As December 5, 2025, unfolds, the cryptocurrency market is navigating a delicate balance between persistent macroeconomic headwinds and glimmers of sector-specific optimism. The total market capitalization stands at approximately $3.23 trillion, reflecting a modest 0.4% decline over the past 24 hours but a 2.7% rebound from November's lows. Bitcoin has stabilized around $92,500 after a volatile week, while Ethereum shows relative strength at $3,180 amid DeFi rotation and the recent Fusaka hard fork upgrade. Meanwhile, Switzerland-based ETF issuer 21Shares has brought the first exchange-traded product tracking the price of SUI to the U.S. Market. Stablecoins risk accelerating currency substitution in countries with relatively weak monetary frameworks, potentially undermining central banks' control over capital flows, the International Monetary Fund warned Thursday. Figure Technology Solutions today announced the launch of an RWA consortium, a landmark coalition that will expand access to Figure's more than $1 billion in monthly on-chain loan originations, starting on Solana.

Crypto Market Overview

BTC (-1.18% | Current Price: $92,318.48)

Historically, Bitcoin's performance in December has resulted in an average gain of approximately 9.7%, making it the third strongest month in terms of trends. After rebounding from November's low of $80,495, BTC currently faces resistance at $95,000, with support levels between $85,000 and $91,800. The RSI stands at 55, indicating a neutral stance, and the formation of a symmetrical triangle pattern suggests consolidation. A breakout above $95,000 could target $100,000 or higher, especially if today’s PCE data (with core PCE expected at 2.3%) underwhelms expectations. Additionally, the extended period of quantitative tightening and a hawkish Federal Reserve, where 7 out of 16 officials foresee no further rate cuts may exert downward pressure on BTC toward the $80,000 level, aligning with weaknesses observed in the Nasdaq.

On the bullish side, confirmation of a rate cut and strong cash reserves of $1.44 billion in strategies indicate resilience, potentially supporting a 20–30% increase into the first quarter of 2026. The year-end target range is estimated at $90,000–$95,000 as a baseline, with potential to reach $110,000 if a dovish pivot occurs.

On December 4th, Bitcoin exchange-traded funds (ETFs) registered an outflow of $81.6 million, with Fidelity's FBTC saw an outflow of $54.2 million.

ETH (-1.13% | Current Price: $3,177.92)

After experiencing a more than 20% pullback in November, Ethereum's price is currently attempting to stabilize around the key support area of $3,050. A significant source of pressure is capital outflow: between November 11th and 20th, US spot Ethereum ETFs experienced a massive net outflow of approximately $1.28 billion, although a subsequent inflow of $368 million provided some cushioning, the initial damage had already been done.

Ethereum maintains support at $3,100, with resistance at $3,500. A MACD crossover indicates a potential early reversal, and the RSI stands at 58. Gas fees remain exceptionally low at an average of 0.024 Gwei (under $0.01 per transaction), with moderate network utilization at 53.64% and approximately 57,928 pending transactions, with no significant spikes observed. From a fundamental perspective, shark wallets accumulated assets during November's dip, although institutional treasuries purchased only 370,000 ETH last month, representing an 81% decrease compared to August. Additionally, PayPal's PYUSD stablecoin supply has tripled to $3.8 billion, enhancing stablecoin utility within the Ethereum ecosystem.

On December 4th, ETH ETFs experienced a total net outflow of $69.9 million, with Fidelity's FETH saw an outflow of $17.9 million.

Altcoins

The Crypto Fear & Greed Index sits at 25 (Fear), down from 12 Extreme Fear earlier this week, reflecting easing panic but persistent caution. The Alt Season Index stands at 23 out of 100, indicating that the market is currently favoring Bitcoin over altcoins. Only 24% of the top 100 altcoins have outperformed Bitcoin over the past 90 days, a decline from 40% in the third quarter. Bitcoin’s market dominance is at 57.1%, representing a 0.6% decrease over the past 24 hours, which continues to suppress altcoin performance. However, a decline below 55% in market dominance may signal the potential for a rotation into altcoins, aligning with historical indicators of an upcoming alt season.

