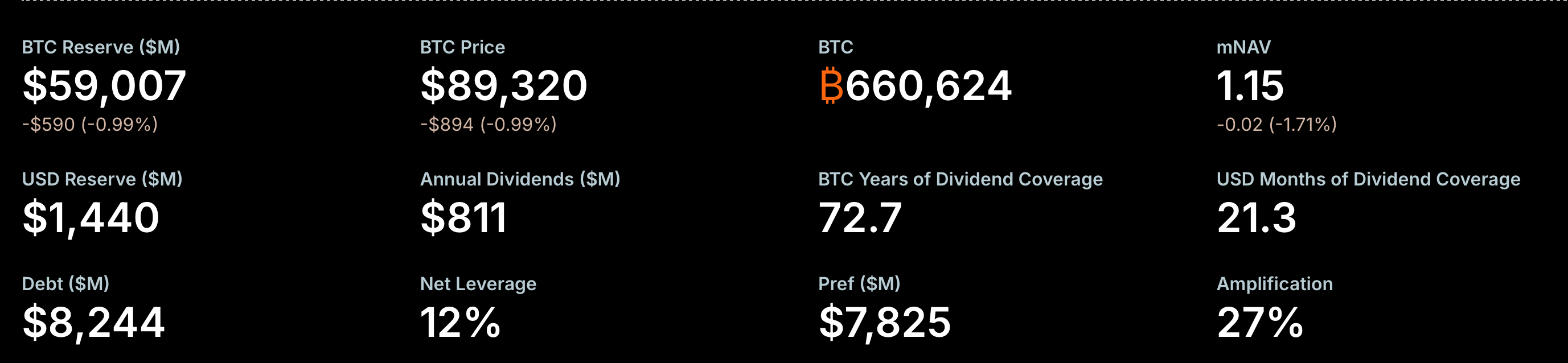

MSTR mNAV metrics. Source: Strategy official site

The mNAV metric itself has come under professional criticism. Greg Cipolaro, Global Head of Research at NYDIG, argues the metric "needs to be deleted," calling it inaccurate and misleading. The critique centers on mNAV's failure to account for corporate liabilities (like debt used to buy crypto) and its inappropriate application to companies that have operational businesses beyond just holding digital assets. The market's growing awareness of these flaws has further undermined confidence in mNAV as a reliable valuation tool.

Dilution and Concentration Risks

The declining mNAV and stock prices reflect a deeper shift in investor sentiment. Patience for the DAT model's inherent financial engineering has worn thin, particularly concerning two core risks: perpetual dilution and extreme asset concentration.

Many DAT companies, especially newer entrants, have minimal traditional business operations and generate little to no operational revenue. Their growth model is entirely dependent on issuing equity to raise capital for more crypto purchases. When trading at a high mNAV premium, this dilution was offset by the perceived value creation of a growing treasury. With premiums vanished or turned to discounts, each new share issuance is now viewed as a direct transfer of wealth from existing shareholders to the company's balance sheet, with no organic business to replenish that value. Investors are increasingly refusing to finance this circular mechanism.

Secondly, the extreme concentration risk is now a paramount concern. A DAT company's fate is inextricably and hyper-leveraged to the price of a single cryptocurrency. BitMNR's identity is wholly tied to Ethereum. This creates a dangerous, reflexive feedback loop: a decline in ETH's price reduces the company's NAV, pressures its stock price and mNAV, which can impair its ability to raise funds or meet obligations. In a worst-case scenario, this could force asset sales, creating selling pressure on the underlying asset itself. Vitalik Buterin's warning about DAT companies devolving into "over-leveraged gambling games" that could trigger cascading liquidations highlights the systemic risk this concentration poses. The market is now penalizing, rather than rewarding, this lack of diversification.

SEC Investigation and Market Implications

Adding immense pressure to the sector is a sweeping regulatory offensive. In September 2025, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) jointly announced an investigation into more than 200 public companies that had announced crypto treasury plans. The probe focuses on "unusual trading activity" in these stocks preceding their public announcements, citing widespread instances of "news unpublished, stock price first" activity.

Cases like SharpLink Gaming, which saw its volume spike and price jump 159% days

before its major ETH acquisition announcement, have drawn particular scrutiny and fueled suspicions of information leaks or insider trading. This regulatory action has cast a long shadow, increasing legal risk, raising compliance costs, and deterring new speculative entrants. It directly challenges the legitimacy of the DAT frenzy and aims to "compress insider space and increase issuance thresholds".

Furthermore, exchanges like Nasdaq have proposed stricter rules, potentially requiring shareholder approval for equity issuances aimed at funding crypto purchases. These regulatory moves threaten to dismantle the very financing mechanisms that powered the DAT flywheel, accelerating a market consolidation where only the most transparent and robust companies survive.

Market Behavior and Evolution

The future of the DAT model hinges on market behavior and its capacity to evolve beyond its initial, simplistic premise. The phase of easy premiums and indiscriminate speculation is conclusively over. The path forward points to a stark bifurcation and maturation.

The market is forcing a great consolidation. As analyst Arthur Hayes noted, within each asset class (BTC, ETH, SOL), only one or two leaders are likely to endure. Companies with strong balance sheets, credible management, and perhaps most importantly, viable operational income streams or staking yields will separate themselves from the dozens of "shell companies" that adopted the DAT narrative as a last resort. Many of these smaller players face delisting or dissolution.

The investment thesis must also transition from "financial alchemy" to fundamental value creation. Successful DATs will need to demonstrate more than just holding assets. This involves:

-

Generating Real Yield: Effectively leveraging staking, restaking, and DeFi strategies to produce a sustainable income stream from treasury assets.

-

Building Operational Moats: Developing adjacent businesses, technology, or services that provide tangible value beyond the treasury's market value.

-

Prioritizing Shareholder Returns: In an environment of mNAV discounts, the rational corporate action shifts from issuing shares to buy crypto, towards using treasury assets to buy back shares or pay dividends, directly returning value to shareholders.

Finally, the regulatory outcome of the SEC investigation will be pivotal. A harsh crackdown could permanently cripple the model for all but the most established players. A more measured resolution could help cleanse the sector of bad actors and establish clearer rules, allowing a healthier, more sustainable version of the DAT model to develop.

Conclusion

The dramatic sell-off in DAT stocks, punctuated by sharp declines like BMNR's 9.17% drop, signals not a sudden death, but a severe and necessary crisis of the model. The initial, unbridled DAT narrative—built on the fragile mechanics of the mNAV flywheel, investor tolerance for pure dilution, and regulatory permissiveness—has indeed ruptured.

However, the core concept of corporations holding digital assets on their balance sheets is not inherently invalid. Instead, it is undergoing a violent and essential transition from speculative fever to a more mature, risk-aware investment strategy. The market is discarding the weak and the opportunistic, while demanding real economic productivity and robust governance from the survivors. The future belongs not to every company with "treasury" in its description, but to those that can successfully integrate digital assets into a sustainable, transparent, and value-generating corporate strategy. The DAT model is not disappearing; it is growing up, and the growing pains are proving to be exceptionally severe.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.