Macro Data

Today's PCE release is scheduled for 8:30 AM ET, with an expected increase of 2.3% YoY, which is a key indicator. A lower-than-anticipated reading could increase the probability of a rate cut to approximately 89%, supporting a risk-on environment with potential gains of 5–10% in assets such as Bitcoin. Additionally, the Federal Reserve's quantitative tightening is set to conclude on December 1, but reserves remain at multi-decade lows, indicating ongoing tightening pressures. The U.S. National debt exceeding $38 trillion continues to impact Treasury holdings, prompting some institutional shifts towards Bitcoin. Globally, Japan's 10-year government bond yield has risen to 1.92%, a level not seen since 2007, which puts downward pressure on the yen and indirectly supports a stronger U.S. dollar (DXY at 99.1, RSI at 43, indicating a bearish trend).

On December 4th, the S&P 500 gained 0.11%, standing at 6,857.12 points; the Dow Jones Industrial Average dropped 0.07% to 47,850.94 points, and the Nasdaq Composite gained 0.22% to 23,505.14 points. The price of gold is $4,227.01, up 0.33%, at 8:00 UTC, December 5th.

Trending Tokens

SXP Solar (+23.24%, Circulating Market Cap: $46.94 Million)

SXP is trading at $0.07038, up approximately 40.41% in the past 24 hours. Solar is a Layer 1 blockchain network secured by 53 Block Producers through Delegated Proof of Stake (DPoS) consensus, with SXP as its native utility coin. The network's security and governance are maintained through a system where coin holders can participate by voting for Block Producers. As an open, community-driven ecosystem, Solar enables collaboration between Block Producers and coin holders, fostering continuous development and enhancement of the network's infrastructure. Upbit resumed SXP deposits/withdrawals on December 3 after a security audit, deleting old wallet addresses and requiring new ones. This followed a November 28 breach where $30.5M in Solana ecosystem assets (including SXP) were stolen but reimbursed. The relisting restored access to a major liquidity hub, reducing fears of prolonged withdrawal freezes. Traders interpreted this as a risk reduction, triggering buy-side momentum. Notably, SXP’s 24h volume ($139M) exceeded its market cap ($47.1M), indicating frenzied trading.

LUNC Terra Classic (+16.95%, Circulating Market Cap: $181.82 Million)

LUNC is trading at $0.00003312, up approximately 16.59% in the past 24 hours. Terra is a

blockchain protocol that uses fiat-pegged

stablecoins to power price-stable global payments systems. According to its white paper, Terra combines price stability and wide adoption of fiat currencies with the censorship-resistance of

Bitcoin (BTC) and offers fast and affordable settlements. Over 1.2B LUNC were burned in the past week, part of a broader effort that has removed 415B tokens since 2022. Binance’s monthly burns (e.g., 441M LUNC in August 2025) add deflationary pressure. Burns reduce LUNC’s circulating supply (5.48T), creating scarcity. With 15% of supply staked, sell pressure is muted. However, adoption (e.g., dApp activity) remains weak, capping long-term upside.

YB YieldBasis (+10.1%, Circulating Market Cap: $45.68 Million)

YB is trading at $0.5196, up approximately 10.1% in the past 24 hours. What Is YieldBasis (YB)? YieldBasis is a DeFi protocol that enables users to provide liquidity to automated market maker (AMM) pools without experiencing impermanent loss. The protocol achieves this through a 2× compounding leverage mechanism built on Curve Finance's infrastructure, where users deposit crypto assets and receive YieldBasis LP tokens representing their share in the liquidity pool. YB broke above the 38.2% Fibonacci retracement ($0.519) with RSI7 at 69.27, nearing overbought territory. The MACD histogram turned positive (+0.0086), signaling short-term bullish momentum. Traders may interpret the move above $0.519 as a buy signal, but RSI proximity to 70 suggests overheating risk. Immediate resistance sits at the 23.6% Fib level ($0.547), while failure to hold $0.519 could trigger profit-taking.

Market News

First Sui-Based ETF Approved as 21Shares Brings Leveraged Fund to Market

Switzerland-based ETF issuer 21Shares has brought the first exchange-traded product tracking the price of SUI to the U.S. market, as the total number of crypto ETF launches continues to pile up.

The 21Shares 2x SUI ETF (ticker TXXS) was approved for trading on the Nasdaq exchange. This is a leveraged product designed to offer 200% the daily return of the Sui token.

Sui is a decentralized cryptocurrency built on the Ethereum blockchain. With its proof-of-stake consensus mechanism, transactions are conducted peer-to-peer, increasing transparency and eliminating the need for intermediaries. Its native token is used for transaction fees, network governance, and staking. Sui has surpassed $10 billion in 30-day DEX volume and processed over $180 billion in stablecoin transfer volume for the fourth consecutive month, according to Thursday's release.

21Shares filed a registration statement with the SEC for a spot Sui ETF back in May, when it also announced a "strategic partnership" with Sui to produce product collaborations, research reports, and other initiatives.

Leveraged ETFs are typically short-term plays for experienced traders because of the high risk involved through the use of derivatives. In fact, the U.S. Securities and Exchange Commission recently halted the potential launch of 3x and 5x ETFs that are in the pipeline.

Bloomberg senior ETF analyst Eric Balchunas noted that it's rare for the first crypto-based ETF to be a leveraged product. TXXS marks the 74th crypto ETF to launch this year and the 128th overall. Crypto trading firm FalconX acquired 21Shares for an undisclosed sum last month. Around the same time, the latter launched a leveraged Dogecoin ETF.

IMF Warns Stablecoins May Accelerate Currency Substitution, Weaken Central Bank Control

Stablecoins risk accelerating currency substitution in countries with relatively weak monetary frameworks, potentially undermining central banks' control over capital flows, the International Monetary Fund warned Thursday.

In a report titled "Understanding Stablecoins" published Thursday, the IMF cautioned that the rapid rise of dollar-denominated stablecoins — combined with their ease of cross-border use — could push households and businesses to abandon local currencies in favor of dollar stablecoins, especially in high-inflation or low-trust environments.

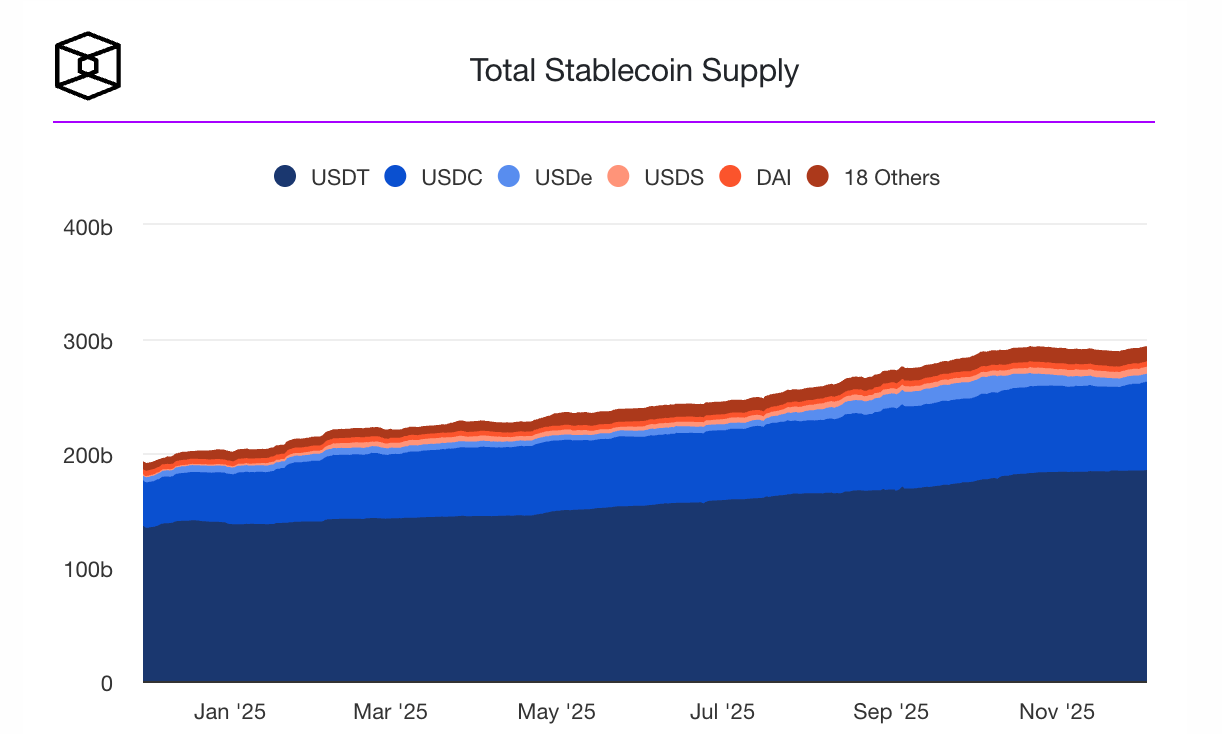

The concerns, outlined in a separate IMF blog post and the new report, stemmed from an expansion of stablecoin markets. The two largest stablecoins, USDT and USDC, have tripled in size since 2023 to a combined $260 billion, while trading volumes surged to $23 trillion in 2024, the report said.

Asia now leads all regions in total stablecoin activity, though usage relative to GDP is most pronounced in Africa, the Middle East and Latin America, regions where currency substitution risks are historically elevated.

Meanwhile, the IMF also sees potential for widening financial access. In many developing regions, mobile-based digital services already outpace traditional banking. Stablecoins, if supported by strong regulatory and legal frameworks, could increase competition, lower payment costs and integrate more people into digital financial ecosystems.

However, the IMF argued that these benefits come with significant macro-financial hazards. Runs on stablecoins remain a central fear: if users lose confidence in redemption rights or if reserve assets decline in value, issuers could be forced into fire sales of their reserve assets and other holdings, roiling broader markets.

The IMF also said that stablecoins' pseudonymous, cross-border nature could weaken capital controls, facilitate illicit finance and erode the quality of macroeconomic data. The global distribution of holders, often unknown due to unhosted wallets, complicates crisis monitoring and policymaking.

Figure and Leading Crypto Partners Launch RWA Consortium for Onchain Finance on Solana

Figure Technology Solutions, Inc. (“Figure”)(Nasdaq: FIGR), the leading blockchain-native capital marketplace for the origination, funding, sale, and trading of on-chain loan products and tokenized real-world assets (RWAs), today announced the launch of an RWA consortium, a landmark coalition that will expand access to Figure's more than $1 billion in monthly on-chain loan originations, starting on Solana. The consortium represents a coordinated effort by leading crypto platforms to support and drive adoption of PRIME, the liquid staking token built on the Hastra liquidity protocol, developed in partnership with Figure and the Provenance Blockchain Foundation. PRIME is powered by the Democratized Prime decentralized lending protocol on the Provenance Blockchain, which allows users to lend against pools of tokenized Figure RWA loans. Through this coalition, everyday DeFi users can now access institutional-grade yields previously reserved for banks and accredited investors.

The RWA Consortium builds on Figure’s vision to bring capital markets on-chain, a goal most recently reinforced during its IPO and the expansion of its RWA ecosystem across multiple blockchains. By extending beyond the Provenance Blockchain to integrate with Layer 1 networks like Solana, Figure is partnering with Hastra to leverage Chainlink CCIP to power the cross-chain interoperability needed for a connected, multi-chain finance ecosystem. With over $19 billion in on-chain loan originations to date and a 70% market share in the RWA private credit, Figure is uniquely positioned to bridge traditional credit markets with DeFi.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.